- Expats should maintain separate Wills for different jurisdictions to avoid probate delays and ensure compliance with local laws.

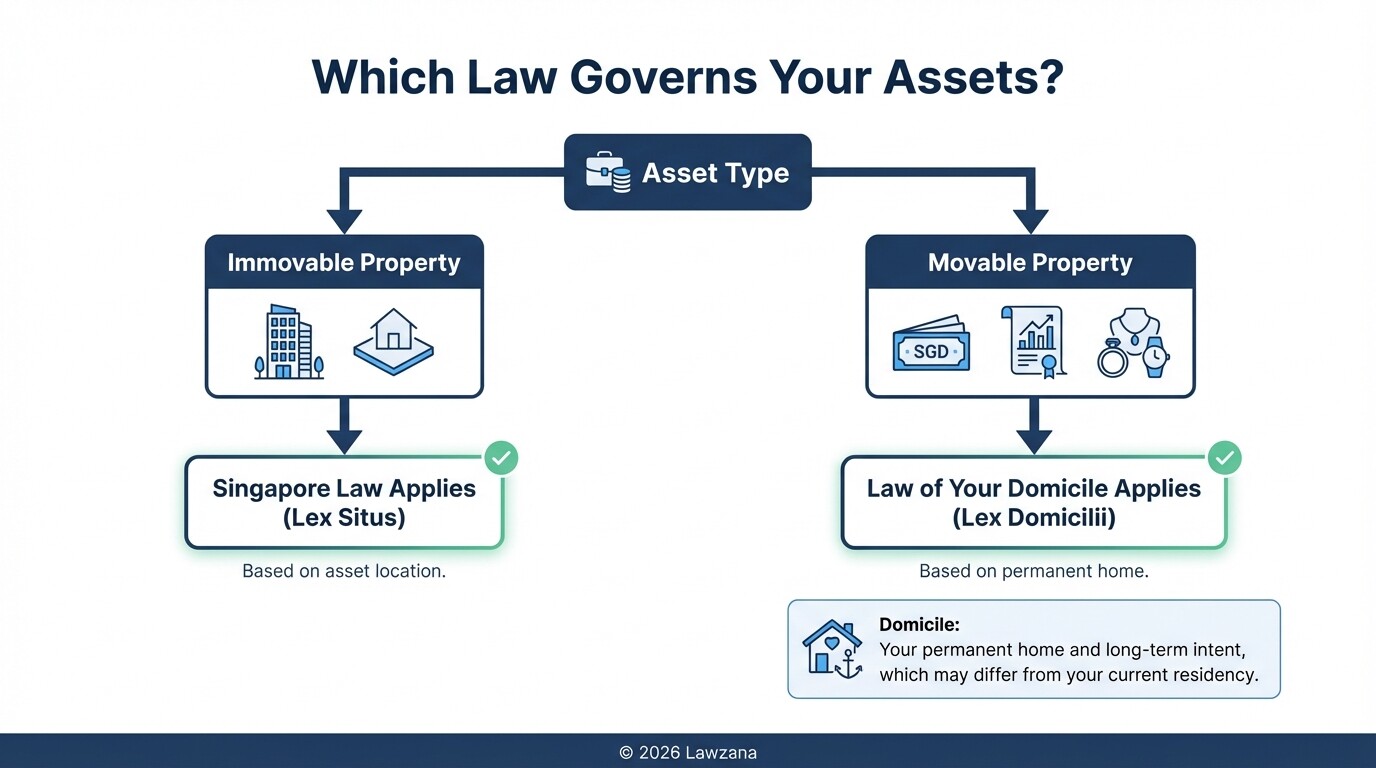

- Singapore governs real estate (immovable property) by the law where it is located, while movable assets like bank accounts follow the law of your domicile.

- Although Singapore has no inheritance tax, expats remain liable for "death taxes" in their home countries (e.g., US or UK) on their global assets.

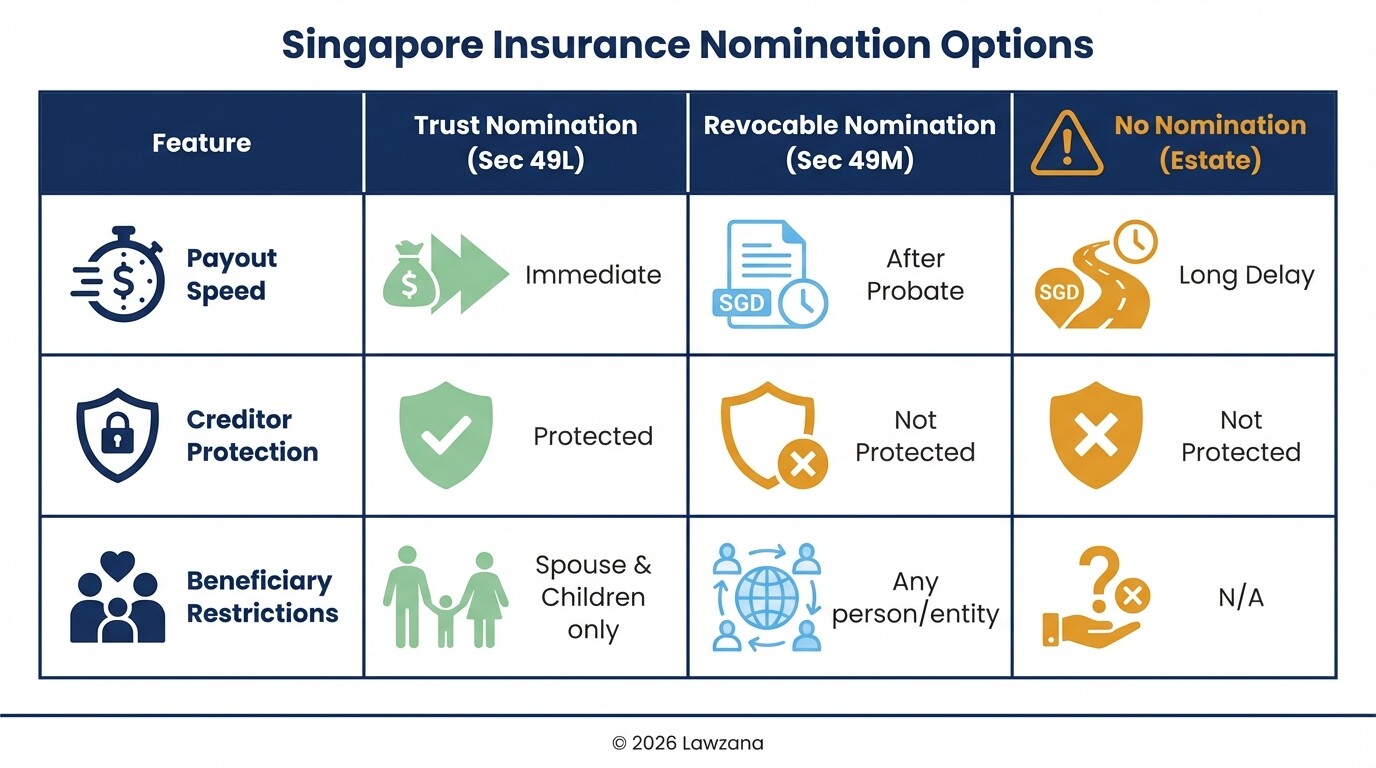

- Mismanaging beneficiary designations on Singapore insurance policies can lead to assets being locked in the estate rather than passing directly to loved ones.

- Digital assets and international bank accounts require specific "coordination clauses" to prevent one Will from accidentally revoking another.

Conflict of Laws: Determining Which Country Rules Your Assets

Singapore law differentiates between "movable" and "immovable" property when determining which country's succession laws apply. For immovable property like a condo in Sentosa, Singapore law (lex situs) always governs the distribution, whereas movable property like cash or stocks is governed by the law of your domicile (lex domicilii) at the time of your passing.

Determining your "domicile" is a complex legal question that goes beyond mere residency; it involves your permanent home and intent to remain. If you are a British expat living in Singapore but intend to return to London eventually, your domicile remains the UK. This means your Singapore bank accounts could be subject to UK inheritance laws and taxes. Understanding this distinction is the first step in preventing your estate from being frozen in a cross-border legal tug-of-war.

Checklist for Creating a Singapore Will Alongside a Foreign Will

Creating a "Local Will" for your Singapore-based assets is the most efficient way to ensure your family can access funds quickly. However, these documents must be carefully synchronized to ensure they do not legally conflict.

- Inventory All Assets: Categorize assets by jurisdiction (Singapore vs. Home Country) and type (Real estate vs. Movable property).

- Define Jurisdiction Limits: Explicitly state in your Singapore Will that it only applies to assets located within Singapore to prevent it from accidentally revoking your foreign Will.

- Appoint Local Executors: Select at least one executor residing in Singapore to simplify the court process and administrative tasks.

- Include a Coordination Clause: Insert language that acknowledges the existence of your foreign Will and confirms that both documents are intended to operate concurrently.

- Review Forced Heirship Rules: If you own property in "civil law" jurisdictions (like France or Indonesia), verify if those laws override your Will's instructions.

- Witnessing Requirements: Ensure the Singapore Will is signed in the presence of two witnesses who are not beneficiaries, as required by the Wills Act 1838.

Sample Coordination Clause for Multiple Wills

When maintaining Wills in two different countries, you must include a "limitation of scope" clause. This prevents the standard "revocation clause" (which cancels all previous Wills) from inadvertently deleting your estate plan in another country.

Sample Language: "I declare that this Will is intended to govern only my assets situated in the Republic of Singapore. This Will shall not revoke or affect any testamentary dispositions I have previously made, or may hereafter make, concerning property situated in [Your Home Country]. Both Wills shall be read together as independent documents governing assets in their respective jurisdictions."

Timelines and Procedures for the Grant of Probate in 2026

The Grant of Probate is the court order that validates a Will and allows executors to distribute assets. In 2026, Singapore's Family Justice Courts utilize a fully digitized eLitigation system, which has streamlined the process significantly compared to previous decades.

| Stage of Process | Estimated Timeline | Key Action |

|---|---|---|

| Filing Application | 1 - 2 Weeks | Lawyer files the Originating Process and supporting affidavits. |

| Caveat Search | 1 Week | Court verifies no one else is claiming the estate or contesting the Will. |

| Grant of Probate Issued | 2 - 4 Months | The Court issues the "Grant," authorizing the executor to act. |

| Asset Collection | 1 - 3 Months | Executor presents the Grant to banks and the Land Authority. |

| Final Distribution | Variable | Debts are paid and remaining assets are transferred to beneficiaries. |

Common Mistakes in Naming Beneficiaries for International Insurance

Expats often assume that their Singapore life insurance policies will automatically go to their spouse or children. However, under Singapore's Insurance Act, failure to make a "Nomination of Beneficiaries" can lead to the payout being treated as part of the general estate, subjecting it to the probate process and potential creditors.

A common error is naming "The Estate" as the beneficiary. This forces the insurance company to wait for a Grant of Probate before releasing funds, which can take months. Instead, expats should utilize a Trust Nomination (Section 49L) or a Revocable Nomination (Section 49M). A Trust Nomination is particularly powerful for families, as it creates a statutory trust that protects the payout from the deceased's creditors and ensures immediate liquidity for the family.

Legal Impact of Singapore's Lack of Inheritance Tax

Singapore abolished estate duty (inheritance tax) for all deaths occurring on or after February 15, 2008. This makes Singapore one of the most tax-efficient jurisdictions in the world for wealth transfer. However, this "tax-free" status does not shield an expat from the tax laws of their home country.

For example, US citizens and Green Card holders are taxed on their worldwide assets regardless of where they live. Similarly, UK "domiciled" individuals are subject to a 40% inheritance tax on their global estate above the nil-rate band. While Singapore will not take a cut of your estate, you must ensure your Singapore Will accounts for the liquidity needed to pay taxes in your home jurisdiction. Without proper planning, your beneficiaries might be forced to sell a Singapore property quickly-and potentially at a loss-to cover a tax bill in another country.

Common Misconceptions About Cross-Border Wills

"One Will covers everything globally." While a Will made in your home country might be legally valid in Singapore under the International Wills Act, the process of "resealing" a foreign Grant of Probate is often slower, more expensive, and more legally complex than having a dedicated Singapore Will.

"My assets will automatically go to my spouse." Singapore does not have a "joint tenancy" rule for all assets. If you die without a Will (intestate), the Intestate Succession Act dictates how assets are split. For a married person with children, the spouse only receives half the estate, while the children receive the other half. This can create significant financial hardship for a surviving spouse who may need full access to those funds.

Frequently Asked Questions

Can I use a foreign Will to manage my Singapore bank accounts?

Yes, but it is inefficient. The Singapore courts must first "reseal" the foreign probate document. This requires your home country to be a recognized Commonwealth jurisdiction or for your lawyer to go through a more complex "Grant of Letters of Administration with Will Annexed" process. A local Will bypasses these hurdles.

What happens to my HDB flat or condo if I don't have a Will?

If you own the property as "Joint Tenants," it passes automatically to the surviving owner. However, if you own it as "Tenants-in-Common," your share becomes part of your estate and will be distributed according to the Intestate Succession Act or your Will, which could result in a foreign relative owning a share of your Singapore home.

Do I need a separate Will for my CPF savings?

Yes. A Will cannot distribute your Central Provident Fund (CPF) savings. You must make a specific CPF Nomination through the CPF Board. If no nomination is made, the funds are handed over to the Public Trustee for distribution according to intestacy laws, and a fee is charged for this service.

When to Hire a Lawyer

Cross-border estate planning is not a "DIY" project. You should consult a Singapore-qualified lawyer if:

- You own real estate in more than one country.

- You are a citizen of a country with high inheritance taxes (UK, US, Japan).

- You have "movable" assets in Singapore exceeding $50,000.

- You have children who are minors and require the appointment of guardians in your Will.

- You want to ensure your Singapore insurance and CPF nominations align with your overall estate plan.

Next Steps

- Audit your assets: List every bank account, property, and insurance policy you hold in Singapore and abroad.

- Review your domicile status: Consult with a tax or legal professional to determine which country has primary taxing rights over your global estate.

- Draft a Singapore-specific Will: Work with a lawyer to create a document that complements, rather than conflicts with, your home-country estate plan.

- Update your nominations: Log into your CPF and insurance portals to ensure your beneficiaries are correctly named.

- Secure your documents: Inform your executors where your original Wills are stored, as Singapore courts require the physical original for probate.