- South African courts generally require either a submission to jurisdiction or the attachment of assets to hear a case against a foreign entity.

- The Hague Service Convention streamlines the legal process by providing a standardized method for serving South African court papers on international defendants.

- International arbitration is often the most efficient route for debt recovery due to the International Arbitration Act of 2017 and the New York Convention.

- Creditors can attach a foreign debtor's South African assets-including bank accounts, shares, or trademarks-to secure a claim or satisfy a judgment.

- Costs for cross-border litigation typically start at ZAR 50,000 for basic matters but can exceed ZAR 500,000 for complex, contested international disputes.

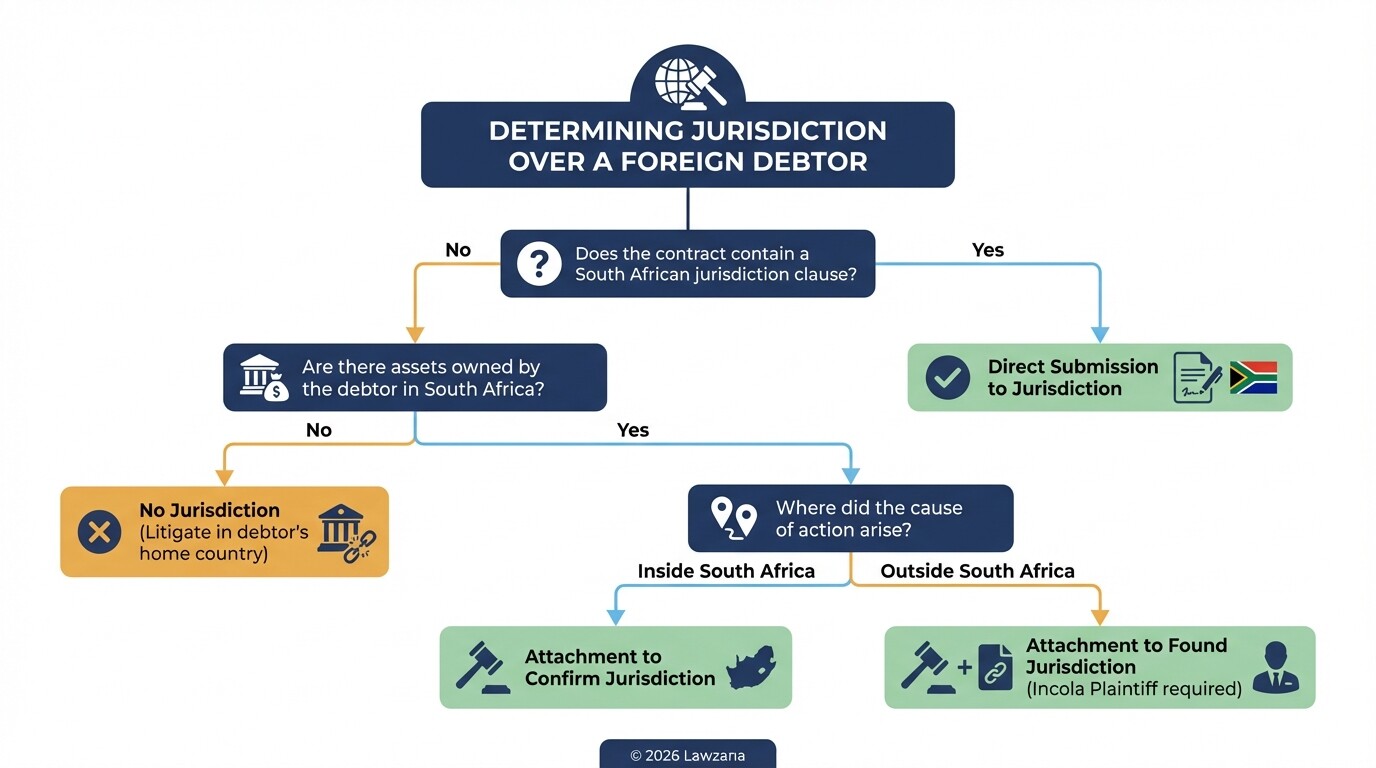

How does jurisdiction affect debt recovery against foreign entities?

Jurisdiction in South Africa is determined by the presence of a sufficient link between the court and the defendant or the cause of action. For a South African court to hear a case against a foreign entity (a "peregrinus"), the plaintiff must demonstrate that the court has the legal power to give a binding judgment, usually through the presence of assets within the country or a specific contractual agreement.

Under the Superior Courts Act, jurisdiction over foreign entities is established in one of three ways:

- Consent or Submission: The foreign entity explicitly agrees in a contract or during legal proceedings to submit to the jurisdiction of South African courts.

- Attachment to Found Jurisdiction: If the plaintiff is a South African resident (an "incola") and the cause of action arose outside the country, they may attach the defendant's property located in South Africa to establish the court's authority.

- Attachment to Confirm Jurisdiction: If the cause of action arose within South Africa, the plaintiff attaches the defendant's property to "confirm" the jurisdiction that already exists due to the location of the transaction or incident.

How can a South African business obtain a judgment against a foreign debtor?

To obtain a judgment against a foreign entity, a South African business must initiate a summons through the High Court and ensure the defendant is properly notified according to international standards. Once the court is satisfied that it has jurisdiction and that service was performed correctly, the case proceeds similarly to local litigation, potentially resulting in a default judgment if the foreigner fails to defend the claim.

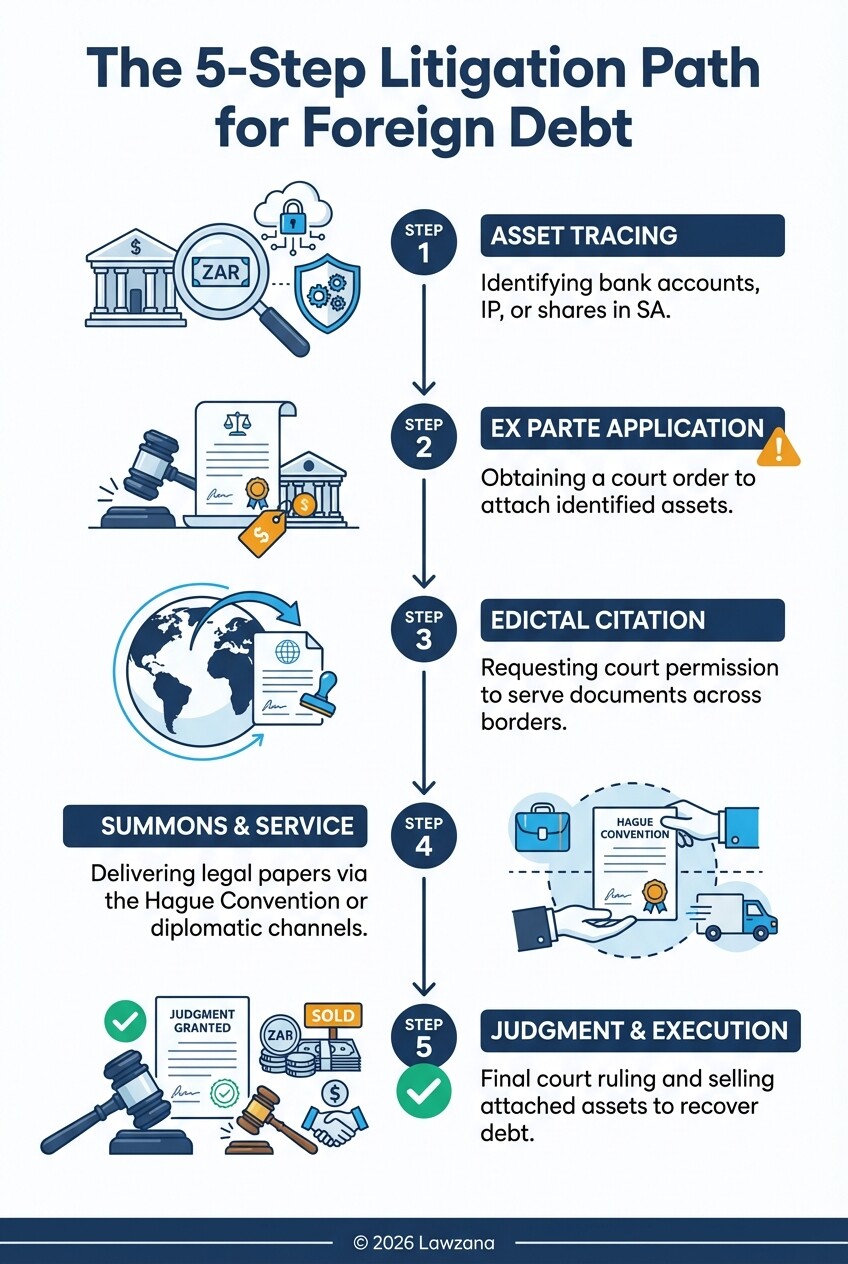

The process generally follows these steps:

- Verification of Assets: Identify any tangible or intangible assets held by the foreign debtor within South Africa (e.g., intellectual property, shares, or debt owed to them by another local company).

- Ex Parte Application: Apply to the High Court for an order to attach those assets to found or confirm jurisdiction.

- Issuing the Summons: Draft and issue a formal summons detailing the debt, interest, and legal costs claimed.

- Edictal Citation: If the defendant is abroad, the plaintiff must apply for "edictal citation," which is a court order granting permission to serve legal documents outside South African borders.

- Trial or Summary Judgment: If the debtor defends the matter, the case moves toward trial; if the defense is clearly a delay tactic, the plaintiff may apply for summary judgment to expedite the process.

What role does the Hague Convention play in cross-border debt recovery?

The Hague Convention on the Service Abroad of Judicial and Extrajudicial Documents provides a uniform framework for transmitting legal documents between signatory countries. South Africa's adherence to this convention ensures that service of process on a foreign entity is recognized as valid both locally and in the debtor's home country, reducing the risk of a judgment being overturned later due to procedural errors.

| Feature | Impact on Debt Recovery |

|---|---|

| Central Authority | Documents are sent to a designated government office in the debtor's country, ensuring official delivery. |

| Standardized Forms | Uses "Model Forms" that are universally recognized, preventing delays caused by foreign bureaucratic rejection. |

| Legal Certainty | Provides a certificate of service that serves as definitive proof in a South African court that the debtor was notified. |

| Translation Requirements | Usually requires documents to be translated into the official language of the recipient country, which adds to the initial cost. |

Can international arbitration speed up the debt settlement process?

International arbitration is often the fastest and most effective way to recover debt because South Africa's International Arbitration Act of 2017 incorporates the UNCITRAL Model Law. This legal framework limits the ability of local courts to interfere in private disputes and ensures that arbitration awards are easily enforceable across borders under the New York Convention.

Benefits of utilizing arbitration for foreign debt include:

- Enforceability: Under the New York Convention, an arbitration award issued in South Africa is enforceable in over 160 countries, often more easily than a standard court judgment.

- Confidentiality: Unlike High Court proceedings, which are public, arbitration is private, which can protect the commercial reputation of both parties.

- Expertise: Parties can select an arbitrator with specific expertise in international trade or the relevant industry, leading to more accurate decisions.

- Speed: Arbitration timelines are generally shorter than the High Court roll, which can be backlogged for 12 to 24 months.

What are the risks and costs of the "attach and execute" procedure?

The "attach and execute" procedure involves seizing a debtor's assets to pay off a judgment debt, but it carries significant financial and legal risks. While it is a powerful tool for forcing payment, the plaintiff must often provide security for costs and may be liable for damages if the attachment is later found to be wrongful.

| Risk Category | Description |

|---|---|

| Lapse of Value | The attached assets (like machinery or vehicles) may depreciate during long-drawn-out litigation. |

| Storage Costs | The plaintiff may be responsible for the costs of the Sheriff storing and insuring the seized goods. |

| Prior Claims | Other creditors or banks may have "preferential" claims or liens over the same assets, leaving nothing for the plaintiff. |

| Legal Challenges | Foreign entities often challenge the valuation of the attached assets, leading to secondary legal battles. |

Typical costs for these procedures in South Africa:

- Sheriff's Fees: ZAR 5,000 - ZAR 20,000 depending on the location and nature of assets.

- Security for Costs: A court may require the plaintiff to pay a bond (often 10-20% of the claim value) into a trust account as security if they are also a foreign entity or if the case is high-risk.

Common Misconceptions About Foreign Debt Recovery

Myth 1: You cannot sue a foreign company if they don't have an office in South Africa. In reality, you can sue a foreign company if the contract was signed in South Africa, if the work was performed here, or if you can find and attach any of their assets (including digital assets or trademarks) within South African borders to establish jurisdiction.

Myth 2: Foreign judgments are automatically enforceable in South Africa. This is incorrect. A foreign judgment must first be "recognized" or "registered" by a South African High Court through a process called a "provisional sentence summons" or under the Enforcement of Foreign Civil Judgments Act before it can be enforced by a local Sheriff.

Myth 3: Recovery is impossible if the debtor has no physical goods in the country. Debt recovery often succeeds through the attachment of incorporeal property. This includes the debtor's right to receive payment from other South African clients, their shares in local subsidiaries, or their registered South African patents and trademarks.

FAQ

How long does it take to recover debt from a foreign entity in South Africa?

Simple matters where the debtor does not defend can take 6 to 9 months. If the matter is defended and goes to trial in the High Court, it can take 2 to 3 years. Arbitration typically concludes within 12 months.

Can I recover legal fees from a foreign debtor?

Yes, South African courts typically award "party and party" costs to the successful side. However, this usually only covers 50% to 70% of your actual legal spend. You can only recover 100% of your costs if your contract specifically provides for "attorney and own client" costs.

What happens if the foreign debtor has no assets in South Africa?

If there are no assets in South Africa and no submission to jurisdiction, you may have to litigate in the debtor's home country. Alternatively, you can obtain a South African arbitration award and seek to enforce it in the foreign jurisdiction where the debtor's assets are located.

Is there a minimum debt amount for international litigation?

There is no legal minimum, but due to the high costs of edictal citation and international service, it is rarely commercially viable to pursue foreign debts under ZAR 150,000 unless the debtor has easily accessible local assets.

When to Hire a Lawyer

You should consult a commercial litigation expert if your outstanding foreign invoice exceeds ZAR 200,000 or if the debtor is raising complex jurisdictional defenses. Legal intervention is critical when:

- You need to apply for an urgent attachment of assets to prevent them from being moved out of South Africa.

- The contract involves complex Private International Law (Conflict of Laws) issues.

- You need to serve papers in a country that is not a member of the Hague Convention.

- You are facing a "special plea" challenging the South African court's authority to hear the case.

Next Steps

- Audit Your Contracts: Review your Terms and Conditions to see if you have a "Consent to Jurisdiction" clause or an "Arbitration Clause."

- Asset Tracing: Work with a legal team to identify any South African-based assets owned by the foreign debtor.

- Issue a Letter of Demand: Have a South African attorney draft a formal demand that complies with local practice and international treaties.

- Apply for Edictal Citation: If the debtor remains non-compliant, move to the High Court to begin the formal process of overseas service.

For more information on court rules, visit the Department of Justice and Constitutional Development. For details on international treaties, refer to the Hague Conference on Private International Law.