- Choosing between PEZA and BOI depends on your location strategy; PEZA requires operating within designated ecozones, while BOI allows for more geographical flexibility.

- Export-oriented IT-BPM firms (exporting 60% or more of services) can be 100% foreign-owned with a minimum paid-in capital as low as PHP 5,000, though higher capital is recommended for operational ease.

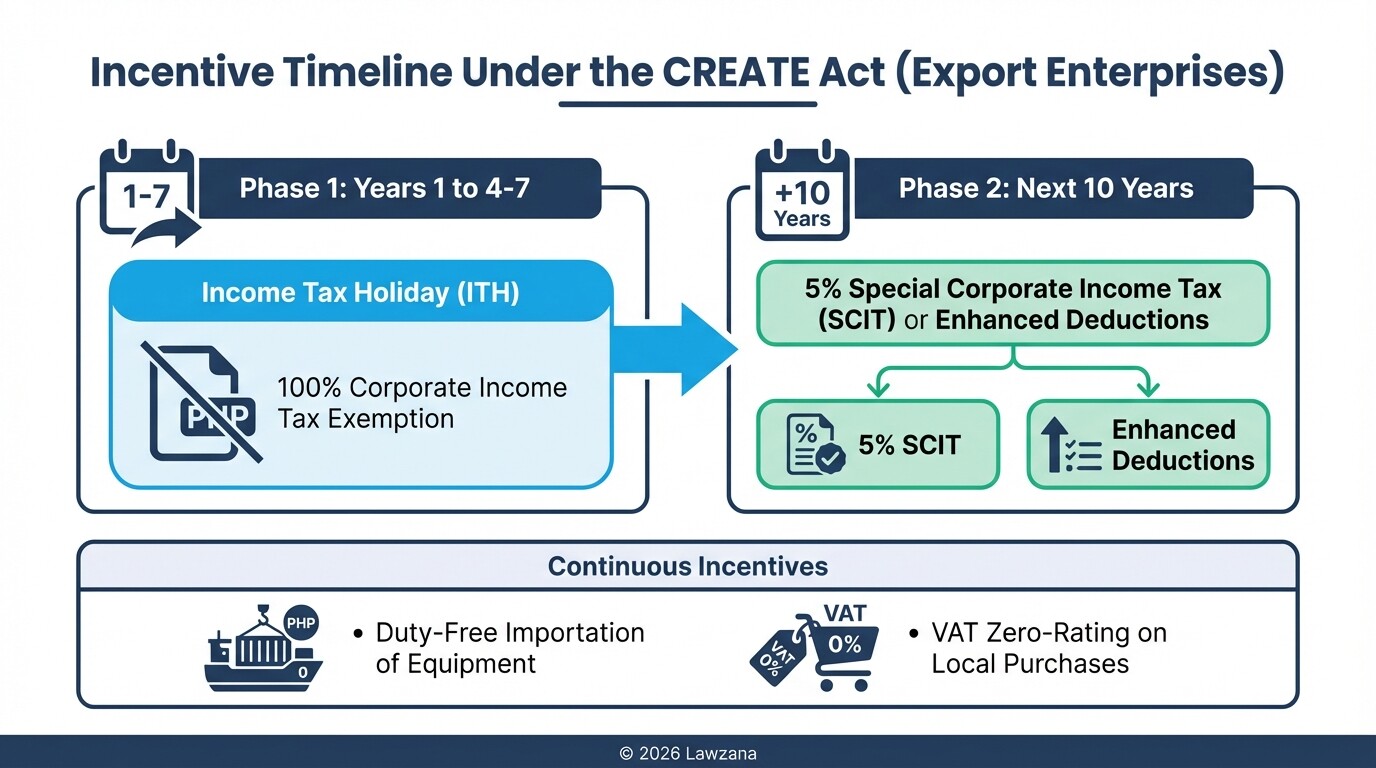

- The CREATE Act provides a standardized incentive menu, including Income Tax Holidays (ITH) of up to 7 years followed by a 5% Special Corporate Income Tax (SCIT) or Enhanced Deductions.

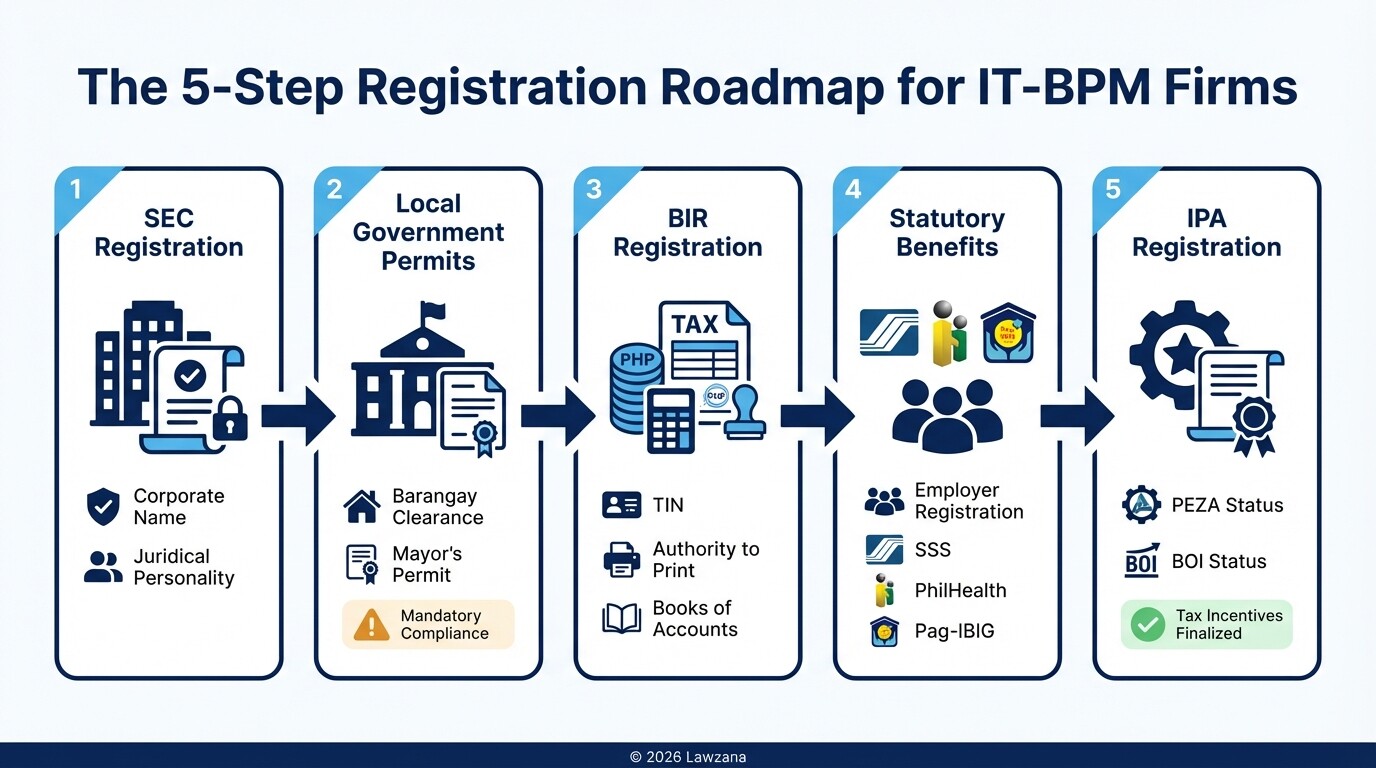

- Registration is a multi-step process involving the SEC, local government units (LGU), the Bureau of Internal Revenue (BIR), and the relevant incentive investment promotion agency (IPA).

- Compliance with workspace requirements is mandatory for PEZA firms, including leasing in PEZA-certified buildings to maintain tax-exempt status.

Should you register with PEZA or BOI for your IT-BPM business?

The choice between the Philippine Economic Zone Authority (PEZA) and the Board of Investments (BOI) depends on whether your business requires a specific physical location or flexibility for remote operations. PEZA is traditionally the preferred route for IT-BPM firms that lease space in certified IT parks, while the BOI is better suited for firms that do not wish to be tied to a specific economic zone.

The Philippine government recently introduced more flexibility regarding work-from-home (WFH) arrangements. Many IT-BPM firms have shifted their registration from PEZA to BOI to allow 100% WFH without losing tax incentives. Below is a comparison of the two agencies:

| Feature | PEZA (Philippine Economic Zone Authority) | BOI (Board of Investments) |

|---|---|---|

| Location Requirement | Must be located in a PEZA-certified IT Building or Park. | Can be located anywhere in the Philippines. |

| Primary Target | Export-oriented enterprises. | Both export-oriented and domestic-market projects. |

| Remote Work | Historically restrictive; requires specific filings for WFH. | Highly flexible; allows for 100% remote work models. |

| Administrative Fees | Standardized processing and annual fees. | Generally lower administrative overhead for registration. |

What are the minimum capital requirements for export-oriented enterprises?

For foreign-owned IT-BPM firms classified as export enterprises, the minimum paid-in capital requirement is PHP 5,000. Under the Foreign Investments Act, an "export enterprise" is defined as a business that exports at least 60% of its goods or services. This low threshold is designed to attract foreign direct investment into the high-growth tech and outsourcing sectors.

While the legal minimum is very low, practical operational needs often dictate a higher capitalization. Most foreign investors opt for at least USD 10,000 to USD 50,000 to cover initial operating expenses, lease deposits, and government filing fees. If your firm intends to serve the domestic Philippine market (more than 40% of revenue), the minimum capital requirement jumps significantly to USD 200,000 unless you employ at least 50 Filipino workers and utilize advanced technology.

How do you register an IT-BPM company with the SEC and local government?

Registering a business in the Philippines involves a sequential process that starts with the Securities and Exchange Commission (SEC) and ends with local permits. You must first secure your corporate existence before applying for tax incentives with the BOI or PEZA.

The following steps outline the standard registration path:

- SEC Registration: Use the SEC Electronic Simplified Processing of Applications for Registration of Company (ESPARCE) to reserve your corporate name and submit your Articles of Incorporation and Bylaws. This step establishes your legal entity.

- Local Government Permits: Once you have your SEC Certificate of Incorporation, you must apply for a Barangay Clearance and a Mayor's Permit (Business Permit) in the city where your office is located. This involves inspections by the Bureau of Fire Protection and the City Health Office.

- BIR Registration: Register your books of accounts and apply for a Taxpayer Identification Number (TIN) and "Authority to Print" invoices with the Bureau of Internal Revenue (BIR).

- Statutory Benefits Registration: Register the company as an employer with the Social Security System (SSS), PhilHealth, and Pag-IBIG to manage mandatory employee contributions.

- IPA Registration: After SEC registration, you apply for your Certificate of Registration with either PEZA or BOI to activate your tax incentives.

What are the lease and workspace requirements for obtaining incentives?

To qualify for PEZA incentives, your IT-BPM business must be physically located within a PEZA-registered IT Center or Park. The workspace must be dedicated to the registered activity and cannot be shared with non-registered entities without prior approval.

Key documentation and physical requirements include:

- Valid Lease Agreement: A long-term lease contract with a PEZA-registered developer.

- PEZA Visa (Optional): Foreign investors and executives can apply for a special non-immigrant visa (47(a)2) once the workspace is established and the firm is registered.

- Technical Inspection: PEZA officials may conduct a site inspection to verify that the office has the necessary infrastructure (redundant power, high-speed internet connectivity) to support IT-BPM operations.

- BOI Flexibility: Unlike PEZA, the BOI does not require your office to be in a specific building, but you must still provide a valid lease contract for a commercial address to satisfy SEC and LGU requirements.

How does the CREATE Act affect IT-BPM business incentives?

The Corporate Recovery and Tax Incentives for Enterprises (CREATE) Act, enacted in 2021, overhauled the country's tax code to make incentives more competitive and transparent. For IT-BPM firms, CREATE replaced the previous "forever" 5% Gross Income Tax (GIT) with a time-bound system that rewards high-value investments.

Under the CREATE Act, IT-BPM firms can access:

- Income Tax Holiday (ITH): A period of 4 to 7 years where the company is 100% exempt from corporate income tax.

- Special Corporate Income Tax (SCIT): After the ITH expires, export enterprises may enjoy a 5% tax on gross income earned in lieu of all national and local taxes for 10 years.

- Enhanced Deductions: Alternatively, firms can choose enhanced deductions for expenses like labor, research and development, and power costs for up to 10 years.

- Duty-Free Importation: Exemption from customs duties on the importation of capital equipment, raw materials, and spare parts directly used in the registered activity.

Common Misconceptions About Philippine Business Registration

"I need a Filipino partner to own an IT-BPM company."

This is a common myth. Since IT-BPM is considered an "export enterprise" under the Foreign Investments Act, it is not subject to the 40% foreign ownership cap. You can own 100% of the equity in your Philippine outsourcing company as long as you export at least 60% of your services to clients outside the country.

"PEZA registration covers all taxes forever."

While PEZA offers significant relief, it is not an all-encompassing tax shield. Companies are still responsible for withholding taxes on employee salaries and fringe benefits. Furthermore, the 5% SCIT under the CREATE Act is now time-bound (usually 10 years), whereas, under old laws, it was often perpetual.

"Registering with the SEC is enough to start operating."

The SEC certificate only gives you "juridical personality"-the right to exist as a corporation. You cannot legally hire staff or issue invoices until you have completed registration with the BIR and obtained your Mayor's Permit from the local government.

FAQs

Can a foreign IT company operate 100% remotely in the Philippines?

Yes, but to qualify for tax incentives while operating remotely, the company should register with the Board of Investments (BOI) rather than PEZA. The BOI allows for 100% work-from-home arrangements without the geographical restrictions imposed by economic zones.

How long does the registration process take?

On average, setting up the full legal structure (SEC, LGU, BIR, and IPA registration) takes 8 to 12 weeks. SEC registration via the online portal can be done in a few days, but local permits and tax incentive applications require more extensive documentation and processing time.

What is the difference between a Branch Office and a Domestic Corporation?

A Domestic Corporation is a separate legal entity from its parent, offering better liability protection. A Branch Office is considered an extension of the foreign head office. Most tech investors prefer a Domestic Corporation because it is generally easier to register for BOI/PEZA incentives.

Are there specific incentives for "Green" IT-BPM projects?

Yes, under the Strategic Investment Priority Plan (SIPP), projects that involve sustainable practices or high-tech environmental solutions may qualify for longer ITH periods (Tier II or Tier III incentives) under the CREATE Act.

When to Hire a Lawyer

Navigating the Philippine regulatory landscape requires precision, especially when dealing with the intersection of the CREATE Act and investment promotion agencies. You should consult a lawyer or a professional incorporation firm if:

- You are unsure which investment tier your IT-BPM project falls under for tax purposes.

- You need to draft complex shareholders' agreements for a joint venture.

- You are applying for special non-immigrant visas for foreign executives.

- You need to appeal a local government zoning decision or a BIR tax assessment.

Next Steps

- Determine your Market: Confirm if you will export 60% or more of your services to qualify for 100% foreign ownership and export incentives.

- Choose your Agency: Decide between PEZA (if you want an ecozone office) or BOI (if you want WFH flexibility).

- Secure your SEC Name: Visit the SEC ESPARCE portal to check for name availability and start the incorporation process.

- Draft your Articles of Incorporation: Ensure your "Primary Purpose" is clearly defined to match the requirements of your chosen incentive agency.

- Consult an Expert: Engage a legal advisor to review your lease and incentive applications to ensure long-term compliance with the CREATE Act.