- The Pre-Packaged Insolvency Resolution Process (PIRP) is a "debtor-in-possession" model, allowing MSME owners to retain control of their business during restructuring.

- To be eligible, a business must be classified as a Micro, Small, or Medium Enterprise (MSME) under the MSMED Act, 2006.

- The entire process is strictly time-bound, requiring completion within 120 days from the commencement date.

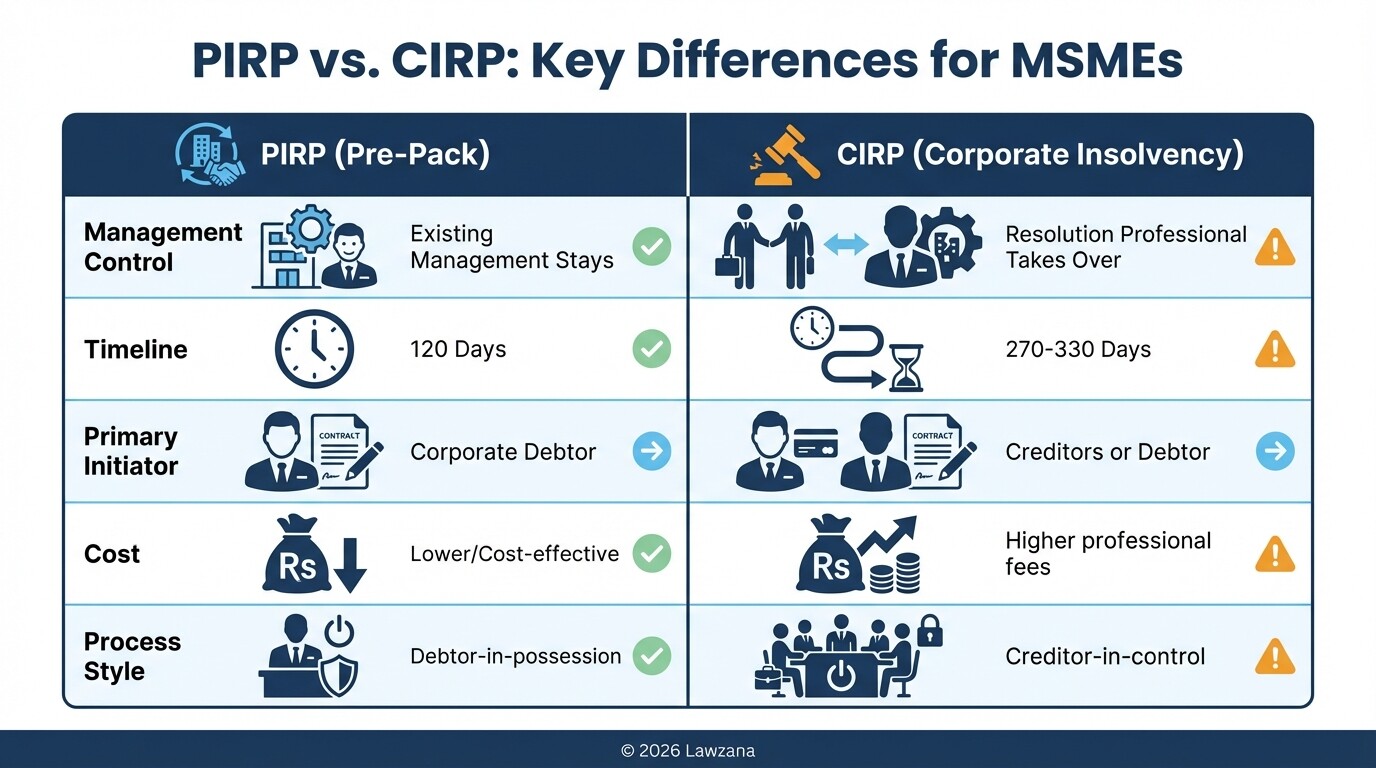

- PIRP is significantly more cost-effective and less disruptive than the standard Corporate Insolvency Resolution Process (CIRP).

- Approval requires the consent of at least 66 percent of unrelated financial creditors before the application is filed with the National Company Law Tribunal (NCLT).

Which MSMEs Are Eligible for the PIRP Under the IBC?

To qualify for the Pre-Packaged Insolvency Resolution Process, a corporate debtor must be registered as an MSME and have committed a payment default of at least 10 Lakh Rupees (approximately $12,000). The business must not have undergone a PIRP or a standard insolvency process (CIRP) in the three years preceding the application date.

Eligibility is governed by Section 7 of the Micro, Small and Medium Enterprises Development Act, 2006. The current criteria for classification are based on investment in plant and machinery and annual turnover:

| Enterprise Category | Investment Limit | Turnover Limit |

|---|---|---|

| Micro | Not more than 1 Crore Rupees | Not more than 5 Crore Rupees |

| Small | Not more than 10 Crore Rupees | Not more than 50 Crore Rupees |

| Medium | Not more than 50 Crore Rupees | Not more than 250 Crore Rupees |

Beyond the MSME status, the debtor must be eligible to submit a resolution plan under Section 29A of the Insolvency and Bankruptcy Code (IBC). This means the promoters cannot be willful defaulters or disqualified under specific legal criteria. Additionally, a majority of the company's directors must make a formal declaration stating that the PIRP is not being initiated to defraud any person.

How Does a Business Prepare the Base Resolution Plan?

The Base Resolution Plan (BRP) is a restructuring proposal prepared by the MSME owners before the formal insolvency process begins. It serves as the starting point for negotiations with creditors and outlines how the business intends to settle its debts while continuing operations.

The preparation of a BRP is a strategic exercise that requires a realistic assessment of the company's financial health. Under the PIRP framework, the debtor presents this plan to the financial creditors for preliminary approval.

Key components of a robust Base Resolution Plan include:

- Debt Restructuring: Proposals for hair-cuts (reductions), extended repayment schedules, or interest rate adjustments.

- Operational Strategy: A roadmap showing how the company will achieve profitability to honor the new payment terms.

- Asset Valuation: A clear disclosure of current assets and their market value.

- Creditor Hierarchy: Ensuring that the plan respects the legal priority of payments, particularly for operational creditors like suppliers.

If the BRP does not result in the full payment of confirmed claims, the Committee of Creditors (CoC) may call for competing "challenger" plans from third-party investors. However, the original promoters usually have the "right to match" these competing bids to retain ownership.

What is the Role of the Resolution Professional in PIRP?

In a Pre-packaged process, the Resolution Professional (RP) acts as an independent monitor and facilitator rather than a manager of the company's daily affairs. Their primary duty is to ensure the integrity of the process, verify claims, and report to the National Company Law Tribunal (NCLT).

Unlike the standard insolvency process where the RP takes over management, in PIRP, your management team remains in place. The RP's responsibilities are specifically defined under the Insolvency and Bankruptcy Board of India (IBBI) regulations:

- Verification of Claims: The RP confirms the amounts owed to various creditors based on the company's books and external submissions.

- Monitoring Management: While the board stays in control, the RP monitors the business to ensure assets are not siphoned off or undervalued.

- Conducting Meetings: The RP chairs the Committee of Creditors (CoC) meetings and facilitates voting on the resolution plan.

- Compliance Reporting: The RP submits the final approved plan to the NCLT and ensures all statutory timelines are met.

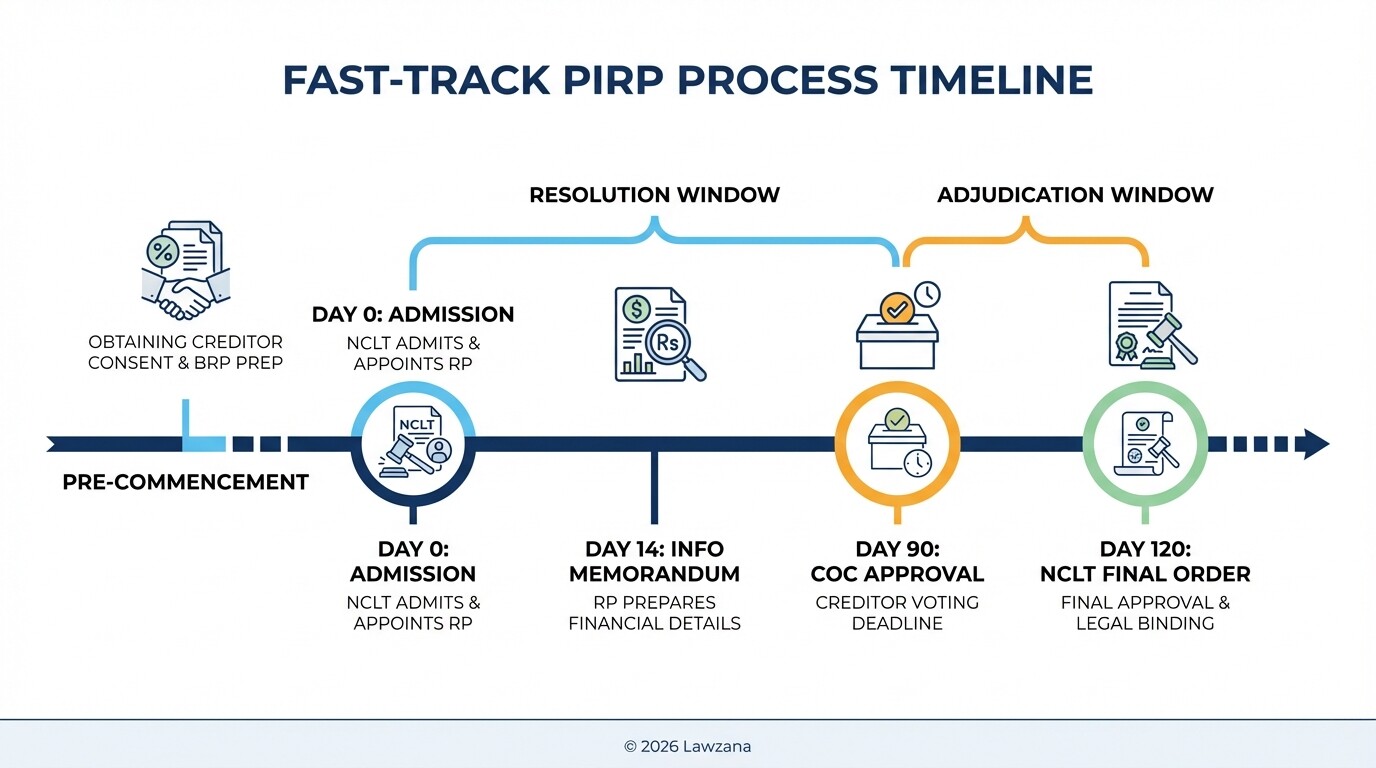

What is the Timeline and Approval Process by the NCLT?

The PIRP is designed for speed, mandating a total timeline of 120 days from start to finish. Of this, the first 90 days are dedicated to the Committee of Creditors (CoC) for plan approval, followed by 30 days for the NCLT to pass a final order.

The process follows a structured path to ensure transparency and legal finality:

- Pre-Commencement (Variable): The debtor obtains 66 percent approval from financial creditors and prepares the Base Resolution Plan.

- Admission (Day 0): The NCLT admits the application and appoints the Resolution Professional.

- Information Memorandum (Within 14 days): The RP prepares a document detailing the company's finances to help creditors make informed decisions.

- CoC Approval (Within 90 days): The Committee of Creditors must approve the Base Resolution Plan (or a modified plan) with a 66 percent majority.

- NCLT Final Order (Within 120 days): The approved plan is submitted to the Tribunal. Once the NCLT signs off, the plan becomes legally binding on the company, employees, creditors, and stakeholders.

If the CoC does not approve a plan within the 90-day window, the RP must file an application to terminate the PIRP, which may lead to the liquidation of the company.

Why is Maintaining Management Control Vital for MSMEs?

The "debtor-in-possession" model is the most significant advantage of PIRP, as it prevents the total operational paralysis that often occurs during standard insolvency. By allowing the existing management to run the business, the PIRP preserves the specialized knowledge and relationships essential for an MSME's survival.

There are several strategic benefits to this arrangement:

- Business Continuity: Suppliers and customers are less likely to flee if they see the familiar management team remains in charge.

- Cost Reduction: Because the RP does not have to hire a team to run the company, the administrative costs of the insolvency process are significantly lower.

- Incentive to Resolve: Promoters are more likely to seek help early if they know they will not be immediately stripped of their company.

- Employee Stability: Retaining management provides a sense of security to the workforce, preventing a mass exodus of talent during the restructuring.

However, this control is not absolute. If the management is found to be fraudulent or grossly negligent, the CoC can vote (with a 66 percent majority) to shift the management control to the Resolution Professional.

Common Misconceptions About PIRP

"PIRP is only for businesses that are already bankrupt."

Many business owners believe they must wait until they are completely insolvent to apply. In reality, PIRP is a tool for proactive restructuring. Using it early, when a default first occurs, increases the chances of a successful turnaround and prevents total financial collapse.

"I will lose my company to the highest bidder."

While there is a "Swiss Challenge" mechanism that allows for competing bids if the original plan is insufficient, MSME promoters have unique protections. Under the PIRP framework, the law prioritizes the preservation of the MSME, often giving promoters a chance to match higher bids or improve their own offer to retain control.

"The process is as long and expensive as regular insolvency."

Standard insolvency (CIRP) can drag on for 270 days or more and involves high professional fees. PIRP is capped at 120 days and, because the management stays in place, the professional overhead is drastically reduced, making it specifically tailored for the tighter budgets of small businesses.

Practical Steps to Initiate PIRP

If your MSME is facing financial distress, following a systematic approach is crucial for a successful PIRP application.

- Conduct an internal audit: Verify your MSME registration status and ensure your financial statements are up to date.

- Draft a declaration: Prepare the mandatory director's declaration stating the purpose of the PIRP and that the company is not being liquidated to defraud creditors.

- Engage with financial creditors: Start informal talks with your bank or lenders. You need 66 percent of them to agree to the process before you can even file.

- Appoint an Insolvency Professional: Select an RP who has experience with MSME structures to guide you through the pre-filing stage.

- Submit the application: File Form 1 with the relevant NCLT bench along with the required fee (currently 15,000 Rupees).

Frequently Asked Questions

Can operational creditors (suppliers) block a PIRP?

No, the initial approval for starting a PIRP and the approval of the resolution plan rests primarily with the financial creditors (banks and lenders). However, the plan must still address the dues of operational creditors fairly according to the IBC hierarchy.

What happens if the NCLT rejects the PIRP plan?

If the NCLT finds that the plan does not comply with the legal requirements of the IBC, it can reject it. In such a case, the PIRP is terminated. The company may then be forced into a standard CIRP or liquidation, depending on the circumstances of the default.

Does PIRP protect me from legal suits by creditors?

Yes. Once the NCLT admits the PIRP application, a "moratorium" is imposed. This creates a legal shield that prevents creditors from filing new lawsuits or continuing existing ones against the company for the duration of the 120-day process.

Can I settle with creditors outside of PIRP?

Yes, you can always attempt an out-of-court settlement. However, PIRP provides a formal, legally binding framework that forces dissenting minority creditors to accept the deal if the majority agrees, which is not possible in a purely informal settlement.

When to Hire a Lawyer

Navigating the Insolvency and Bankruptcy Code requires a blend of financial acumen and legal precision. You should hire a lawyer specializing in restructuring if your MSME is facing its first payment default, if you are being threatened with legal action by a creditor, or if you need to draft a Base Resolution Plan that complies with Section 29A.

Legal counsel is essential for:

- Defending against "challenger" bids during the resolution process.

- Ensuring your MSME classification is legally sound to prevent application dismissal.

- Representing the company before the NCLT during the admission and approval hearings.

- Protecting the personal assets of promoters from being pulled into corporate debt proceedings.

Next Steps

- Verify your MSME Udyam Registration: Ensure your certificate is current and reflects your actual investment and turnover.

- Review your debt obligations: Identify which creditors are "financial" and which are "operational" to understand your voting pool.

- Consult an Insolvency Professional: Get a preliminary assessment of whether your business model can support a Base Resolution Plan.

- Gather Director Consents: Hold a board meeting to pass the necessary resolutions to initiate the PIRP process.