- B-BBEE is a commercial imperative for international firms seeking to participate in the South African economy, particularly for government tenders and large-scale private supply chains.

- Multinationals can bypass the requirement to sell equity to local partners by utilizing Equity Equivalence Investment Programs (EEIP) approved by the government.

- Fronting, or misrepresenting B-BBEE status, is a criminal offense in South Africa that carries significant fines and potential jail time for corporate directors.

- Compliance is measured through an annual verification process conducted by accredited rating agencies, resulting in a Level 1 (highest) to Level 8 (lowest) certificate.

- Integrating B-BBEE into corporate governance is essential for risk management and maintaining a "license to operate" within the South African market.

What is B-BBEE and why is it mandatory for international firms?

Broad-Based Black Economic Empowerment (B-BBEE) is a legislative framework designed to address the economic exclusions of the apartheid era by encouraging the participation of Black South Africans in the economy. While B-BBEE is not a "law" that forces a company to change its structure to exist, it is a regulatory requirement for any business wishing to do business with the South African government or receive licenses in regulated sectors like mining, telecommunications, or banking.

For international firms, the pressure often comes from the private sector. Large South African corporations earn "procurement points" by buying from B-BBEE-compliant suppliers. If your firm is not compliant, you become an expensive choice for local partners because you negatively impact their own B-BBEE scores. Consequently, compliance is a strategic necessity for market access and competitiveness.

How does the B-BBEE Scorecard measure compliance?

The B-BBEE Scorecard measures a company's contribution to economic transformation across five specific elements, each with its own weighting and targets. A firm's total score across these elements determines its B-BBEE Status Level, which ranges from Level 1 (over 100 points) to Level 8 (40 to 54 points).

The five elements under the Generic Codes of Good Practice are:

- Ownership (25 points): Measures the percentage of the entity owned by Black people. This is often the most challenging element for foreign multinationals.

- Management Control (19 points): Evaluates the representation of Black people on the board of directors and in executive management positions.

- Skills Development (20 points + 5 bonus): Measures investment in the training and development of Black employees and unemployed individuals.

- Enterprise and Supplier Development (42 points + 4 bonus): Focuses on procurement from B-BBEE-compliant suppliers and providing financial or operational support to Black-owned small businesses.

- Socio-Economic Development (5 points): Measures corporate social responsibility initiatives that facilitate sustainable economic access for Black communities.

| Element | Weighting (Points) | Focus Area |

|---|---|---|

| Ownership | 25 | Direct and indirect shareholding |

| Management Control | 19 | Board representation and senior management |

| Skills Development | 20 | Training spend and apprenticeships |

| Enterprise & Supplier Development | 42 | Procurement and SME support |

| Socio-Economic Development | 5 | Community investment and grants |

How can multinationals meet ownership requirements without selling shares?

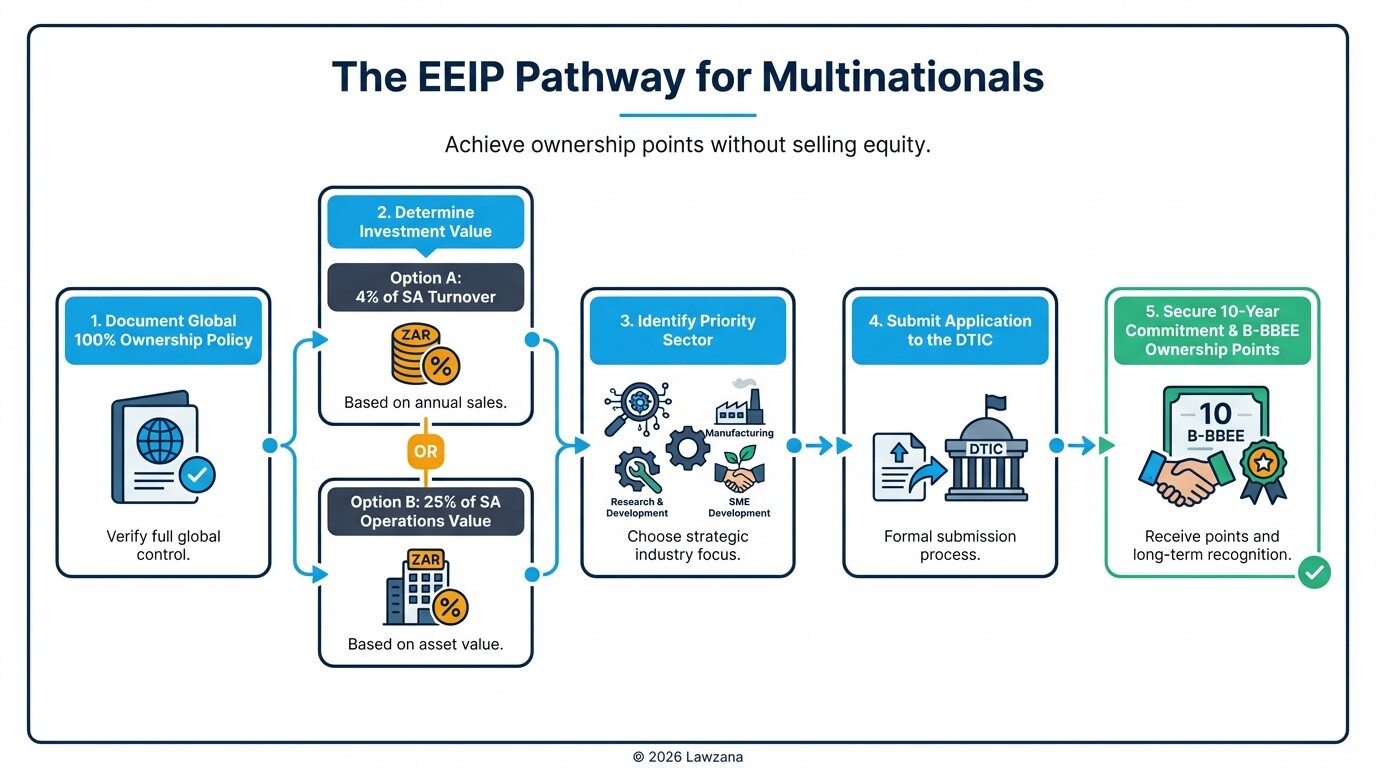

International firms with global policies that prohibit the dilution of equity in local subsidiaries can apply for the Equity Equivalence Investment Program (EEIP). Administered by the Department of Trade, Industry and Competition (DTIC), this program allows a multinational to earn ownership points by investing in "equivalent" initiatives instead of transferring actual shares to Black partners.

To qualify for an EEIP, the firm must demonstrate that it has a global policy of owning 100% of its subsidiaries worldwide. If approved, the firm commits to a long-term investment (usually over 10 years) in South African priority sectors, such as manufacturing, research and development, or critical infrastructure. The value of this investment must be equal to 25% of the value of the South African operations or 4% of the firm's annual turnover in the country. This allows the firm to maintain its global corporate structure while achieving a high B-BBEE rating.

What are the legal risks of B-BBEE fronting?

Fronting is a fraudulent practice where a company creates a false appearance of B-BBEE compliance to secure contracts or licenses while the underlying economic benefits and decision-making power remain unchanged. Examples include appointing "token" Black directors who have no actual authority or using complex trust structures that prevent Black beneficiaries from ever receiving dividends.

The B-BBEE Act, as amended, established the B-BBEE Commission to investigate these practices. Fronting is a criminal offense in South Africa. If found guilty, a company can face a fine of up to 10% of its annual turnover. Furthermore, individual directors and shareholders involved in the scheme can be sentenced to up to 10 years in prison. Beyond the legal penalties, a company found guilty of fronting will be "blacklisted" from doing business with the government for 10 years, causing irreparable brand damage.

How does B-BBEE status impact commercial litigation and contract awards?

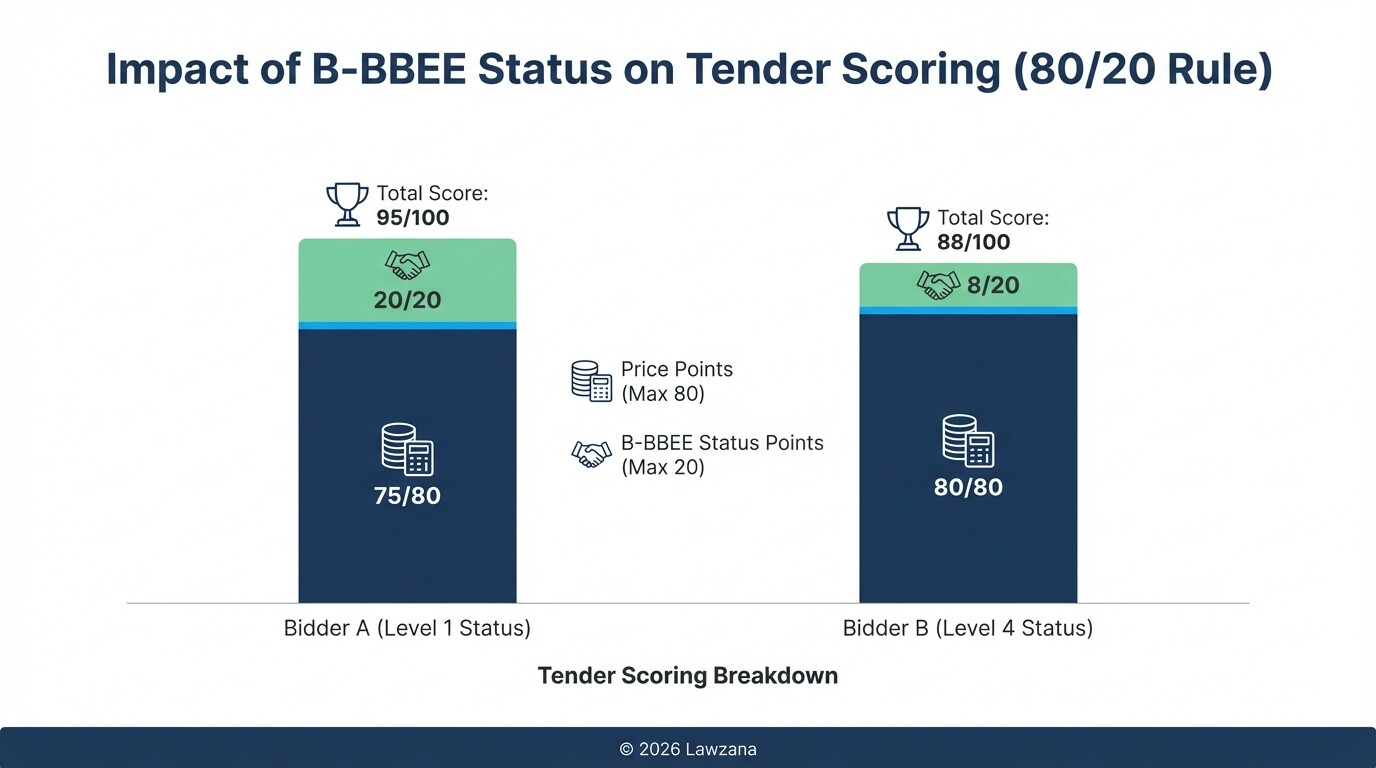

In the South African legal landscape, B-BBEE status is a decisive factor in the awarding of state tenders under the Preferential Procurement Policy Framework Act (PPPFA). Government entities use a "point system" (usually 80/20 or 90/10) where 80 or 90 points are awarded for price, and the remaining 10 or 20 points are awarded based on the bidder's B-BBEE level. In highly competitive bids, a superior B-BBEE level often offsets a higher price.

In the context of commercial litigation, B-BBEE compliance has become a frequent point of contention in administrative law. Unsuccessful bidders often challenge the awarding of a contract by alleging that the winning party's B-BBEE certificate is invalid or that their compliance constitutes fronting. Consequently, ensuring your B-BBEE verification is robust and defensible is a critical component of risk management for any firm operating in the public or regulated private sectors.

How can firms integrate B-BBEE into corporate governance frameworks?

Effective B-BBEE compliance should not be treated as a year-end "accounting exercise" but as a core component of corporate governance and ESG (Environmental, Social, and Governance) reporting. For international firms, this means embedding B-BBEE targets into the performance KPIs of local executives and ensuring the Board of Directors has oversight of transformation initiatives.

To integrate B-BBEE into your governance framework, consider the following steps:

- Establish a Social and Ethics Committee: Under the Companies Act, most large firms are required to have this committee, which should oversee B-BBEE strategy and compliance.

- Conduct Quarterly Audits: Do not wait for the annual verification. Review your procurement spend and skills development progress every three months to ensure you are on track for your target level.

- Verify Your Suppliers: Implement a rigorous vetting process for your own vendors to ensure their B-BBEE certificates are valid and updated, as your score depends heavily on their compliance.

- Link B-BBEE to Business Strategy: Align your "Enterprise and Supplier Development" spend with your actual supply chain needs to ensure your compliance investment also improves your operational efficiency.

Common Misconceptions About B-BBEE

Myth 1: B-BBEE is a form of tax. B-BBEE is not a tax paid to the government. It is a set of commercial incentives. The money spent on B-BBEE initiatives, such as training employees or supporting small businesses, remains within the company's ecosystem or its supply chain.

Myth 2: You must give away 25% of your company for free. Ownership points can be achieved through various models, including selling shares at market value to Black investors, employee share ownership schemes (ESOPs), or the Equity Equivalence program mentioned above for multinationals.

Myth 3: B-BBEE only applies to government contracts. While mandatory for the public sector, B-BBEE is a commercial reality in the private sector. Most "JSE-listed" companies (Johannesburg Stock Exchange) will refuse to sign major supply contracts with firms that do not have a valid B-BBEE certificate, as it dilutes their own compliance score.

Frequently Asked Questions

What is the cost of a B-BBEE verification?

The cost depends on the size of the company. A Small Enterprise (EME) often only needs an affidavit, which costs very little. Larger firms (Generic entities) must hire a SANAS-accredited verification agency, with fees typically ranging from ZAR 30,000 to ZAR 150,000 depending on the complexity of the audit.

How long does a B-BBEE certificate remain valid?

A B-BBEE certificate is valid for exactly 12 months from the date of issue. Companies must undergo a fresh audit every year based on their most recent financial year-end data.

Do small foreign startups need to comply?

Companies with an annual turnover of less than ZAR 10 million are classified as Exempted Micro Enterprises (EMEs). These entities automatically qualify as a "Level 4" contributor (or Level 1 if they are 100% Black-owned) simply by providing a sworn affidavit, making the entry barrier for small foreign startups very low.

When to Hire a Lawyer

Navigating the complexities of B-BBEE requires legal expertise when your firm is:

- Structuring a multi-million Rand equity transaction or Employee Share Ownership Plan (ESOP).

- Applying for an Equity Equivalence Investment Program (EEIP) with the DTIC.

- Responding to a "Section 13" investigation or summons from the B-BBEE Commission regarding fronting allegations.

- Drafting complex commercial contracts where B-BBEE targets are a condition of the deal.

- Challenging or defending a tender award in the High Court based on B-BBEE irregularities.

Next Steps

- Determine your category: Calculate your annual turnover to see if you are an EME (under ZAR 10m), QSE (ZAR 10m to 50m), or Generic Entity (over ZAR 50m).

- Perform a Gap Analysis: Hire a consultant or legal advisor to perform a mock audit and identify where your current structure falls short of your desired B-BBEE level.

- Review Global Ownership Policies: If you cannot sell equity, begin the preliminary application for an Equity Equivalence program immediately, as approval can take 12 to 18 months.

- Appoint a Verification Agency: Select a SANAS-accredited agency early in the year to ensure your data collection aligns with their audit requirements.