- Corporate Tax Compliance: Free zone entities must register for UAE Corporate Tax and maintain audited financial statements to potentially qualify for a 0% tax rate.

- Economic Substance Requirements: Companies performing "Relevant Activities" must prove local economic presence to avoid penalties starting at AED 20,000.

- UBO Transparency: All free zone companies must maintain a Real Beneficial Borrower (UBO) register and report data to their registrar to comply with AML laws.

- Director Liability: Directors in common law zones like DIFC and ADGM face personal liability for breaches of fiduciary duties, including the duty to act in good faith.

- Reporting Deadlines: Compliance is not a one-time event; ESR notifications and UBO updates have strict annual and situational deadlines.

How does the UAE Corporate Tax Law impact free zone entities?

The UAE Corporate Tax Law, effective from June 1, 2023, requires all free zone entities to register for tax purposes and file annual returns regardless of their income level. While many free zone companies can benefit from a 0% "Qualifying Free Zone Person" (QFZP) rate on qualifying income, they must adhere to rigorous substance and reporting requirements to maintain this status.

To qualify for the 0% rate under Federal Decree-Law No. 47 of 2022, a free zone entity must:

- Maintain adequate substance in the UAE.

- Derive "Qualifying Income" as defined by the Ministry of Finance.

- Not have made an election to be subject to the standard 9% tax rate.

- Comply with transfer pricing rules and documentation requirements.

- Prepare and maintain audited financial statements.

Failure to meet any of these conditions results in the entity being taxed at the standard 9% rate on all taxable income exceeding AED 375,000. For more details on registration, visit the Federal Tax Authority.

What are the Economic Substance Regulations (ESR) compliance requirements?

Economic Substance Regulations (ESR) require UAE free zone companies that engage in specific "Relevant Activities" to demonstrate a genuine economic presence in the country. This ensures that profits are not being artificially shifted to a low-tax jurisdiction without corresponding local activity.

If your company performs any of the following activities, you must pass the Economic Substance Test:

- Banking, Insurance, or Investment Fund Management

- Lease-Finance or Headquarters Business

- Shipping or Holding Company Business

- Intellectual Property (IP) Business

- Distribution and Service Center Business

The Three Pillars of the Economic Substance Test

- Directed and Managed: The company must be directed and managed in the UAE (e.g., board meetings held locally with a quorum physically present).

- Core Income-Generating Activities (CIGA): The primary activities that generate income must be performed within the UAE.

- Adequacy: The company must have an adequate number of qualified employees, adequate physical assets (office space), and adequate operating expenditure in the UAE.

| Requirement | Deadline | Penalty for Non-Compliance |

|---|---|---|

| ESR Notification | Within 6 months of financial year-end | AED 20,000 |

| ESR Report | Within 12 months of financial year-end | AED 50,000 (first year) / AED 400,000 (repeat) |

Detailed guidance and filing portals can be accessed through the Ministry of Finance.

What are the fiduciary duties of directors in free zone jurisdictions?

Directors in UAE free zones, particularly in the Dubai International Financial Centre (DIFC) and Abu Dhabi Global Market (ADGM), are bound by fiduciary duties rooted in common law principles. These duties require directors to prioritize the company's interests above their own and to act with a level of care that protects shareholders and creditors.

While specific regulations vary by zone, core duties typically include:

- Duty to Act within Powers: Directors must act in accordance with the company's constitution (Articles of Association).

- Duty to Promote the Success of the Company: Directors must act in good faith to promote the long-term success of the entity for the benefit of its members.

- Duty of Independent Judgment: Directors must not fetter their discretion by following the instructions of third parties without personal evaluation.

- Duty of Care, Skill, and Diligence: Directors must exercise the care that would be exercised by a reasonably diligent person with the general knowledge and experience required for the role.

In the event of insolvency, these duties shift toward protecting the company's creditors. Breach of these duties can lead to personal financial liability or disqualification from holding directorships.

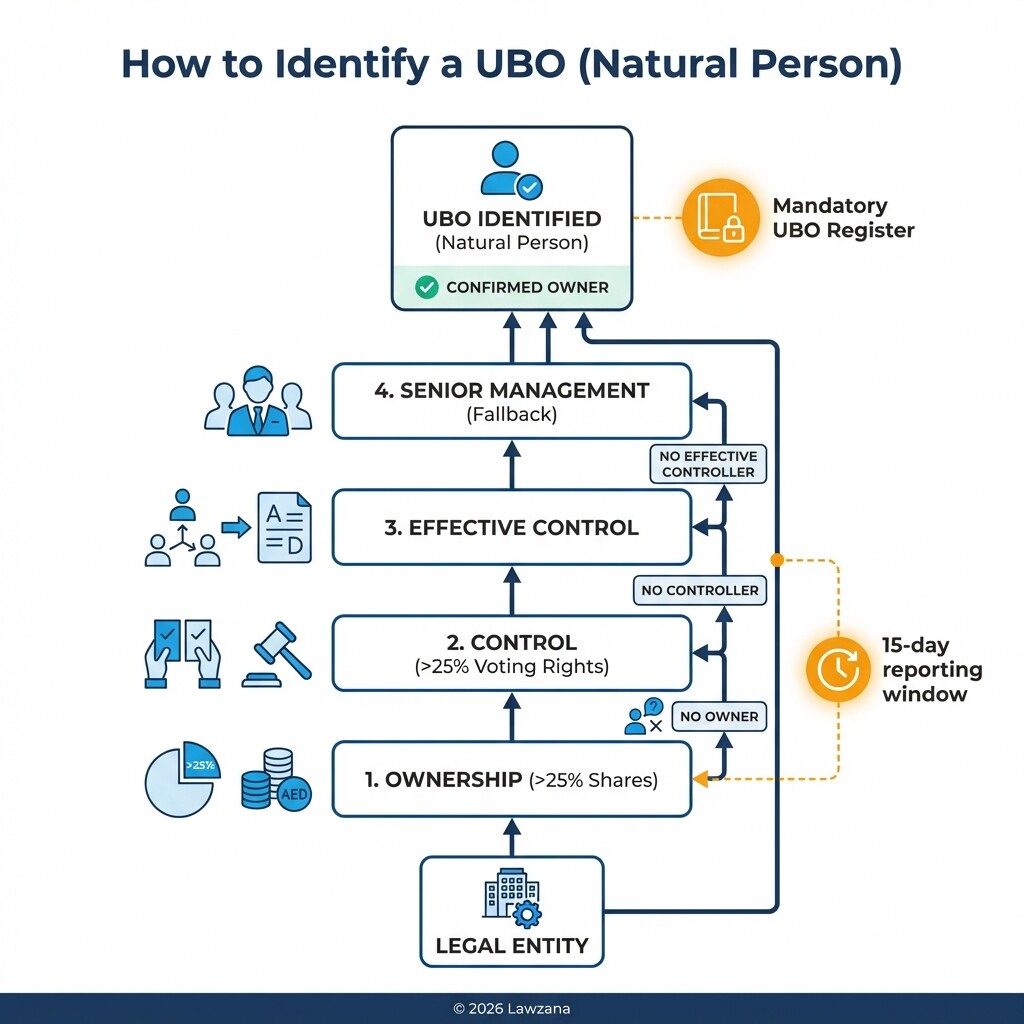

How do AML reporting and Ultimate Beneficial Owner (UBO) registers work?

UAE free zone companies are required to identify and record their Ultimate Beneficial Owners (UBO) to combat money laundering and terrorism financing. This information must be maintained in a dedicated register and submitted to the respective Free Zone Authority, which acts as the registrar.

Under Cabinet Decision No. 58 of 2020, a UBO is generally defined as any natural person who:

- Ultimately owns or controls, directly or indirectly, 25% or more of the company's capital.

- Holds 25% or more of the voting rights.

- Exercises control through other means, such as the right to appoint or dismiss the majority of directors.

Compliance Checklist for AML/UBO

- Maintain a UBO Register: Keep a physical or digital record of names, nationalities, and ID numbers of all beneficial owners.

- Register of Nominee Directors: If you use nominee directors, their details must also be recorded.

- Report Changes: Any change in UBO status must be reported to the licensing authority within 15 days of the change.

- Suspicious Activity Reports (SAR): Companies in "Designated Non-Financial Businesses and Professions" (DNFBPs) must register on the "goAML" portal to report suspicious transactions.

How should boards manage conflicts of interest in decision-making?

Managing conflicts of interest requires a transparent process where directors disclose any personal, professional, or financial interests that could influence their objectivity. In the UAE's sophisticated free zones, failure to disclose a conflict can result in the transaction being voided and the director being held liable for any resulting losses.

Effective conflict management involves these steps:

- Annual Declaration: Directors should sign a statement annually disclosing their interests in other companies or ventures.

- Ad-hoc Disclosure: Before any board meeting, directors must declare if they have a direct or indirect interest in any agenda item.

- Recusal: The conflicted director should leave the room during the discussion and must not vote on the specific resolution.

- Minute-Taking: The board secretary must meticulously document the disclosure, the recusal, and the basis on which the remaining board members determined the transaction was in the company's best interest.

Common Misconceptions About UAE Corporate Governance

"Free zones are completely exempt from UAE federal laws." This is false. While free zones have their own regulations (especially DIFC and ADGM), federal laws regarding Anti-Money Laundering (AML), Combating the Financing of Terrorism (CFT), and now Corporate Tax apply to all entities operating within the UAE, regardless of their zone.

"If I have a 0% tax rate, I don't need to do bookkeeping." This is a dangerous myth. To maintain the 0% "Qualifying Free Zone Person" status, companies are legally required to maintain audited financial statements. Without proper records, the Federal Tax Authority can disqualify the entity from tax incentives and apply the 9% rate plus penalties.

"Nominee directors protect the real owners from liability." In the UAE, the law looks at "shadow directors" or those who exercise actual control. If a nominee director acts solely on the instructions of a beneficial owner, both parties can be held liable for corporate failures or regulatory breaches.

FAQ

Do I need an audit for my free zone company every year?

Yes, most major free zones (including DMCC, DIFC, and ADGM) require annual audited financial statements. Furthermore, under the new Corporate Tax Law, audited accounts are a mandatory requirement for any free zone company wishing to benefit from the 0% tax rate.

What is the penalty for failing to file an ESR notification?

The penalty for failing to file an ESR notification is AED 20,000. If you fail to file the full ESR Report or fail to meet the "Economic Substance Test," the penalty starts at AED 50,000 and can escalate to AED 400,000 for repeat offenses.

Can a foreign company be a UBO?

No. A UBO must be a natural person (a human being). If a company is owned by another legal entity, you must "look through" the layers of ownership until you identify the individual humans who ultimately own or control the business.

How often should the UBO register be updated?

The UBO register should be updated immediately whenever a change occurs. Legally, you must notify the licensing authority of any changes to the UBO information within 15 days of the change.

When to Hire a Lawyer

Corporate governance in the UAE has shifted from a "light-touch" environment to a highly regulated one. You should consult a legal professional if:

- You are unsure if your business activities fall under the "Relevant Activities" for ESR.

- You are restructuring your company and need to ensure UBO compliance.

- A director is facing a potential conflict of interest in a high-value transaction.

- You have received a notice of non-compliance or a penalty from the Federal Tax Authority or your Free Zone registrar.

- You are transitioning a "paper-only" entity into an operational business and need to meet "substance" requirements.

Next Steps

- Conduct a Governance Audit: Review your current Articles of Association and board minutes to ensure they meet the standards of your specific free zone.

- Register for Corporate Tax: If you haven't already, register through the EmaraTax portal to avoid late registration fines.

- Review ESR Status: Determine if your 2023 or 2024 activities require an ESR notification or report.

- Update UBO Data: Verify that the information held by your Free Zone Authority matches your current internal shareholding records.

- Appoint a Compliance Officer: For larger entities, designate a specific individual to monitor regulatory deadlines and filing requirements.