- Business rescue is a formal rehabilitation process designed to save "financially distressed" companies from liquidation.

- A general moratorium is triggered immediately, providing legal protection against creditor claims and asset seizures.

- The Business Rescue Practitioner (BRP) takes full management control of the company, effectively displacing the board's autonomous authority.

- Directors face personal liability for "reckless trading" if they continue operations while insolvent without initiating a recovery plan.

- Creditors hold the ultimate power to approve or reject the business rescue plan through a structured voting process.

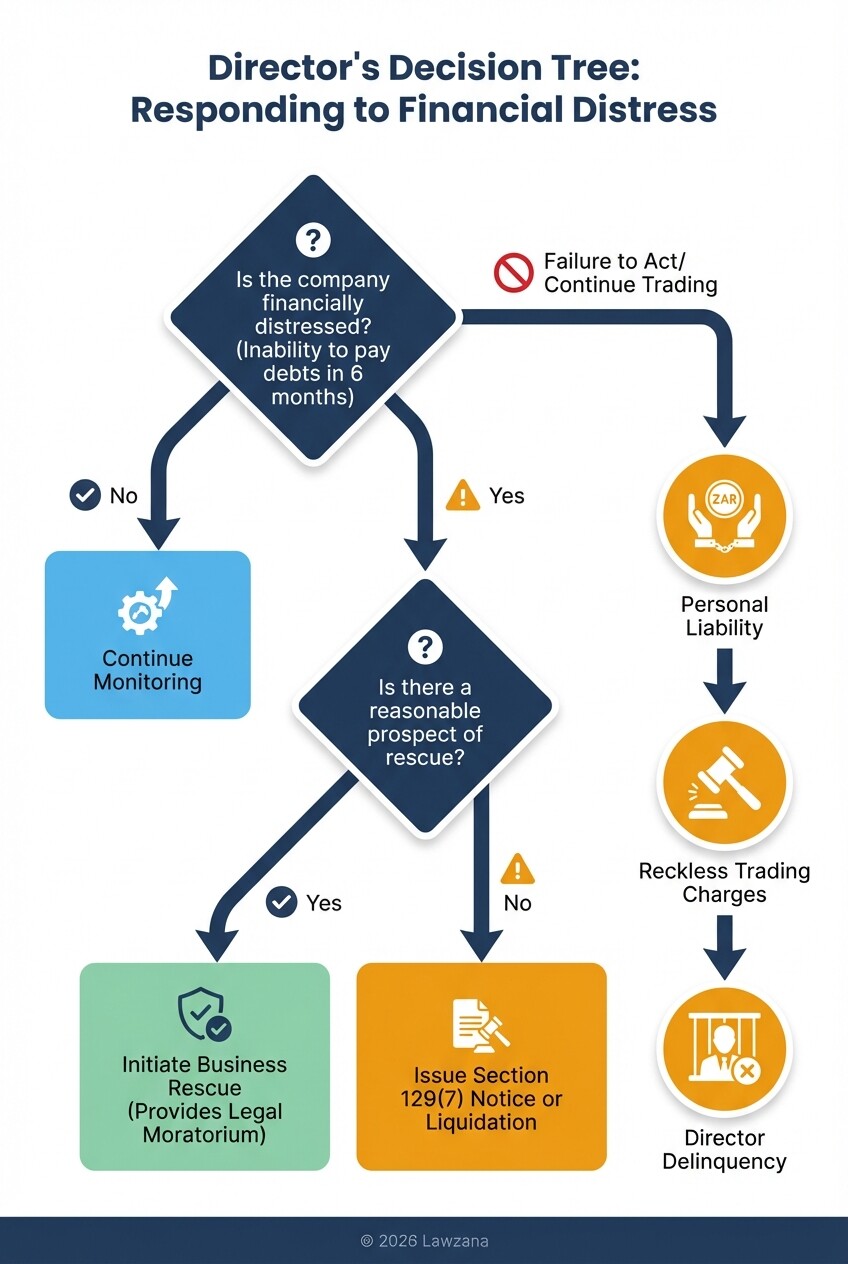

What are the criteria for initiating business rescue versus liquidation?

Business rescue is available to companies that are "financially distressed" but still possess a reasonable prospect of being saved. Liquidation is the final legal process for companies that are commercially or factually insolvent with no viable future, resulting in the winding up of the business and the distribution of assets to creditors.

According to Chapter 6 of the Companies Act 71 of 2008, a company is considered financially distressed if it appears unlikely that the company will be able to pay all of its debts as they become due within the next six months, or if it appears likely that the company will become insolvent within the next six months.

| Feature | Business Rescue | Liquidation |

|---|---|---|

| Objective | Rehabilitation and continued existence | Winding up and asset distribution |

| Trigger | Financial distress with a prospect of recovery | Insolvency with no hope of recovery |

| Control | Business Rescue Practitioner (BRP) | Liquidator |

| Outcome | Improved return for creditors or survival | Company ceases to exist |

| Legal Basis | Chapter 6, Companies Act 2008 | Companies Act 1973/2008 & Insolvency Act |

How does legal protection from creditors work during business rescue?

The legal protection provided during business rescue is known as a "moratorium," which acts as a stay on all legal proceedings against the company. This prevents creditors from instituting new lawsuits, executing judgments, or seizing company assets while the rescue plan is being formulated.

Under Section 133 of the Companies Act, this moratorium is absolute unless the Business Rescue Practitioner provides written consent or a court grants leave for proceedings to continue. This "breathing room" is essential because it allows the company to maintain its operations and preserve its value without the immediate threat of asset stripping by aggressive creditors.

- Automatic Stay: The moratorium begins the moment the company files for business rescue with the Companies and Intellectual Property Commission (CIPC).

- Contractual Obligations: The BRP has the authority to entirely, partially, or conditionally suspend any obligation of the company that arises under an agreement to which the company was a party at the start of the proceedings.

- Property Protection: No person can exercise any right over property in the possession of the company, regardless of whether the company owns that property, without the BRP's approval.

What are the roles and powers of the Business Rescue Practitioner (BRP)?

The Business Rescue Practitioner is an independent professional, registered with the CIPC, who assumes full management control of the company. Their primary role is to investigate the company's affairs, draft a business rescue plan, and oversee its implementation if approved.

Once appointed, the BRP has the responsibilities and liabilities of a director but operates with a higher level of authority. They must remain objective and act in the best interests of all stakeholders, including creditors, employees, and shareholders.

- Management Control: The BRP may delegate certain functions back to the original directors, but they hold the final say on all operational and financial decisions.

- Investigation: The BRP must determine if there is a reasonable prospect of the company being rescued. If they conclude there is no prospect, they are legally obligated to apply to the court for liquidation.

- Plan Development: The BRP is responsible for chairing meetings with creditors and employees to present a viable restructuring strategy.

- Professional Fees: BRP fees are regulated by the Companies Act based on the size of the company (Small, Medium, or Large) and usually involve a basic hourly rate plus a success fee.

What are the potential liabilities for directors during financial distress?

Directors face significant personal liability if they fail to act decisively when a company enters financial distress. Under South African law, specifically Section 22 and Section 77 of the Companies Act, directors can be held personally responsible for the company's debts if they are found to have engaged in reckless trading or fraudulent activities.

If a board of directors has reasonable grounds to believe the company is financially distressed but chooses not to enter business rescue, they must deliver a formal notice to all affected persons (shareholders, creditors, and employees) explaining why they have chosen not to do so. Failure to take action can lead to:

- Personal Liability: Directors may be sued by creditors or the company itself for losses incurred while trading under insolvent conditions.

- Delinquency Status: A court may declare a director "delinquent," which prohibits them from serving as a director of any company for at least seven years.

- Criminal Charges: If a director knowingly carries on business with the intent to defraud creditors, they may face criminal prosecution.

How is a business rescue plan developed and voted on?

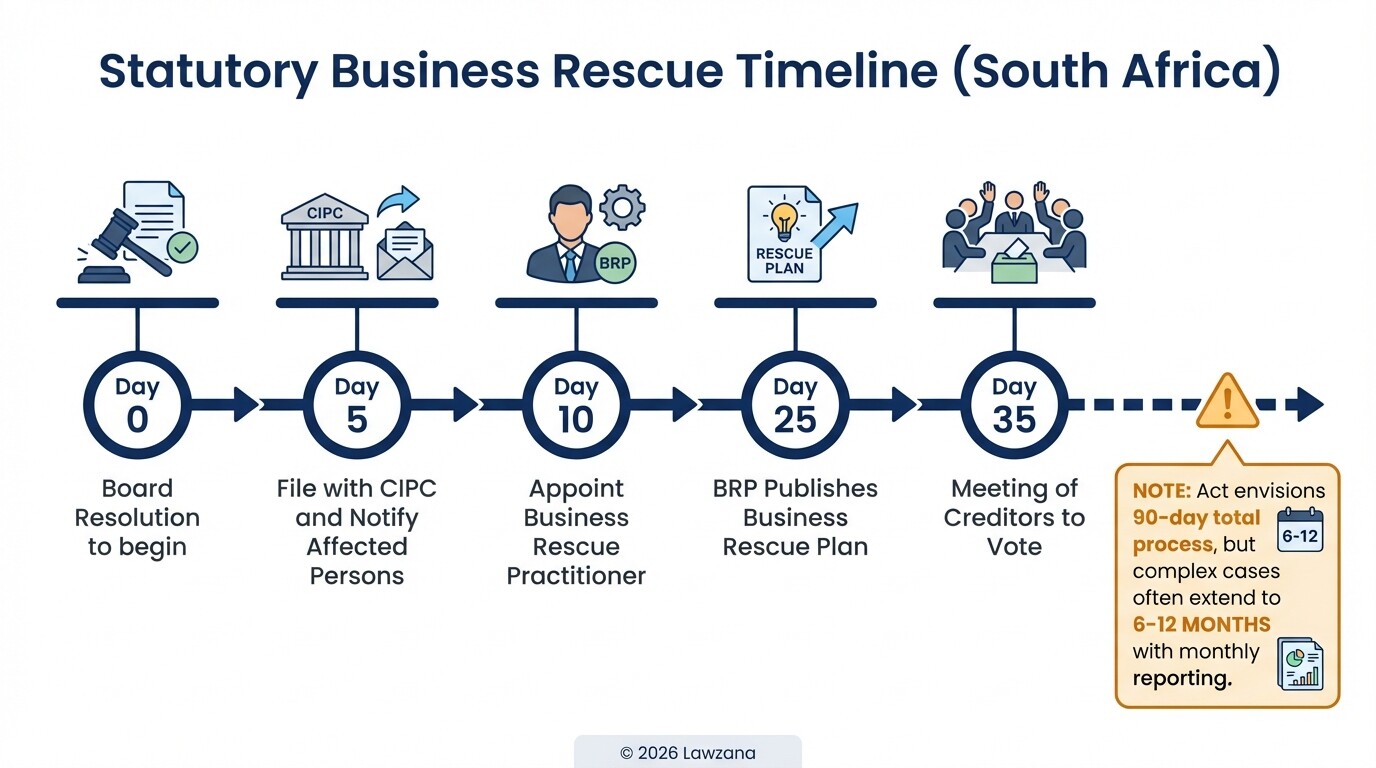

The business rescue plan is a detailed document that outlines how the company intends to restructure its affairs, pay its debts, and return to profitability. The BRP must publish this plan within 25 business days of their appointment, though this timeline can be extended with creditor approval.

Once the plan is published, the BRP convenes a meeting of creditors and other holders of voting interests to consider the proposal. For the plan to be adopted, it must satisfy a two-tier voting threshold:

- Majority Support: It must be supported by the holders of more than 75% of the creditors' voting interests that were voted.

- Independent Support: At least 50% of the votes cast in favor of the plan must be from "independent" creditors (those who are not related to the company or its directors).

If the plan is rejected, the BRP may seek a vote to revise the plan, or any affected person may offer to purchase the voting interests of the dissenting creditors at a fair market value. If no plan is adopted, the business rescue proceedings usually terminate, often leading directly to liquidation.

Common Misconceptions

- "Business rescue is a way to avoid paying debts entirely." This is incorrect. Business rescue is a restructuring tool meant to maximize the return for creditors compared to what they would receive in liquidation. Debts are often restructured or delayed, but the process is not a "get out of jail free" card.

- "The directors stay in charge of the company." Many directors are surprised to find that the BRP takes full management control. While the BRP often works with the board, the directors' powers are severely restricted and subject to the BRP's oversight.

- "Only large corporations can use business rescue." Small and medium enterprises (SMEs) are equally eligible. In fact, many SMEs find business rescue more effective because their structures are simpler and easier to reorganize quickly.

FAQ

How much does it cost to enter business rescue in South Africa?

The cost varies based on the company's size. Basic filing fees are minimal, but the primary cost is the BRP's hourly rate, which is capped by regulation (e.g., approximately R1,250 to R2,000 per hour depending on the company size category). Large companies may also negotiate a success fee.

How long does the business rescue process take?

The Companies Act envisions a fast-track process of three months. However, in practice, complex restructurings often take six to 12 months, requiring regular progress reports to the CIPC and stakeholders every month after the initial 90-day period.

Can employees be dismissed during business rescue?

Section 136 of the Act protects employees, stating that their terms and conditions of employment remain unchanged unless otherwise agreed upon or if retrenchments are carried out in strict accordance with the Labour Relations Act.

What happens to existing contracts?

The BRP has the power to suspend any contractual obligation for the duration of the rescue proceedings. However, they cannot suspend employment contracts or contracts specifically excluded by the Act, such as certain financial market agreements.

When to Hire a Lawyer

Directors should consult a legal expert specializing in South African insolvency law the moment they suspect "financial distress" (the six-month window). Legal counsel is critical for:

- Drafting the initial board resolution to begin rescue.

- Navigating the complex "reckless trading" provisions to protect personal assets.

- Engaging with a Business Rescue Practitioner to ensure the board's interests are represented.

- Contesting or defending creditor claims during the moratorium.

- Evaluating the legal feasibility of the proposed business rescue plan.

Next Steps

- Conduct a Financial Audit: Determine if your company meets the "financial distress" criteria (inability to pay debts in the next 6 months).

- Pass a Board Resolution: If the criteria are met and there is a prospect of recovery, the board must formally resolve to begin business rescue.

- File with CIPC: Submit the resolution and supporting documents to the CIPC within five business days of the board's decision.

- Appoint a BRP: Select a qualified Business Rescue Practitioner and notify all affected persons (employees, creditors, and shareholders) within the statutory timelines.

- Collaborate on the Plan: Work closely with the BRP to provide the data and operational insight needed to draft a successful restructuring plan.