Best Power of Attorney Notarization Lawyers in St. Paul

Share your needs with us, get contacted by law firms.

Free. Takes 2 min.

List of the best lawyers in St. Paul, Canada

1. About Power of Attorney Notarization Law in St. Paul, Canada

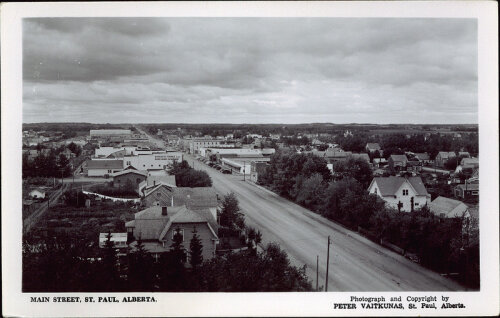

St. Paul is a town in northeastern Alberta, Canada. In Alberta, a Power of Attorney (POA) enables a chosen person to manage your finances, property, or personal care if you cannot act for yourself. Notarization helps verify the authenticity of the POA when you deal with banks, government agencies, and certain institutions. In Alberta, two core frameworks shape POA practice: the Adult Guardianship and Trusteeship Act and the Notaries Public Act, which regulate representation and notary services respectively.

A POA for property covers financial decisions such as paying bills, managing investments, and handling banking matters. A POA for personal care covers decisions about health and daily living arrangements. In Alberta you may encounter terms like durable or enduring POA, which remain effective if you lose decision-making capacity. Always confirm current requirements with a licensed attorney or a notary in St. Paul before executing documents.

Notarization is typically performed by a Notary Public or by a lawyer acting as a legal professional who can witness signatures and affix a formal seal. Notarization alone does not create a POA; it authenticates the document so banks and government offices will recognize it. For many institutions, particularly in rural Alberta communities like St. Paul, notarized POAs provide a reliable pathway to continued access to finances and care arrangements.

For residents and families, understanding the interplay between POA documents, guardianship concepts, and healthcare directives is essential. Seek clear advice from a local legal professional who can tailor a POA to your specific family or business needs. Official sources for Alberta POA law include government and professional bodies, which ensure you use up-to-date forms and comply with current rules.

Key jurisdictions to consult include Alberta's government resources and the Law Society of Alberta. For foundational information, see Government of Alberta resources on guardianship, trusteeship, and notary practice, and consult CanLII for statutory texts.

Source: Alberta government resources on guardianship and notaries and CanLII for statute texts.

Guardianship and Trusteeship Act - Alberta - provides the framework for appointing guardians and trustees, including related powers and protections.

Law Society of Alberta - governs notaries and notarial practices in Alberta, including POA notarizations.

CanLII - offers access to Alberta statutes and regulations relevant to POA and guardianship matters.

2. Why You May Need a Lawyer

In St. Paul, concrete scenarios show why professional legal help is essential when dealing with Power of Attorney and notarization.

- Scenario 1 - An elderly parent with early dementia wants a POA for finances and property. A lawyer can ensure the POA language covers all necessary financial powers and includes durable terms, while a notary validates the document for banking institutions.

- Scenario 2 - A local business owner plans for succession and wants a POA for business matters if they become incapacitated. A lawyer can draft a POA that authorizes corporate decisions, contracts, and payroll obligations while safeguarding the company.

- Scenario 3 - A blended family needs to appoint a trusted individual to manage personal care decisions. A lawyer can structure a POA for personal care that aligns with complex family dynamics and potential conflicts of interest.

- Scenario 4 - A person moving to a retirement community requires a POA for healthcare decisions and access to medical records. A legal professional can ensure compliance with Alberta healthcare directives and privacy rules.

- Scenario 5 - You must revoke or update an existing POA due to a change in trusted relationships or concerns about abuse. A lawyer can guide you through a formal revocation and replacement process with minimal risk.

- Scenario 6 - You need to have a POA recognized by banks and government agencies outside Alberta. A lawyer can prepare documents in the correct form and arrange proper notarization to avoid delays.

3. Local Laws Overview

In St. Paul, Alberta, two main statutes shape Power of Attorney and notarial activities, with practical implications for residents and institutions.

- Adult Guardianship and Trusteeship Act (Alberta) - This act provides the legal framework for appointing guardians and trustees for adults, including powers and duties related to financial management and personal care. It addresses when decisions can be made on an adult's behalf and how disputes are resolved.

- Notaries Public Act (Alberta) - This act governs the licensing and conduct of notaries in Alberta, including the notarization of documents such as Powers of Attorney and the requirements for witnessing signatures and affixing notarial seals. It is the primary mechanism by which POAs can be authenticated for use with banks and other institutions.

- Bank Act (Canada) - While not a POA statute, this federal act influences how banks in Alberta recognize and accept Powers of Attorney for banking transactions, including requirements for authentication and notarization. Banks may require specific documentation or additional formalities for POA transactions.

Notes on dates and updates: Alberta statutes are subject to amendments. The AGTA and Notaries Public Act have seen revisions over the years to expand or clarify powers, safeguards and notarial procedures. For current versions, consult the Government of Alberta website and CanLII, which host up-to-date texts and statutory notes.

Useful official resources include:

- Guardianship and Trusteeship Act - Alberta

- Law Society of Alberta - Notaries

- CanLII - Alberta Statutes (example: AGTA texts)

4. Frequently Asked Questions

What is a Power of Attorney for personal care in Alberta?

A Power of Attorney for personal care authorizes a designated person to make health and daily living decisions when you cannot. It is different from a POA for property, which covers finances. A lawyer can tailor the document to reflect your values and ensure it fits Alberta law.

How do I create a Power of Attorney in St. Paul, Alberta?

Consult a local lawyer to draft the POA and discuss whether you need a POA for property, personal care, or both. After drafting, you typically sign in the presence of witnesses and a Notary Public for notarization. Banks often require a notarized POA for large transactions.

What documents are usually needed to draft a POA?

Common documents include your government-issued photo ID, the proposed Attorney's information, and any existing POA or guardianship papers. If you have a healthcare directive, bring it for coordination. A lawyer can request additional medical or financial records as needed.

How much does it cost to notarize a Power of Attorney in St. Paul?

Costs vary by lawyer and notary, but you can expect a lawyer's drafting fee plus a notary's witnessing and stamping charge. Plan for a total range of several hundred dollars, depending on complexity and whether extra services are required.

How long does the POA process take from start to finish?

Drafting and execution can take a few days to a few weeks, depending on the complexity and schedules. Notarization can happen the same day if documents are ready. If a court or guardian involvement is needed, timelines extend accordingly.

Do I need a lawyer to prepare a Power of Attorney?

No, you can use standard forms, but a lawyer helps ensure the POA is comprehensive and legally sound. A lawyer can tailor the document to your situation and minimize the risk of invalid provisions. For most people, professional guidance reduces future disputes.

What is the difference between a POA and guardianship?

A POA authorizes someone else to act while you are still capable, whereas guardianship is a court appointment to act when you are not capable. POAs may be revoked, but guardianship typically requires court approval to change or end it. AGTA governs guardianship matters in Alberta.

Can a Power of Attorney be revoked or canceled?

Yes. You can revoke a POA at any time while you have mental capacity. The revocation should be in writing and communicated to the Attorney, institutions, and, if needed, filed with relevant authorities. A lawyer can help ensure the revocation is effective and clearly communicated.

What is the difference between durable and non-durable Power of Attorney?

A durable POA remains in effect if you later become incapacitated. A non-durable POA ceases if you lose capacity. In Alberta, most clients choose a durable POA for long-term planning and protection.

How can I ensure a bank accepts my Power of Attorney?

Provide a fully executed, notarized POA accompanied by identification and any bank-specific forms. Some banks require a copy of the POA and a certificate of notarial authentication. Consulting your bank and your lawyer early helps prevent delays.

Can a POA be used outside Alberta or in Canada-wide transactions?

Reaction to out-of-province or federal matters depends on the institution and provincial rules. Some banks accept Alberta POAs nationwide; others require local forms or additional authentication. A lawyer can prepare a multi-jurisdiction POA if you have cross-border needs.

Should I use a notary or a lawyer for POA notarization?

A notary public can witness and notarize the document, while a lawyer can draft and advise on content. For complex family situations or business concerns, working with a lawyer is advisable before notarization. Banks often accept notarized POAs prepared by either professional.

Do I need to include a medical directive with my POA?

While not always required, a medical directive or living will complements a POA by clarifying your healthcare preferences. A lawyer can ensure the directives work together and comply with Alberta law. This minimizes confusion during treatment decisions.

Is a Power of Attorney valid if I travel outside Canada?

POAs generally remain valid if drafted correctly, but access to records or enforcement may depend on local laws and institutions. If you travel frequently, include clear provisions and select an Attorney who can handle cross-border matters. Check with your bank about international recognition.

What counts as valid identification when signing a POA in Alberta?

Acceptable IDs typically include a government photo ID, such as a driver's license or passport. Banks and notaries may have additional requirements. Bring multiple ID documents to the signing appointment to avoid delays.

What is the difference between a POA and an Advance Medical Directive?

A POA appoints someone to act on financial or personal care matters, while an Advance Medical Directive states your medical preferences. They serve complementary roles and are often drafted together for comprehensive planning. Lawyers can assist with both to ensure consistency.

5. Additional Resources

- Alberta Government - Guardianship and Trusteeship Act - Official statutes outlining guardianship, trusteeship, and representation for adults. https://www.alberta.ca/guardianship-trusteeship-act.aspx

- Law Society of Alberta - Regulates notaries and provides guidance on notary services and POA notarizations. https://lawsociety.ab.ca/

- CanLII - Alberta Statutes - Free access to Alberta legislation including AGTA and related acts. https://www.canlii.org/en/ca/law/stat/rsa-2000-angagt/

6. Next Steps

- Define your POA goals clearly. Decide whether you need a POA for property, personal care, or both, and list specific powers you want to grant.

- Gather essential documents. Collect government IDs, contact details for the Attorney, and any existing POA or healthcare directives.

- Find a local St. Paul lawyer with POA experience. Ask for a preliminary consultation to discuss goals, timeline, and costs.

- Schedule a drafting session. Have the attorney draft the POA and any related healthcare directives, and review all provisions carefully.

- Arrange notarization or witnessing. Coordinate with a Notary Public or lawyer to witness signatures and affix the notarial seal as needed for banks and institutions.

- Execute, distribute, and store originals securely. Provide copies to the Attorney, bank, and health care providers, and store the original in a safe location.

- Review the documents periodically. Update the POA after major life events such as marriage, divorce, relocation, or changes in health or assets.

Lawzana helps you find the best lawyers and law firms in St. Paul through a curated and pre-screened list of qualified legal professionals. Our platform offers rankings and detailed profiles of attorneys and law firms, allowing you to compare based on practice areas, including Power of Attorney Notarization, experience, and client feedback.

Each profile includes a description of the firm's areas of practice, client reviews, team members and partners, year of establishment, spoken languages, office locations, contact information, social media presence, and any published articles or resources. Most firms on our platform speak English and are experienced in both local and international legal matters.

Get a quote from top-rated law firms in St. Paul, Canada — quickly, securely, and without unnecessary hassle.

Disclaimer:

The information provided on this page is for general informational purposes only and does not constitute legal advice. While we strive to ensure the accuracy and relevance of the content, legal information may change over time, and interpretations of the law can vary. You should always consult with a qualified legal professional for advice specific to your situation.

We disclaim all liability for actions taken or not taken based on the content of this page. If you believe any information is incorrect or outdated, please contact us, and we will review and update it where appropriate.