- Regulatory Approval: Most exits via secondary sales or buybacks must comply with Foreign Exchange Management Act (FEMA) pricing guidelines to ensure capital can be legally repatriated.

- Enforceability: Put and call options are legally valid in India provided they do not feature a guaranteed return, adhering instead to the prevailing fair market value at the time of exercise.

- Taxation: Capital gains tax varies significantly between listed and unlisted securities, with Treaty benefits (like those with Mauritius or Singapore) increasingly scrutinized under General Anti-Avoidance Rules (GAAR).

- Repatriation: Reporting to the Reserve Bank of India (RBI) via the FIRMS portal is a mandatory step for any cross-border transfer of shares.

- Director Liability: Exit phases often trigger "tail-end" liabilities for nominee directors; indemnification and D&O insurance are critical protective measures.

What are the legal implications of secondary sales vs. strategic trade sales?

Secondary sales involve the transfer of shares from one private equity (PE) investor to another financial buyer, whereas strategic trade sales involve selling to a competitor or industry player. The primary legal difference lies in the depth of due diligence, the nature of representations and warranties (R&Ws), and the long-term regulatory obligations of the buyer.

In a secondary sale, the transaction is often faster as the incoming financial investor typically understands the PE model. However, a strategic trade sale usually commands a higher "control premium" but involves rigorous antitrust scrutiny by the Competition Commission of India (CCI) if the transaction exceeds certain asset or turnover thresholds.

- Representations and Warranties: In secondary sales, PE sellers usually provide only "fundamental" warranties (title to shares, capacity). In trade sales, buyers often demand "business" warranties, necessitating the use of Warranty and Indemnity (W&I) insurance to protect the exiting fund.

- Governance Rights: Secondary buyers often expect a "mirroring" of the existing Shareholders' Agreement (SHA), whereas strategic buyers typically seek to integrate the entity, leading to a complete overhaul of the Articles of Association (AoA).

- Tax Implications: Both routes are subject to Section 9 of the Income Tax Act (indirect transfers), but strategic sales may involve complex asset-slump sale structures which carry different tax burdens than simple share transfers.

| Feature | Secondary Sale (PE to PE) | Strategic Trade Sale |

|---|---|---|

| Typical Buyer | Financial Institution/Fund | Corporate/Competitor |

| Diligence Scope | Moderate | Comprehensive |

| CCI Filing | Less common (unless fund size is massive) | Highly likely |

| Exit Valuation | Financial multiples | Synergistic value + Control premium |

How are exit rights like put options and drag-along clauses enforced?

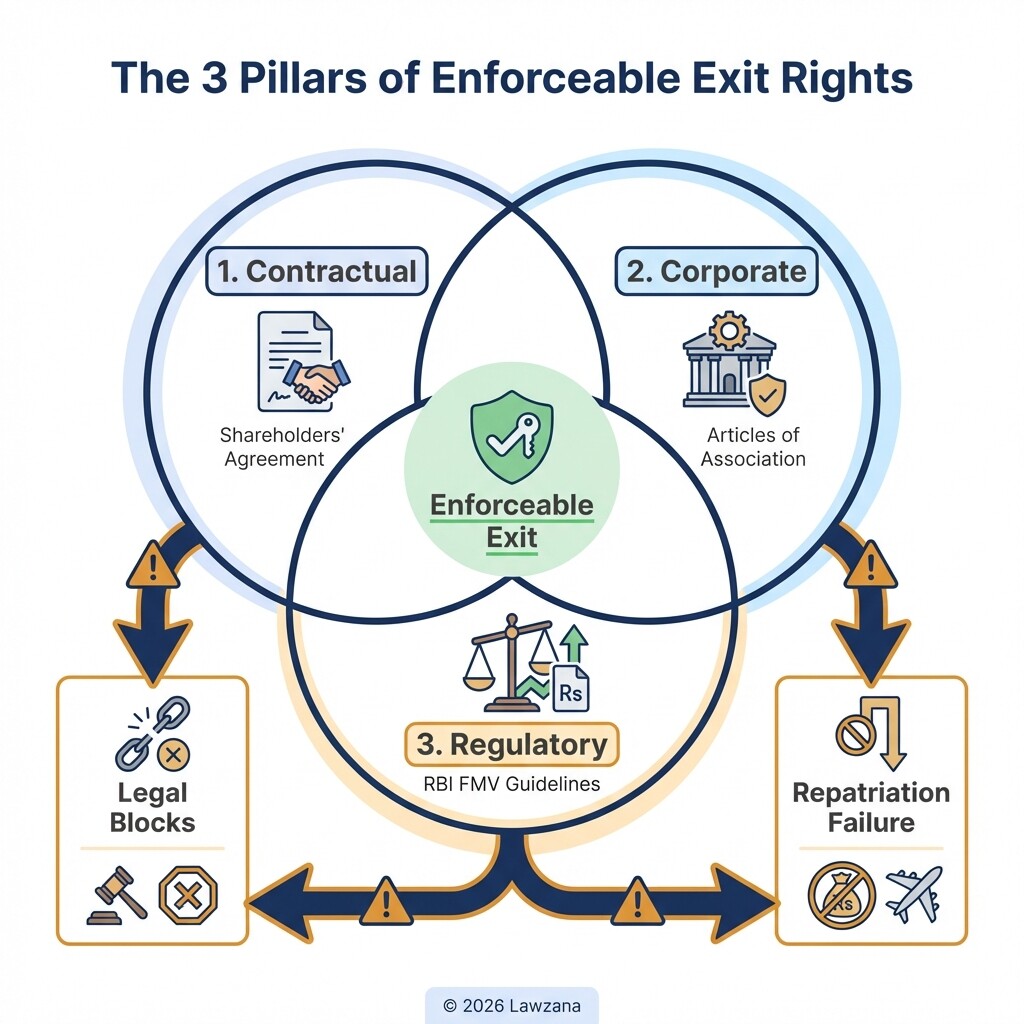

Exit rights are enforced through specific performance under the Indian Contract Act and must be mirrored in the company's Articles of Association to be binding on the company. While the Supreme Court of India has affirmed the validity of put and call options, they must be structured as "optionality clauses" without a guaranteed return to remain compliant with RBI regulations.

Drag-along clauses allow a majority investor to force minority shareholders to join in the sale of the company to a third party. To be enforceable, these must be drafted with "tag-along" protections for the minority and must clearly define the triggering events, such as a failure to achieve a Qualified IPO (QIPO) within a specific timeframe.

- The "No Guaranteed Return" Rule: Foreign investors cannot exit at a pre-determined price that guarantees a specific ROI. The exit price must be at the Fair Market Value (FMV) determined by a Chartered Accountant using a globally accepted pricing methodology.

- Specific Performance: If a promoter refuses to honor a put option, the investor can approach the National Company Law Tribunal (NCLT) or initiate arbitration.

- AoA Integration: An exit right exists only as a personal contract unless it is incorporated into the company's Articles. Without this, the company secretary may legally refuse to register the transfer of shares.

What are the regulatory requirements for repatriating capital under FEMA?

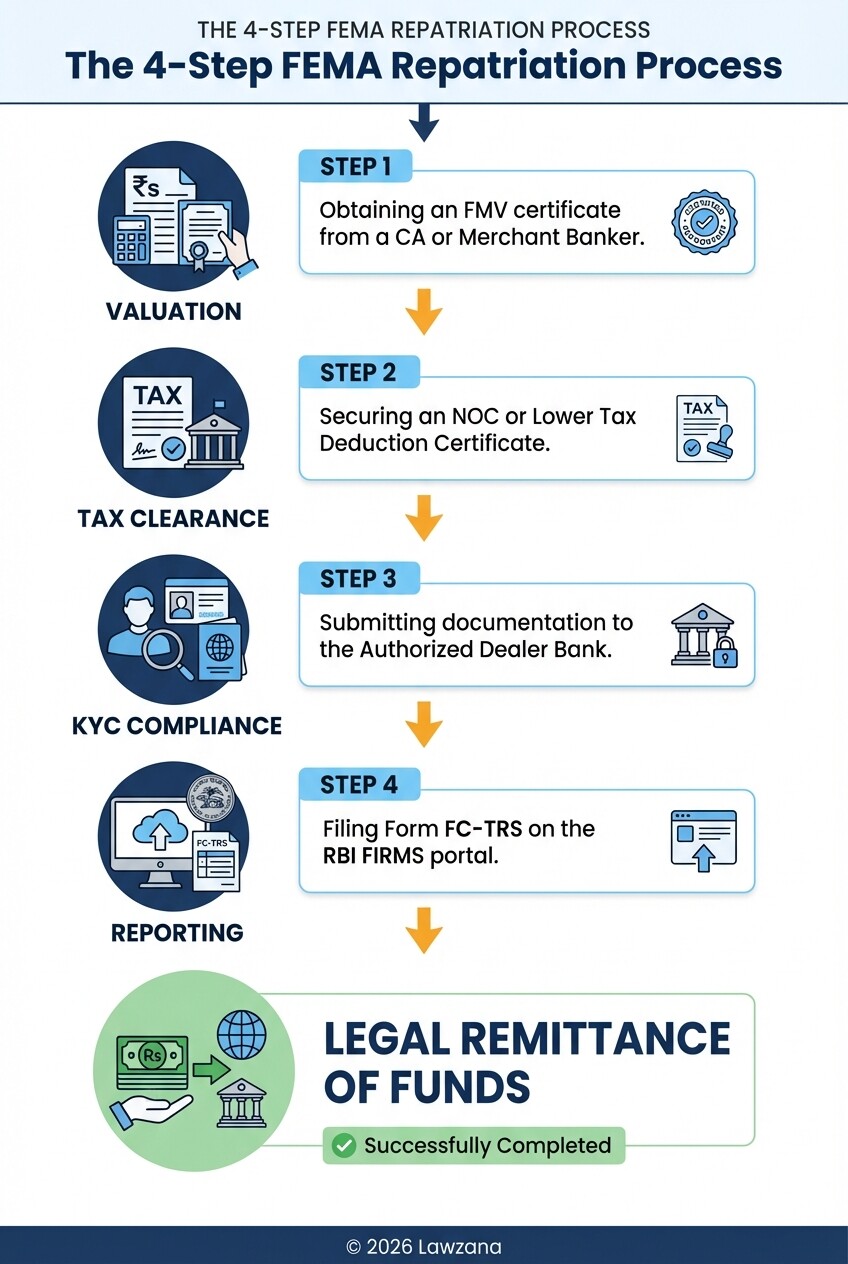

Repatriation of capital from India is governed by the Foreign Exchange Management Act (FEMA) and overseen by the Reserve Bank of India (RBI). For an international PE fund to move funds out of India, the sale price of the shares must not exceed the fair value calculated as per the RBI's pricing guidelines.

The process requires the submission of Form FC-TRS (Foreign Collaboration-Transfer of Shares) on the FIRMS portal within 60 days of receiving the sale consideration. Failure to file this form can lead to heavy compounding penalties and may block the legal movement of funds across borders.

- Valuation Certificate: Obtain an FMV certificate from a SEBI-registered Category-I Merchant Banker or a Chartered Accountant.

- Tax Clearance: Secure a "No Objection Certificate" (NOC) or a Lower Tax Deduction Certificate from the Income Tax authorities to ensure the remitting bank allows the transfer.

- KYC Compliance: Both the buyer and seller must provide KYC documents to the Authorized Dealer (AD) Bank in India.

- Filing Form FC-TRS: The onus of filing is generally on the resident party, but PE investors must ensure this is a condition precedent (CP) in the sale agreement.

How do investors manage director liability during the divestment phase?

Managing director liability requires a combination of robust contractual indemnities and the formal resignation of nominee directors upon the completion of the exit. In India, "Officers in Default" can be held personally liable for the company's non-compliance with statutory dues, labor laws, and environmental regulations, even after they have left the board.

During an exit, the "exit audit" should include a review of all pending litigations and statutory filings. Investors should ensure that the Sale and Purchase Agreement (SPA) includes a specific indemnity for the nominee director, covering any actions taken during their tenure.

- Resignation and Form DIR-12: Nominee directors must resign immediately upon exit, and the company must file Form DIR-12 with the Registrar of Companies (RoC). The director should also independently file Form DIR-11 to put their resignation on public record.

- D&O Insurance: Ensure that the company's Directors and Officers (D&O) insurance policy has a "run-off" cover or "tail" period, typically extending 6-7 years post-exit.

- Exemptions for Non-Executive Directors: Under the Companies Act, 2013, non-executive directors not involved in day-to-day operations have limited liability, but they must prove they acted in good faith and without knowledge of the contravention.

What dispute resolution mechanisms apply to shareholder exit conflicts?

Dispute resolution for PE exits in India typically relies on institutional arbitration, often seated in neutral jurisdictions like Singapore (SIAC) or London (LCIA). While Indian courts have become more arbitration-friendly, the Shareholders' Agreement must explicitly state whether the arbitration is "International Commercial Arbitration" to allow for swifter enforcement under the New York Convention.

If the conflict involves "oppression and mismanagement," the National Company Law Tribunal (NCLT) has exclusive jurisdiction. This can sometimes lead to parallel proceedings where one party seeks arbitration and the other files a petition with the NCLT, a tactic often used to delay the exit process.

- Choice of Seat: Selecting a foreign seat (like Singapore) allows investors to seek interim relief from foreign courts, though such orders must often be re-litigated in India under Section 9 of the Arbitration and Conciliation Act.

- Fast-Track Arbitration: For smaller exits, parties can opt for the fast-track procedure under Indian law, which mandates an award within six months.

- Emergency Arbitration: Many PE agreements now include provisions for Emergency Arbitrators to grant urgent stays on share transfers or board changes during a dispute.

Common Misconceptions About Private Equity Exits in India

Misconception 1: "Put Options with fixed returns are always enforceable." Reality: While the contract may say 15% IRR, the RBI views this as a debt instrument rather than equity. If the FMV at the time of exit is lower than 15%, you can only legally repatriate the FMV amount.

Misconception 2: "An IPO is the easiest exit route." Reality: The Securities and Exchange Board of India (SEBI) imposes strict "lock-in" periods. For "Promoters," this can be 18 months, and for non-promoter shareholders (like PE funds), it is generally 6 months for pre-issue capital.

Misconception 3: "Tax is only paid in the home country if there is a tax treaty." Reality: India's "Place of Effective Management" (POEM) rules and the Multilateral Instrument (MLI) have significantly narrowed treaty benefits. Most exits now face a 10% to 20% capital gains tax in India regardless of the fund's jurisdiction.

FAQ

Can a PE investor exit via a share buyback?

Yes, but under the Companies Act, 2013, buybacks are capped at 25% of the aggregate of paid-up capital and free reserves per financial year. This is often an inefficient route for a full exit.

What is the typical timeline for a trade sale in India?

A strategic trade sale usually takes 6 to 9 months, accounting for due diligence, CCI approvals (if required), and tax clearing.

Are oral exit promises enforceable in India?

No. Indian courts and regulators require written, stamped, and signed agreements. Furthermore, exit rights must be incorporated into the company's Articles of Association to be effective against the company.

Is W&I insurance common in Indian PE deals?

It is becoming the gold standard for PE exits. It allows the fund to distribute proceeds to LPs immediately without holding back a portion of the exit proceeds in escrow for indemnity claims.

When to Hire a Lawyer

You should engage a legal team specializing in Indian corporate law at the following stages:

- Drafting the SHA: To ensure "optionality clauses" are FEMA-compliant from day one.

- Pre-Exit Audit: 12 months before the intended exit to clean up statutory non-compliances that could stall a sale.

- Regulatory Filings: When navigating the FIRMS portal or seeking CCI approval.

- Dispute Escalation: Immediately if a promoter blocks a board meeting or refuses to provide financial data required for valuation.

Next Steps

- Review Your Articles: Confirm that your drag-along and put-option rights are explicitly stated in the company's Articles of Association.

- Initiate Valuation: Commission a preliminary fair market valuation to understand the gap between your desired exit price and the RBI-mandated ceiling.

- Assess Tax Liability: Consult a tax professional to calculate the impact of Section 9 and potential treaty benefits.

- Secure Records: Ensure all historical FC-GPR and FC-TRS filings are in order; missing filings are the most common cause of delayed exits in India.