- Foreign corporations must file their General Information Sheet (GIS) with the SEC within 30 days of their annual meeting or the anniversary of their license issuance.

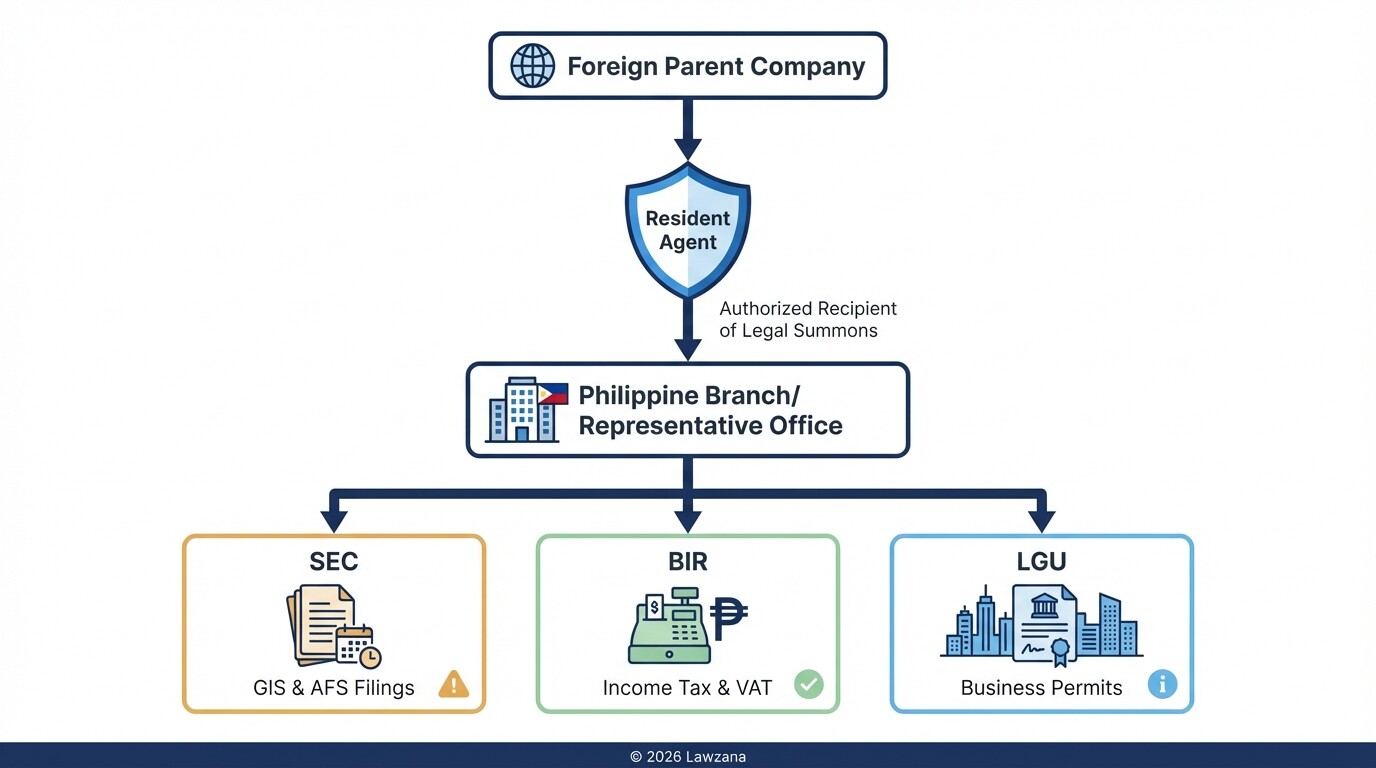

- Maintaining a local Resident Agent is a non-negotiable legal requirement for foreign branches and representative offices to receive legal notices.

- Audited Financial Statements (AFS) must be filed with both the SEC and the Bureau of Internal Revenue (BIR) to avoid "delinquent" status.

- Non-compliance for three consecutive years can lead to the automatic revocation of a foreign corporation's license to do business in the Philippines.

- Corporate governance under the Revised Corporation Code (RCC) emphasizes digital filing through the SEC eFAST system.

How do foreign corporations submit the General Information Sheet (GIS)?

Foreign corporations must submit the General Information Sheet (GIS) to the Securities and Exchange Commission (SEC) within 30 days of their annual stockholders' meeting or the anniversary date of their Philippine license. This document serves as the official record of the company's current ownership structure, directors, officers, and operational status.

The GIS is the most critical recurring document for maintaining a corporation's "good standing." While domestic corporations tie this to their meeting date, foreign branches often tie this to the anniversary of their SEC registration. The process involves:

- Digital Submission: All filings must now be processed through the SEC Electronic Filing and Submission Tool (eFAST).

- Required Data: The form requires the names and addresses of directors/officers, the Resident Agent's details, and the specific nature of business.

- Verification: The document must be notarized in the Philippines or, if signed abroad, must be apostilled or authenticated by the Philippine consulate in the country of origin.

What are the financial reporting requirements for foreign branch offices?

Foreign branch offices are required to file annual Audited Financial Statements (AFS) that reflect the financial health of both the Philippine branch and, in many cases, the head office. These statements must be audited by an SEC-accredited independent Certified Public Accountant (CPA) and filed according to the SEC's annual schedule, which usually falls between April and June.

Navigating Philippine tax and corporate accounting requires precision. Foreign entities must manage two distinct financial reporting tracks:

- SEC Filing: The AFS must include a Statement of Management's Responsibility and be filed through eFAST. For branches, the SEC may require the consolidated financial statements of the parent company as well.

- BIR Filing: By April 15 of each year, the corporation must file its Annual Income Tax Return (AITR) with the Bureau of Internal Revenue (BIR).

- Local Government Units (LGU): Every January, foreign corporations must renew their Mayor's Permit or Business Permit, which involves paying local business taxes based on the prior year's gross receipts.

Why is maintaining a Resident Agent status mandatory?

A foreign corporation must maintain a Resident Agent in the Philippines to serve as the authorized recipient of all legal summons and processes. Without a valid Resident Agent, the SEC can immediately revoke the corporation's license to do business, as the state requires a reliable point of contact for legal accountability.

The Resident Agent can be either an individual residing in the Philippines or a domestic corporation lawfully transacting business in the country. Key responsibilities and requirements include:

- Eligibility: If an individual, they must be of good moral character and possess sound financial standing.

- Change of Agent: If a Resident Agent resigns or moves, the corporation must file a "Notice of Change of Resident Agent" with the SEC immediately.

- Liability: While the agent is not typically liable for the corporation's debts, they are the primary point of contact for the judiciary and regulators. Failure to update this information leads to "constructive service," meaning a court can proceed with a case even if you didn't personally receive the papers.

How does the Revised Corporation Code affect foreign ownership?

The Revised Corporation Code (RCC) of the Philippines simplified governance by removing the minimum number of incorporators and introducing the One Person Corporation (OPC). For foreign investors, the RCC aligns local governance with international standards, emphasizing electronic signatures, remote communication for meetings, and perpetual corporate existence.

While the RCC modernized the framework, foreign corporations must still navigate the Foreign Investment Negative List (FINL). This list dictates which industries allow 100% foreign ownership and which require a local partner (usually a 60/40 split). Compliance with the RCC involves:

- Board Composition: While the RCC allows more flexibility, some industries still require a certain percentage of directors to be Philippine residents.

- Compliance Officers: Larger corporations or those with public interest must appoint a Compliance Officer and a Corporate Secretary (who must be a Filipino citizen and resident).

- Reportorial Requirements: The RCC empowers the SEC to impose much higher fines for late filings than the previous code allowed.

What are the penalties for non-compliance and how to avoid revocation?

The SEC imposes a progressive scale of fines for late or non-existent filings, which can escalate to the revocation of the license to do business. If a corporation fails to file its GIS or AFS for a period of five years, or if it fails to commence operations within five years of incorporation, it may be placed under delinquent status or revoked.

The SEC recently implemented a "Compliance Monitoring" system. To avoid the "Revoked" or "Suspended" status, corporations should follow these steps:

| Penalty Level | Trigger | Consequence |

|---|---|---|

| First Offense | Late filing of GIS or AFS | Monetary fines based on total assets (starting at approx. PHP 10,000). |

| Delinquency | Failure to file for 3 times within 5 years | The corporation cannot SEC-certify its good standing for contracts or banking. |

| Revocation | Prolonged non-filing or failure to move | Permanent loss of license; requires a petition for lifting of revocation. |

To avoid these outcomes, corporations should conduct an internal "compliance audit" every Q4 to ensure all eFAST accounts are active and all local tax certificates are updated.

Common Misconceptions about Philippine Corporate Governance

"If my head office is abroad, I don't need to follow Philippine audit standards." This is a common mistake. The SEC and BIR require that financial statements filed in the Philippines follow the Philippine Financial Reporting Standards (PFRS), which are largely aligned with IFRS but have specific local tax adjustments.

"The Resident Agent is just a figurehead." Many foreign investors believe the Resident Agent is a mere formality. However, if your agent is unreachable and you miss a court summons, a "default judgment" can be issued against your company, potentially leading to the seizure of Philippine assets without your knowledge.

"I only need to report to the SEC once a year." While the GIS is annual, any major change-such as a change in directors, a change in business address, or an increase in capital-requires an immediate filing or amendment. Waiting until the annual GIS update is a violation of the Revised Corporation Code.

Annual Compliance Checklist for Foreign Corporations

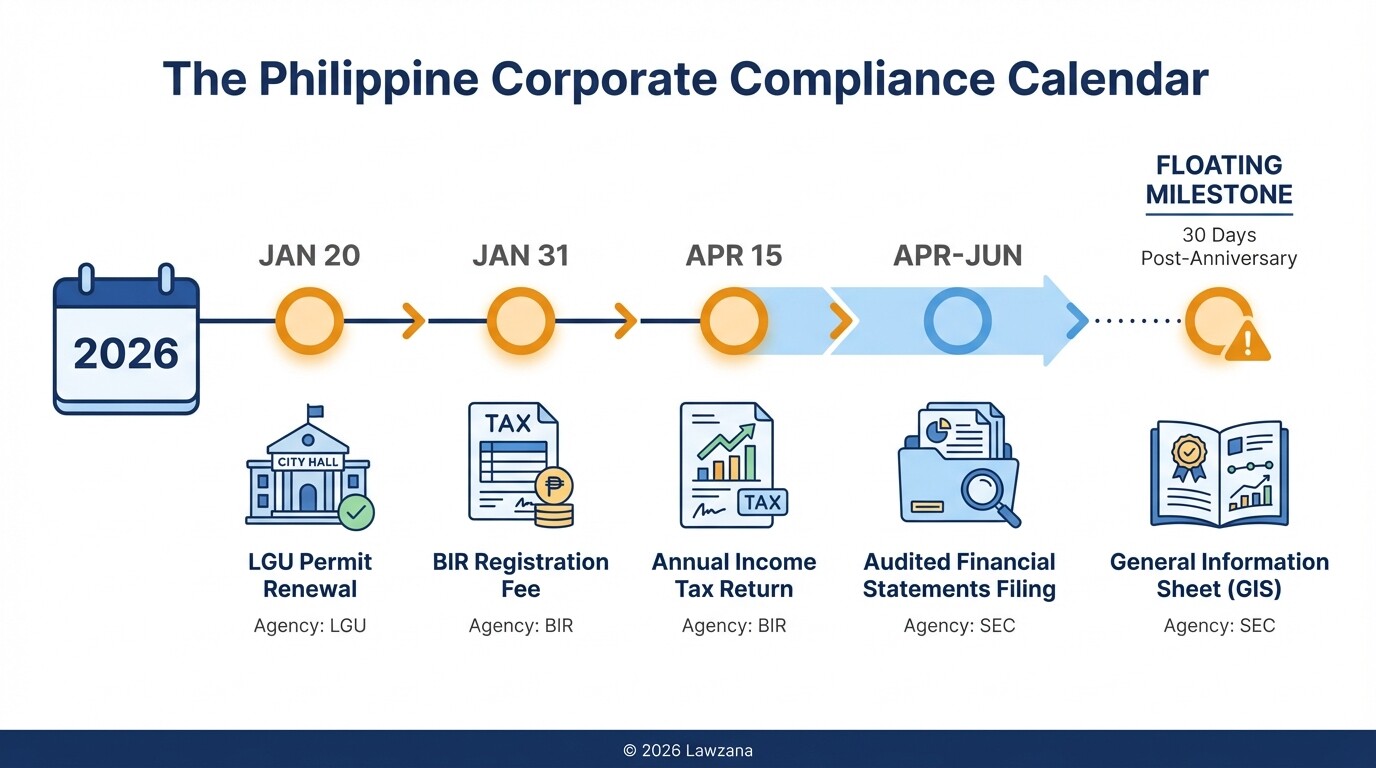

- January 20: Deadline for LGU Business Permit renewal and payment of local business taxes.

- January 31: Deadline for the BIR Annual Registration Fee (PHP 500 per location).

- April 15: Deadline for filing the Annual Income Tax Return (AITR) with the BIR.

- SEC Window (April-June): Filing of Audited Financial Statements via eFAST (check the SEC's annual calendar for specific date brackets based on the last digit of the SEC registration number).

- 30 Days Post-Anniversary: Filing of the General Information Sheet (GIS).

- Ongoing: Quarterly and monthly tax filings (VAT, Withholding Tax).

FAQ

What happens if I miss the April 15 BIR deadline?

Missing the BIR deadline results in a 25% surcharge on the tax due, plus 12% annual interest and a compromise penalty based on the amount of tax. Even if no tax is due, a "no-payment" return must be filed to avoid penalties.

Can a foreign corporation own land in the Philippines?

Generally, no. Foreign-owned corporations (more than 40% foreign equity) cannot own land. They may, however, lease land for up to 50 years, renewable for another 25 years, or own the buildings and improvements on the land.

Does a representative office pay income tax?

No, a representative office does not derive income from the Philippines and therefore does not pay income tax. However, it must still file an "Annual Information Return" and maintain its SEC and LGU registrations.

How much are the SEC fines for late GIS filing?

Fines depend on the corporation's total assets. For a small entity, a late GIS may cost PHP 10,000, but for larger corporations, fines can exceed PHP 100,000 per violation plus daily accruals.

When to Hire a Lawyer

Foreign corporations should consult a Philippine corporate lawyer when:

- Establishing a new branch, subsidiary, or representative office.

- Navigating the "Lifting of Revocation" if a license has been suspended.

- Managing disputes between the foreign parent and local stakeholders.

- Interpreting the Foreign Investment Negative List for industry-specific restrictions.

- Changing the Resident Agent or Corporate Secretary to ensure proper SEC notification.

Next Steps

- Verify your SEC Status: Log into the eFAST portal to check if your corporation is listed as "In Good Standing."

- Review your Resident Agent: Ensure your current agent is still reachable and resides at the address listed with the SEC.

- Audit your Records: Confirm that your GIS and AFS filings for the last three years are complete and on file.

- Consult an Expert: If you have missed any deadlines, seek legal counsel immediately to file for "amnesty" or settle penalties before the SEC initiates revocation proceedings.