- India is a signatory to the New York Convention, making foreign awards from over 50 reciprocating territories enforceable as decrees of an Indian court.

- The enforcement process is governed by Part II of the Arbitration and Conciliation Act, 1996, which limits judicial interference in international awards.

- Enforcement must be sought in a High Court that has original jurisdiction where the assets of the debtor are located.

- Indian courts cannot review the merits of the case; they can only refuse enforcement on narrow grounds such as public policy or lack of proper notice.

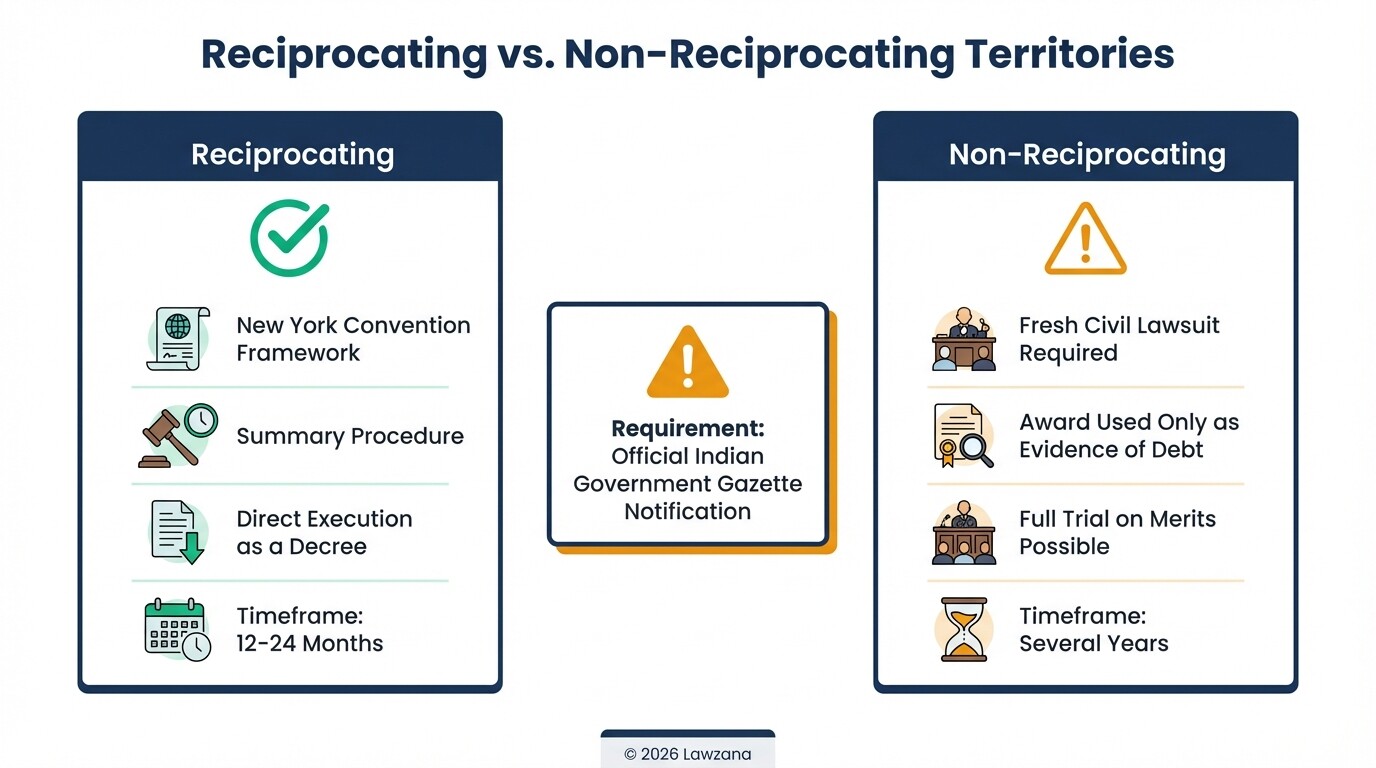

- Recent judicial trends in Delhi and Mumbai have significantly reduced timelines, though the process still typically takes 12 to 24 months.

How Does India Enforce Foreign Arbitration Awards?

India enforces foreign arbitration awards by treating them as if they were a decree of a local Indian court once the court is satisfied the award is enforceable. This process is governed by the Arbitration and Conciliation Act, 1996, specifically Part II, which streamlines the transition from an overseas arbitral decision to a locally executable order.

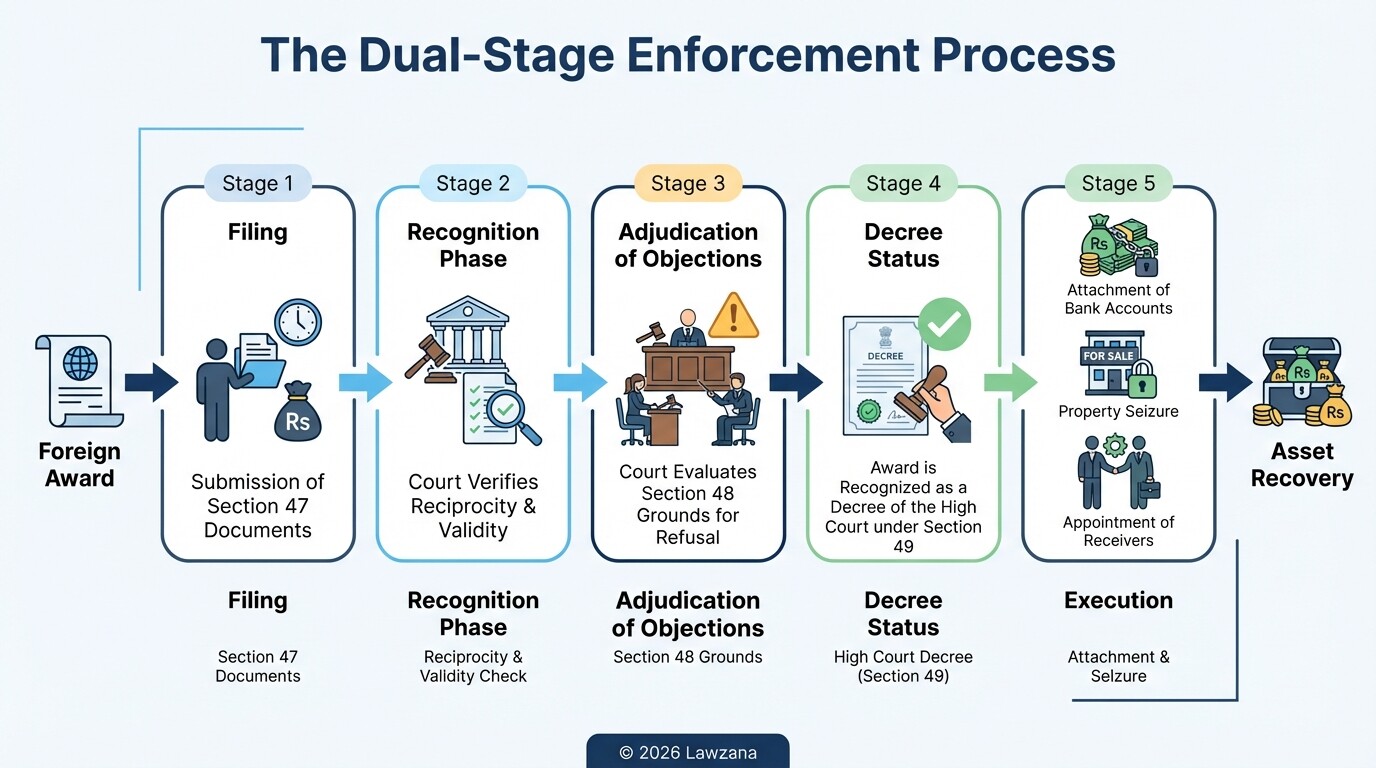

The procedure follows a dual-stage process under Section 47 and Section 49 of the Act. In the first stage, the court determines the "recognisability" of the award. In the second stage, if the court finds the award enforceable, it proceeds to the "execution" phase. During execution, the court can use its powers to attach bank accounts, seize property, or appoint receivers to satisfy the debt.

What Are the Differences Between the New York and Geneva Conventions in India?

The New York Convention (1958) is the primary framework used for enforcing foreign awards in India, while the Geneva Convention (1927) serves as a historical predecessor that is rarely invoked today. India incorporated the New York Convention under Chapter I of Part II of the Arbitration Act, providing a more modern and pro-enforcement regime than the Geneva Convention found in Chapter II.

Most commercial entities favor the New York Convention because it places the burden of proof on the party opposing enforcement. In contrast, the Geneva Convention required the party seeking enforcement to prove certain conditions were met. Because almost all major trading partners of India are signatories to the New York Convention, it is the standard mechanism for international B2B disputes.

Which Countries Are Considered Reciprocating Territories?

A foreign award is only enforceable under the Indian Arbitration Act if it was issued in a country that the Indian Central Government has officially notified as a "reciprocating territory." This means that even if a country is a signatory to the New York Convention, an award from that country cannot be enforced in India unless the Indian government has issued a specific notification in the Official Gazette.

Currently, India recognizes over 50 territories, including:

- United States

- United Kingdom

- Singapore

- United Arab Emirates

- Hong Kong

- France

- Germany

- Japan

If an award is issued in a non-reciprocating territory, the award holder cannot use the summary enforcement procedure under the Act. Instead, they must file a fresh lawsuit in an Indian court using the foreign award merely as evidence of a debt, which is a significantly slower and more complex legal route.

What Are the Grounds for Refusal of Enforcement?

Under Section 48 of the Arbitration Act, an Indian court can refuse to enforce a foreign award only if the party resisting enforcement provides specific proof of procedural or legal failure. The court is strictly prohibited from re-evaluating the evidence or the merits of the underlying dispute.

The permitted grounds for refusal include:

- Incapacity or Invalidity: The parties were under some incapacity, or the arbitration agreement is invalid under the law to which the parties subjected it.

- Lack of Notice: The party against whom the award is invoked was not given proper notice of the appointment of the arbitrator or of the proceedings.

- Beyond Scope: The award deals with a dispute not contemplated by or not falling within the terms of the submission to arbitration.

- Procedural Irregularity: The composition of the arbitral authority or the procedure was not in accordance with the agreement of the parties.

- Public Policy: The enforcement of the award would be contrary to the "Public Policy of India."

The "Public Policy" ground is the most frequently litigated but has been narrowed by recent amendments. Enforcement can now only be set aside on public policy grounds if the award was induced by fraud, violates the fundamental policy of Indian law, or conflicts with the most basic notions of morality or justice.

What Documentation Is Required for an Enforcement Petition?

To initiate enforcement, the petitioner must file an execution petition along with specific evidentiary documents as mandated by Section 47 of the Act. All documents must be original or duly certified copies to satisfy the court of their authenticity.

The mandatory checklist includes:

- The Original Award: Or a copy authenticated in the manner required by the law of the country in which it was made.

- The Original Arbitration Agreement: Or a duly certified copy showing the consent of both parties to arbitrate.

- Certified Translations: If the award or agreement is in a foreign language, an English translation certified as correct by a diplomatic or consular agent or a sworn translator is required.

- Evidence of Reciprocity: While courts often take judicial notice of this, providing the gazette notification for the country of origin is best practice.

What Is the Timeline for Enforcement in High Courts?

The timeline for enforcing a foreign award in India generally ranges from 12 to 24 months, depending on the complexity of the challenges raised. Enforcement petitions must be filed in the High Court of the state where the debtor's assets are located, as these courts have the "Commercial Division" specialized in handling international disputes.

| Location | Typical Timeline (Recognition) | Typical Timeline (Execution) |

|---|---|---|

| Delhi High Court | 10 - 15 Months | 6 - 12 Months |

| Bombay High Court | 12 - 18 Months | 8 - 14 Months |

| Other High Courts | 18 - 24 Months | 12+ Months |

Courts in Delhi and Mumbai are highly experienced with international arbitration and tend to follow a pro-enforcement approach, often dismissing frivolous challenges at the admission stage.

Estimated Costs of Enforcement in India

The cost of enforcing a foreign award in India includes court fees, legal representation, and administrative expenses. Court fees vary significantly by state, as they are governed by local State Court Fees Acts.

- Court Fees: In Delhi, the court fee is relatively nominal (fixed fee), whereas in Mumbai (Maharashtra), it can be ad valorem (based on a percentage of the award value), though often capped at a maximum of approximately ₹300,000 (roughly $3,600).

- Legal Fees: Expert arbitration counsel in India typically charge per appearance or a flat fee for the entire enforcement proceeding.

- Translation and Notarization: These administrative costs usually range between ₹20,000 and ₹50,000 ($250 - $600).

Common Misconceptions Regarding Indian Enforcement

Myth: Indian Courts Will Re-try the Entire Case

Many international companies fear that an Indian judge will review the evidence and change the outcome of the arbitration. In reality, Section 48 specifically prevents the court from reviewing the merits. Even if the arbitrator made an error of law or fact, the award remains enforceable unless it hits the narrow "Public Policy" threshold.

Myth: You Must Pay Heavy Stamp Duty Immediately

There is a misconception that a foreign award must be stamped under the Indian Stamp Act before it can be enforced. Recent judicial rulings have clarified that while an award may eventually need stamping for certain procedural steps, the lack of a stamp does not make a foreign award "unenforceable" or invalid at the time of filing.

FAQs

Can an Indian court grant an injunction against a foreign award?

No, Indian courts generally cannot grant an injunction to "stay" a foreign award. Once the award is passed, the only recourse for the losing party is to challenge enforcement under Section 48.

Is an Indian award treated differently than a foreign award?

Yes. Domestic awards can be "set aside" under Section 34, whereas foreign awards can only be "refused enforcement" under Section 48. This distinction is vital because a foreign award cannot be annulled by an Indian court; it can only be denied execution within India.

What happens if the debtor has assets in multiple Indian states?

The petitioner may file for enforcement in one High Court where a significant asset is located and then seek a "transfer of decree" to other local courts to seize assets in different jurisdictions.

When to Hire a Lawyer

You should engage an Indian legal expert immediately after receiving a final foreign award if the debtor has assets in India. Legal counsel is necessary to:

- Determine if the country of origin is a notified reciprocating territory.

- Draft the execution petition to meet the strict requirements of the High Court Commercial Divisions.

- Navigate the "Public Policy" arguments often raised by debtors to delay payment.

- Conduct asset searches within India to ensure the enforcement petition is filed in the correct jurisdiction.

Next Steps

- Verify Reciprocity: Confirm that the award was issued in a territory notified by India.

- Gather Documents: Collect the original award and agreement and obtain certified English translations.

- Asset Mapping: Identify the specific location of the debtor's bank accounts, real estate, or receivables in India.

- Select Jurisdiction: Determine which High Court (e.g., Delhi High Court or Bombay High Court) has jurisdiction over the assets.

- File Petition: Submit the enforcement petition under Section 47 of the Arbitration and Conciliation Act.