- The Consumer Protection Act (CPA) applies only to property sold by developers or investors in the ordinary course of their business, not to private sales between individuals.

- Developers cannot use the "voetstoots" (as-is) clause to escape liability for latent defects under the CPA.

- Buyers have a statutory right to receive property that is reasonably suited for its intended purpose and free of any defects for at least six months after delivery.

- If a structural defect is discovered, the buyer has the right to demand a repair, replacement, or a refund of the purchase price, though price reduction is more common.

- Verification of the NHBRC registration and approved building plans is a mandatory step before signing any Offer to Purchase.

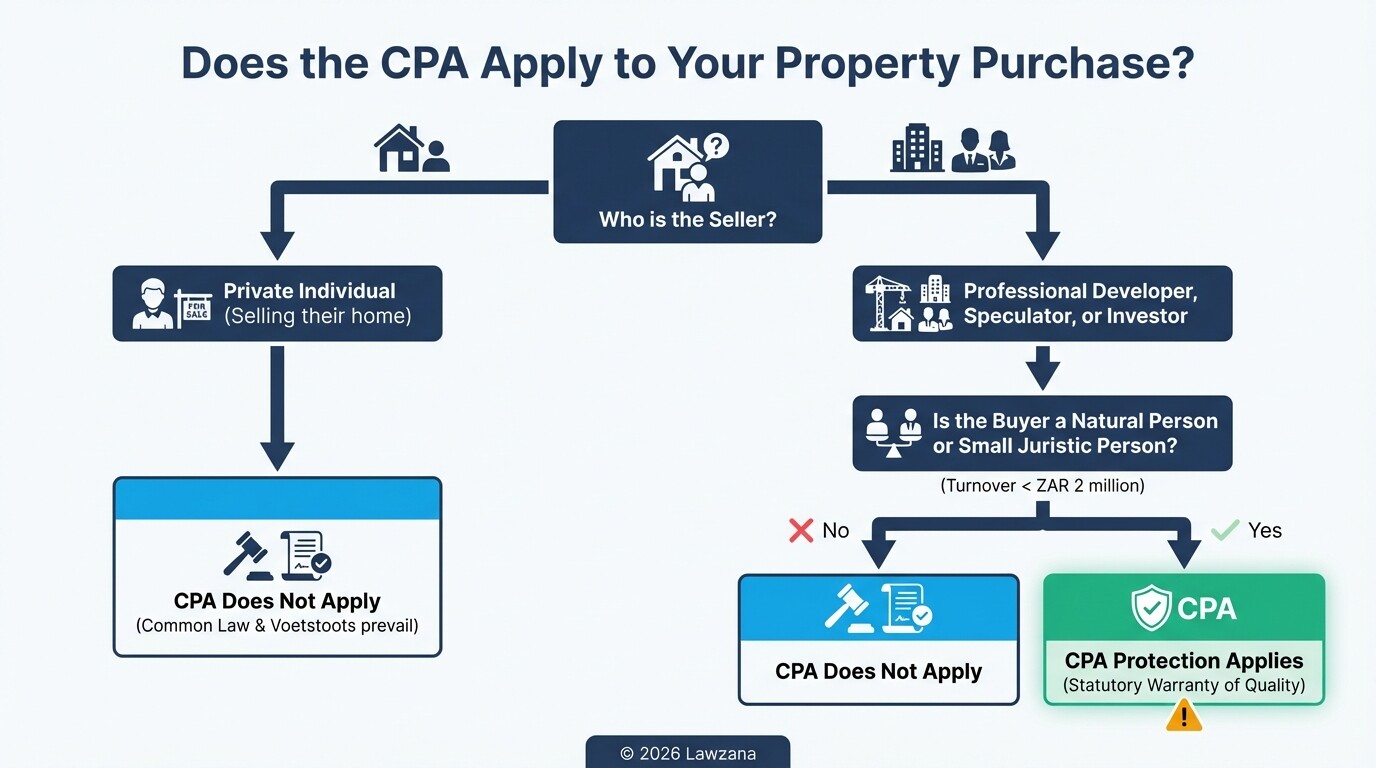

When does the CPA apply to South African property sales?

The Consumer Protection Act applies to property sales where the seller is acting in the "ordinary course of business," such as a property developer, speculator, or professional investor. It establishes a protective framework for the "consumer" (the buyer) against "suppliers" (the developers) to ensure fair marketing and quality standards.

If you are buying a home from a private individual who is simply selling their primary residence, the CPA generally does not apply. In those private instances, the common law and the "voetstoots" clause remain the dominant legal principles. To determine if your transaction falls under the CPA, consider these criteria:

- Seller Status: Is the seller a developer or a company that regularly flips or builds houses?

- Transaction Nature: Is the sale part of the seller's professional commercial activity?

- Buyer Status: Is the buyer a natural person or a small juristic person (with an annual turnover or asset value below R2 million)?

| Transaction Type | CPA Applicable? | Governing Rule |

|---|---|---|

| Buying from a Developer | Yes | CPA Section 55 & 56 |

| Buying from a Private Seller | No | Common Law (Voetstoots) |

| Buying via Estate Agent (Private Sale) | Partially | CPA applies to the Agent's service only |

How does the CPA affect "Voetstoots" and the duty of disclosure?

The CPA effectively removes the protection of the "voetstoots" clause for professional developers, preventing them from selling a property "as it stands" to avoid liability for hidden defects. Under the CPA, every consumer has a right to receive property that is of good quality, in good working order, and free of any defects.

In a traditional private sale, a "voetstoots" clause protects the seller unless the buyer can prove the seller knew about a defect and intentionally hid it. However, under the CPA, the developer is held to a higher standard. They have a mandatory duty of disclosure and must provide a property that meets the following requirements:

- Fitness for Purpose: The home must be suitable for the purpose for which it is generally intended (habitation).

- Good Quality: The materials and construction must be of a standard that a reasonable person would expect.

- Compliance: The building must comply with the National Building Regulations and Building Standards Act.

What are the legal remedies for structural defects found after transfer?

If a structural defect is discovered within six months of the property transfer, the CPA provides the buyer with the right to insist on a repair, a replacement, or a refund. In the context of real estate, a full "refund" usually translates to a claim for damages or a reduction in the purchase price to cover the cost of necessary repairs.

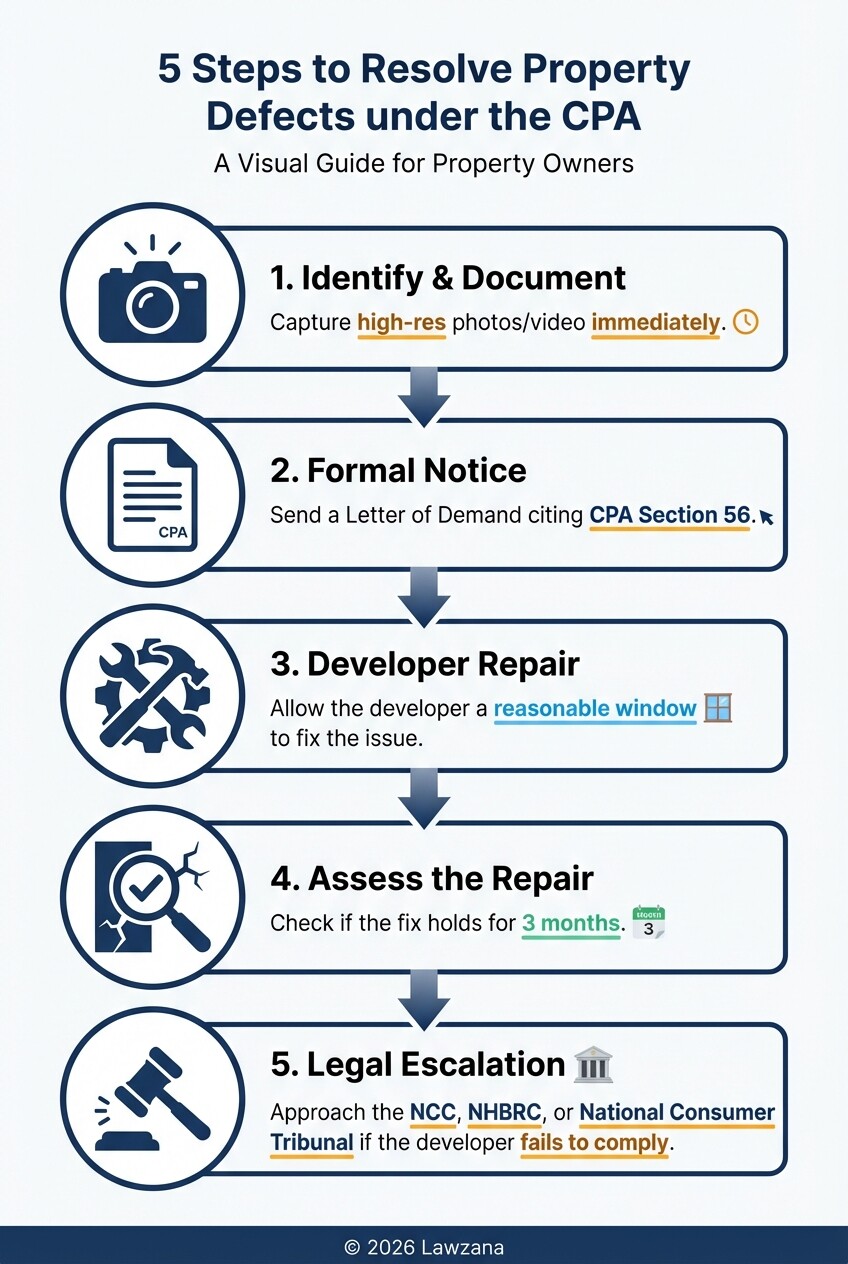

When a defect like a leaking roof, cracked foundation, or faulty electrical wiring appears, the buyer should follow these steps:

- Notify the Developer: Send a formal written notice (Letter of Demand) detailing the defect and referencing Section 56 of the CPA.

- Request Repair: The developer must be given a reasonable opportunity to remedy the defect at their own expense.

- Six-Month Rule: If the repair fails or a further defect is discovered within three months of the repair, the developer must replace the component or refund a portion of the price.

- Escalation: If the developer refuses to cooperate, the buyer can approach the National Consumer Commission (NCC) or the Motor Industry Ombudsman of South Africa (if applicable to specific fixtures), though property disputes usually move toward the National Consumer Tribunal.

What is the role of the National Consumer Tribunal in property disputes?

The National Consumer Tribunal (NCT) acts as an independent adjudicatory body that has the power to hear cases involving prohibited conduct under the CPA and issue orders that have the same legal standing as a High Court judgment. It serves as a more accessible and cost-effective alternative to traditional litigation for home buyers.

The NCT can assist a property buyer by:

- Issuing a compliance order against a developer who refuses to fix structural defects.

- Imposing administrative fines on developers who engage in unconscionable conduct.

- Resolving disputes that have been referred to it by the National Consumer Commission after an investigation.

Before reaching the Tribunal, buyers are typically encouraged to seek alternative dispute resolution (ADR) through the National Consumer Commission. This administrative route is significantly cheaper than hiring a private attorney for a High Court battle, which can easily cost upwards of R50,000 to R100,000 in South Africa.

What essential documentation must be verified before signing an Offer to Purchase?

Before signing an Offer to Purchase (OTP) with a developer, you must verify that the property complies with statutory safety and ownership requirements to ensure your CPA rights are enforceable. Failure to check these documents can lead to prolonged disputes where the developer claims the buyer "accepted" the condition of the property.

The Essential Checklist:

- NHBRC Enrollment Certificate: Professional developers must register every new home with the National Home Builders Registration Council. This provides a five-year warranty on structural defects.

- Approved Building Plans: Ensure the local municipality has approved the plans for the current structure. Unapproved additions are a major source of legal "latent defects."

- Occupation Certificate: Issued by the municipality, this confirms the house is safe to live in and meets all building codes.

- Title Deed and Zoning: Confirm there are no restrictive covenants or servitudes that would prevent you from using the property as intended.

- Sectional Title Records: If buying in a complex, review the latest audited financial statements of the Body Corporate to ensure the scheme is solvent.

Common Misconceptions About the CPA and Property

Myth 1: The CPA applies to every property sale in South Africa. This is false. The CPA only applies when the seller is a "supplier" acting in their ordinary course of business. If you buy a pre-owned home from a family moving to another province, you are likely buying "voetstoots," and the CPA will not protect you from defects unless you can prove fraud.

Myth 2: You can't claim for defects if you signed an "as-is" clause in a developer contract. Under the CPA, a developer cannot force you to waive your rights to a quality product. Any clause in a developer's contract that attempts to exclude the CPA's implied warranty of quality is considered "unfair, unreasonable, or unjust" and is legally void.

Myth 3: The CPA protects you forever. The automatic "implied warranty" under Section 56 of the CPA lasts for six months. While the NHBRC provides a five-year warranty for major structural defects, your strongest CPA-based protections for smaller (but significant) defects expire half a year after delivery.

Costs and Timelines for Resolving Disputes

Navigating a property dispute in South Africa involves specific timelines and potential costs that vary based on the forum chosen.

| Step | Expected Timeline | Estimated Cost (ZAR) |

|---|---|---|

| Letter of Demand | 7-14 Days | R1,500 - R5,000 |

| NCC Investigation | 3-12 Months | Free (Administrative) |

| National Consumer Tribunal | 6-18 Months | Low Filing Fees |

| High Court Litigation | 2-4 Years | R100,000+ |

FAQ

Does the CPA cover "latent" defects?

Yes. Latent defects are those that are not visible upon a reasonable inspection (like a cracked foundation under the floor). The CPA mandates that the property must be free of such defects for at least six months, regardless of what the contract says.

Can I cancel the sale if I find a defect?

You can only cancel the sale (rescind the contract) if the defect is "material"-meaning it is so severe that you would not have bought the house had you known about it. For smaller defects, the remedy is usually a repair or a price reduction.

What if the developer goes bankrupt?

If the developer is insolvent, your CPA claim becomes a concurrent claim against the insolvent estate. However, if the home was registered with the NHBRC, the council may still cover the costs of repairing major structural defects.

Does the CPA apply to the estate agent?

Yes, but only regarding the service the agent provides. The agent must act honestly and cannot misrepresent the property. If an agent lies about a property feature, you may have a claim against them under the CPA, even if the seller is a private individual.

When to Hire a Lawyer

While the CPA provides administrative routes for redress, you should consult a South African property attorney if:

- The developer ignores your Letter of Demand or denies the existence of a defect.

- You are asked to sign a "waiver of rights" or a complex settlement agreement.

- The defect is structural and endangers the safety of the occupants.

- You are purchasing a high-value property (over R5 million) where the financial stakes of a defect are extreme.

Next Steps

- Document Everything: Take high-resolution photos and videos of the defects immediately upon discovery.

- Review Your Contract: Check if the seller is a developer and if the Department of Trade, Industry and Competition regulations apply to your specific transaction size.

- Contact the NHBRC: If the home is less than five years old, file a formal complaint with the NHBRC to trigger an inspection.

- Issue a Formal Notice: Draft a written notice to the seller citing Section 55 and 56 of the Consumer Protection Act, demanding a remedy within a specific timeframe (usually 14 days).