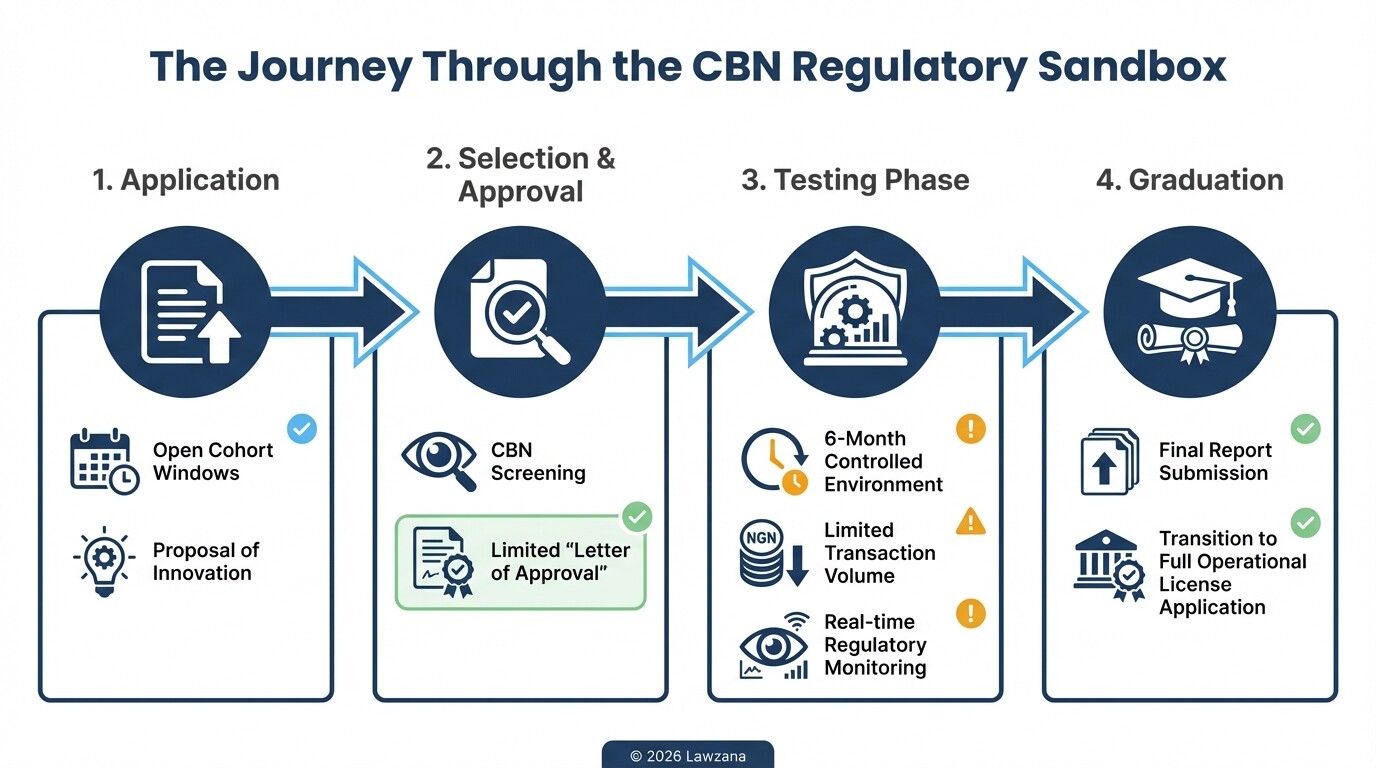

- The Central Bank of Nigeria (CBN) Regulatory Sandbox allows foreign fintechs to test innovative products for up to six months before obtaining full operational licenses.

- Foreign entities must either incorporate a local subsidiary or partner with a licensed Nigerian financial institution to participate in the sandbox.

- Participation in the sandbox does not grant an automatic waiver for minimum capital requirements, which can reach 5 billion Naira for certain licenses like Payment Service Banks.

- Compliance with the Nigeria Data Protection Act (NDPA) and upcoming 2026 NDPC guidelines is mandatory for all participants handling citizen data.

- Testing in the sandbox is categorized into cohorts, and successful "graduation" can significantly streamline the final licensing process with the CBN.

What is the Central Bank of Nigeria Regulatory Sandbox?

The CBN Regulatory Sandbox is a controlled environment where fintech startups can test innovative financial products, services, or business models under the oversight of the regulator. It is designed to foster financial inclusion and allow the CBN to understand emerging technologies before they hit the mass market. For foreign startups, it serves as a critical entry point to the Nigerian market, providing a "safe space" to prove viability without immediately incurring the full weight of traditional regulatory compliance.

The sandbox operates on a cohort basis, meaning the CBN opens application windows at specific times during the year. During the testing period, which typically lasts six months, the startup is granted limited "Letters of Approval" to operate within predefined parameters, such as a limited customer base or transaction volume. This allows the regulator to monitor risks like money laundering, consumer protection vulnerabilities, and systemic stability in real-time.

Pre-Application Checklist for Foreign Fintech Startups

Foreign companies looking to enter the Nigerian market via the regulatory sandbox should complete the following steps to ensure their application is not rejected during the initial screening phase.

| Requirement | Action Item |

|---|---|

| Local Incorporation | Register a Nigerian subsidiary with the Corporate Affairs Commission (CAC). |

| Product Innovation | Document how the product differs from existing solutions in the Nigerian market. |

| Risk Management | Create a framework for mitigating fraud, cyber threats, and data breaches. |

| Exit Strategy | Outline how customers will be protected if the test fails or the sandbox period ends. |

| Capital Sufficiency | Provide proof of funds to sustain operations throughout the 6 to 12-month testing window. |

| Partnership Agreement | If not applying solo, secure a Memorandum of Understanding (MoU) with a licensed local bank. |

Eligibility Criteria for the CBN Regulatory Sandbox

To qualify for the regulatory sandbox, a fintech must demonstrate that its product is truly innovative and addresses a gap in the Nigerian financial ecosystem. The CBN prioritizes solutions that promote financial inclusion, particularly for the unbanked or underbanked populations. A product that simply replicates an existing banking app without adding a unique technological or social value is unlikely to be accepted.

Applicants must also show that they have done their "homework." This means providing evidence of a functional prototype (Minimum Viable Product) and a clear testing plan. The CBN requires foreign startups to demonstrate that they have conducted an internal risk assessment and have the technical capacity to manage the proposed test. Finally, the applicant must show that the product does not currently fit clearly into the existing Nigerian regulatory framework, necessitating the sandbox's flexible approach.

License Requirements for Payment Service Banks (PSB) and IMTOs

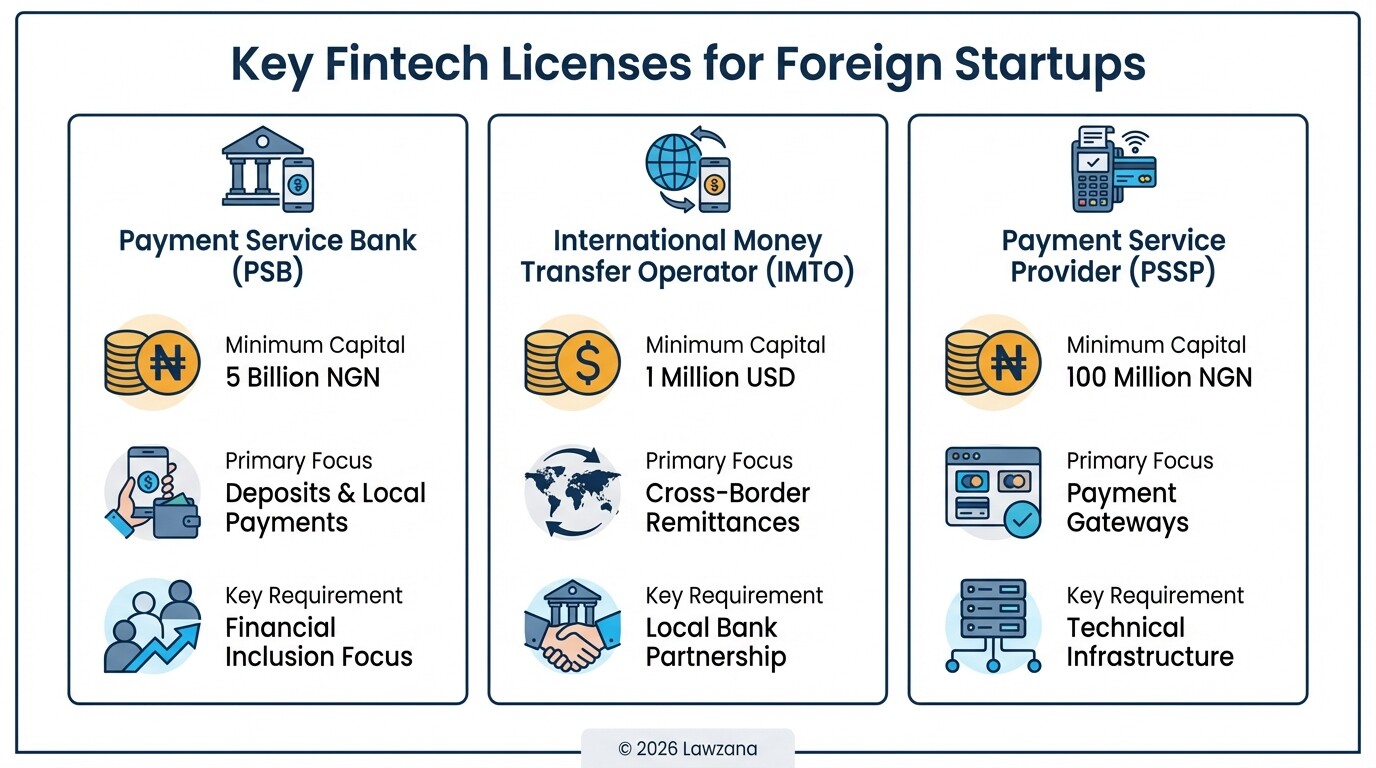

While the sandbox allows for testing, startups eventually need formal licenses to operate at scale. The Payment Service Bank (PSB) license is ideal for fintechs focusing on high-volume, low-value transactions in rural areas. PSBs are restricted from granting loans or trading in foreign exchange but can accept deposits and offer payments. The primary hurdle for foreign firms is the 5 billion Naira minimum capital requirement, which must be deposited with the CBN before a license is issued.

For fintechs focused on cross-border remittances, the International Money Transfer Operator (IMTO) license is required. Foreign companies applying for an IMTO license must have a minimum share capital of 1 million USD (or its equivalent) and must partner with a local deposit money bank. Unlike PSBs, IMTOs focus exclusively on facilitating the transfer of funds from abroad to recipients in Nigeria, making them a popular choice for global "Neo-banks" looking to capture the Nigerian diaspora market.

Application and Monitoring Costs for International Applicants

Entering the Nigerian fintech space involves both direct and indirect costs. While the CBN does not always charge a massive "fee" just to enter the sandbox, the administrative costs of compliance are significant. For formal licensing, there is usually a non-refundable application fee (typically around 500,000 Naira for most categories) and a licensing fee (around 2 million Naira) once the Approval-in-Principle is granted.

Monitoring costs during the sandbox phase include regular reporting and independent audits. Foreign startups should budget for:

- Legal and Professional Fees: Retaining a Nigerian firm to handle CAC registration and CBN liaison.

- Data Residency Costs: Expenses related to hosting data on local servers to comply with Nigerian law.

- Operational Deposits: Some licenses require a significant percentage of the minimum capital to be held as a refundable deposit with the CBN.

- Annual Renewal: Most licenses require yearly renewals, which range from 100,000 to 1,000,000 Naira depending on the license type.

Partnering with Licensed Banks for White Label Solutions

For many foreign fintechs, the most efficient way to enter Nigeria is through a "White Label" or "Agency" partnership with an existing licensed bank. This allows the startup to leverage the bank's existing license (such as a Commercial Banking or Microfinance license) to offer services under their own brand. This "Banking-as-a-Service" model bypasses the need for the startup to hold its own 5 billion Naira capital if they are merely acting as a service interface.

When pursuing a white label solution, the contract between the fintech and the Nigerian bank is the most critical document. The CBN still oversees these partnerships and requires that the licensed bank remains responsible for AML/KYC (Anti-Money Laundering and Know Your Customer) compliance. For the foreign startup, this provides a faster time-to-market, though it often involves sharing a percentage of transaction revenue with the local partner bank.

Compliance with the 2026 Nigerian Data Protection Commission Guidelines

The Nigerian Data Protection Commission (NDPC) has signaled a move toward stricter enforcement by 2026, building upon the Nigeria Data Protection Act of 2023. Any fintech startup in the sandbox must implement "Privacy by Design." This means data protection must be an integral part of the product's architecture, not an afterthought. Foreign startups must ensure that the personal data of Nigerian citizens is processed and stored according to local standards, which often require data to reside within Nigerian borders.

By 2026, fintechs will likely face mandatory annual data protection audits and the requirement to appoint a dedicated Data Protection Officer (DPO) based in Nigeria. Non-compliance can lead to massive fines-up to 2% of annual gross revenue or 10 million Naira, whichever is higher. Foreign firms should prioritize local server infrastructure and robust encryption methods to satisfy these evolving NDPC requirements during their sandbox testing phase.

Common Misconceptions

Myth 1: The Sandbox provides a permanent license.

Many believe that once they are accepted into the sandbox, they are "fully licensed." This is false. The sandbox is a temporary testing phase. Successful participants must still apply for a full operational license (like a PSSP or MFB license) after their cohort period ends.

Myth 2: Foreign companies don't need a local office.

Even if a fintech is entirely digital, the CBN and CAC require a physical presence or a registered address in Nigeria. You cannot operate a regulated fintech business in Nigeria solely from an offshore headquarters without a registered local subsidiary.

Myth 3: Sandbox participants are exempt from AML/KYC.

Some startups assume the "controlled environment" means they can skip customer verification. In reality, the CBN is stricter about AML/KYC in the sandbox because the product is unproven. You must demonstrate a robust ability to track and report suspicious transactions from day one.

FAQ

Can a foreign company apply for the CBN Sandbox without a local partner?

Yes, but you must register a local Nigerian subsidiary. The CBN requires a local legal entity to hold accountable for regulatory compliance, even if the parent company is based abroad.

How long does the sandbox application process take?

The application window is periodic. Once the window closes and your application is submitted, the review process can take 30 to 60 days. If accepted, the testing phase usually lasts six months.

What happens if my product fails the sandbox test?

You must trigger your "Exit Strategy." This involves notifying all test participants, settling any outstanding financial obligations, and securely deleting or archiving user data according to NDPC guidelines.

Is the 5 billion Naira capital requirement the same for all fintechs?

No. The 5 billion Naira requirement is specific to Payment Service Banks (PSBs). Other licenses, like the Payment Service Provider (PSSP) or Switching license, have different capital requirements, ranging from 100 million to 2 billion Naira.

When to Hire a Lawyer

You should consult a Nigerian legal expert specializing in FinTech and Banking regulation as soon as you begin your market entry strategy. Legal counsel is essential for:

- Structuring your local subsidiary to comply with foreign ownership laws.

- Drafting the Sandbox application and ensuring your "innovation" meets CBN's legal definitions.

- Negotiating Partnership Agreements or White Label contracts with Nigerian banks.

- Navigating the complex "Approval-in-Principle" (AIP) process for full licensing.

- Ensuring your data processing workflows meet the 2026 NDPC compliance standards.

Next Steps

- Incorporate your local subsidiary: Use a legal service to register with the CAC and obtain your Tax Identification Number (TIN).

- Review the CBN Sandbox Manual: Download the latest framework from the Central Bank of Nigeria website to check for open cohort windows.

- Conduct a Gap Analysis: Determine if your product fits into an existing license or if the sandbox is truly your only path to market.

- Draft your Testing Plan: Outline exactly how many users you will test, what data you will collect, and how you will protect them.

- Secure Local Counsel: Engage a law firm to review your risk management framework before submission to the CBN.