- California mandates a minimum six-month waiting period from the date the respondent is served before a divorce can be finalized.

- Mediation is significantly more cost-effective, typically costing 50% to 70% less than a traditional litigated divorce.

- Accurate financial disclosure is a legal requirement; omitting assets can lead to the court overturning your entire settlement years later.

- The "Date of Separation" is the most critical factor in determining which assets are communal and which remain separate property.

- Litigation provides a structured environment for high-conflict cases, whereas mediation requires both parties to be willing to negotiate in good faith.

Should you choose mediation or litigation for a California divorce?

Choosing between mediation and litigation depends on your level of conflict, the complexity of your assets, and your ability to communicate with your spouse. Mediation involves a neutral third party helping you reach a mutual agreement, while litigation places decision-making power in the hands of a Superior Court judge.

The primary differences between these two paths involve cost, privacy, and control:

| Feature | Divorce Mediation | Divorce Litigation |

|---|---|---|

| Cost | Generally $3,000-$10,000 total | Often $20,000-$50,000+ per person |

| Timeline | 3 to 9 months | 12 to 24+ months |

| Privacy | Private and confidential sessions | Public record in open court |

| Control | Spouses decide the outcome | Judge decides the outcome |

| Atmosphere | Collaborative and informal | Adversarial and formal |

Mediation is highly recommended for couples who want to preserve a co-parenting relationship and minimize the emotional toll on children. Litigation is often the only viable option when there is a history of domestic violence, a significant power imbalance, or a spouse who refuses to be transparent about finances.

What are common mistakes when filing the Petition for Dissolution (FL-100)?

The FL-100 is the foundational document for a California divorce, and errors here can cause significant delays or the loss of specific legal claims. Common mistakes include failing to list all minor children of the marriage or failing to "reserve" the court's jurisdiction over spousal support, which can prevent you from asking for financial help later.

To ensure your filing is accurate, avoid these frequent pitfalls:

- Incorrect Residency Statements: You must have lived in California for six months and the county of filing for three months to meet jurisdictional requirements.

- Vague Property Lists: While you do not need to list every fork and spoon, failing to check the box for "Property Declaration" (FL-160) or failing to note that there are community assets to be divided can lead to procedural roadblocks.

- Missing Spousal Support Requests: If you do not check the box requesting spousal support, or if you do not ask the court to terminate the ability to award support to your spouse, you may lose the opportunity to litigate this issue.

- Failure to Serve Correctly: Filing the petition is only half the battle; the respondent must be served properly with a Summons (FL-110) and the Petition, and a Proof of Service (FL-115) must be filed with the court.

What mandatory financial disclosure documents are required in California?

California law requires a "full and accurate" disclosure of all assets and debts, regardless of whether you believe they are separate or community property. This process involves serving your spouse with a Preliminary Declaration of Disclosure, which includes several specific state forms and supporting financial records.

The following documents are mandatory for every California divorce:

- Declaration of Disclosure (FL-140): A cover sheet stating that you have provided your spouse with all required financial information.

- Schedule of Assets and Debts (FL-142): A comprehensive list of everything you own and owe, including real estate, bank accounts, retirement funds, and credit card balances.

- Income and Expense Declaration (FL-150): A detailed monthly budget including your current earnings, tax returns from the last two years, and your average monthly costs for housing, food, and healthcare.

- Declaration Regarding Service of Declaration of Disclosure (FL-141): A form filed with the court to prove that you and your spouse have exchanged these private documents.

Failure to be honest during this phase can result in "sanctions," where the judge orders you to pay your spouse's attorney fees, or the court may award 100% of an undisclosed asset to the other spouse as a penalty.

Why is documenting the Date of Separation critical for asset division?

In California, the "Date of Separation" is the specific day when the community property interest in your earnings and acquisitions ends. Everything earned or acquired from the date of marriage until the date of separation is generally considered community property (split 50/50), while anything earned after that date is the separate property of the individual spouse.

Determining this date can be complex, especially if spouses still live under the same roof for financial reasons. California courts look for two specific elements to confirm the date:

- One spouse has communicated to the other spouse their intent to end the marriage.

- The conduct of that spouse is consistent with the intent to end the marriage (e.g., moving out, opening separate bank accounts, or stopping social engagements as a couple).

If one spouse receives a large year-end bonus or an inheritance right around the time of the split, a disagreement over the separation date by even a few days can result in a difference of tens of thousands of dollars in the final settlement.

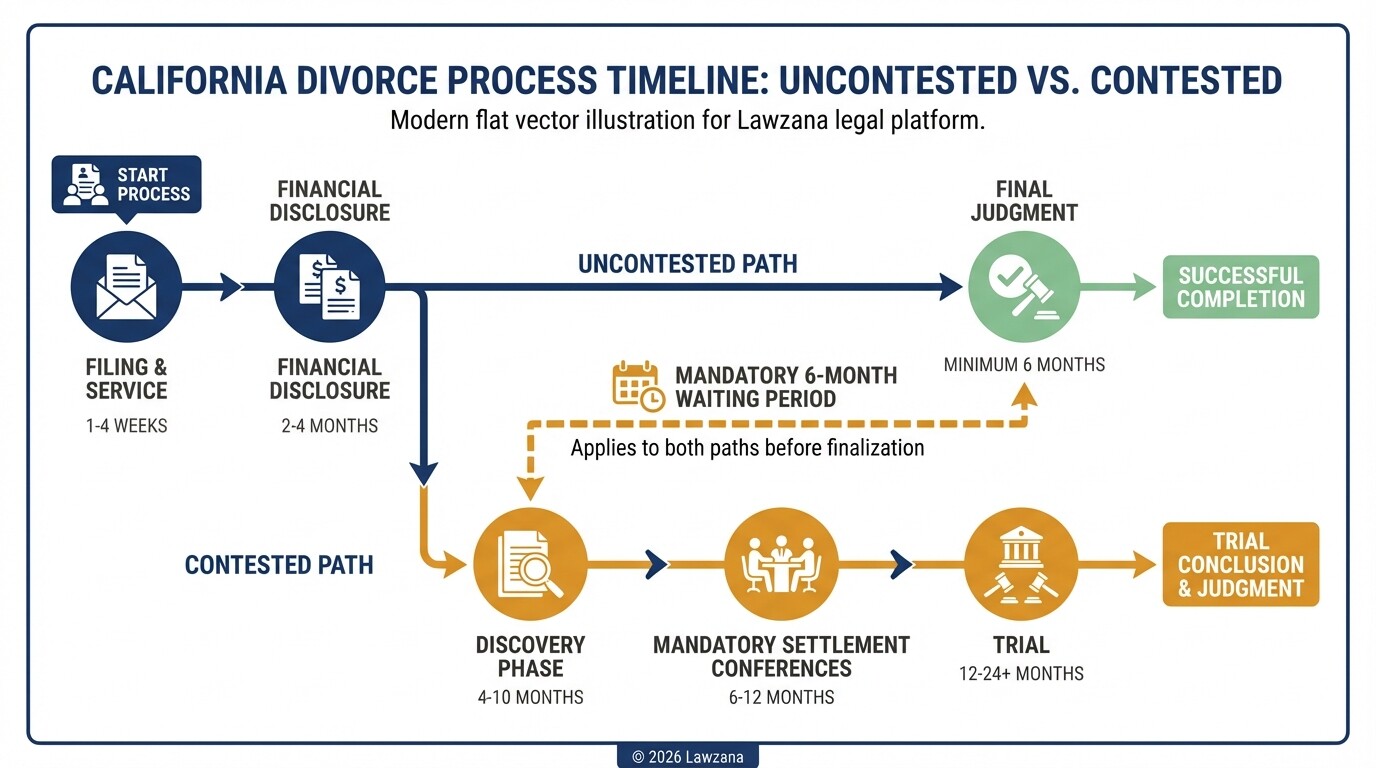

How long does a contested versus uncontested divorce take in California?

The fastest a divorce can be finalized in California is six months and one day from the date the respondent is served, but this only occurs in perfectly "uncontested" cases. Contested cases-where spouses disagree on custody, support, or property-frequently take between 12 and 18 months to reach a final judgment.

The timeline is generally dictated by the following phases:

- Initial Filing and Service: 1 to 4 weeks.

- Financial Disclosure Phase: 2 to 4 months.

- Discovery (In Litigation): 4 to 10 months. This is when attorneys exchange subpoenas and take depositions.

- Mandatory Settlement Conferences: Occurs 6 to 12 months after filing to attempt a resolution before trial.

- Trial (If needed): Usually scheduled 12 to 24 months after the initial filing, depending on the court's backlog.

Mediation can bypass many of these delays because you are not dependent on the court's crowded calendar for every small motion or hearing.

What is the cost-benefit analysis of hiring a mediator versus a trial lawyer?

Hiring a mediator is almost always the more affordable path, as both parties often share the cost of one neutral professional rather than paying two separate attorneys their full hourly rates. However, a trial lawyer provides individual advocacy and "protection" that a mediator, who must remain neutral, cannot offer.

Mediation Benefits:

- Cost Savings: You avoid the high costs of "discovery" (formal evidence gathering) and multiple court appearances.

- Speed: You set your own schedule for meetings.

- Emotional Health: Reduced conflict often leads to better long-term co-parenting.

Trial Lawyer Benefits:

- Advocacy: Your lawyer's only job is to protect your specific interests.

- Power Balance: Essential if your spouse is hiding money or is emotionally abusive.

- Complex Litigation: Necessary if you own a business that requires professional valuation or if there are complicated international custody issues.

Common Misconceptions About California Divorce

Myth 1: "If my spouse cheated, I get more money."

California is a "no-fault" divorce state. This means the court does not care about infidelity or "who is to blame" for the breakup when it comes to dividing assets or awarding spousal support. The only exception is if a spouse spent community money on their extramarital affair, which may be reimbursable to the community.

Myth 2: "We can skip the financial disclosure if we already agree on everything."

Even in a 100% amicable mediation, you cannot legally waive the Preliminary Declaration of Disclosure. The court will not sign a final judgment unless both parties file the FL-141 form proving they have exchanged financial information. This protects both parties from future claims that the agreement was signed under false pretenses.

Myth 3: "My spouse can refuse to give me a divorce."

In California, you do not need your spouse's permission to get a divorce. If you file the paperwork and they refuse to respond or sign anything, you can eventually finish the process through a "true default" judgment. One person has the right to end the marriage regardless of the other person's wishes.

FAQs

Can we use one lawyer for both of us in a California divorce?

No. An attorney cannot represent both spouses in a divorce because it is an inherent conflict of interest. However, you can hire one neutral mediator to help you both, or one person can hire a lawyer while the other remains "unrepresented" (though this is not recommended).

How is child support calculated in California?

California uses a statewide uniform guideline (a mathematical formula) that considers both parents' actual income, their tax filing status, and the "timeshare" (how much physical time the child spends with each parent). You can find the official calculator at the California Department of Child Support Services.

What is the difference between legal separation and divorce?

A legal separation handles all the same issues as a divorce (custody, support, property division) but does not officially end the marriage. This allows spouses to remain on each other's health insurance or meet religious requirements, but they cannot remarry until they file a separate motion to terminate the marriage status.

When to Hire a Lawyer

You should consult with a California family law attorney if your case involves any of the following:

- Domestic Violence: If there is a fear for your safety or a need for restraining orders.

- High Assets: If you own businesses, stock options, or international property.

- Disputed Custody: If you and your spouse cannot agree on a parenting plan.

- Hidden Assets: If you suspect your spouse is moving money to secret accounts.

- Power Imbalance: If your spouse has a lawyer and you feel overwhelmed by the legal process.

Next Steps

- Gather Documents: Collect three years of tax returns, recent pay stubs, and statements for all bank, retirement, and credit card accounts.

- Determine Your Path: Decide if you and your spouse are candidates for mediation or if the level of conflict requires litigation.

- Consult the Court Website: Review the California Courts Self-Help Guide to understand the local forms required in your specific county.

- Interview Professionals: Schedule consultations with at least two mediators or family law attorneys to compare their approaches and fee structures.