- The WHOA (Dutch Court Confirmation of Extrajudicial Restructuring Plans) allows companies to restructure debt without the consent of all creditors.

- A "cross-class cram-down" can bind dissenting classes of creditors to a plan if at least one "in-the-money" class votes in favor.

- Creditors have limited windows to challenge a plan, usually requiring proof that they are worse off under the plan than in a standard bankruptcy.

- The "cooling-off period" prevents creditors from seizing assets or filing for bankruptcy for up to eight months during negotiations.

- WHOA is designed to be recognized across the EU, making it a powerful tool for international businesses with Dutch subsidiaries.

What is the WHOA insolvency proceeding in the Netherlands?

The WHOA (Wet Homologatie Onderhands Akkoord) is a pre-insolvency tool that allows a debtor to offer a restructuring plan to its creditors and shareholders outside of formal bankruptcy. Once the Dutch court confirms (homologates) the plan, it becomes legally binding on all affected parties, including those who voted against it.

This framework, often called the "Dutch Scheme," bridges the gap between voluntary workouts and formal insolvency. It is heavily inspired by the US Chapter 11 and the UK Scheme of Arrangement. The primary goal is to prevent the liquidation of viable businesses that are burdened by excessive debt. For creditors, this means your contractual rights can be modified-such as reducing the principal amount owed or extending payment terms-without your explicit signature, provided the court finds the plan fair and legally compliant.

How does the "cram-down" mechanism bind minority creditors?

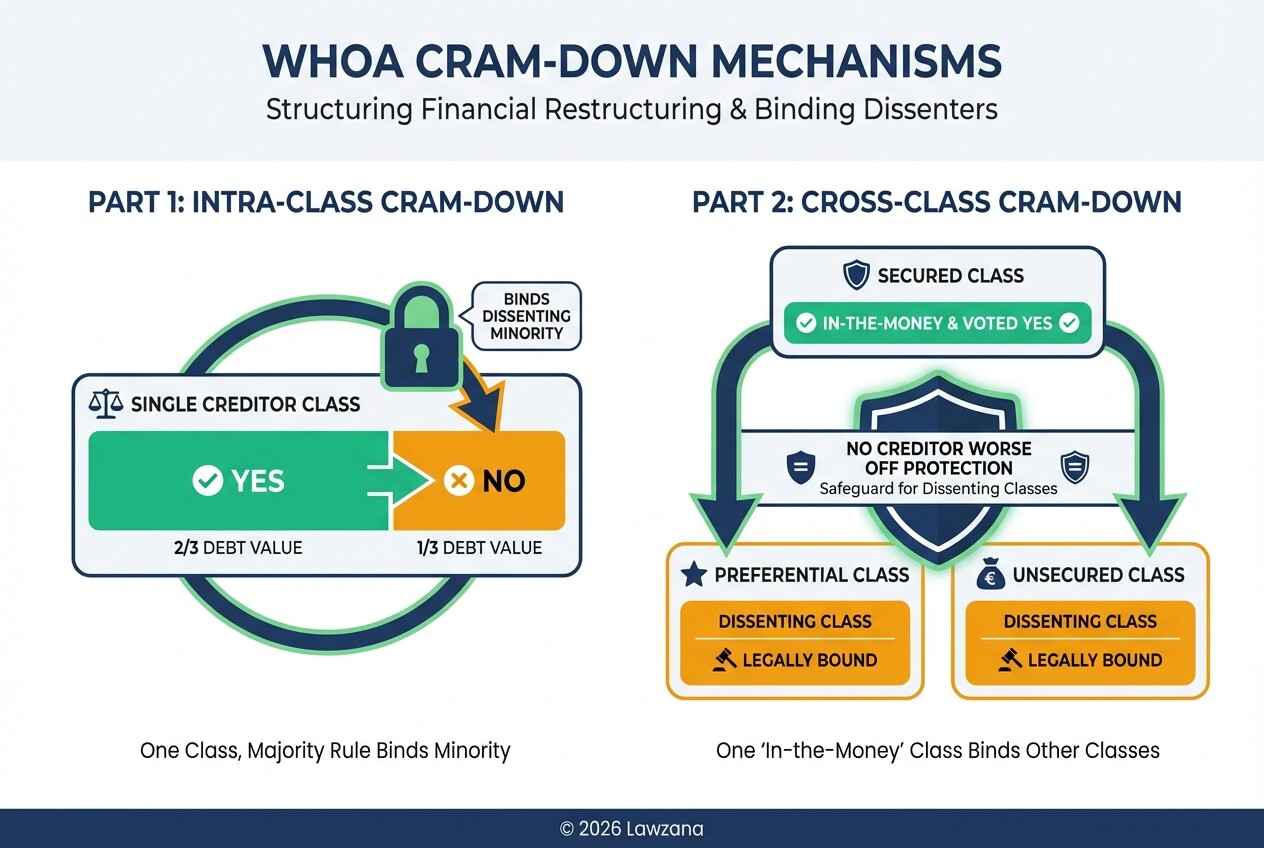

The "cram-down" mechanism allows a restructuring plan to be enforced on dissenting creditors if specific voting thresholds are met within "classes" of creditors. In the Netherlands, creditors are grouped into classes based on the similarity of their legal rights (e.g., secured creditors, preferential creditors, and unsecured trade creditors).

A plan is accepted by a class if creditors representing at least two-thirds of the total debt amount in that class vote in favor. The WHOA features two types of cram-downs:

- Intra-class Cram-down: If the two-thirds majority in a class is reached, the remaining one-third in that same class is bound by the plan.

- Cross-class Cram-down: The court can confirm a plan even if entire classes vote against it, provided at least one class of creditors that would receive a payout in a liquidation scenario (an "in-the-money" class) has voted in favor.

To protect dissenting creditors, the WHOA applies the "No Creditor Worse Off" principle. The court will not confirm a plan if a dissenting creditor can prove they would receive more in a standard bankruptcy liquidation than they are offered under the restructuring plan.

What documentation is required to challenge a restructuring plan?

To successfully challenge a WHOA plan in a Dutch court, a creditor must provide robust financial evidence demonstrating that the plan is either procedurally flawed or substantively unfair. Because the court moves quickly, having your documentation ready before the confirmation hearing is critical.

Key documents for a challenge include:

- Valuation Reports: Independent assessments showing that the "liquidation value" (what you would get in bankruptcy) is higher than the "restructuring value" offered in the plan.

- Class Composition Analysis: Evidence that the debtor grouped creditors incorrectly to manipulate the voting outcome.

- Feasibility Data: Financial projections showing the debtor is unlikely to survive even if the plan is confirmed, meaning the sacrifice requested of creditors is futile.

- The "Best Interest" Test Evidence: Documentation proving that the plan distributes value in a way that deviates from the legal priority of claims without a valid reason.

Creditors generally have a short window-often only eight days after the voting results are submitted-to lodge a formal objection with the court.

How does WHOA impact cross-border guarantees and security interests?

The WHOA has significant implications for international B2B contracts because it can affect not only the Dutch debtor but also the rights creditors hold against third parties. Specifically, the WHOA allows for the restructuring of obligations involving group companies if those companies are integral to the restructuring.

- Guarantees: A restructuring plan can include provisions that modify or discharge a creditor's claim against a group company that has guaranteed the debtor's debt. This prevents creditors from "bypassing" the restructuring by simply suing a parent company or affiliate.

- Security Interests: While secured creditors (like banks with pledges or mortgages) are usually placed in their own class, their security can be affected. The plan might extend the maturity of the secured debt or change interest rates, as long as the secured creditor is not left worse off than in a liquidation.

- Jurisdiction: For international creditors, the WHOA can be conducted as a "public" proceeding (listed in the EU Insolvency Regulation) for automatic recognition across the EU, or a "private" proceeding for more confidential handling, though recognition outside the EU may then rely on local private international law.

What is the timeline for the cooling-off period and plan confirmation?

The WHOA process is designed to be efficient, often concluding within three to six months, though the law allows for some flexibility depending on the complexity of the debt.

| Phase | Description | Typical Duration |

|---|---|---|

| Start Statement | The debtor files a "startverklaring" with the court to initiate the process. | Immediate |

| Cooling-off Period | The court grants a stay, preventing creditors from enforcing claims or seizing assets. | 4 months (extendable to 8) |

| Plan Proposal | The debtor sends the draft plan to affected creditors for review. | At least 8 days before voting |

| Voting Period | Creditors cast their votes by class. | Specified by the debtor |

| Confirmation (Homologation) | The court holds a hearing to decide whether to make the plan legally binding. | 8 to 14 days after the vote |

Once the court issues the homologation order, the decision is final. There is generally no right of appeal, which provides immediate certainty for the company and its creditors.

What are the alternatives to WHOA in the Netherlands?

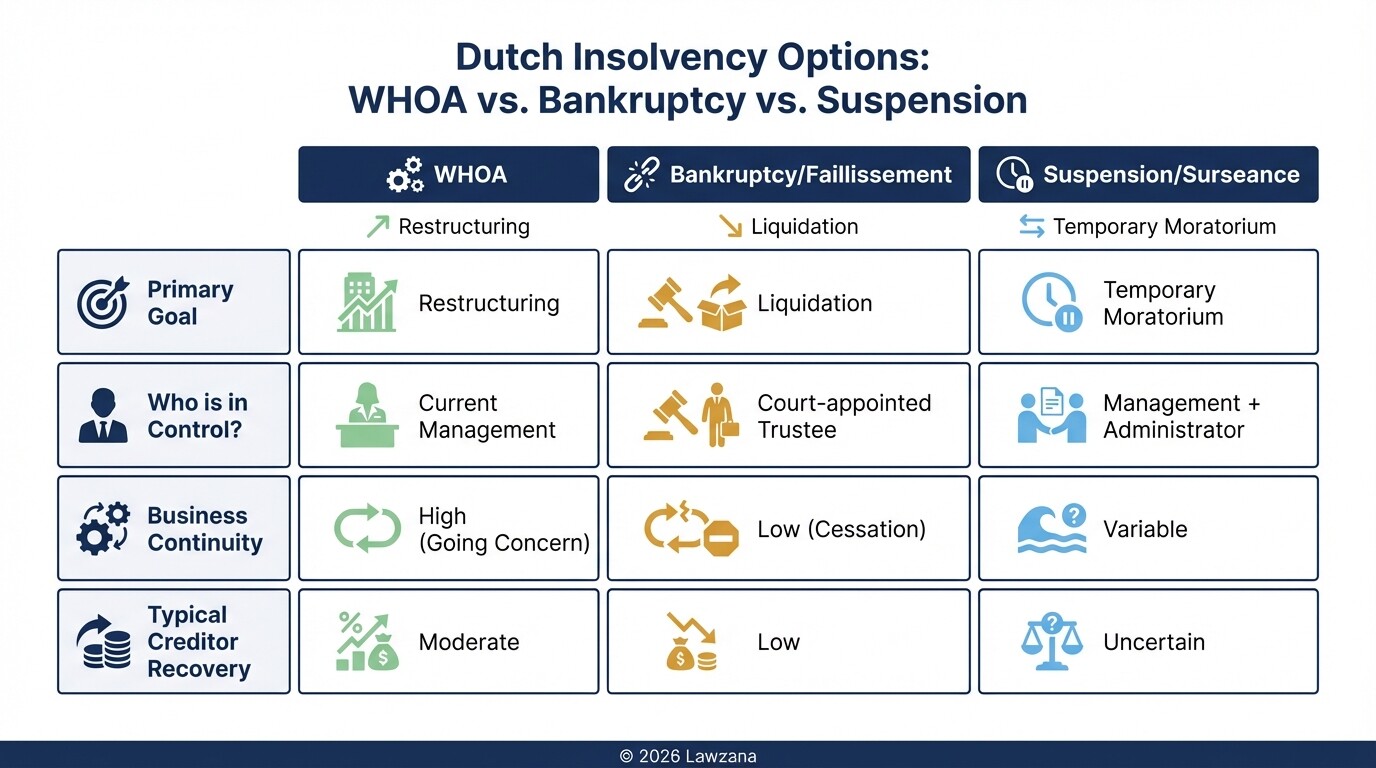

When a company faces financial distress in the Netherlands, the WHOA is one of three primary paths. Choosing between them depends on whether the business is inherently viable and how much cooperation exists between the debtor and creditors.

- Traditional Bankruptcy (Faillissement): This is a liquidation process. A court-appointed trustee takes over the company, sells assets, and distributes the proceeds. For creditors, this usually results in the lowest recovery rate, often $0$ for unsecured trade creditors.

- Suspension of Payments (Surseance van betaling): This is intended for temporary liquidity issues. It provides a moratorium on debts but rarely leads to a successful long-term restructuring. It often ends in bankruptcy.

- Voluntary Liquidation (Turboliquidatie): If a company has no assets left, the board can dissolve it without a formal bankruptcy process. However, recent laws (2023) have increased the transparency requirements for this to protect creditors from fraud.

Compared to these options, the WHOA offers the highest chance of business continuity and potentially higher recovery rates for creditors through a "going-concern" valuation.

Common Misconceptions About WHOA

Myth 1: Only the debtor can start a WHOA process. Actually, creditors, shareholders, or even the works council can trigger the process by requesting the court to appoint a "restructuring expert" (herstructureringsdeskundige). This expert then takes the lead in drafting and proposing the plan, ensuring the debtor does not have total control.

Myth 2: If I vote "No," I cannot be forced to accept a haircut. This is the most dangerous misconception for creditors. Under the cross-class cram-down rules, even if your entire class rejects the plan, the court can still force it upon you. Your protection lies in the "No Creditor Worse Off" rule, not in the power of your vote alone.

FAQ

Can a WHOA plan terminate my existing contracts?

Yes. A debtor can propose to amend or terminate burdensome contracts (like expensive office leases or supply agreements) as part of the plan. If the counterparty does not agree, the debtor can terminate the contract unilaterally, and the resulting claim for damages will be treated as an unsecured debt within the restructuring plan.

Does the WHOA apply to international creditors outside the Netherlands?

Yes. If the Dutch court has jurisdiction (usually because the debtor's "Center of Main Interests" is in the Netherlands), the plan applies to all creditors regardless of their location. For EU-based creditors, the official Dutch court website provides information on how these proceedings are recognized under EU Regulation 2015/848.

How are employees affected by a WHOA plan?

The WHOA specifically excludes the rights of employees. Their employment contracts, salaries, and pension rights cannot be modified or terminated through a WHOA restructuring plan. Employee-related restructuring must follow standard Dutch labor law.

When to Hire a Lawyer

Navigating a WHOA proceeding as a creditor requires immediate action and specialized technical knowledge. You should consult a Dutch restructuring attorney if:

- You receive a "start statement" or a draft restructuring plan from a Dutch business partner.

- You believe you have been placed in the wrong creditor class (e.g., being grouped with unsecured creditors when you hold security).

- You want to challenge the debtor's valuation of the company to ensure you aren't being underpaid.

- You are a majority creditor and wish to propose your own "restructuring expert" to take over the process from the debtor's management.

Next Steps

- Review the Notice: Immediately check the deadlines mentioned in any WHOA notice you receive. The windows for voting and objecting are extremely short.

- Audit Your Claims: Verify the exact amount owed, including interest and costs, and ensure you have all documentation for any security or guarantees held.

- Analyze the Class: Determine which class you have been assigned to and identify other creditors in that same class to see if you can form a voting bloc.

- Consult Counsel: Contact a legal expert in the Netherlands to review the feasibility of the plan and prepare a potential challenge before the court hearing.