- Trade sales remain the most common exit route in the UAE due to speed and the high presence of strategic international buyers seeking regional footprints.

- Initial Public Offerings (IPOs) on the DFM or ADX provide significant liquidity but require rigorous compliance with the Securities and Commodities Authority (SCA) regulations.

- The UAE Corporate Tax law, effective since June 2023, introduces a 9 percent rate, though participation exemptions often apply to capital gains from private equity exits.

- Secondary Buyouts (SBOs) are increasing in frequency as the regional private equity ecosystem matures and larger global funds acquire assets from mid-market local firms.

- Legal frameworks differ significantly between UAE Mainland (governed by the Commercial Companies Law) and Free Zones like DIFC or ADGM (governed by common law principles).

How do IPOs compare to Trade Sales for UAE exits?

Choosing between an Initial Public Offering (IPO) and a Trade Sale depends on the fund's timeline, the desired valuation, and the willingness to undergo public scrutiny. While an IPO on the Dubai Financial Market (DFM) or Abu Dhabi Securities Exchange (ADX) offers high visibility and a liquidity event for all shareholders, a trade sale to a strategic buyer typically provides a faster, 100 percent exit with lower regulatory costs.

Trade Sales: The Preferred Path

A trade sale involves selling the portfolio company to a strategic investor, often a larger multinational or a regional conglomerate.

- Speed: These transactions usually close within 4 to 9 months.

- Finality: It allows the Private Equity (PE) firm to exit its entire position at once, unlike IPOs which often involve lock-up periods.

- Synergy Premium: Strategic buyers may pay a premium based on expected operational synergies.

IPOs on DFM and ADX

The UAE has seen a surge in IPO activity, particularly in Abu Dhabi. This route is ideal for "trophy assets" or companies with a valuation exceeding 1 billion AED.

- Regulatory Rigor: Requires approval from the Securities and Commodities Authority (SCA) and adherence to strict transparency standards.

- Partial Exit: PE firms usually sell a minority stake (typically 25 to 30 percent) initially, retaining the rest for future tranches.

- Costs: Expect to pay significant fees to investment banks, legal counsel, and auditors, often ranging from 2 to 5 percent of the offering size.

| Feature | Trade Sale | IPO (DFM/ADX) |

|---|---|---|

| Typical Timeline | 4-9 Months | 12-18 Months |

| Control | Full transfer of control | Retained control or shared governance |

| Public Disclosure | Confidential | High public transparency required |

| Exit Percentage | Usually 100% | Partial (subject to lock-up) |

What are the dynamics of Secondary Buyouts in the UAE?

A Secondary Buyout (SBO) occurs when one private equity firm sells its stake in a portfolio company to another private equity firm. In the UAE market, SBOs have become a vital exit mechanism as the region attracts larger global players like Blackstone, Apollo, and Brookfield who look for established businesses previously "de-risked" by smaller, local PE firms.

SBOs are particularly popular in the Dubai International Financial Centre (DIFC) and Abu Dhabi Global Market (ADGM) jurisdictions. These "financial free zones" utilize English Common Law, which provides the sophisticated legal instruments required for complex PE-to-PE transfers.

Strategic Advantages of SBOs

- Continuity: The management team often stays in place, providing stability during the transition.

- Professionalized Governance: Because the company has already been under PE ownership, the financial reporting and governance structures are usually already at an institutional standard.

- Flexible Financing: SBOs in the UAE are increasingly supported by regional banks and private credit funds that understand the PE model.

Which legal clauses are critical in a UAE Share Purchase Agreement?

The Share Purchase Agreement (SPA) is the primary document governing a private equity exit, and it must address specific UAE legal nuances to protect the seller. Key clauses must define the exact mechanisms for price adjustment, the scope of liability, and the rights of remaining shareholders.

Essential Exit Clauses

- Drag-Along Rights: This allows the majority PE seller to force minority shareholders to join the sale. This is crucial for a 100 percent trade sale. Under the UAE Commercial Companies Law, these must be explicitly drafted in the Articles of Association to be enforceable.

- Locked Box vs. Completion Accounts: In the UAE, the "Locked Box" mechanism (where the price is fixed based on a historical balance sheet) is becoming more common to provide price certainty to the seller.

- Warranties and Indemnities (W&I): Sellers should aim for limited warranties. W&I insurance is now a standard tool in UAE deals to bridge the gap between a buyer's demand for protection and a seller's desire for a "clean" exit.

- Good Leaver / Bad Leaver: These provisions dictate how management shareholders are compensated for their equity if they leave the company during or shortly after the exit process.

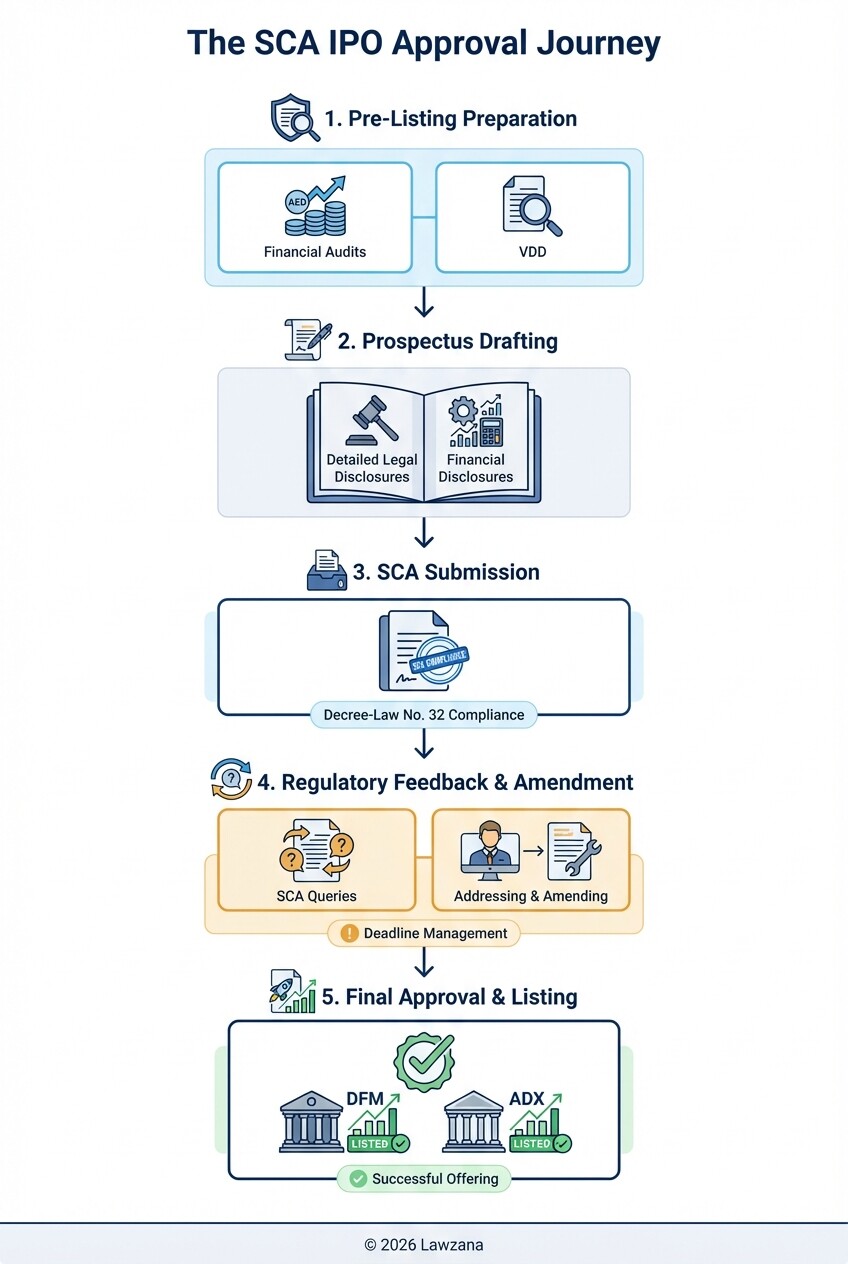

What regulatory approvals are required from the SCA?

Exits involving public joint-stock companies or listings on UAE exchanges require formal oversight and approval from the Securities and Commodities Authority (SCA). The SCA ensures that the exit process maintains market integrity and protects minority shareholder interests.

The SCA Approval Process

- Prospectus Approval: For an IPO exit, the SCA must review and approve the prospectus, a process that involves detailed financial disclosures and legal opinions.

- Disclosure Obligations: If the exit involves a significant stake in a listed company, the "Insider Trading" and "Disclosure" regulations of Federal Decree-Law No. 32 of 2021 on Commercial Companies apply.

- Fees: Fees vary depending on the transaction type. For a listing, the SCA fee is typically 0.02% of the total value of the shares offered for public subscription, capped at specific limits.

- M&A Regulation: The SCA oversees the "Takeover Code," which applies if an acquirer seeks to purchase more than 30 percent of a public company's shares.

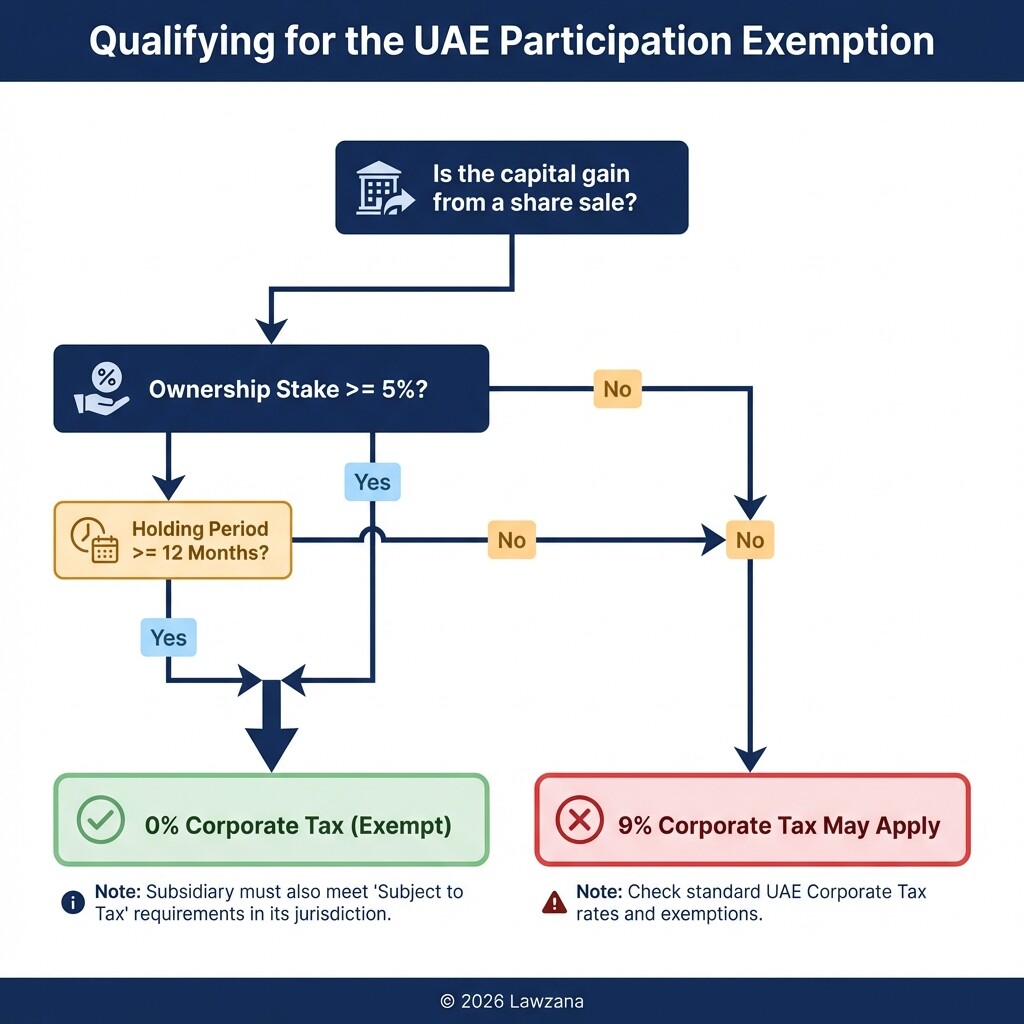

How does UAE tax law affect the repatriation of capital?

Capital repatriation from a UAE entity is generally straightforward, but the introduction of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses has changed the landscape for PE exits. While the UAE remains a tax-friendly environment, PE funds must now structure their exits to qualify for specific exemptions.

Key Tax Considerations

- Participation Exemption: Gains from the sale of shares are generally exempt from the 9 percent corporate tax if the UAE holding company owns at least 5 percent of the subsidiary for at least 12 months.

- Withholding Tax: Currently, there is a 0 percent withholding tax on dividends and capital gains repatriated to foreign investors from the UAE.

- Free Zone Exceptions: Entities located in the DIFC or ADGM may qualify for a 0 percent tax rate on "Qualifying Income," though the definitions are strict and require the entity to maintain adequate "substance" in the zone.

- Double Taxation Treaties: The UAE has over 130 treaties in place. PE firms often use these to minimize tax leakage when moving exit proceeds through various international jurisdictions.

Common Misconceptions about UAE PE Exits

"You must have a local Emirati partner to sell a mainland business."

Following the 2021 amendments to the Commercial Companies Law, many mainland activities now allow 100 percent foreign ownership. You no longer need a 51 percent local partner for most commercial sectors, making exits much cleaner for foreign PE funds.

"Free Zone companies cannot be sold via an IPO."

While Free Zone companies are governed by their own regulations, they can and do list on the DFM and ADX. Companies registered in the DIFC or ADGM frequently convert to Public Joint Stock Companies (PJSC) to facilitate a public exit.

"Exit disputes must go to UAE local courts."

Most PE transactions in the UAE utilize arbitration (such as the DIAC) or the specialized courts of the DIFC or ADGM. These courts operate in English and provide a familiar environment for international investors.

FAQs

What is the average timeline for a private equity exit in the UAE?

A trade sale usually takes 6 to 9 months, while an IPO requires 12 to 18 months of preparation. Secondary buyouts can sometimes be faster, closing in as little as 4 months if the due diligence is streamlined.

Can I repatriate 100 percent of my exit proceeds from the UAE?

Yes, the UAE generally allows for the full repatriation of capital and profits. There are no currency exchange controls, although banks will conduct standard Anti-Money Laundering (AML) checks on large transfers.

Do I need a physical presence in the UAE to sell my stake?

While the transaction can be handled remotely through legal counsel and powers of attorney, the entity being sold must comply with Economic Substance Regulations (ESR) to ensure the exit is recognized as valid for tax purposes.

What are the typical legal costs for a UAE exit?

Legal fees vary widely. For a mid-market trade sale (50 million to 200 million AED), legal costs typically range from 150,000 AED to 500,000 AED, depending on the complexity of the SPA and regulatory filings.

When to Hire a Lawyer

Navigating a private equity exit in the UAE requires specialized legal expertise to bridge the gap between international market standards and local regulatory requirements. You should engage a UAE-based legal advisor if:

- You are negotiating a Share Purchase Agreement (SPA) with complex price adjustment mechanisms.

- Your exit involves a transition from a Free Zone entity to a Mainland Public Joint Stock Company.

- You need to structure a "Drag-Along" or "Tag-Along" right that is enforceable under UAE Federal Law.

- The transaction involves "Qualifying Income" assessments under the new UAE Corporate Tax regime.

- You require a formal legal opinion for the Securities and Commodities Authority (SCA) or a stock exchange listing.

Next Steps

- Conduct a Vendor Due Diligence (VDD): Before engaging buyers, perform an internal audit of your UAE entity's compliance, licenses, and labor contracts.

- Select Your Jurisdiction: Decide if the exit will be governed by UAE Mainland law or the common law frameworks of the DIFC/ADGM.

- Assess Tax Impact: Consult with a tax advisor to ensure your holding structure qualifies for the Participation Exemption under the 2023 Corporate Tax Law.

- Prepare the Articles of Association: Ensure your company's constitutional documents are updated to reflect the desired exit rights (drag-along/tag-along).

- Engage Financial and Legal Advisors: Secure a team with specific experience in the UAE market to manage the SCA approvals and SPA negotiations.