Best Restructuring & Insolvency Lawyers in Las Palmas de Gran Canaria

Share your needs with us, get contacted by law firms.

Free. Takes 2 min.

List of the best lawyers in Las Palmas de Gran Canaria, Spain

About Restructuring & Insolvency Law in Las Palmas de Gran Canaria, Spain

Restructuring and insolvency law in Las Palmas de Gran Canaria, Spain, is primarily designed to help businesses and individuals facing financial distress. These laws provide structured processes for dealing with overwhelming debt, whether through reorganization, negotiating with creditors, or formal insolvency proceedings. The goal is often to enable viable businesses to survive or to ensure the orderly liquidation of assets to repay creditors if recovery is not possible. Las Palmas, as a major hub in the Canary Islands, follows Spain’s national insolvency laws but also benefits from local expertise, particularly for businesses in tourism, shipping, and commerce.

Why You May Need a Lawyer

People and businesses may require legal help with restructuring and insolvency for various reasons:

- Individuals facing unmanageable personal debt or mortgage arrears

- Business owners unable to meet payments to suppliers, employees, or lenders

- Companies seeking to restructure existing debts to avoid collapse

- Creditors wishing to recover funds from insolvent debtors

- Entrepreneurs needing advice on legal protections during financial recovery

- Understanding rights and obligations under insolvency proceedings

- Dealing with cross-border insolvency issues between Spain and other territories

A lawyer can provide vital support in navigating complex legal processes, protecting your rights, and maximizing the chances of recovery or fair debt resolution.

Local Laws Overview

Restructuring and insolvency in Las Palmas de Gran Canaria operate under Spain’s national insolvency regime, known as the Concurso de Acreedores. Key aspects include:

- Concurso Voluntario: Debtors can initiate insolvency proceedings when unable to meet obligations on time.

- Concurso Necesario: Creditors may request the court to declare a debtor insolvent.

- Pre-Pack and Early Agreements: Negotiated restructuring agreements before formal insolvency, aiming for business continuity.

- Creditor Ranking: Spanish law establishes a hierarchy, with secured creditors paid before unsecured creditors.

- Clawback Actions: Suspicious transactions prior to insolvency may be reversed to protect creditor interests.

- Second Chance Mechanism: Individuals may seek debt relief under “fresh start” provisions if conditions are met.

- Local Courts: Specialized commercial courts in Las Palmas handle insolvency disputes.

Due to the international nature of many businesses in the Canary Islands, legal advice is often needed for cross-border matters or coordination between jurisdictions.

Frequently Asked Questions

What is insolvency?

Insolvency is the situation where a person or company cannot pay its debts as they become due. Spanish law defines insolvency both in terms of inability to pay and as an overall state of financial collapse.

How can restructuring help my business avoid liquidation?

Restructuring focuses on renegotiating debt terms, extending deadlines, or reducing obligations, often through a court-supervised process or private agreement with creditors. This can allow a business to continue operating and eventually return to solvency.

What is a Concurso de Acreedores?

The Concurso de Acreedores is the legal process in Spain for insolvency, where a debtor admits its inability to pay and seeks court intervention to manage debts. It includes asset assessment, creditor meetings, and potential liquidation if reorganization fails.

Can individuals file for insolvency or is it just for companies?

Both individuals and companies can file for insolvency in Spain. Individuals may benefit from debt forgiveness options if they meet specific legal requirements.

How long does the insolvency process take in Las Palmas?

The timeline can vary significantly, from a few months for straightforward cases to several years for complex insolvencies. Early legal intervention can sometimes expedite the process.

What happens to employees in a business insolvency in Spain?

Employees have preferential rights for unpaid wages and severance in insolvency proceedings. Legal protections exist to minimize losses to workers as much as possible.

Are directors personally liable in insolvency cases?

Generally, company directors are not personally liable unless there is evidence of wrongful trading, negligence, or breach of legal duties prior to insolvency.

What is the second chance law for individuals?

The “second chance” mechanism (Ley de Segunda Oportunidad) allows qualifying individuals to restructure or discharge debts, offering a route to financial recovery after insolvency.

Can foreign creditors participate in Las Palmas insolvency cases?

Yes, but they must follow Spanish law and local court processes. Cross-border insolvency regulations may apply, and specialized legal advice is recommended.

Is it possible to oppose an insolvency declaration?

Creditors or interested parties can object to an insolvency petition if they have valid grounds, such as disputing the scale of the debtor’s unpaid obligations.

Additional Resources

If you need more information or support, you may find these resources helpful:

- Commercial Courts of Las Palmas: Specialized courts responsible for insolvency proceedings in the province.

- Ilustre Colegio de Abogados de Las Palmas: The local Bar Association provides lawyer referrals and legal information.

- Official State Gazette of Spain (BOE): For updates on legislation affecting restructuring and insolvency.

- Chamber of Commerce of Gran Canaria: Offers support for businesses facing financial difficulties.

- Public Notaries: Can provide guidance on documentation required for insolvency filings.

Next Steps

If you believe you may need legal assistance with restructuring or insolvency in Las Palmas de Gran Canaria:

- Collect all relevant financial documents, including debts, assets, and contracts.

- Note any urgent deadlines or creditor actions you are facing.

- Contact a lawyer specializing in insolvency and restructuring. The Ilustre Colegio de Abogados de Las Palmas can assist with finding qualified professionals.

- Ask for an initial consultation to discuss your situation and potential options.

- Follow your lawyer’s advice closely, respond promptly to requests for information, and keep communication open with creditors where appropriate.

Taking early, informed action is critical to improving outcomes in any restructuring or insolvency scenario. Professional guidance ensures your rights are protected and you have the best chance of a positive resolution.

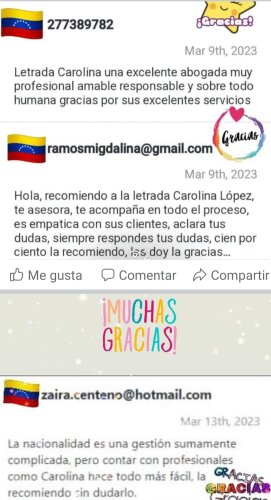

Lawzana helps you find the best lawyers and law firms in Las Palmas de Gran Canaria through a curated and pre-screened list of qualified legal professionals. Our platform offers rankings and detailed profiles of attorneys and law firms, allowing you to compare based on practice areas, including Restructuring & Insolvency, experience, and client feedback.

Each profile includes a description of the firm's areas of practice, client reviews, team members and partners, year of establishment, spoken languages, office locations, contact information, social media presence, and any published articles or resources. Most firms on our platform speak English and are experienced in both local and international legal matters.

Get a quote from top-rated law firms in Las Palmas de Gran Canaria, Spain — quickly, securely, and without unnecessary hassle.

Disclaimer:

The information provided on this page is for general informational purposes only and does not constitute legal advice. While we strive to ensure the accuracy and relevance of the content, legal information may change over time, and interpretations of the law can vary. You should always consult with a qualified legal professional for advice specific to your situation.

We disclaim all liability for actions taken or not taken based on the content of this page. If you believe any information is incorrect or outdated, please contact us, and we will review and update it where appropriate.