Best Business Lawyers in Sion

Share your needs with us, get contacted by law firms.

Free. Takes 2 min.

List of the best lawyers in Sion, Switzerland

About Business Law in Sion, Switzerland

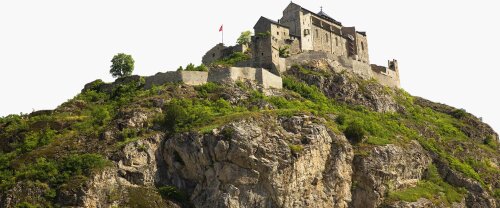

Sion is the capital of the canton of Valais in Switzerland and serves as a significant economic and administrative center in the region. Business in Sion benefits from Switzerland’s stable legal framework, transparent regulatory environment, and strategic location. The city is home to a mix of startups, established companies, and international organizations, making it an attractive location for entrepreneurs and investors. Business law in Sion encompasses a variety of fields, including company formation, contract law, employment law, taxation, intellectual property, mergers and acquisitions, and compliance with local and federal regulations.

Why You May Need a Lawyer

Whether you are starting a new business, acquiring a company, negotiating contracts, or facing commercial disputes, the complexities of Swiss and local business laws can make legal assistance invaluable. Common scenarios where people may require legal help in business include:

- Setting up a company or branch office

- Navigating permits, licenses, and regulatory compliance

- Drafting and reviewing contracts and commercial agreements

- Resolving disputes with partners, clients, or suppliers

- Employment matters, including hiring, firing, and workplace disputes

- Intellectual property protection and licensing

- Dealing with tax planning or audits

- Handling mergers, acquisitions, or restructuring

- Liquidating or dissolving a business

- Complying with data protection and privacy regulations

A knowledgeable lawyer can help you avoid costly mistakes, ensure your actions comply with Swiss and local laws, and represent you in negotiations or litigation.

Local Laws Overview

Business activities in Sion are regulated at both the cantonal (Valais) and federal levels. Some key aspects of local laws relevant to business include:

- Company Formation: Company types include sole proprietorships, partnerships, limited liability companies (GmbH/Sàrl), and corporations (AG/SA). Each has specific formation, capital, and reporting requirements.

- Commercial Registration: Most businesses must register with the Commercial Register of the Canton of Valais. Registration confers legal status and allows for public recognition.

- Taxation: Swiss companies are subject to federal, cantonal, and communal taxes. Sion and Valais may offer incentives for certain business activities or sectors.

- Labor Law: Employment relationships are governed by both Swiss Code of Obligations and special labor laws covering work conditions, salaries, and social security obligations.

- Permits and Licenses: Some activities require specific permits, especially in regulated fields like hospitality, finance, or healthcare.

- Intellectual Property: Swiss law provides for the protection of trademarks, patents, copyrights, and trade secrets. Registration is recommended for full protection.

- Commercial Contracts: Swiss law generally upholds the freedom to contract, but contracts must not violate statutory provisions or public policy.

- Business Disputes: Disputes may be resolved through negotiation, mediation, arbitration, or litigation in local civil courts.

- Data Protection: Businesses handling personal data must comply with Swiss data protection laws, which are set to align closely with European standards.

Individuals or companies doing business in Sion should understand these legal frameworks and consult with a legal specialist for specific guidance.

Frequently Asked Questions

What is the process for starting a business in Sion?

To start a business, you must choose an appropriate legal structure (such as sole proprietorship, GmbH, or AG), register with the Commercial Register, obtain necessary permits, and fulfill tax and social security obligations. Legal advice can help ensure all steps are completed correctly.

Do I need to register my business in Sion?

Yes, most business activities require registration in the Commercial Register of Valais to gain legal status, issue invoices, and open a corporate bank account.

What are the main types of business structures in Switzerland?

The most common types are sole proprietorship, general partnership, limited partnership, limited liability company (GmbH/Sàrl), and corporation (AG/SA). Each has unique requirements regarding minimum capital, liability, and governance.

Are there any local incentives for new businesses in Sion?

At times, the canton of Valais and the city of Sion may offer incentives such as reduced tax rates, grants, or advisory support for innovative startups or businesses contributing to the regional economy.

How are business contracts regulated in Switzerland?

Business contracts must comply with the Swiss Code of Obligations. Parties are generally free to negotiate terms, but certain statutory rules and good faith principles apply.

What taxes do businesses in Sion have to pay?

Businesses are subject to federal, cantonal (Valais), and communal (Sion) taxes, including corporate income tax, VAT, and social security contributions.

What labor laws apply to employers in Sion?

Swiss labor laws cover employment contracts, working conditions, holiday entitlements, termination processes, and social security. Employers must also adhere to anti-discrimination laws and workplace safety standards.

Is it necessary to protect intellectual property and how?

Yes, intellectual property, such as trademarks, patents, and designs, should be registered at the Swiss Federal Institute of Intellectual Property to receive protection.

How can business disputes be resolved in Sion?

Disputes can be settled through direct negotiation, mediation, arbitration, or litigation in civil courts. Many business contracts include arbitration clauses to resolve issues outside traditional court proceedings.

Do I need special permits to operate in specific industries?

Certain sectors, such as hospitality, healthcare, financial services, and real estate, require special permits from local or cantonal authorities. Consult a legal expert to identify necessary permits for your industry.

Additional Resources

For individuals seeking more guidance or support regarding business law in Sion, the following resources and organizations may be helpful:

- Commercial Register of the Canton of Valais - Registration and company information

- Economic Promotion Office of Valais - Business development assistance, incentives, and advisory services

- Sion Chamber of Commerce and Industry - Networking and business resources

- Swiss Federal Tax Administration - Information on business and corporate taxation

- Swiss Federal Institute of Intellectual Property - Guidance on protecting intellectual property rights

- Local law firms specializing in business and commercial law

- Sion’s municipal authorities - Information for new entrepreneurs and local regulations

Next Steps

If you require legal assistance regarding business in Sion, Switzerland, consider taking these steps:

- Define your legal question or concern clearly before reaching out for help.

- Gather all relevant documentation, such as contracts, correspondence, permits, or registration papers.

- Contact a lawyer or local law firm experienced in Swiss business law and familiar with Valais regulations.

- Consult local government offices or business advisory centers for preliminary information or support.

- Keep records of all interactions and advice received to ensure clarity and compliance moving forward.

Taking informed and timely action improves your chances of achieving successful outcomes and helps your business comply with all legal obligations in Sion.

Lawzana helps you find the best lawyers and law firms in Sion through a curated and pre-screened list of qualified legal professionals. Our platform offers rankings and detailed profiles of attorneys and law firms, allowing you to compare based on practice areas, including Business, experience, and client feedback.

Each profile includes a description of the firm's areas of practice, client reviews, team members and partners, year of establishment, spoken languages, office locations, contact information, social media presence, and any published articles or resources. Most firms on our platform speak English and are experienced in both local and international legal matters.

Get a quote from top-rated law firms in Sion, Switzerland — quickly, securely, and without unnecessary hassle.

Disclaimer:

The information provided on this page is for general informational purposes only and does not constitute legal advice. While we strive to ensure the accuracy and relevance of the content, legal information may change over time, and interpretations of the law can vary. You should always consult with a qualified legal professional for advice specific to your situation.

We disclaim all liability for actions taken or not taken based on the content of this page. If you believe any information is incorrect or outdated, please contact us, and we will review and update it where appropriate.

Browse business law firms by service in Sion, Switzerland

Sion, Switzerland Attorneys in related practice areas.