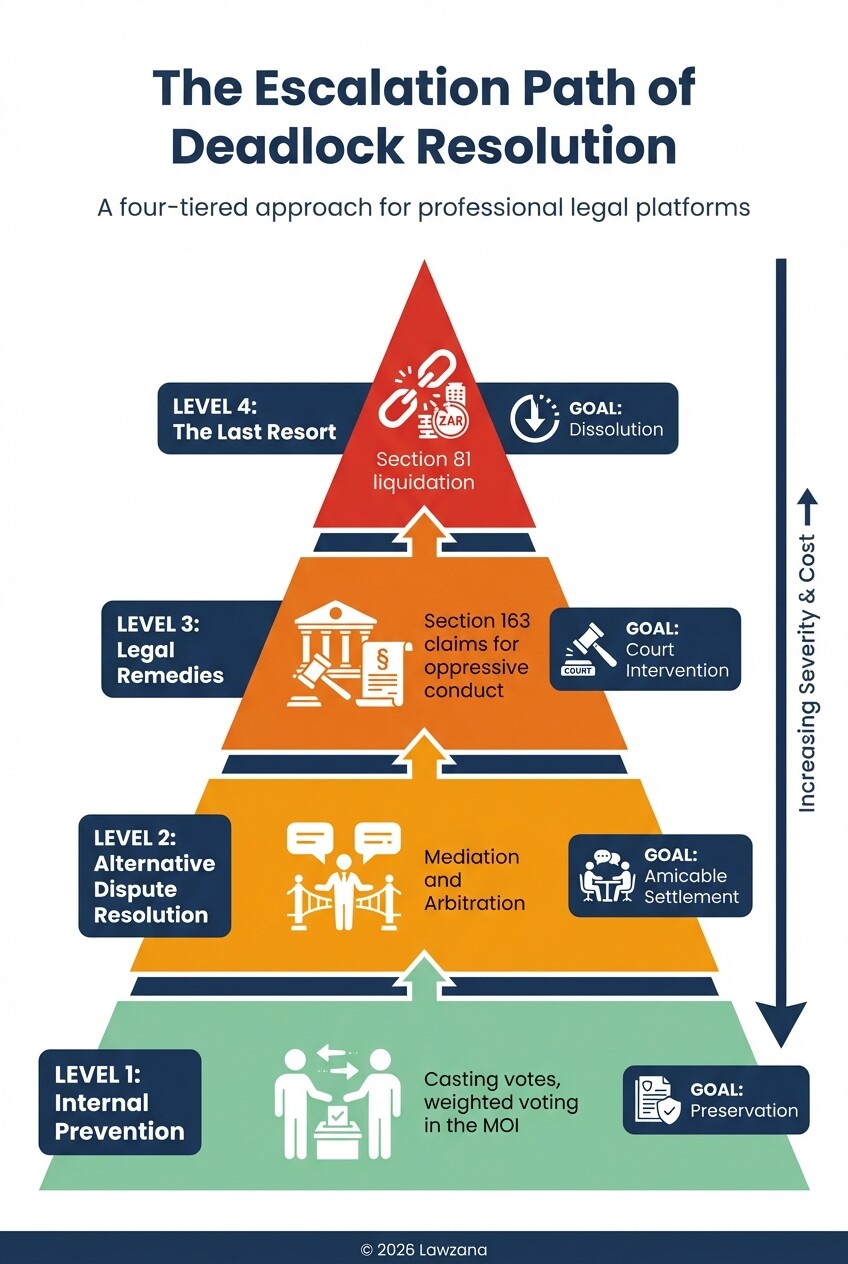

- Shareholders in South African private companies can proactively prevent deadlocks by including customized tie-breaker provisions in their Memorandum of Incorporation (MOI).

- The "Shotgun Clause" is a high-stakes exit mechanism that forces one party to buy out the other at a set price, ensuring a clean break when management is paralyzed.

- Section 163 of the Companies Act provides a powerful remedy for shareholders to claim relief from "oppressive or unfairly prejudicial" conduct.

- Courts view the liquidation of a solvent company as a last resort, typically only granted when the "just and equitable" standard is met due to a total breakdown in trust.

- Mediation and arbitration are often more cost-effective and private than litigation, preserving the company's reputation during internal disputes.

How can the Memorandum of Incorporation prevent shareholder deadlocks?

The Memorandum of Incorporation (MOI) serves as the primary governing document for South African companies and can include specific "tie-breaker" rules to resolve voting stalemates. By anticipating potential areas of disagreement during the incorporation phase, shareholders can avoid the high costs of litigation or the forced closure of a profitable business.

Effective MOI provisions to prevent deadlocks include:

- Casting Votes: Granting the Chairperson of the board or a specific lead shareholder a second "casting" vote in the event of a tie.

- Weighted Voting: Assigning different voting weights to specific classes of shares for certain categories of decisions, such as financial approvals or director appointments.

- Rotating Veto Power: Giving different shareholders the final say on specific operational areas on a rotating annual basis.

- Referral to an Expert: Including a clause that requires a neutral third party (like an independent auditor or industry specialist) to make a binding decision on technical or financial disputes.

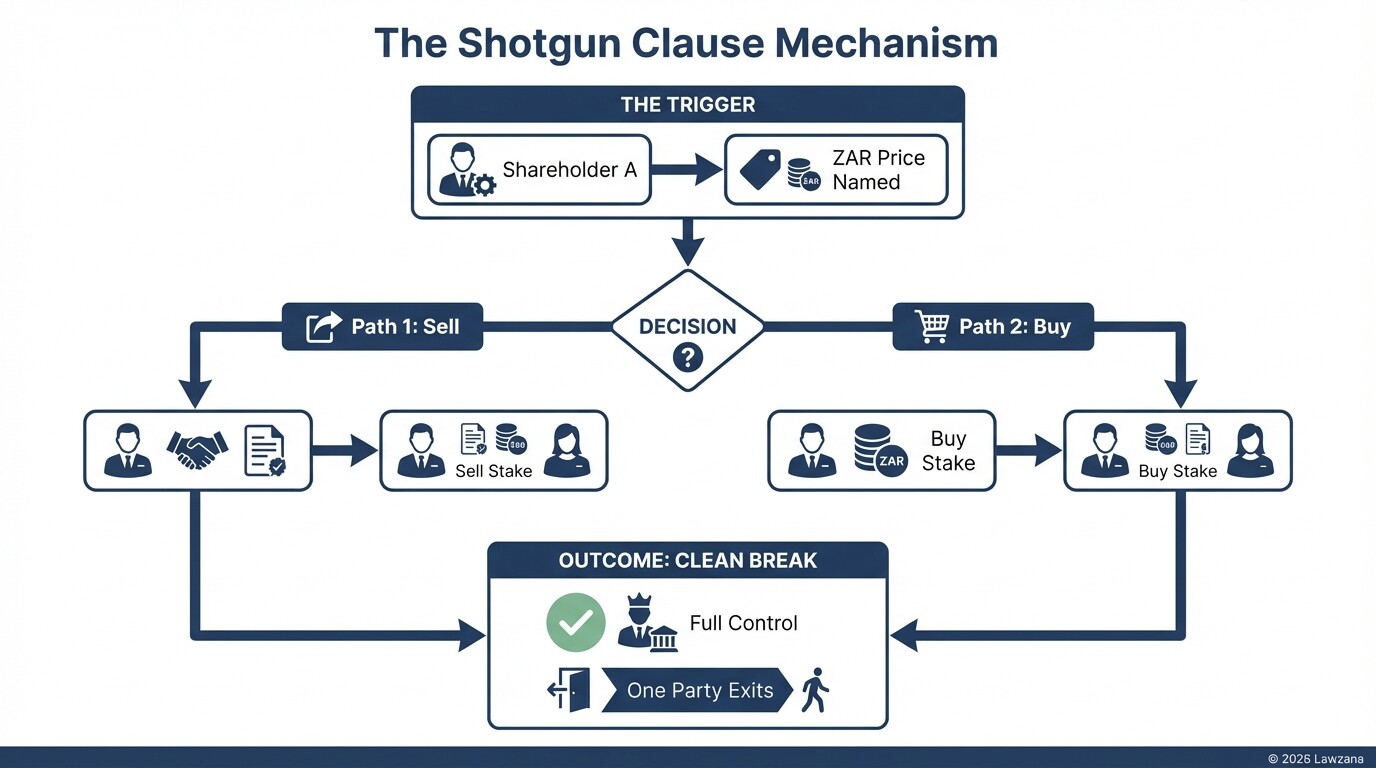

What is a Shotgun Clause in a South African shareholders agreement?

A shotgun clause is a mandatory buy-sell arrangement designed to force a quick resolution to a deadlock by requiring one shareholder to exit the company. This mechanism is often included in a private Shareholders Agreement rather than the public MOI to keep the specific exit terms confidential between the parties.

The process typically follows these steps:

- The Trigger: Shareholder A (the Offeror) serves a notice on Shareholder B (the Offeree) stating they wish to invoke the shotgun clause.

- The Price: Shareholder A names a specific price per share for the entire stake.

- The Choice: Shareholder B has a set period (usually 30 to 60 days) to either sell their shares to Shareholder A at that price or buy Shareholder A's shares at that same price.

- The Outcome: The deadlock is broken because one party is completely bought out, leaving the other with full control of the entity.

This clause is considered a "nuclear option" because the party initiating it must be prepared to either buy the business or lose their own stake at the price they proposed.

How do mediation and arbitration serve as alternatives to court?

Mediation and arbitration provide a private and streamlined path to resolving shareholder disputes without the public exposure and long delays of the South African High Court. Section 166 of the Companies Act 71 of 2008 explicitly allows for "Alternative Dispute Resolution" (ADR) through the Companies Tribunal or accredited mediators.

| Feature | Mediation | Arbitration | High Court Litigation |

|---|---|---|---|

| Control | Parties decide the outcome | Arbitrator decides | Judge decides |

| Privacy | Completely private | Private | Public record |

| Speed | 1 to 4 weeks | 3 to 9 months | 1 to 3 years |

| Cost | Low (ZAR 15,000+) | Moderate (ZAR 50,000+) | High (ZAR 200,000+) |

| Binding? | Only if a settlement is signed | Yes (legally binding) | Yes (subject to appeal) |

For South African businesses, arbitration is often the preferred route for high-value B2B disputes because the parties can select an arbitrator with specific expertise in South African corporate law, ensuring a more nuanced decision than a generalist judge might provide.

What legal remedies exist for oppressive or prejudicial conduct?

South African law protects minority shareholders from "oppressive" or "unfairly prejudicial" conduct through Section 163 of the Companies Act. This remedy is available when a company's actions, or the actions of a related person, result in an outcome that is unfairly harmful to the interests of a shareholder.

To seek relief under Section 163, a shareholder must demonstrate that the conduct is more than just a disagreement; it must be inequitable or unfair. The court has a broad range of powers to fix the situation, including:

- Restraining the company from specific actions (interdicts).

- Appointing a director to the board to represent the aggrieved party.

- Ordering the company or other shareholders to buy the aggrieved party's shares at a fair market value.

- Amending the company's MOI or shareholders agreement.

- Varying or setting aside a contract to which the company is a party.

Additionally, Section 165 allows for "derivative actions," where a shareholder can force the company to take legal action against a director who has breached their fiduciary duties, ensuring that the company's interests are protected even when management refuses to act.

When can the court order the liquidation of a solvent company?

A court may order the winding up (liquidation) of a solvent company under Section 81 of the Companies Act if it is deemed "just and equitable" to do so. This typically occurs when a deadlock is so severe that the company can no longer function, or when the underlying "trust and confidence" between shareholders in a small, quasi-partnership company has completely evaporated.

Common scenarios where a South African court might grant a "just and equitable" winding up include:

- Functional Deadlock: The directors are evenly split and cannot pass resolutions, leading to an inability to manage the business.

- Loss of Substratum: The company's original purpose or main business objective has become impossible to achieve.

- Breakdown of Relationship: In small private companies where shareholders are also managers, a total breakdown in personal relations may justify closing the entity to allow parties to take their capital elsewhere.

Liquidation is a drastic measure. South African courts prefer to explore other remedies, such as ordering one party to buy the other out, before choosing to dissolve a profitable and solvent business.

Practical Checklist for Resolving a Deadlock

If you find yourself in a shareholder stalemate, follow these steps to protect your interests and the company's value:

- Review the MOI and Shareholders Agreement: Identify if any tie-breaker, mediation, or shotgun clauses already exist.

- Document the Deadlock: Keep a paper trail of failed board meetings, rejected proposals, and the specific issues causing the impasse.

- Formal Notice of Dispute: Issue a formal notice as per your agreement to trigger any required cooling-off or negotiation periods.

- Engage a Professional Mediator: Attempt a structured negotiation before moving to more aggressive legal tactics.

- Obtain an Independent Valuation: Before buying or selling shares, hire a chartered accountant to determine the fair market value of the company.

- Consult a Corporate Attorney: If mediation fails, evaluate whether a Section 163 application for oppressive conduct or a Section 81 winding-up application is the best strategic move.

Common Misconceptions

"The majority shareholder always wins a deadlock."

While majority shareholders have significant power, they cannot use that power to act in a way that is "oppressive" or "unfairly prejudicial." Minority shareholders have robust protections under Section 163 of the Companies Act and can successfully challenge decisions that unfairly harm their investment.

"If we are deadlocked, the company must be liquidated."

Liquidation is the last resort. Courts and the Companies Act prioritize the survival of the business. Most deadlocks are resolved through share buy-outs, mediation, or court-ordered changes to the company structure rather than the total destruction of the entity.

"Standard MOIs from the CIPC cover deadlock resolution."

The standard short-form MOI provided by the Companies and Intellectual Property Commission (CIPC) contains very basic governance rules and rarely includes the sophisticated deadlock-breaking mechanisms needed for complex private companies. Most businesses require a customized MOI to be fully protected.

FAQ

How long does it take to resolve a shareholder dispute in South Africa?

If resolved through mediation, a dispute can be settled in weeks. However, if the matter goes to the High Court, it can take 18 to 36 months to reach a final judgment, depending on the complexity of the case and the court's backlog.

What is the 'Just and Equitable' rule?

This is a legal standard used by courts to decide if a company should be liquidated even if it is making a profit. It applies when the relationship between shareholders has failed so completely that it would be unfair to force them to remain in business together.

Can a director be removed during a deadlock?

Yes, under Section 71 of the Companies Act, a director can be removed by an ordinary resolution of the shareholders. However, if the shareholders are split 50/50, this resolution will fail, which is why deadlock-breaking clauses in the MOI are so vital.

Does a Shareholders Agreement override the MOI?

In South Africa, the Companies Act states that if there is a conflict between the MOI and a Shareholders Agreement, the MOI (and the Act itself) takes precedence. It is essential to ensure these documents are synchronized.

When to Hire a Lawyer

You should consult a South African corporate attorney if:

- Your business is paralyzed because shareholders or directors cannot agree on critical decisions.

- You believe your rights as a minority shareholder are being ignored or suppressed by the majority.

- You wish to invoke a shotgun clause or other exit mechanism in your shareholders agreement.

- You are being served with a notice for the liquidation or winding up of your company.

- You need to draft a custom MOI to prevent future disputes as your company grows.

Next Steps

- Audit your documents: Check your current MOI and Shareholders Agreement for dispute resolution clauses.

- Initiate communication: If a deadlock is brewing, suggest a "without prejudice" meeting to discuss a voluntary buy-out or mediation.

- Seek expert advice: Contact a legal professional specializing in South African corporate governance to assess your standing under the Companies Act 71 of 2008.