Best Funds & Asset Management Lawyers in Tallinn

Share your needs with us, get contacted by law firms.

Free. Takes 2 min.

List of the best lawyers in Tallinn, Estonia

About Funds & Asset Management Law in Tallinn, Estonia

Funds and asset management law in Tallinn covers the legal frameworks that regulate investment funds, asset management companies, fund managers, and investor protection. Tallinn, as Estonia’s capital and financial hub, adheres closely to European Union (EU) financial regulations, providing a transparent and investor-friendly environment. The industry encompasses collective investment undertakings such as mutual funds, hedge funds, private equity, pension funds, and the professional management of individual and institutional assets.

Funds and asset management in Tallinn is supervised by competent authorities that ensure compliance with both local and EU regulations. The legal landscape is designed to create trust, encourage innovation, and protect stakeholders within the financial markets.

Why You May Need a Lawyer

Navigating the complexities of funds and asset management law can be daunting. Many situations may require the specialized assistance of a lawyer, including:

- Establishing or licensing an investment fund or management company

- Ensuring compliance with Estonian and EU financial regulations

- Drafting or reviewing agreements with fund managers or investors

- Structuring cross-border investments or fund offerings

- Handling disputes between stakeholders such as investors, managers, or service providers

- Implementing risk management and anti-money laundering measures

- Assisting with financial supervision investigations or audits

- Dealing with taxation issues related to fund structures and investor returns

An experienced lawyer can help ensure you are compliant, protect your interests, and minimize risks.

Local Laws Overview

Estonia’s regulatory regime for funds and asset management benefits from alignment with EU directives such as AIFMD (Alternative Investment Fund Managers Directive) and UCITS (Undertakings for Collective Investment in Transferable Securities). Some of the key legal aspects include:

- The Investment Funds Act regulates the establishment, operation, and supervision of investment funds and fund managers in Estonia

- Fund managers operating in or from Estonia must usually be licensed by the Estonian Financial Supervision and Resolution Authority (Finantsinspektsioon)

- Specific requirements apply for different types of funds, such as UCITS and alternative investment funds (AIFs)

- Stringent rules on anti-money laundering (AML) and customer due diligence must be followed

- Transparent disclosure and reporting obligations are enforced to protect investors

- Supervisory fees, capital adequacy requirements, and risk management standards are imposed on management companies

- Cross-border activities are facilitated by Estonia’s participation in the EU single market

Legal advice is key to staying compliant with these evolving regulations.

Frequently Asked Questions

What is required to set up an investment fund in Tallinn?

Establishing a fund typically requires preparing legal documentation, obtaining necessary licenses from the Financial Supervision Authority, and meeting minimum capital and organizational requirements. Compliance with the Investment Funds Act and EU regulations is essential.

Who regulates funds and asset management in Estonia?

The Estonian Financial Supervision and Resolution Authority (Finantsinspektsioon) is the primary regulatory body for funds and asset management in Estonia.

What types of investment funds can be established in Estonia?

Both UCITS (public funds) and alternative investment funds (AIFs) such as hedge funds or private equity funds can be established. Estonia offers structures for open-ended and closed-ended funds, as well as special fund types like pension funds.

Do foreign fund managers need a license to operate in Estonia?

Foreign fund managers may operate under the EU passporting regime, subject to notification procedures. Non-EU managers generally require a license from the Estonian Financial Supervision Authority to manage or market funds in Estonia.

What are the main investor protection measures in place?

Investor protection includes disclosure requirements, segregation of assets, independent custodian arrangements, periodic reporting, and strict rules on advertising and marketing materials.

Are there specific anti-money laundering obligations for asset managers?

Yes. Asset managers must implement comprehensive AML policies, conduct customer due diligence, and report suspicious transactions to the Estonian Financial Intelligence Unit.

How are disputes between investors and fund managers resolved?

Disputes can often be resolved through direct negotiation, but may also involve mediation, arbitration, or litigation in Estonian courts, depending on the contractual terms and the nature of the dispute.

Are there any tax incentives for investment funds in Estonia?

Estonia offers a deferred profit taxation system for companies, including some fund structures. Taxation may depend on the fund type and distribution policy. Specific advice is necessary to optimize tax efficiency.

Can funds engage in cross-border investments?

Yes. Estonian funds and asset managers can invest internationally, subject to compliance with Estonian laws and the regulatory requirements of the jurisdictions involved.

What is the procedure for licensing an asset management company?

A management company must apply to the Financial Supervision Authority, submit detailed business plans, demonstrate professional competence, and comply with capital and organizational requirements.

Additional Resources

For more information or support, the following resources can be helpful:

- Estonian Financial Supervision and Resolution Authority (Finantsinspektsioon) - regulator for funds and asset management

- Estonian Financial Intelligence Unit - authority for anti-money laundering oversight

- Estonian Investment Funds Association - industry organization providing guidance and advocacy

- Estonian Tax and Customs Board - information about taxation of investment funds and asset managers

- Legal firms in Tallinn specializing in financial services, corporate law, and investment sector regulations

Next Steps

If you need legal assistance regarding funds and asset management in Tallinn:

- Assess your specific situation and needs - are you planning to set up a fund, seek a license, handle a dispute, or ensure compliance?

- Gather all relevant documentation and details about your project or issue

- Seek out local law firms or legal advisors with expertise in funds and asset management

- Arrange an initial consultation to discuss your objectives, fees, and timelines

- Follow through on your lawyer’s advice, prepare necessary documents, and maintain open communication throughout the process

Seeking timely legal guidance will help you navigate the regulatory complexity and safeguard your interests in Tallinn’s dynamic funds and asset management sector.

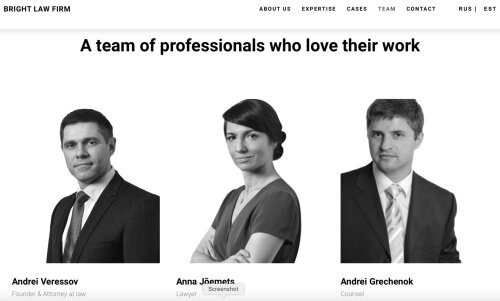

Lawzana helps you find the best lawyers and law firms in Tallinn through a curated and pre-screened list of qualified legal professionals. Our platform offers rankings and detailed profiles of attorneys and law firms, allowing you to compare based on practice areas, including Funds & Asset Management, experience, and client feedback.

Each profile includes a description of the firm's areas of practice, client reviews, team members and partners, year of establishment, spoken languages, office locations, contact information, social media presence, and any published articles or resources. Most firms on our platform speak English and are experienced in both local and international legal matters.

Get a quote from top-rated law firms in Tallinn, Estonia — quickly, securely, and without unnecessary hassle.

Disclaimer:

The information provided on this page is for general informational purposes only and does not constitute legal advice. While we strive to ensure the accuracy and relevance of the content, legal information may change over time, and interpretations of the law can vary. You should always consult with a qualified legal professional for advice specific to your situation.

We disclaim all liability for actions taken or not taken based on the content of this page. If you believe any information is incorrect or outdated, please contact us, and we will review and update it where appropriate.