Best Bad Faith Insurance Lawyers in Germany

Share your needs with us, get contacted by law firms.

Free. Takes 2 min.

Or refine your search by selecting a city:

List of the best lawyers in Germany

About Bad Faith Insurance Law in Germany

In Germany, insurance contracts are primarily governed by the Insurance Contract Act (Versicherungsvertragsgesetz - VVG). Bad faith insurance generally refers to situations where an insurance company may not act in the best interest of the policyholder. This can involve unfair claim denials, delays in payment, or failure to conduct a proper investigation of claims. While the concept of bad faith is more explicitly recognized in some legal jurisdictions, German law provides robust consumer protection mechanisms to ensure fair treatment of policyholders, obligating insurers to act truthfully and honorably.

Why You May Need a Lawyer

Legal assistance might be necessary in several scenarios involving bad faith insurance practices in Germany. You may need a lawyer if you are dealing with unjust claim denials, have experienced unreasonable delays in claim processing, face unclear policy terms interpretation, or believe your insurer failed to properly communicate their policy obligations. Navigating the complex legal framework governing insurance claims can be challenging, and a knowledgeable lawyer can help protect your rights, ensure compliance with legal requirements, and facilitate a fair resolution.

Local Laws Overview

The Insurance Contract Act (VVG) is the primary legislation governing insurance contracts in Germany, setting forth guidelines on the duty of disclosure, policyholder rights, and insurer obligations. Key aspects relevant to potential bad faith practices include the insurer's duty to promptly fulfill claims and the obligation to provide transparent information regarding policy terms and coverage. Additionally, consumer protection laws, such as the German Civil Code (BGB), provide avenues for pursuing claims against unfair practices or misrepresentations by insurers.

Frequently Asked Questions

What constitutes bad faith insurance in Germany?

Bad faith insurance typically involves unfair claim handling practices by insurers, although this specific term is more common in jurisdictions like the United States. In Germany, such practices may be addressed under consumer protection and contractual obligation laws.

Can an insurer deny my claim without explanation?

No, German law requires insurers to provide clear justifications for any claim denials. You have the right to request further explanation and file a complaint if dissatisfied with the response.

How long does my insurer have to process my claim?

Under German law, insurers must process and pay valid claims within a reasonable timeframe. Delays without valid reasons may be grounds for legal action.

What should I do if I suspect my insurer is acting in bad faith?

If you suspect bad faith, document all communications, gather evidence, and consult with a lawyer experienced in insurance law to evaluate your case and advise on the next steps.

Can I challenge the interpretation of my insurance policy terms?

Yes, if you believe your insurer's interpretation of policy terms is unfair or misleading, legal advice can help you challenge such interpretation, potentially through mediation or court action.

Are there time limits for pursuing legal action against my insurer?

Yes, specific time limits may apply based on your policy and the nature of your complaint. Consulting a lawyer as soon as possible is advisable to ensure compliance with any applicable deadlines.

What role does the Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) play?

BaFin regulates and supervises insurance companies in Germany. It provides oversight to ensure compliance with financial regulations and consumer protection standards. Policyholders can lodge complaints with BaFin.

Can mediation be an alternative to going to court?

Mediation can be an effective alternative for resolving disputes with insurance companies, often resulting in faster, less adversarial outcomes compared to formal litigation.

What impact does a legal victory have on my insurance premiums?

Winning a case against your insurer should not directly impact your premiums, but costs and conditions may vary based on individual circumstances and policy terms.

How can I ensure better protection against bad faith practices?

Thoroughly reviewing your insurance policies, maintaining detailed records of all interactions with your insurer, and seeking professional advice when necessary can provide better protection.

Additional Resources

Individuals seeking more information or assistance can refer to the following resources:

- Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) - A regulatory body overseeing the financial industry, including insurance companies.

- Consumer Protection Agencies - Provide guidance and support for resolving disputes with insurance providers.

- Legal Aid Clinics - Offer free or low-cost legal advice for individuals with limited financial resources.

- The German Bar Association (Deutsche Anwaltauskunft) - Can help locate qualified lawyers specializing in insurance law.

Next Steps

If you find yourself dealing with bad faith practices by your insurance company, consider taking the following steps:

- Document Everything: Keep detailed records of all communications, policy papers, and any evidence supporting your claim.

- Seek Legal Advice: Contact a lawyer specializing in insurance law to evaluate your case and discuss potential strategies.

- Explore Alternative Dispute Resolution: Consider mediation or negotiation before pursuing formal litigation.

- Contact Regulatory Bodies: Lodge a complaint with regulatory authorities like BaFin if necessary.

- Stay Informed: Regularly consult reliable resources to understand your rights and the nuances of insurance law.

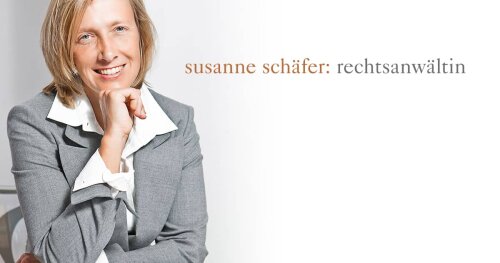

Lawzana helps you find the best lawyers and law firms in Germany through a curated and pre-screened list of qualified legal professionals. Our platform offers rankings and detailed profiles of attorneys and law firms, allowing you to compare based on practice areas, including Bad Faith Insurance, experience, and client feedback.

Each profile includes a description of the firm's areas of practice, client reviews, team members and partners, year of establishment, spoken languages, office locations, contact information, social media presence, and any published articles or resources. Most firms on our platform speak English and are experienced in both local and international legal matters.

Get a quote from top-rated law firms in Germany — quickly, securely, and without unnecessary hassle.

Disclaimer:

The information provided on this page is for general informational purposes only and does not constitute legal advice. While we strive to ensure the accuracy and relevance of the content, legal information may change over time, and interpretations of the law can vary. You should always consult with a qualified legal professional for advice specific to your situation.

We disclaim all liability for actions taken or not taken based on the content of this page. If you believe any information is incorrect or outdated, please contact us, and we will review and update it where appropriate.

Browse bad faith insurance law firms by city in Germany

Refine your search by selecting a city.