Best Pension Lawyers in Zimbabwe

Share your needs with us, get contacted by law firms.

Free. Takes 2 min.

Or refine your search by selecting a city:

List of the best lawyers in Zimbabwe

About Pension Law in Zimbabwe

Pension law in Zimbabwe governs the rights and obligations related to retirement benefits for employees and the operations of pension funds. Under Zimbabwean law, pensions provide a critical form of financial security, ensuring that retirees have a source of income after leaving the workforce. The framework primarily aims to protect beneficiaries’ interests and mandates compliance with established standards to ensure the solvency and proper administration of pension funds.

Why You May Need a Lawyer

There are multiple circumstances where you might require legal advice regarding pension matters in Zimbabwe:

- Disputes with Employers: When there are disagreements over pension entitlements or contributions between employees and employers.

- Pension Fund Administration Issues: Concerns about the management or mismanagement of pension funds, including delayed or inaccurate benefit payments.

- Regulatory Compliance: Ensuring that pension funds comply with the Pension and Provident Funds Act and other relevant regulations.

- Transfer of Pension Rights: When changing jobs or moving abroad, legal advice might be needed for transferring pension rights.

- Family Law Matters: Negotiating pension rights during divorce or separation.

Local Laws Overview

Zimbabwe’s pension regulations are primarily governed by the Pension and Provident Funds Act. Key aspects include:

- All pension funds must register with the Insurance and Pensions Commission (IPEC).

- Pension contributions are mandatory for certain employment categories, with both employers and employees making contributions.

- Pension funds must adhere to strict investment guidelines to protect beneficiaries’ interests.

- There are provisions for safeguarding members' rights, ensuring transparency in administration, and providing for the orderly wind-up of pension funds if necessary.

Frequently Asked Questions

What is a pension in Zimbabwe?

A pension in Zimbabwe is a retirement plan that provides a monthly income to retirees from a fund to which both the employee and employer contributed during the employee's working life.

Who regulates pensions in Zimbabwe?

The Insurance and Pensions Commission (IPEC) is the primary regulatory body overseeing pension schemes in Zimbabwe.

Can I withdraw my pension early?

Early withdrawal of pension funds in Zimbabwe is generally restricted, except in specific circumstances like severe illness or if the member is leaving the country permanently.

What happens to my pension if I change employers?

You may be able to transfer your accumulated pension rights to the new employer’s scheme or maintain it within the original scheme as a deferred pension.

How are disputes over pensions resolved?

Pension disputes can be resolved through negotiation, mediation, or legal proceedings if necessary, often requiring the assistance of a lawyer.

Is my pension taxed in Zimbabwe?

Yes, pensions in Zimbabwe are subject to taxation, though specific tax reliefs may apply based on individual circumstances and retirement ages.

What is the role of a pension administrator?

A pension administrator manages the day-to-day operations of a pension fund, ensuring compliance with regulations and timely payments of benefits to members.

How can I confirm if my employer is making pension contributions?

You should receive regular statements from your pension fund detailing contributions and balances. If not, contact your employer or the fund directly.

What should I do if I suspect my pension fund is being mismanaged?

Report your concerns to the Insurance and Pensions Commission (IPEC) and consider seeking legal advice to protect your interests.

Can changes be made to pension benefits?

Changes can be made, but they should comply with legal regulations and the pension fund’s rules, and typically require member consent.

Additional Resources

For more information or assistance, consider reaching out to the following:

- Insurance and Pensions Commission (IPEC): The regulatory authority overseeing pension management and compliance.

- Ministry of Public Service, Labour and Social Welfare: Offers guidance and assistance on labor-related issues, including pensions.

- Zimbabwe Association of Pension Funds: A body representing pension funds’ interests at a national level.

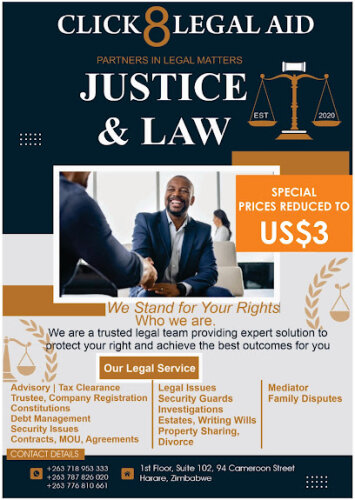

- Legal Aid Clinic: Offers legal advice or representation if affordability is an issue.

Next Steps

If you require legal assistance regarding pensions:

- Identify the specific area where you need help, such as disputes, compliance, or fund management.

- Gather relevant documents, including employment contracts, pension statements, and correspondence with employers or fund administrators.

- Consult with a lawyer specialized in pension law to discuss your case and explore potential legal actions.

- Consider mediation or negotiation as an initial step to resolve disputes amicably before opting for litigation.

Seeking professional legal advice can ensure that your rights and interests in pension matters are adequately protected and any issues are resolved efficiently.

Lawzana helps you find the best lawyers and law firms in Zimbabwe through a curated and pre-screened list of qualified legal professionals. Our platform offers rankings and detailed profiles of attorneys and law firms, allowing you to compare based on practice areas, including Pension, experience, and client feedback.

Each profile includes a description of the firm's areas of practice, client reviews, team members and partners, year of establishment, spoken languages, office locations, contact information, social media presence, and any published articles or resources. Most firms on our platform speak English and are experienced in both local and international legal matters.

Get a quote from top-rated law firms in Zimbabwe — quickly, securely, and without unnecessary hassle.

Disclaimer:

The information provided on this page is for general informational purposes only and does not constitute legal advice. While we strive to ensure the accuracy and relevance of the content, legal information may change over time, and interpretations of the law can vary. You should always consult with a qualified legal professional for advice specific to your situation.

We disclaim all liability for actions taken or not taken based on the content of this page. If you believe any information is incorrect or outdated, please contact us, and we will review and update it where appropriate.

Browse pension law firms by city in Zimbabwe

Refine your search by selecting a city.