- The Digital Personal Data Protection Act (DPDP Act) applies to all digital personal data processed within India and data processed outside India if it relates to offering goods or services to persons within India.

- Non-compliance carries heavy financial penalties, reaching up to ₹250 crore ($30 million approximately) per instance, with no upper ceiling for multiple violations.

- Global firms must appoint a Data Protection Officer (DPO) and an India-based representative if they are categorized as Significant Data Fiduciaries.

- Consent must be free, specific, informed, unconditional, and manifested through a clear affirmative action.

- Data Principals (individuals) have the "Right to Erasure," requiring firms to delete data once the specific purpose for collection is fulfilled or consent is withdrawn.

Compliance Checklist for Global Firms

To align with India's DPDP Act, international organizations must transition from general global privacy policies to India-specific frameworks. This checklist provides the foundational steps for establishing a compliant data processing ecosystem in the Indian market.

| Action Item | Description | Priority |

|---|---|---|

| Data Mapping | Identify all personal data collected from Indian residents and track its flow across borders. | High |

| Privacy Notice Update | Create clear, plain-language notices available in English and specified Indian languages. | High |

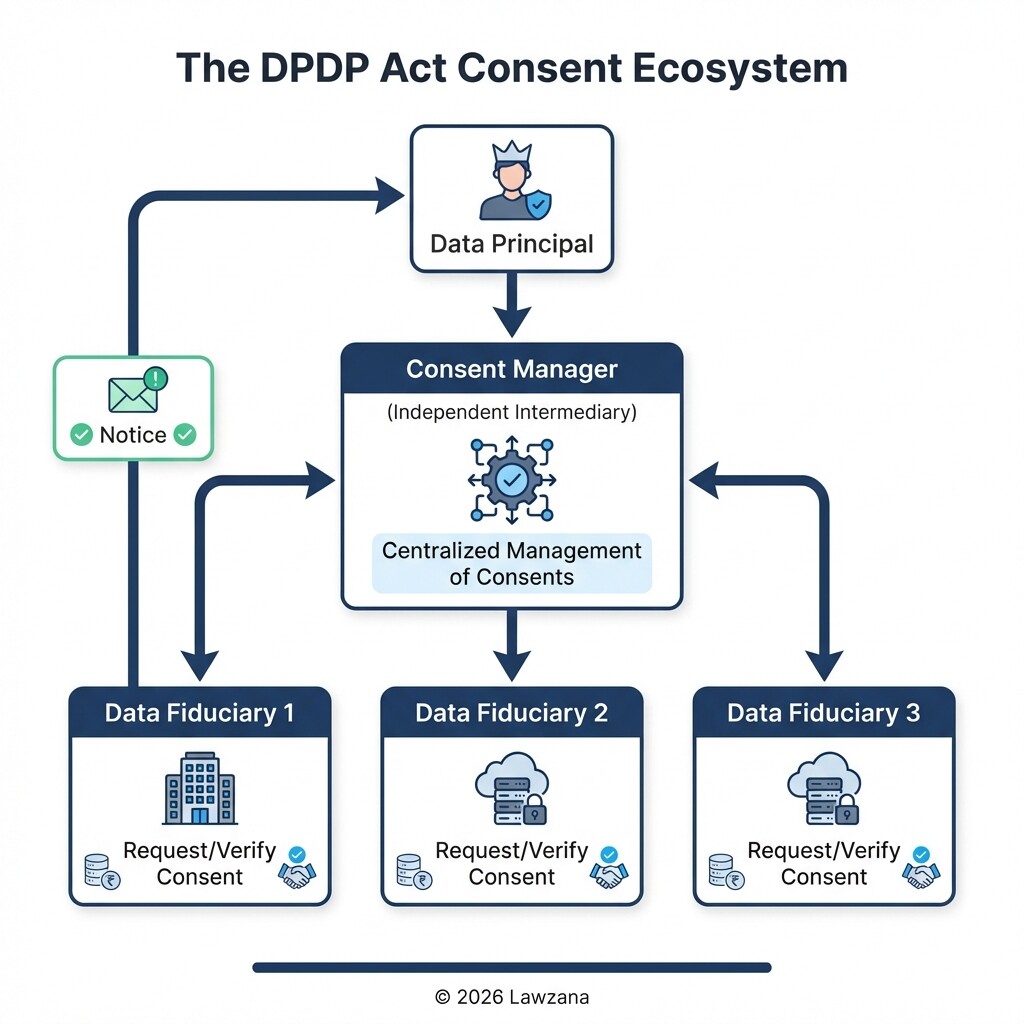

| Consent Management | Implement "Consent Managers" and affirmative opt-in mechanisms; remove pre-ticked boxes. | High |

| DPO Appointment | Designate a Data Protection Officer for Indian operations (mandatory for Significant Data Fiduciaries). | Medium |

| Contractual Audit | Review third-party data processor agreements to ensure they meet Indian statutory standards. | High |

| Breach Protocol | Establish a 72-hour internal identification and reporting mechanism for data breaches. | High |

| Erasure Workflow | Build automated systems to delete data once the "specified purpose" is completed. | Medium |

Responsibilities of Data Fiduciaries

A Data Fiduciary is any person or entity that determines the purpose and means of processing personal data. Under the DPDP Act, these entities bear the primary responsibility for ensuring that data is processed lawfully and that the rights of individuals are protected.

Data Fiduciaries must ensure that the personal data they process is accurate and complete, especially if it is used to make decisions that affect the Data Principal. If a firm shares data with a third-party "Data Processor," the Fiduciary remains legally liable for the processor's compliance. Furthermore, the Act introduces the concept of a Significant Data Fiduciary (SDF). The Indian government designates certain firms as SDFs based on the volume of data handled or the risk to national security. SDFs face stricter requirements, including:

- Conducting mandatory Data Protection Impact Assessments (DPIA).

- Appointing an independent data auditor to evaluate compliance.

- Maintaining a resident Data Protection Officer in India.

Consent Management and Notice Requirements

Consent under the DPDP Act is the bedrock of lawful processing and must be sought through a clear, transparent process. Firms cannot bundle consent for multiple purposes or hide it within lengthy Terms of Service; it must be a standalone, affirmative action by the individual.

Every request for consent must be accompanied by a Notice. This notice must describe the personal data to be collected, the specific purpose of processing, and how the individual can exercise their rights or file a complaint with the Data Protection Board of India. Notably, if a firm processed data based on consent before the Act was implemented, they must provide a fresh notice to those individuals as soon as possible to maintain compliance. Global firms should also prepare to offer these notices in English and any of the 22 languages specified in the Eighth Schedule to the Indian Constitution, depending on their target demographic.

Cross-Border Data Transfer Restrictions

India has adopted a "negative list" or "blacklisting" approach to cross-border data transfers. This means that personal data can generally be transferred to any country unless the Indian government specifically restricts transfers to that jurisdiction for reasons of national security or public interest.

While this is more liberal than the "white-listing" approach used by some other jurisdictions, global firms must still ensure that the transfer is governed by a robust contract. The contract must mandate that the recipient of the data provides a level of protection at least equivalent to the DPDP Act. Additionally, certain types of sensitive data-such as financial or health data-may be subject to sector-specific localization requirements from the Reserve Bank of India (RBI) or other regulators, which operate alongside the DPDP Act.

Rights of Data Principals to Access and Erasure

The DPDP Act empowers individuals, known as Data Principals, with significant control over their digital footprint. These rights are not absolute but provide a framework for transparency that global firms must be prepared to facilitate through dedicated online portals or communication channels.

The primary rights include:

- Right to Information: Individuals can request a summary of the personal data being processed and the identities of all other entities with whom the data has been shared.

- Right to Correction and Erasure: Firms must correct inaccurate data, complete incomplete records, and update outdated information. More importantly, the Right to Erasure mandates that firms delete personal data when the individual withdraws consent or when the purpose for which the data was collected is no longer served.

- Right to Grievance Redressal: Every Data Fiduciary must provide a clear mechanism for individuals to register complaints. A Principal must generally exhaust this internal grievance process before approaching the Data Protection Board of India.

Potential Penalties for Non-Compliance and Data Breaches

The DPDP Act introduces a tiered penalty structure designed to deter even the largest global conglomerates from negligence. Unlike previous Indian laws, these fines are not based on a percentage of turnover but are fixed amounts based on the nature of the violation.

The Data Protection Board of India (DPBI) adjudicates these penalties after an inquiry. The severity of the fine depends on the nature, gravity, and duration of the breach.

| Violation Type | Maximum Penalty |

|---|---|

| Failure to take reasonable security safeguards to prevent data breach | Up to ₹250 Crore |

| Failure to notify the Board or affected individuals of a breach | Up to ₹200 Crore |

| Non-fulfillment of obligations regarding children's data | Up to ₹200 Crore |

| General non-compliance with other provisions of the Act | Up to ₹50 Crore |

Common Misconceptions About the DPDP Act

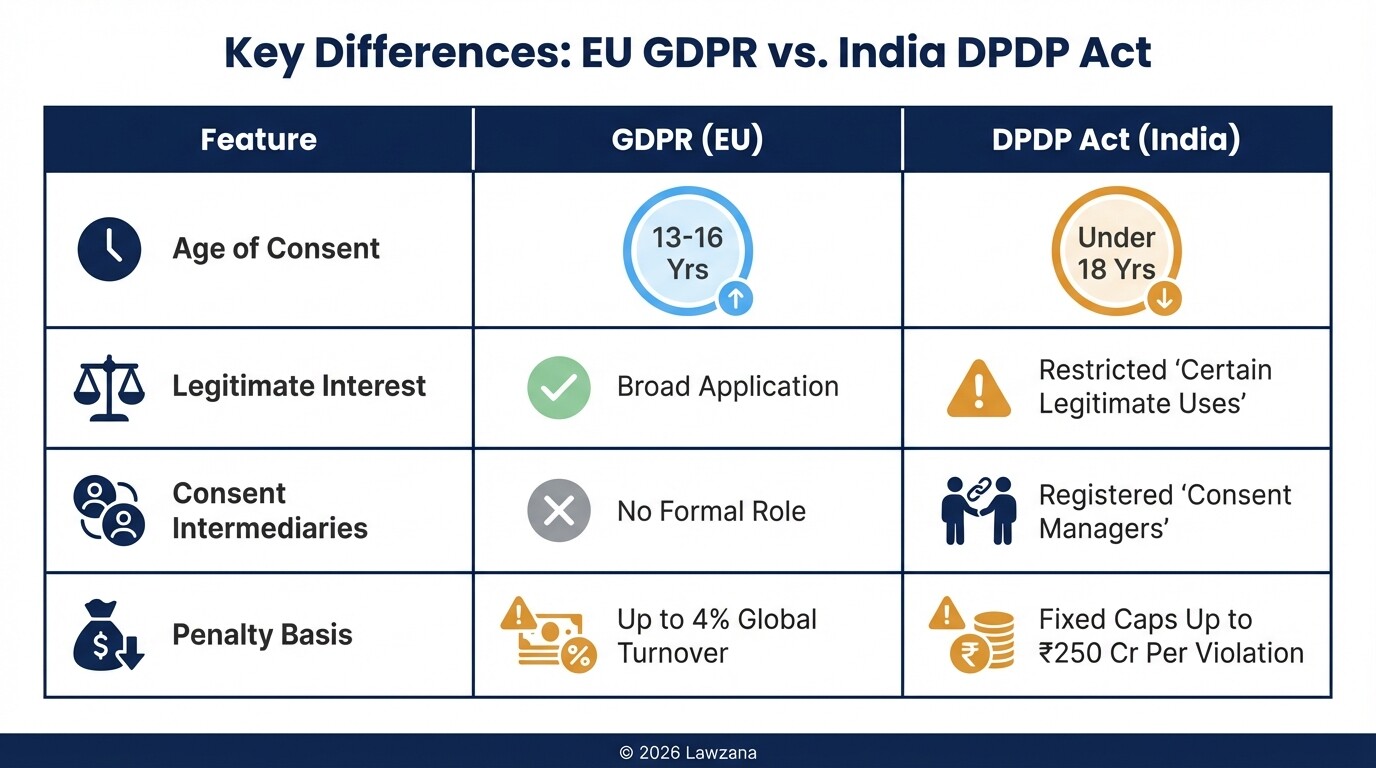

Myth 1: "We are GDPR compliant, so we are automatically DPDP compliant."

While both laws share similarities, the DPDP Act has unique requirements, such as the specific role of "Consent Managers" and different notification timelines. The Indian Act also lacks a "Legitimate Interest" clause as broad as the GDPR, meaning firms may need to rely more heavily on explicit consent in India.

Myth 2: "The Act only applies to companies with an office in India."

The Act has extraterritorial reach. If your firm processes the data of individuals located in India to offer them goods or services-even if you have no physical presence in the country-you are legally bound by the DPDP Act.

FAQ

Does the DPDP Act apply to B2B data?

The Act applies to "personal data," which is any data about an individual who is identifiable. If B2B data includes personal information of employees, directors, or points of contact, that specific data is protected under the Act.

What is a Consent Manager?

A Consent Manager is a specialized entity registered with the Data Protection Board that allows individuals to manage, withdraw, and give consent through a single platform. Global firms must ensure their systems can interface with these managers.

Are there special rules for children's data?

Yes. Processing the data of anyone under 18 requires verifiable parental consent. Firms are strictly prohibited from processing data that is likely to cause detrimental effects on the well-being of a child or involves tracking and behavioral advertising targeted at children.

When to Hire a Lawyer

Navigating the DPDP Act requires more than just a technical update; it requires a legal overhaul of your data governance strategy. You should consult a legal professional if:

- You are designated as a Significant Data Fiduciary and need to conduct a Data Protection Impact Assessment.

- You are drafting cross-border data transfer agreements and need to ensure they meet Indian standards.

- You have experienced a data breach and must navigate the 72-hour reporting window to the Data Protection Board.

- You need to localize your global privacy policy to comply with the 22 official languages and specific notice requirements of India.

Next Steps

- Conduct a Data Audit: Map all data touchpoints involving Indian residents to understand your current exposure.

- Review Consent Architecture: Audit your website and app interfaces to ensure consent is affirmative and specific.

- Appoint a Representative: If you lack an Indian office, identify a local legal representative to handle communications with the Data Protection Board.

- Monitor Official Notifications: The Indian government frequently releases updated "Rules" that provide specific technical details on how the Act's broad provisions must be implemented. Stay updated via the Ministry of Electronics and Information Technology (MeitY).