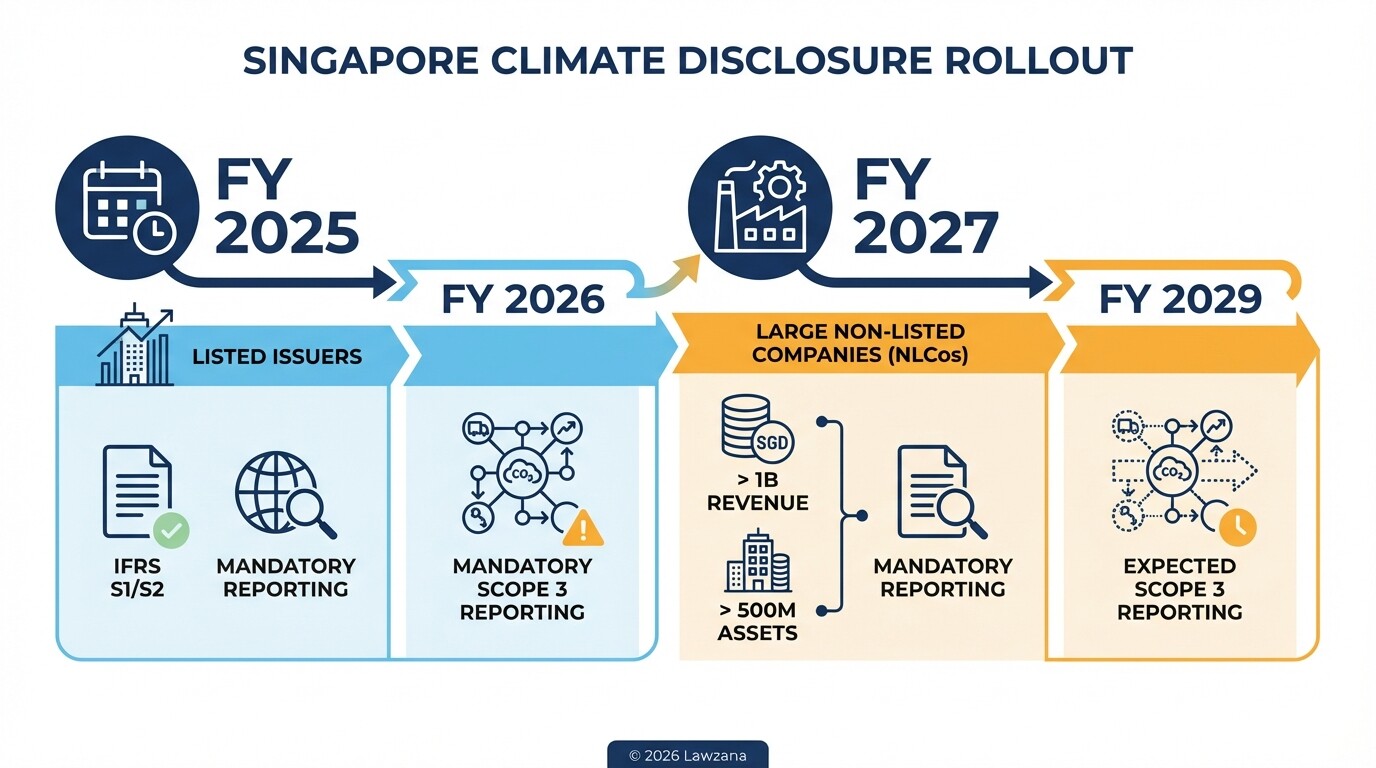

- Starting in 2025 and 2027, Singapore will mandate climate-related disclosures for both listed and large non-listed companies based on International Sustainability Standards Board (ISSB) frameworks.

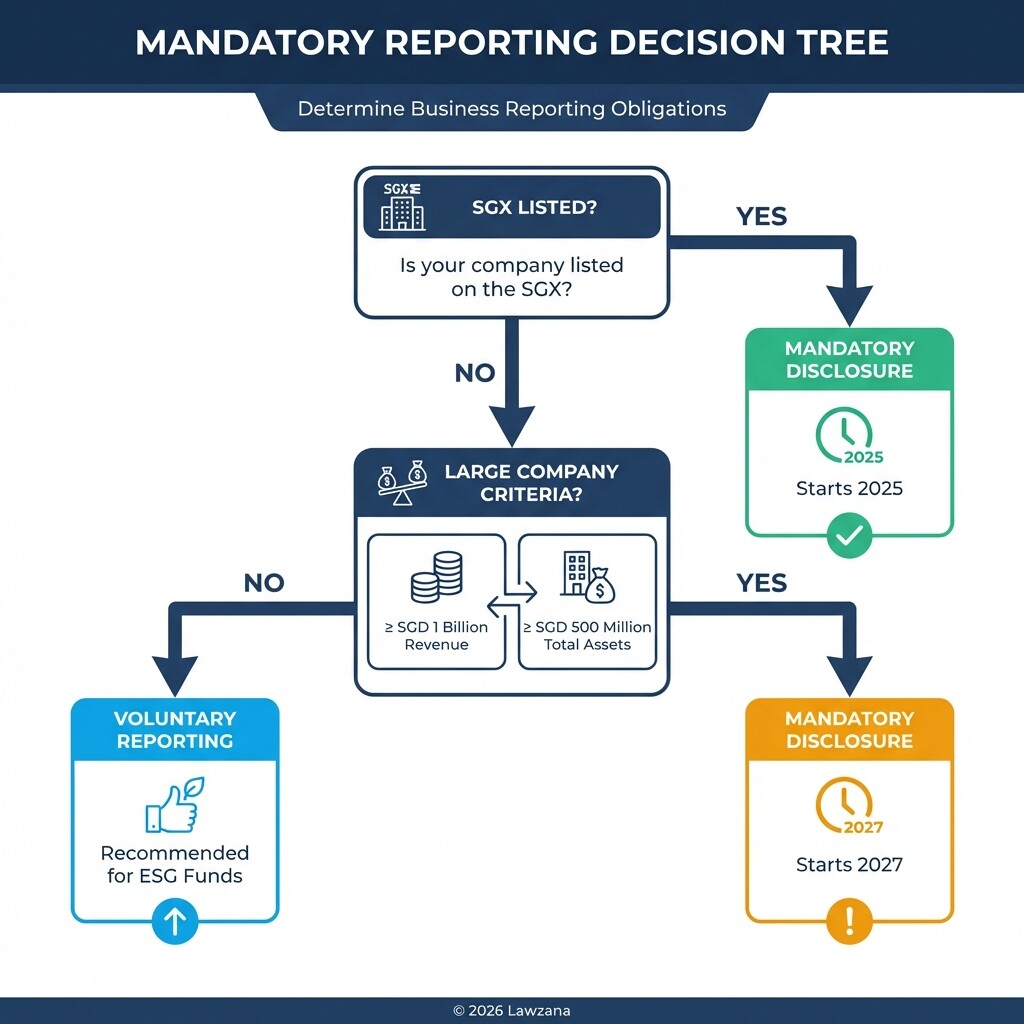

- Large non-listed companies with annual revenue of at least SGD 1 billion and total assets of at least SGD 500 million must begin reporting climate data in 2027.

- Financial institutions and investment funds must align with the Monetary Authority of Singapore (MAS) Guidelines on Environmental Risk Management to avoid greenwashing penalties.

- Failure to comply with the new disclosure standards can lead to enforcement actions by ACRA or MAS, including fines and potential personal liability for directors.

Singapore's 2026 Climate Disclosure Timeline

Singapore's transition to mandatory climate reporting follows a phased approach that culminates in significant regulatory shifts by 2026 and 2027. Listed issuers are required to report for financial years starting January 1, 2025, while the preparation for large non-listed companies begins in earnest in 2026 to meet the 2027 mandate.

The Accounting and Corporate Regulatory Authority (ACRA) and the Singapore Exchange (SGX) are the primary bodies overseeing these timelines. For international investment funds, this means that portfolio companies in Singapore will soon be legally required to provide standardized ESG data, facilitating more transparent "Green" investment decisions.

Green Investment Compliance Checklist

Investment funds and corporations must prepare for the 2026 transition by ensuring their internal data collection and reporting mechanisms meet the upcoming legal requirements. This checklist provides the essential steps for maintaining compliance with Singapore's new standards.

| Compliance Step | Required Action | Responsible Entity |

|---|---|---|

| Scoping Analysis | Determine if the company meets the SGD 1B revenue / SGD 500M asset threshold. | Board of Directors |

| ISSB Alignment | Map current disclosures against IFRS S1 (General Requirements) and IFRS S2 (Climate-related). | ESG/Compliance Team |

| Scope 1 & 2 Emissions | Measure and document direct and indirect greenhouse gas emissions. | Operations/Legal |

| Scope 3 Readiness | Establish data pipelines for supply chain emissions (mandatory by FY2026/2027). | Procurement/ESG |

| External Assurance | Engage an independent auditor to provide limited assurance on Scope 1 and 2 reports. | Independent Auditor |

| MAS Fund Prospectus | Update fund offering documents to reflect specific green investment criteria. | Fund Manager |

Alignment with International Sustainability Standards Board (ISSB)

Singapore has officially adopted the ISSB standards, specifically IFRS S1 and IFRS S2, as the baseline for its climate-related disclosures. This alignment ensures that disclosures made in Singapore are globally comparable and meet the high expectations of international institutional investors.

IFRS S1 focuses on general sustainability-related financial information, while IFRS S2 targets specific climate-related risks and opportunities. By integrating these into the local regulatory framework, the Monetary Authority of Singapore (MAS) ensures that "Green" labels are backed by standardized, high-quality data. Companies must shift from qualitative "sustainability stories" to quantitative, audit-ready financial data that accounts for climate resilience.

Mandatory Reporting for Large Non-Listed Companies

One of the most significant changes in the 2026 regulatory landscape is the extension of mandatory climate reporting to large non-listed companies (NLCos). Previously, ESG reporting was largely reserved for public companies; however, the new standards apply to any private entity with at least SGD 1 billion in revenue and SGD 500 million in assets.

This expansion aims to provide transparency across the broader economy, preventing private companies from becoming "black boxes" for carbon-intensive activities. For investment funds, this means that private equity portfolios will now require the same level of ESG scrutiny as public holdings. These NLCos must report on governance, strategy, risk management, and specific metrics and targets related to climate change.

Legal Risks of Greenwashing and ESG Misrepresentation

Greenwashing in Singapore carries significant legal and reputational risks, ranging from regulatory fines to civil litigation for misrepresentation. The MAS and the Competition and Consumer Commission of Singapore (CCCS) have increased their oversight of "green" claims to ensure that investment products labeled as sustainable actually meet those criteria.

Under the Companies Act and the Securities and Futures Act, directors can be held liable for making false or misleading statements in their financial reports. If a fund claims to be "ESG-aligned" but lacks the documentation required by the new 2026 standards, it faces potential:

- Administrative Sanctions: Fines and public censures by MAS.

- Contractual Claims: Lawsuits from investors for breach of fiduciary duty or misrepresentation.

- Regulatory Penalties: Enforcement actions by ACRA for non-compliance with statutory reporting standards.

Documentation for Green Fund Classification

To qualify as a "Green" or "ESG" fund in Singapore, managers must maintain specific documentation that justifies their sustainability claims. This documentation must be consistent with the Disclosure and Reporting Requirements for Retail ESG Funds issued by MAS.

Required documentation typically includes:

- Investment Strategy Evidence: Detailed records showing how ESG factors are integrated into the investment selection process.

- Portfolio Weighting Reports: Proof that a significant portion of the fund is invested in companies meeting the ISSB disclosure standards.

- Impact Metrics: Periodic reporting on the fund's progress toward its stated sustainable objectives (e.g., carbon intensity reduction).

- Assurance Statements: Independent verification of the fund's adherence to its green mandates.

The Role of the Monetary Authority of Singapore (MAS) in Enforcement

The MAS acts as the primary regulator for financial institutions, ensuring that green finance remains a credible pillar of Singapore's economy. Through the "Green Finance Action Plan," MAS has introduced strict guidelines on environmental risk management that apply to banks, insurers, and asset managers.

In 2026, MAS enforcement will likely focus on "transition risk"-how companies and funds are managing the move toward a low-carbon economy. The regulator uses a mix of thematic reviews, off-site monitoring, and on-site inspections to verify that disclosure standards are being met. Non-compliant firms may face restricted licenses or heavy financial penalties, as the MAS seeks to protect Singapore's status as a trusted global financial hub.

Common Misconceptions

Misconception 1: Only public companies need to worry about ESG in 2026.

While public companies were the first to face these requirements, the 2026/2027 standards capture large private companies as well. If your private firm meets the revenue and asset thresholds, you are legally obligated to report.

Misconception 2: "Greenwashing" is just a marketing issue.

In Singapore, greenwashing is a legal compliance issue. Misleading ESG claims can violate consumer protection laws and securities regulations, leading to director disqualification and significant fines.

Misconception 3: Scope 3 emissions reporting is optional.

Under the ISSB-aligned framework adopted by Singapore, reporting on Scope 3 emissions (supply chain) will eventually become mandatory for all companies in scope. Preparing for this data collection in 2026 is critical to avoid non-compliance in subsequent years.

FAQ

What are the thresholds for mandatory reporting in Singapore?

Non-listed companies must report if they have an annual revenue of at least SGD 1 billion and total assets of at least SGD 500 million. All listed issuers on the SGX are required to report regardless of size.

What happens if a company fails to provide climate disclosures?

Failure to comply with ACRA-mandated reporting can result in fines for the company and its directors. For financial institutions, MAS may impose regulatory sanctions, including the loss of certain business licenses.

Does Singapore allow for "safe harbor" from ESG litigation?

While there is no formal "safe harbor" for ESG, companies that follow the ISSB framework and obtain third-party assurance are significantly better protected against claims of misrepresentation or greenwashing.

When do Scope 3 emissions need to be reported?

Listed issuers must begin reporting Scope 3 emissions for financial years starting on or after January 1, 2026. Large non-listed companies will follow a slightly delayed timeline, generally starting in 2029.

When to Hire a Lawyer

Navigating the 2026 disclosure standards requires more than just accounting; it requires a robust legal framework to mitigate liability. You should consult a corporate lawyer in Singapore if:

- You are unsure if your company or its subsidiaries meet the mandatory reporting thresholds.

- You need to draft or review "Green" investment prospectuses to ensure compliance with MAS guidelines.

- Your firm is facing an investigation or query from ACRA or MAS regarding ESG disclosures.

- You are restructuring your supply chain and need to include ESG compliance clauses in commercial contracts.

Next Steps

- Conduct a Gap Analysis: Compare your current ESG reporting practices against the IFRS S1 and S2 standards to identify missing data points.

- Review Director Liability: Ensure your Board of Directors is educated on their legal responsibilities regarding climate-related financial disclosures.

- Engage Professional Assurance: Identify and vet independent auditors who can provide the "limited assurance" required by Singapore law for emissions reporting.

- Update Investor Documents: If managing a fund, update your offering documents to reflect the new 2026 regulatory reality.