Table of Contents

Introduction: Demystifying the New Law

A Paradigm Shift in UAE Insolvency Law

- The Core Objective of the New Legislation

- Who Does the New Law Apply To? Navigating Jurisdictions

- Onshore vs. Financial Free Zone Applicability

- Commercial vs. Personal Insolvency

The New Judicial Framework

- The Specialized Bankruptcy Court

- Supporting Administrative Bodies

Pathways to Rescue: Options for Debt Relief

- The Preventive Settlement: An Early Intervention Tool

- The Court-Supervised Restructuring Process

The Bankruptcy and Liquidation Process

- The Orderly Process of Liquidation

- The "Liquidation Waterfall": Who Gets Paid First?

Heightened Duties and Personal Liability for Directors

- Expanded Scope of Liability Beyond the Boardroom

- Prohibited Actions and "Claw-Back" Powers

- The Test for Personal Contribution to Corporate Debts

Conclusion: A New Era for Financial Restructuring in the UAE

The United Arab Emirates has fundamentally reshaped its approach to corporate financial distress with the enactment of Federal Decree-Law No. 51 of 2023. This legislation, which came into force on May 1, 2024, marks a paradigm shift away from a traditionally punitive and creditor-focused framework toward a modern, rescue-oriented regime aligned with international best practices. For business owners, company directors, and creditors, the term "bankruptcy" can be intimidating. The introduction of a new law, while progressive, naturally brings uncertainty: What has really changed? How does this new "rescue culture" work in practice, and what are the new responsibilities and protections for stakeholders?

This guide is designed to demystify the new UAE bankruptcy law. We will break down its core objectives, explain the new court-supervised procedures created to save viable businesses, and clarify the critical implications for debtors, creditors, and company management. By the end of this article, you will have a clearer understanding of your rights and obligations within this modernized legal landscape.

A Paradigm Shift in UAE Insolvency Law

The passage of Federal Decree-Law No. 51 of 2023 signifies a major revision of the United Arab Emirates' approach to corporate bankruptcy. This new legislation, which came into effect on May 1, 2024, repeals the prior 2016 statute and signifies a fundamental shift in legal thought. It takes the country away from a historically creditor-centric and frequently punishing paradigm. In its place is a contemporary, rescue-oriented approach meant to comply with worldwide best practices for assisting enterprises overcome financial difficulties.

What is The Core Objective of the New UAE Bankruptcy Law?

The fundamental purpose of the new legislation is to offer a legal framework that enables struggling enterprises to avoid outright bankruptcy and liquidation via different restructuring processes. It offers sophisticated technologies meant to help viable enterprises to restructure and thrive, which in turn protects economic value and jobs. This strategic shift is designed to reinforce investor confidence, increase the stability of the credit market, and eventually consolidate the UAE's position as a major worldwide center for business and investment.

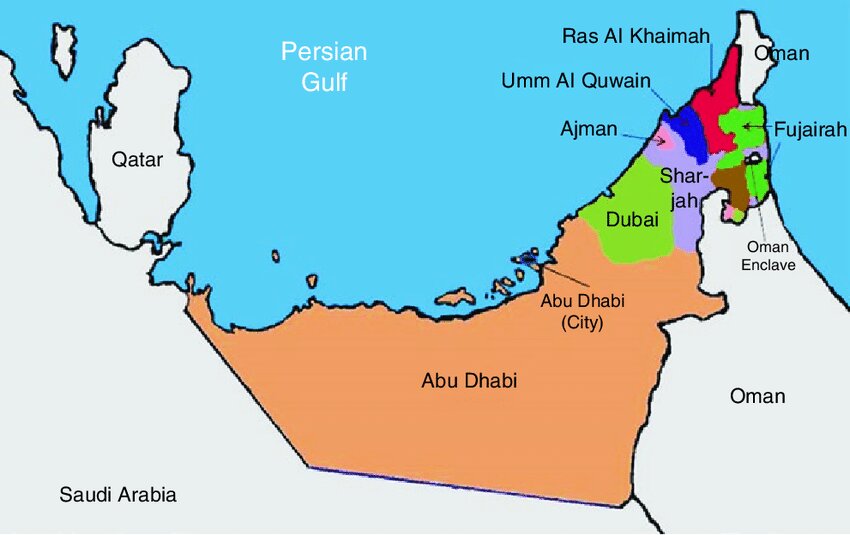

Who Does the New Law Apply To? Navigating Jurisdictions

Understanding the breadth of the new law is the first step for any organization or person analyzing their situation. The law's reach is vast yet has specific and crucial exceptions that determine its authority.

Onshore vs. Financial Free Zone Applicability

The new law's provisions apply to entities operating within the UAE's "onshore" jurisdiction. This includes companies that were established under the UAE Commercial Companies Law. Natural persons who have the legal capacity of a "trader," along with licensed civil companies that carry out professional activities, also fall under its purview. However, a critical delineation is knowing where the law does not apply. The legislation explicitly carves out entities established in the UAE's financial free zones, namely the Dubai International Financial Centre (DIFC) and the Abu Dhabi Global Market (ADGM). These jurisdictions function as independent legal enclaves and operate their own distinct, common-law-based insolvency regimes.

Understanding the Scope of Commercial vs. Personal Insolvency

This new law is primarily focused on commercial insolvency in UAE, governing companies and individuals who are legally classified as traders. It is important to distinguish this from personal financial distress. The law does not govern the insolvency of natural persons who are not considered traders. Their financial difficulties are addressed under a separate statute, Federal Decree-Law No. 19 of 2019 on Insolvency. Therefore, individuals seeking guidance on personal bankruptcy in the UAE should refer to that specific legislation.

The New Judicial Framework Represents a Specialized Approach

A cornerstone of the new insolvency framework is the creation of a specialized judicial ecosystem designed to handle complex financial cases with the required expertise and efficiency. This structural change is intended to foster consistent, predictable, and commercially-aware case law, thereby enhancing stakeholder confidence.

The Bankruptcy Court

The new law creates a specialized Bankruptcy Court that has exclusive jurisdiction over all disputes arising under the Act. Headquartered in the Abu Dhabi Federal Court of First Instance, the court is presided over by experienced judges and formed of a panel of professionals to guarantee a high level of judicial knowledge. An important aspect that increases efficiency is that rulings made by the Bankruptcy Court are deemed writs of execution, which means they are instantly enforceable without being to be served. This approach is aimed to avoid the procedural delays that frequently impeded cases under the former system.

Supporting Administrative Bodies

To assist the courts, the new legislation creates two essential administrative entities. The Bankruptcy Administration is a specialist branch within the court's headquarters that offers critical administrative assistance, administering the procedural parts of cases such as processing applications and conducting creditor meetings. Operating inside the UAE Ministry of Justice is the Financial Reorganisation and Bankruptcy Unit, which conducts critical systemic duties. This organization is responsible for maintaining the official roster of qualified insolvency professionals and developing a public bankruptcy register to record all insolvency decisions.

Pathways to Rescue and Options for Debt Relief in UAE

The new legislation includes two unique, court-supervised processes meant to ease the rescue of viable firms, giving clear avenues for debt relief in the UAE. Both approaches are predicated on the premise of allowing a troubled debtor the required breathing space to restructure its business while balancing the interests of its creditors.

The Preventive Settlement Is An Early Intervention Tool

The Preventive Settlement procedure is a powerful new tool designed for early intervention. It is a "debtor-in-possession" regime, meaning the company's existing management retains control over the business and its assets. This feature fundamentally changes the psychology of restructuring by incentivizing directors to seek protection proactively before financial distress becomes an irreversible crisis. The procedure can only be initiated by a debtor who is facing financial difficulties but is not yet insolvent, which means it has not ceased paying its debts for more than 60 consecutive days. Upon the court's approval, an automatic moratorium is imposed, immediately halting creditor claims for an initial period of three months, which can be extended up to a maximum of six months. Critically, the law also allows the debtor to obtain new financing to provide the working capital needed to stabilize operations.

The Court-Supervised Restructuring Process

For companies that are facing more severe financial distress, the new law provides a formal, court-supervised Restructuring process. This procedure can be initiated by either the debtor or its creditors. While the debtor's management generally remains in control of day-to-day operations, the process is supervised by a court-appointed trustee who oversees the restructuring plan. A key advantage of this process is the extended moratorium on creditor claims, which begins when the court opens the case and remains in effect until a plan is formally ratified. In a significant alignment with international best practices, the law also allows a restructuring plan to include the sale of the entire business as a going concern, a "pre-pack" sale mechanism that can swiftly transfer the viable parts of the business to a new owner, preserving value and saving jobs.

What is The Bankruptcy and Liquidation Process?

When a restructuring is not viable or a rescue attempt fails, the new law provides a clear and orderly process for bankruptcy and liquidation. This procedure serves as the final recourse for a distressed company.

The Orderly Process of Liquidation

The liquidation process can be initiated by the debtor, its creditors, or a relevant regulatory authority. The court will declare a company bankrupt if it determines that a rescue is not possible, a decision which triggers the liquidation of the company's assets to repay its creditors. Upon the commencement of liquidation, the court appoints a bankruptcy trustee who assumes full control over the company's management and assets. The trustee is given extensive powers, which include managing the company's daily affairs and selling its assets through a transparent process to generate funds for creditors.

The "Liquidation Waterfall" and Who Gets Paid First?

A cornerstone of any predictable commercial bankruptcy in the UAE is a clear hierarchy for distributing the proceeds from liquidated assets. The new law establishes a detailed statutory "waterfall" that provides critical certainty for lenders and creditors. The order of priority for payments is as follows:

- Secured Creditors. These creditors are paid first, but only from the proceeds generated by the sale of the specific assets over which they hold security.

- Privileged Debts. After secured creditors are paid from their collateral, these debts are paid from the company's remaining general assets. This category includes judicial fees, employee wages and salaries, and government dues.

- Ordinary Unsecured Creditors. All other creditors who do not hold security or have privileged status fall into this category. They are paid on a pro-rata basis from any funds that remain after all higher-priority claims have been settled in full.

Heightened Duties and Personal Liability for Directors

The new law places a significant emphasis on corporate governance and the accountability of individuals in control of a company facing financial distress. The changes introduce a heightened risk of personal liability for mismanagement, making it crucial for directors to understand their duties.

Expanded Scope of Liability Beyond the Boardroom

A critical development is the expansion of potential liability beyond just the officially appointed board of directors and managers. The law now explicitly covers any person responsible for the actual management of the company, who may be referred to as a de facto or "shadow" director. This is a direct legislative measure against opaque governance structures, allowing courts to look past official titles and hold the true decision-makers accountable for their actions leading to a company's failure.

Prohibited Actions and "Claw-Back" Powers

The law creates personal liability for directors and managers who commit certain acts within the two years prior to the company's cessation of payments. These prohibited actions include disposing of company assets at an undervalue or entering into transactions that give preference to one creditor over others. A bankruptcy trustee can apply to the court to unwind, or "claw-back," such transactions. The general look-back period for these reviewable transactions is six months before the company stopped making payments, but this period extends to two years if the transaction was conducted with a related party.

The Test for Personal Contribution to Corporate Debts

Directors and managers can be ordered by the Bankruptcy Court to personally contribute to the company's debts if a specific two-pronged test is met. First, the company's assets in liquidation must be insufficient to cover at least 20% of its total debts. Second, the directors' or managers' liability for the company's losses must be established under the provisions of the UAE Commercial Companies Law, which includes acts of fraud, abuse of authority, or gross mismanagement. The expanded scope of liability and the serious consequences of mismanagement make it imperative for directors to act cautiously. Navigating the "zone of insolvency" requires expert guidance, and connecting with experienced business lawyers in Dubai can provide the clarity needed to mitigate personal risk.

A New Era for Financial Restructuring in the UAE

Federal Decree-Law No. 51 of 2023 is far more than a simple legislative update; it is a sophisticated and robust framework that fundamentally advances the UAE's restructuring and insolvency landscape. By promoting a culture of corporate rescue, the law is poised to strengthen the resilience of the UAE economy. The new UAE bankruptcy law introduces a system that balances the interests of all stakeholders, emphasizing the survival of viable businesses through modern tools like the Preventive Settlement while establishing specialized courts for expert oversight. At the same time, it increases the accountability of those in management, ensuring greater corporate governance when a company approaches financial distress.

For business leaders, this new era necessitates a proactive approach to financial management. Seeking legal and financial advice at the earliest sign of trouble is crucial to leveraging the new debtor-friendly rescue mechanisms. For creditors, the regime offers a more transparent and structured process where active participation is key to maximizing recovery. Whether you are a director seeking to understand your heightened duties, a creditor protecting your investment, or a business owner considering restructuring, navigating this new legal terrain is complex. Lawzana connects you with qualified business lawyers in Dubai who specialize in the new insolvency law and can provide tailored advice for your specific situation.