- The S.r.l. (Società a responsabilità limitata) is the most flexible and popular corporate structure for foreign investors entering the Italian market.

- An Italian Notary Public is legally required to oversee the incorporation process, verify documents, and file the deed of incorporation.

- All directors and shareholders must obtain an Italian Tax Code (Codice Fiscale) before the company can be legally formed.

- While an S.r.l. can be formed with only €1 in share capital, a capital of at least €10,000 is standard to ensure operational credibility and banking ease.

- Every Italian company must maintain a Certified Email Address (PEC) for all official legal and governmental communications.

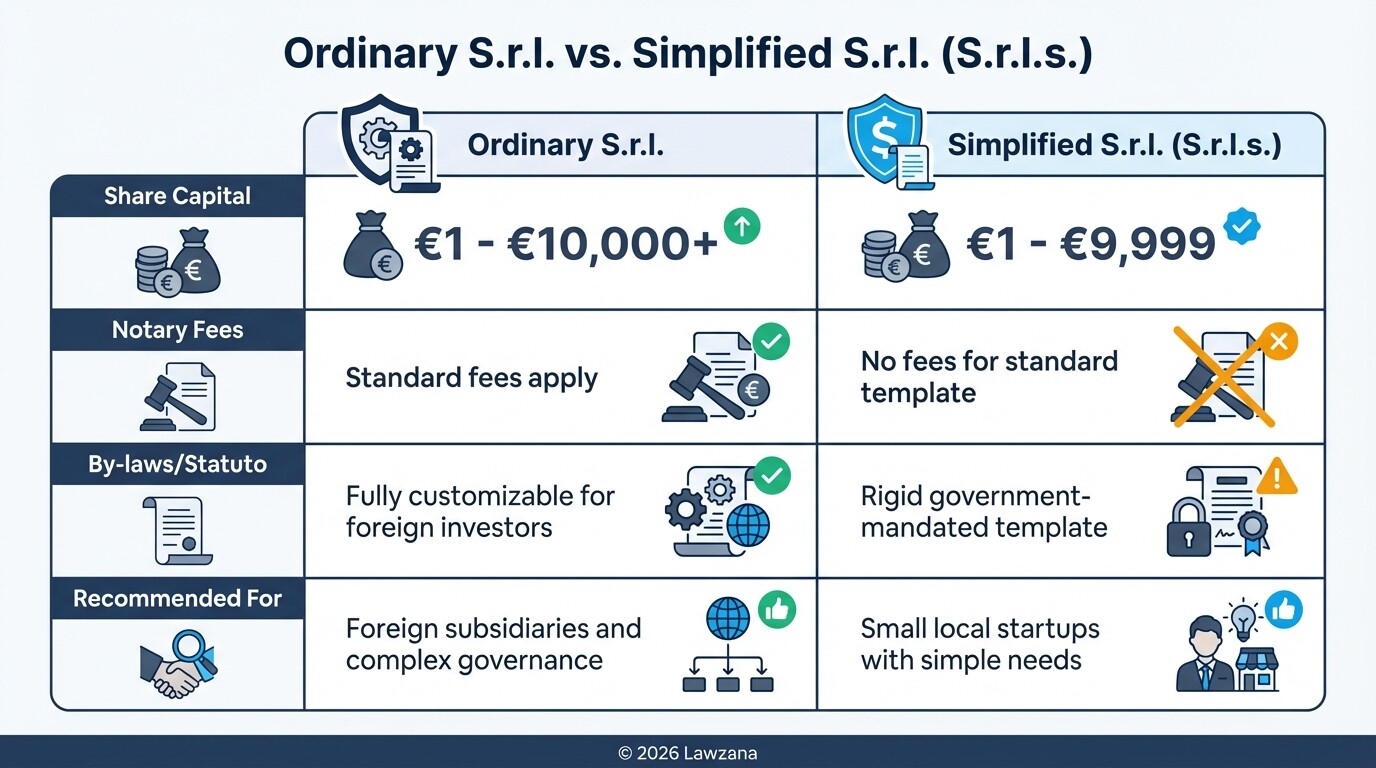

What are the minimum share capital requirements for an S.r.l.?

To establish a standard S.r.l. in Italy, the law generally requires a minimum share capital of €10,000, although it is possible to incorporate with as little as €1. If the capital is €10,000 or more, shareholders only need to pay 25% of the capital upfront into a bank account; if the capital is lower than €10,000 or if the company has a sole shareholder, 100% must be paid immediately.

Investors often choose between two specific formats:

- Ordinary S.r.l.: This version offers maximum flexibility. You can customize your By-laws (Statuto) to fit complex governance needs. It requires a minimum capital of €1, but if capital is below €10,000, you must set aside 20% of annual profits into a legal reserve until the total capital plus reserves reaches €10,000.

- Simplified S.r.l. (S.r.l.s.): Designed for small startups, this version has zero notary fees and a capital range of €1 to €9,999. However, you cannot customize the By-laws; you must use a rigid, government-mandated template. For most foreign investors, the lack of flexibility in the S.r.l.s. makes it unsuitable for complex international operations.

How do you draft the By-laws (Statuto) for foreign shareholders?

The By-laws (Statuto) and the Deed of Incorporation (Atto Costitutivo) serve as the constitution of your Italian company, defining governance, voting rights, and profit distribution. For foreign shareholders, these documents must be drafted with specific clauses that allow for remote board meetings and digital signatures to ensure the company remains manageable from abroad.

When drafting these documents for an international context, consider the following:

- Language Requirements: If a shareholder does not speak Italian, the deed must be prepared in a bilingual format (Italian and the shareholder's native language or English) and a translator must be present at the signing.

- Governance Structure: You can choose between a Sole Director or a Board of Directors. Foreign investors often include clauses allowing for "teleconferencing" to legalise meetings held outside of Italy.

- Transfer of Shares: Specify the rules for selling shares or bringing in new investors. Without specific clauses, Italian law provides default rules that might not align with your exit strategy.

- Power of Attorney: If you cannot travel to Italy for the signing, you can grant a Power of Attorney (Procura) to a local representative. This document must be notarized and apostilled in your home country.

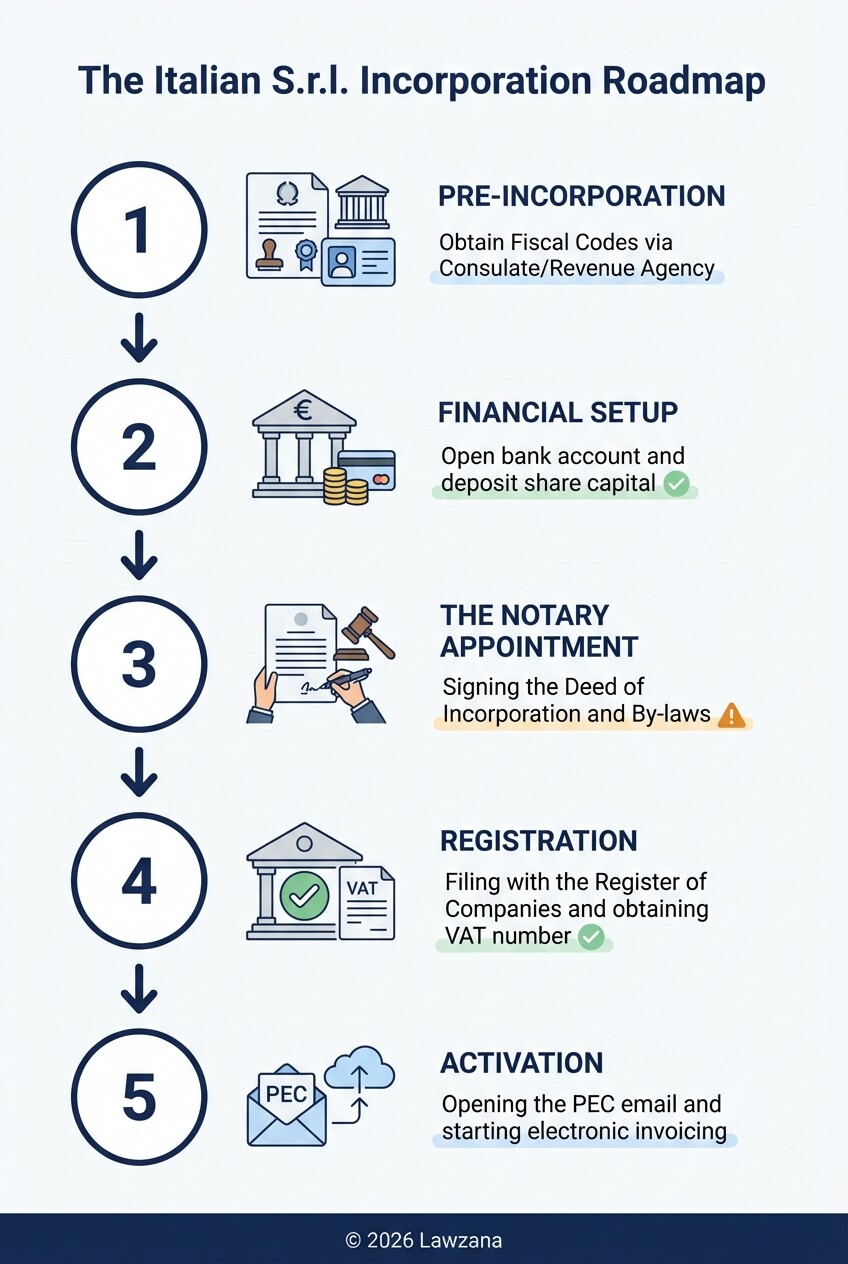

How do you obtain an Italian Fiscal Code and VAT number?

Before any legal paperwork can be signed, every director and shareholder of the new company must obtain an Italian Tax Code (Codice Fiscale). This is a unique alphanumeric identifier used by the Italian authorities to track tax obligations and is required even for non-residents who do not live or work in Italy.

The process for obtaining these credentials involves:

- Codice Fiscale: This can be requested through the local Italian Consulate in your home country or directly at the Agenzia delle Entrate (Italian Revenue Agency) if you are in Italy. You will need a valid passport and an application form.

- VAT Number (Partita IVA): Unlike the tax code, the VAT number is assigned to the company itself, not the individuals. Once the company is incorporated by the notary, the VAT number is usually requested through a "ComUnica" filing. This single digital filing notifies the Revenue Agency, the Social Security Office (INPS), and the Accident Insurance Office (INAIL) of your new business.

Why is the Italian Notary mandatory for incorporation?

In Italy, a Notary Public is not merely a witness but a public official who guarantees the legality of the company's formation. The notary is responsible for verifying the identity of the founders, ensuring the share capital has been deposited, and confirming that the company's purpose complies with Italian law.

The notary's role includes:

- Public Deed Execution: The notary drafts or reviews the Deed of Incorporation and the By-laws to ensure they meet the requirements of the Italian Civil Code.

- Anti-Money Laundering (AML) Checks: The notary must verify the "Ultimate Beneficial Owner" (UBO) of the company to comply with European and Italian AML regulations.

- Registration: Within 20 days of the signing, the notary must file the deed with the Register of Companies (Registro delle Imprese). The company does not legally exist as a separate entity until this registration is complete.

What are the post-incorporation compliance requirements?

Once the notary has filed your deed, the company must fulfill several digital and administrative obligations to remain in good standing. Italy has one of the most advanced digital business environments in Europe, requiring companies to communicate with the state almost exclusively through electronic means.

The essential post-incorporation steps include:

- PEC (Certified Email): Every Italian company must have a Posta Elettronica Certificata. This is a secure email system that gives messages the same legal value as a registered letter with a return receipt. All official notices from the government will be sent here.

- Business Register (Registro delle Imprese): Your company must be active in the Registro Imprese. This register is public, allowing anyone to verify your company's status, directors, and financial statements.

- Electronic Invoicing (Fatturazione Elettronica): Italy mandates that all B2B and B2C invoices be issued through the government's "Exchange System" (SDI). You will need specialized software or a local accountant to manage this.

- UBO Declaration: You must declare the Ultimate Beneficial Owners to a special section of the Business Register to ensure transparency regarding who truly controls the entity.

Common Misconceptions About Italian Business Registration

Myth 1: You must be an Italian resident to start a company. This is false. Shareholders and directors can be of any nationality. However, "reciprocity" rules may apply; Italy allows citizens of other countries to start businesses if those countries allow Italians to do the same. Most Western nations have these agreements in place.

Myth 2: A virtual office is sufficient for registration. While you do not need a massive physical warehouse, your company must have a registered office (Sede Legale) in Italy. This address is where legal documents are served. Many investors use their accountant's or lawyer's office address as the registered office initially.

Myth 3: Incorporating an S.r.l. takes months. If you have your Fiscal Codes and documents ready, the actual act of incorporation with the notary takes only a few hours. The company usually becomes fully active in the Business Register within 3 to 7 business days after the notary's filing.

Frequently Asked Questions

Can a foreign company be the sole shareholder of an Italian S.r.l.?

Yes. A foreign legal entity can own 100% of the shares of an Italian S.r.l. In this case, the parent company's documents (Certificate of Incorporation, By-laws) must be translated into Italian and apostilled to be recognized by the Italian notary.

How much does it cost to set up an S.r.l. in Italy?

Expect to pay between €3,000 and €6,000 for a standard setup. This includes notary fees (approx. €1,500 to €2,500), registration taxes (approx. €600), and professional fees for drafting the By-laws and obtaining tax codes.

Do I need a local bank account before incorporating?

Yes, if you are incorporating a standard S.r.l., you must deposit the share capital into an Italian bank account. Some "fintech" business accounts are now accepted, but they must be able to issue the specific certificate of deposit required by the notary.

What is the corporate tax rate in Italy?

Italian companies are primarily subject to two taxes: IRES (Corporate Income Tax) at a flat rate of 24%, and IRAP (Regional Tax on Productive Activities) at a standard rate of 3.9%, though this varies slightly by region.

When to Hire a Lawyer

Navigating the Italian bureaucracy can be challenging for those unfamiliar with the civil law system. You should hire a lawyer if:

- You are setting up a subsidiary for a foreign parent company and require complex inter-company agreements.

- You cannot travel to Italy and need a trusted professional to act as your Proxy via Power of Attorney.

- Your business operates in a regulated industry (such as finance, healthcare, or food) that requires specific local permits alongside registration.

- You need to draft customized By-laws to protect minority shareholder rights or define specific governance deadlocks.

Next Steps

- Identify your shareholders and directors and collect copies of their passports.

- Apply for Italian Fiscal Codes for all involved parties via the nearest Italian Consulate.

- Draft your By-laws with a legal professional to ensure they meet your specific business objectives.

- Select a Notary and schedule the date for the signing of the Deed of Incorporation.

- Open an Italian bank account and transfer the required share capital.

- Activate your PEC email and complete the "ComUnica" filing to receive your VAT number and activate the company in the Business Register.