- Italy's "Golden Power" legislation allows the government to veto or impose conditions on foreign investments in strategic sectors, including high-tech, AI, and semiconductors.

- Mandatory notification to the Presidency of the Council of Ministers is required for acquisitions that meet specific ownership thresholds or involve strategic assets.

- The S.r.l. (Limited Liability Company) is the most common vehicle for tech startups due to its flexibility, while the S.p.A. (Joint-Stock Company) is preferred for large-scale operations.

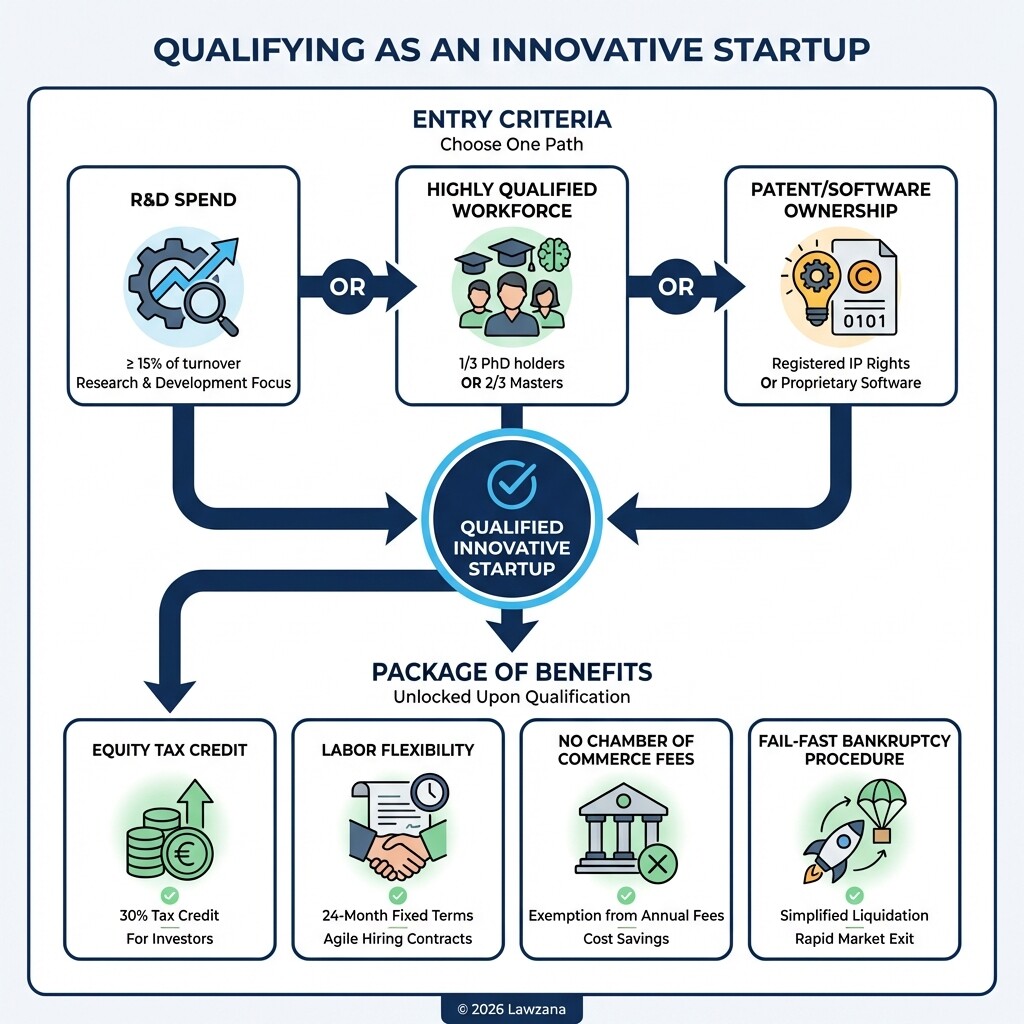

- Certified "Innovative Startups" in Italy benefit from significant tax credits, exemptions from annual fees, and flexible labor regulations.

- Non-compliance with cybersecurity and FDI regulations can result in fines up to double the value of the transaction or 5% of turnover.

What is the Golden Power Decree and how does it impact tech acquisitions?

The Golden Power decree is a legal framework that grants the Italian government special powers to protect national interests in strategic sectors like defense, energy, and high-tech. Under Law Decree No. 21/2012 and subsequent expansions, the government can veto a transaction, impose specific conditions, or require modifications to investment plans to safeguard national security and public order.

For international investors in the tech sector, this means any acquisition of a company holding "strategic assets" must undergo a rigorous screening process. Strategic assets now include:

- Artificial Intelligence (AI) and robotics

- Semiconductors and microelectronics

- Cybersecurity and quantum technologies

- Aerospace and dual-use technologies

- 5G and electronic communication networks

The government evaluates whether the investor is controlled by a non-EU state, the adequacy of the investor's financial resources, and the potential impact on the security of supply chains.

How do mandatory notification procedures work for non-EU investors?

Non-EU investors must formally notify the Presidency of the Council of Ministers of any transaction that results in the acquisition of a significant stake in a strategic Italian company. This notification must typically occur within 10 to 15 days of signing the preliminary agreement or the resolution of a shareholders' meeting, and before the deal is finalized.

The administrative process follows a strict timeline and requires detailed documentation:

- Initial Filing: The investor submits a detailed dossier including the business plan, corporate structure, and the identity of the ultimate beneficial owners.

- Review Period: The government has 45 days to review the transaction. If additional information is requested, this period is suspended until the data is provided.

- Outcome: The Council of Ministers may issue a "clearance" (no objection), "clearance with conditions" (requirements to maintain R&D in Italy or protect data), or a "veto" (prohibition of the deal).

Failure to notify is a serious offense. The government can declare the transaction null and void, and administrative fines can reach up to double the value of the operation.

What are the best legal structures for tech companies: S.r.l. vs. S.p.A.?

Choosing between a Società a Responsabilità Limitata (S.r.l.) and a Società per Azioni (S.p.A.) depends on the scale of the investment and the intended governance structure. Most tech startups and mid-sized foreign subsidiaries choose the S.r.l. because it offers a simplified management structure and lower capital requirements.

| Feature | S.r.l. (Limited Liability Company) | S.p.A. (Joint-Stock Company) |

|---|---|---|

| Minimum Capital | €1 (Standard S.r.l. usually €10,000) | €50,000 |

| Governance | Highly flexible; can be a sole director or board | Board of Directors and Board of Statutory Auditors |

| Transfer of Shares | Via deed filed with the Business Register | Simple endorsement or entry in the share register |

| Audit Requirement | Mandatory only if specific thresholds are met | Always mandatory |

| Suitability | Startups, SMEs, and private ventures | Large corporations, VC-backed firms, or IPO candidates |

For foreign tech investors, the S.r.l. is often more attractive because it allows for customized bylaws that can include specific protections for minority shareholders and simplified digital administrative processes.

How do Italian cybersecurity and data sovereignty laws affect tech firms?

Tech companies operating in Italy must comply with the National Cybersecurity Perimeter (Perimetro di Sicurezza Nazionale Cibernetica), which imposes strict security requirements on entities providing essential functions for the state. This legal framework works alongside the EU General Data Protection Regulation (GDPR) to ensure high standards of data sovereignty and infrastructure resilience.

Key compliance requirements include:

- Mandatory Reporting: Companies within the "Perimeter" must report cybersecurity incidents to the National Cybersecurity Agency (ACN) within 1 to 6 hours.

- Supply Chain Verification: Foreign investors must provide a list of hardware and software components used in strategic networks to ensure they do not pose a risk of foreign interference.

- Data Residency: While EU law promotes the free flow of data, certain strategic datasets related to national security must be stored and processed within Italian territory or certified "sovereign cloud" infrastructures.

Investors should perform thorough due diligence on the target company's IT infrastructure to ensure it meets the standards set by the Agenzia per la Cybersicurezza Nazionale.

What incentives and tax credits are available for innovative tech startups?

The Italian government provides a robust package of incentives designed to attract high-tech investment through the "Startup Act." To qualify, a company must be registered in the Special Section of the Business Register as an "Innovative Startup."

To qualify as an Innovative Startup, a company must meet one of these three criteria:

- At least 15% of the greater of cost or total turnover is devoted to R&D.

- At least one-third of the workforce holds a PhD, or two-thirds hold a Master's degree.

- The company is the owner or licensee of a registered patent or software.

The Benefits Include:

- Tax Credits: A 30% tax credit for individuals or companies investing in the startup's equity.

- R&D Tax Credits: Significant offsets for expenditures in fundamental research and experimental development.

- Exemptions: Waiver of Chamber of Commerce annual fees and stamp duties for administrative filings.

- Labor Flexibility: Ability to hire employees on fixed-term contracts for up to 24 months with simplified renewal rules.

- Fail-Fast Procedure: A simplified bankruptcy procedure that allows founders to close a venture more quickly and start anew.

Common Misconceptions About Tech Investment in Italy

1. Golden Power only applies to non-EU investors. While non-EU investors face the strictest scrutiny, EU-based investors (including Italian ones) can be subject to Golden Power rules if they seek to acquire control of strategic assets in the energy, transport, or communications sectors. In the defense and national security sectors, even the acquisition of a 3% stake by an EU entity can trigger notification requirements.

2. Incorporating a company in Italy takes months of bureaucracy. With the introduction of digital notarization and the specialized "Innovative Startup" registration process, a company can be incorporated and operational in a matter of weeks. The "ComUnica" procedure allows for simultaneous registration with the Tax Office, Social Security (INPS), and the Chamber of Commerce.

FAQ

What is the minimum investment required to trigger Golden Power?

There is no fixed monetary "de minimis" threshold. Instead, the trigger is based on the acquisition of a stake that grants "control" (usually 10% or more for non-EU entities) or hits specific percentage increments (15%, 20%, 25%, 50%) in companies holding strategic assets.

How long does the FDI screening process take in Italy?

The standard review period is 45 days from the date of notification. However, if the government requests more information, the clock stops until the investor provides the documentation. It is wise to plan for a 60-day window for regulatory clearance.

Can a foreign tech worker get a visa easily?

Yes, Italy offers the "Italia Startup Visa" for non-EU entrepreneurs who intend to set up an innovative startup. This is a streamlined, centralized, and digital process that grants a one-year self-employment visa, renewable upon company formation.

When to Hire a Lawyer

Navigating Italy's tech landscape requires specialized legal counsel when:

- You are acquiring an interest in a company that may fall under "Golden Power" jurisdiction.

- You need to draft complex bylaws for an S.r.l. or S.p.A. to protect foreign shareholder rights.

- You are applying for "Innovative Startup" status and require a compliance audit of your R&D expenses.

- You are entering a joint venture with a public entity or a company involved in the National Recovery and Resilience Plan (PNRR).

- You face a formal investigation or request for information from the Presidency of the Council of Ministers.

Next Steps

- Identify Strategic Assets: Determine if your target Italian company operates in sectors defined by the Golden Power decree.

- Select Corporate Structure: Decide between an S.r.l. or S.p.A. based on your long-term capital needs and governance preferences.

- Register for Incentives: If eligible, apply for the Special Section of the Business Register to unlock tax credits and labor flexibilities.

- Prepare Notification: If the deal triggers FDI rules, prepare your notification dossier at least 15 days before the expected closing date.

- Cybersecurity Audit: Conduct a technical audit to ensure your data management practices align with the National Cybersecurity Perimeter requirements.