Corporate Governance Standards for Tech Startups in Nigeria: A Legal Guide

- Every Nigerian startup registered as a private limited company must have at least two directors under the Companies and Allied Matters Act (CAMA) 2020.

- Compliance with the Nigerian Code of Corporate Governance (NCCG) 2018 is mandatory for some sectors but serves as a critical benchmark for startups seeking international venture capital.

- Annual General Meetings (AGMs) must be held every year, with a maximum interval of 15 months between meetings.

- Directors face personal liability for breaches of fiduciary duties, including "duty of care" and "duty to act in good faith."

- Failure to file annual returns with the Corporate Affairs Commission (CAC) can lead to the company being delisted and directors being penalized.

What are the mandatory board composition requirements under CAMA 2020?

In Nigeria, a private company must have a minimum of two directors. While small companies (as defined by turnover and net asset value) may have a single director under specific circumstances, tech startups aiming for scale and investment are legally required to maintain a structured board that reflects accountability.

CAMA 2020 introduced significant changes to how boards function. For startups, the following requirements are critical:

- Minimum Number: You must have at least two directors. If the number falls below two for more than 60 days, the remaining director may be held personally liable for company debts.

- Disqualifications: Individuals under 18, persons of unsound mind, or undischarged bankrupts cannot serve as directors.

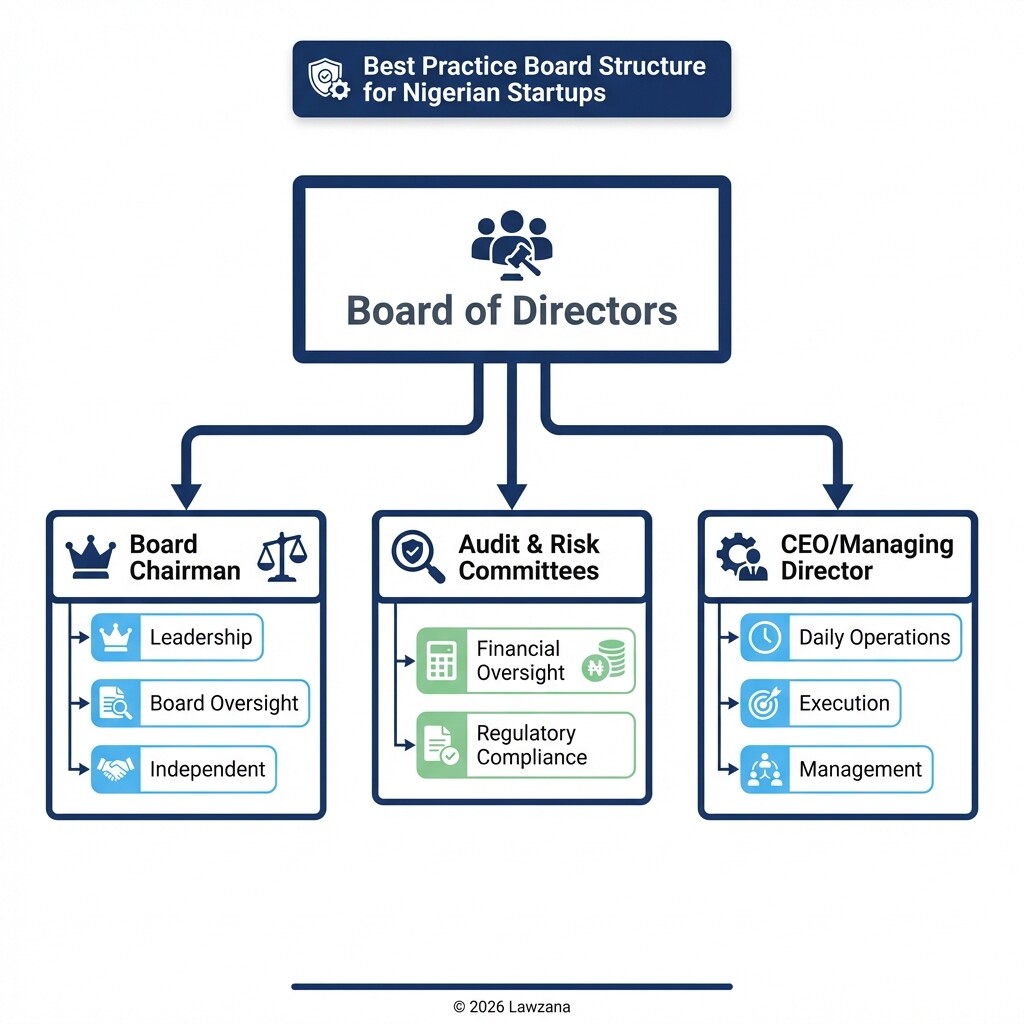

- Independent Directors: While primarily mandatory for public companies (which must have at least three independent directors), startups are encouraged to appoint independent members to enhance credibility during due diligence.

- Secretary: Every company must have a company secretary, though small companies are now exempt from the mandatory appointment. However, for governance health, a secretary is vital for maintaining minutes and statutory registers.

How does the Nigerian Code of Corporate Governance (NCCG) 2018 apply to startups?

The NCCG 2018 operates on an "Apply and Explain" principle, meaning companies should implement the code's practices and explain how they have done so. While the Code is mandatory for public companies and regulated financial institutions, the Financial Reporting Council (FRC) encourages private companies and startups to adopt these standards to ensure long-term sustainability.

Institutional investors, especially those from the US or Europe, use the NCCG as a checklist during Series A or B funding rounds. Key alignment points include:

- Board Diversity: The Code emphasizes a mix of gender, age, and professional skills.

- Chairman vs. CEO: The roles of the Board Chairman and the Managing Director/CEO should ideally be held by different individuals to prevent a concentration of power.

- Reporting: Regular disclosure of financial and non-financial information to stakeholders.

For more details on the code, you can visit the Financial Reporting Council of Nigeria.

How should startups establish audit committees and risk management frameworks?

Startups must establish an audit committee if they transition to a public company, but even as private entities, creating a functional board committee for audit and risk is a legal safeguard. Under CAMA, the audit committee is responsible for examining the auditor's report and making recommendations regarding the appointment of external auditors.

A robust risk management framework for a Nigerian tech startup should include:

- Internal Controls: Policies that prevent fraud and mismanagement of investor funds.

- Risk Committee: A subset of the board that identifies cybersecurity threats, regulatory changes (such as new NITDA regulations), and currency fluctuation risks.

- External Auditors: Engaging a reputable firm to provide an independent view of the company's financial health. Small companies may be exempt from audit requirements under certain turnover thresholds, but most VC-backed startups will require audited financials.

What are the legal requirements for statutory meetings and CAC filings?

Nigerian law mandates that every company hold an Annual General Meeting (AGM) to transact business such as the declaration of dividends, the presentation of financial statements, and the election of directors. The first AGM must be held within 18 months of incorporation; thereafter, it must be held annually.

Aside from meetings, startups must keep their records updated with the Corporate Affairs Commission (CAC). Essential filings include:

- Annual Returns: Filed every year to show the company is still active.

- Changes in Directorship: Any appointment or resignation of a director must be filed within 14 days.

- Share Allotment: When you raise a round and issue new shares, you must file a return of allotment.

- Notice of Situation of Registered Office: Any change in the physical office address must be reported.

| Filing Type | Deadline | Consequence of Default |

|---|---|---|

| Annual Returns | Once a year (after AGM) | Penalties and status marked as "Inactive" |

| Change of Director | Within 14 days | Daily default fines |

| Increase in Share Capital | Within 15 days | Late filing fees and invalidation of the increase |

What are the legal liabilities of directors in early-stage tech companies?

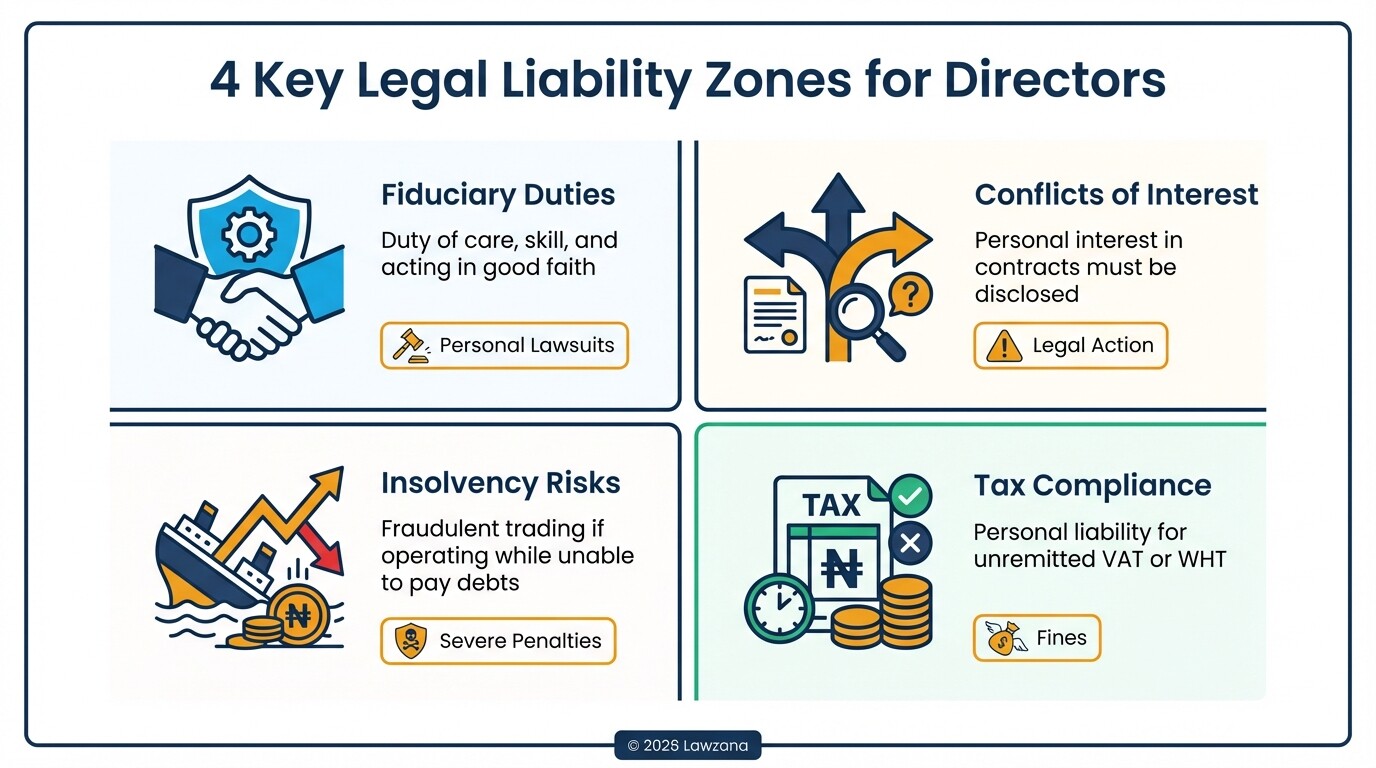

Managing directors and founders in Nigeria owe fiduciary duties to the company, not just to the shareholders who appointed them. If a director acts in their own self-interest at the expense of the company, they can be sued for breach of trust.

Specific liabilities include:

- Duty of Care and Skill: Directors must act with the care that an "ordinarily prudent person" would exercise. Ignorance of the law or the company's financial state is not a valid defense.

- Conflict of Interest: Directors must disclose any personal interest in contracts involving the company. Failure to disclose can make the contract voidable.

- Insolvency Liability: If a director allows the company to continue trading when they know it is insolvent (unable to pay debts), they can be held personally liable for the company's liabilities under "fraudulent trading" provisions.

- Tax Compliance: Directors can be held responsible for the company's failure to remit Value Added Tax (VAT) or Withholding Tax (WHT) to the Federal Inland Revenue Service (FIRS).

Common Misconceptions About Corporate Governance in Nigeria

"Corporate governance is only for big banks and public companies."

Many founders believe governance is a "growth stage" problem. In reality, poor governance is the leading cause of startup failure in Nigeria. Investors often walk away from deals when they see "commingling" of personal and business funds or a lack of board minutes. Implementing governance early makes your startup "investment-ready."

"The CEO has total control over all board decisions."

Legally, the board operates on a majority-vote basis unless the Articles of Association state otherwise. Founders often mistake their "visionary" status for absolute legal authority. Under CAMA, directors have equal votes, and the board has the power to remove a CEO if they fail in their duties.

"Filing annual returns is optional if the company isn't making a profit."

Profitability has no bearing on statutory filing requirements. Even if your startup is pre-revenue, you must file annual returns. Failure to do so leads to the CAC labeling your company as "Inactive," which prevents you from opening bank accounts, processing visas for expatriate staff, or participating in government contracts.

FAQ

Can a foreigner be a director of a Nigerian tech startup?

Yes, foreigners can be directors and shareholders. However, if the foreigner intends to work in Nigeria, the company must obtain a Business Permit and Expatriate Quota from the Ministry of Interior.

What is the minimum share capital for a tech startup in Nigeria?

For a locally-owned private company, the minimum issued share capital is N100,000. However, for companies with foreign participation, the minimum is N10,000,000. Note that "issued" means the shares must be allotted to shareholders, though they do not necessarily need to be fully paid for at the point of incorporation.

Do I need a physical office for my startup in Nigeria?

Yes, the CAC requires a physical "Registered Office Address" within Nigeria. This is where official legal notices and court processes are served. While you can work remotely, you must have a documented physical location for regulatory purposes.

How often should my startup's board meet?

While CAMA doesn't specify the frequency of board meetings, the NCCG recommends meeting at least once every quarter. For an early-stage startup, monthly or bi-monthly meetings are often necessary to navigate rapid growth and pivots.

When to Hire a Lawyer

You should engage a legal professional if you are:

- Navigating an investment round (Seed to Series A) and need to restructure your board.

- Facing a dispute between founders or shareholders regarding company control.

- Responding to a notice of non-compliance or a penalty fine from the CAC or FIRS.

- Planning to issue employee stock options (ESOPs), which require specific board resolutions and filings.

- Expanding operations into regulated sectors like Fintech (requiring CBN licenses) or Healthtech.

Next Steps

- Audit Your Current Filings: Log into the CAC portal to ensure your company's status is "Active" and all annual returns are up to date.

- Review Your Board Composition: Ensure you have at least two directors and that your board includes members with diverse expertise (e.g., legal, financial, or technical).

- Draft a Board Charter: Create a document that clearly outlines the roles, responsibilities, and authorities of the board versus the management team.

- Schedule Your AGM: If you haven't held a meeting in over 12 months, consult with a company secretary to issue notices and organize a formal meeting.