Best Bankruptcy & Debt Lawyers in United Arab Emirates

Share your needs with us, get contacted by law firms.

Free. Takes 2 min.

Or refine your search by selecting a city:

List of the best lawyers in United Arab Emirates

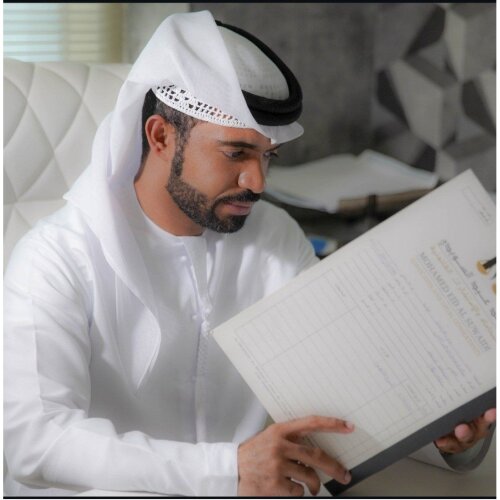

Mohamed Eid Al Suwaidi Advocates & Legal Consultants

30 minutes Free ConsultationUnited Arab Emirates Bankruptcy & Debt Legal Articles

Browse our 2 legal articles about Bankruptcy & Debt in United Arab Emirates written by expert lawyers.

- Debt Collectors in UAE: How to Stop Harassment & Verify Debt

- In the UAE, banks and their collection agents must follow Central Bank Consumer Protection rules that prohibit harassment, threats, and disclosure of your debt to third parties without a legal basis or your consent. You can require collectors to verify the debt and their authority. Ask for an itemized statement,... Read more →

- Understanding the UAE's New Bankruptcy Law

- Table of ContentsIntroduction: Demystifying the New LawA Paradigm Shift in UAE Insolvency LawThe Core Objective of the New LegislationWho Does the New Law Apply To? Navigating JurisdictionsOnshore vs. Financial Free Zone ApplicabilityCommercial vs. Personal InsolvencyThe New Judicial FrameworkThe Specialized Bankruptcy CourtSupporting Administrative BodiesPathways to Rescue: Options for Debt ReliefThe Preventive... Read more →

About Bankruptcy & Debt Law in United Arab Emirates

Bankruptcy and debt laws in the United Arab Emirates are designed to address the financial difficulties of individuals, businesses, and corporations. With a rapidly growing economy and an increasing number of expatriates, the region has implemented comprehensive regulations to streamline debt settlement and insolvency proceedings. The UAE's framework is based on Federal Law No. 9 of 2016 on bankruptcy and Federal Law No. 18 of 1993 on commercial transactions, amended periodically to reflect the dynamic economic landscape. These laws offer mechanisms for debt restructuring, insolvency procedures, and liquidation, providing protection and a structured approach for creditors and debtors alike.

Why You May Need a Lawyer

Engaging a lawyer specializing in bankruptcy and debt law can be crucial in several scenarios. Whether you're facing overwhelming personal debts, a business threatening insolvency, or disputes with creditors, legal expertise can help navigate complex procedures. Lawyers can assist in negotiating with creditors, representing you in court, ensuring compliance with all legal requirements, and providing strategic advice to manage or resolve financial crises effectively.

Local Laws Overview

The legal landscape in the UAE for bankruptcy and debt includes several key components:

- Insolvency Proceedings: These allow businesses to reorganize or liquidate their assets under the supervision of the courts.

- Preventive Composition: Aimed at assisting debtors to negotiate with creditors to restructure debts outside of bankruptcy.

- Out-of-Court Debt Restructuring: An informal agreement between debtors and creditors facilitated by financial advisors.

- Debtor’s Protection: Debt forgiveness and the ability to appeal in cases of unjust creditor actions.

- Credit Reporting: Transparency regulations mandate accurate reporting of an individual's or business's credit history.

Frequently Asked Questions

What is the process for filing for bankruptcy in the UAE?

The process involves submitting a detailed application to the court, including financial statements and proofs of insolvency. The court reviews and either approves for restructuring or for the company/individual to be declared bankrupt.

Can individuals file for bankruptcy in the UAE?

Yes, both individuals and businesses can file for bankruptcy under the UAE's legal system, offering personal debtors protection and a way to resolve severe financial distress.

What does "preventive composition" mean?

Preventive composition is a legal procedure allowing debtors to reach a settlement with creditors to reorganize and repay debts under court supervision without going bankrupt.

Are there penalties for not paying debts in the UAE?

Yes, it can lead to civil lawsuits and potential criminal charges, particularly if checks are involved as they are considered legal tender. However, recent reforms emphasize financial rehabilitation over criminal punishment.

Can creditors seize my assets immediately if I default on a payment?

Creditors must obtain a court order to seize or auction assets. Immediate seizure without due legal process is not permitted.

What role does mediation play in debt resolution?

Mediation is a crucial step recommended by courts for dispute resolution, focusing on amicable settlements between parties to avoid lengthy legal battles.

Is debt consolidation an option in the UAE?

Yes, debt consolidation is available and involves consolidating multiple debts into a single loan with potentially better terms, easing the repayment burden.

How long does bankruptcy remain on my credit report?

Bankruptcy entries typically remain on credit reports for several years, but the duration can depend on specific agreements and laws.

What are the recent amendments in bankruptcy law in the UAE?

Recent amendments focus on more efficient restructuring processes, safeguarding debtor rights, and modernizing legal procedures to address contemporary economic conditions.

Where can I find legal precedents on bankruptcy cases in the UAE?

Legal precedents can be accessed through the Ministry of Justice and local legal publishers, providing insights into how laws are applied in practice.

Additional Resources

If you are seeking more information or assistance, consider reaching out to:

- Ministry of Justice

- Dubai Legal Affairs Department

- Abu Dhabi Judicial Department

- UAE Central Bank for financial regulations

- Local legal firms specializing in bankruptcy law

- Community legal aid clinics offering pro bono advice

Next Steps

If you need legal assistance in bankruptcy and debt matters in the UAE, consider the following steps:

- Consult with a Legal Expert: Engage with a lawyer who has specialized knowledge in UAE bankruptcy and debt laws.

- Prepare Documentation: Gather all relevant financial documents, contracts, and correspondence with creditors.

- Review Legal Options: Discuss your situation thoroughly with your lawyer to explore all possible legal remedies.

- Negotiate Debt Settlements: Work with your lawyer to negotiate with creditors for potential debt restructuring or settlements.

- Understand Your Rights: Ensure you are aware of your legal rights and obligations under current UAE laws.

Taking timely action and receiving professional guidance can greatly enhance your ability to navigate the complexities of bankruptcy and debt proceedings in the UAE effectively.

Lawzana helps you find the best lawyers and law firms in United Arab Emirates through a curated and pre-screened list of qualified legal professionals. Our platform offers rankings and detailed profiles of attorneys and law firms, allowing you to compare based on practice areas, including Bankruptcy & Debt, experience, and client feedback.

Each profile includes a description of the firm's areas of practice, client reviews, team members and partners, year of establishment, spoken languages, office locations, contact information, social media presence, and any published articles or resources. Most firms on our platform speak English and are experienced in both local and international legal matters.

Get a quote from top-rated law firms in United Arab Emirates — quickly, securely, and without unnecessary hassle.

Disclaimer:

The information provided on this page is for general informational purposes only and does not constitute legal advice. While we strive to ensure the accuracy and relevance of the content, legal information may change over time, and interpretations of the law can vary. You should always consult with a qualified legal professional for advice specific to your situation.

We disclaim all liability for actions taken or not taken based on the content of this page. If you believe any information is incorrect or outdated, please contact us, and we will review and update it where appropriate.

Browse bankruptcy & debt law firms by service in United Arab Emirates

United Arab Emirates Attorneys in related practice areas.

Browse bankruptcy & debt law firms by city in United Arab Emirates

Refine your search by selecting a city.