Best Tax Lawyers in Estonia

Share your needs with us, get contacted by law firms.

Free. Takes 2 min.

Or refine your search by selecting a city:

List of the best lawyers in Estonia

About Tax Law in Estonia

Tax law in Estonia is integral to the nation's legal framework, governing the imposition and collection of taxes across various levels of government. The Estonian tax system is relatively straightforward and transparent, focusing on a flat income tax rate and emphasizing digital solutions for tax declarations and interactions with tax authorities. Key taxes include income tax, value-added tax (VAT), corporate tax, and social tax. Estonia is often praised for its ease of doing business and streamlined tax processes, making it an attractive location for entrepreneurs and investors.

Why You May Need a Lawyer

There are several scenarios where seeking legal advice concerning tax matters in Estonia might be essential: - Startup and Corporate Setup: Navigating tax obligations when starting a business. - International Taxation: Addressing complexities of cross-border taxation and double taxation agreements. - Disputes with Tax Authorities: Handling audits, disputes, or grievances with the Estonian Tax and Customs Board. - Personal Wealth Management: Planning for inheritance, estate taxes, or optimizing personal tax liabilities. - Compliance and Reporting: Ensuring adherence to legal requirements for tax reporting and payments.

Local Laws Overview

The Estonian tax framework consists of several key components: - Personal Income Tax: Estonia employs a flat rate system for personal income tax, currently at 20%. - Corporate Income Tax: Empresas' profits are subject to a 20% tax rate on distributed profits; retained earnings are untaxed. - Value-Added Tax (VAT): The standard VAT rate is 20%, with reductions for specific goods and services. - Social Tax: Employers are liable for social tax, which funds the social security system. - Tax Treaties: Estonia has treaties to prevent double taxation with numerous countries, facilitating international business.

Frequently Asked Questions

What is the personal income tax rate in Estonia?

Estonia uses a flat-rate system where personal income is taxed at 20%.

How are corporate earnings taxed?

Estonia taxes corporate distributed profits at 20%, but undistributed profits are not taxed.

What is the VAT rate in Estonia?

The standard VAT rate is 20%, with reduced rates for certain goods and services.

Is there a capital gains tax in Estonia?

Capital gains are treated as regular income and subjected to the 20% income tax rate.

How does Estonia handle double taxation?

Estonia has numerous double taxation agreements, allowing tax credits or exemptions to alleviate double taxation burdens.

What are the tax reporting requirements for businesses?

Businesses must submit monthly VAT declarations and annual financial statements, among others, depending on their size and structure.

Are there tax incentives for foreign investors?

The digital infrastructure, e-Residency program, and untaxed reinvested profits are incentives for foreign investors.

How is the social tax calculated?

The social tax is calculated on gross salary at a rate of 33%, covering health insurance and pensions.

What penalties exist for late tax filings?

Penalties include late payment interest charges and potential audits or legal actions by tax authorities.

Can tax disputes be settled outside of court?

Yes, many tax disputes can be resolved through discussions with tax authorities or using administrative appeal procedures before resorting to courts.

Additional Resources

For more information and assistance regarding tax in Estonia, consider consulting: - Estonian Tax and Customs Board: The primary governmental body overseeing tax collection and compliance. - Ministry of Finance: Provides policy information and updates on fiscal legislation. - E-Residency Program: Offers guidance for digital entrepreneurs on starting and managing businesses in Estonia. - Local Tax Consultants: Private firms that specialize in Estonian taxation can provide personalized advice.

Next Steps

If you require legal assistance regarding tax in Estonia, take the following steps: - Assess Your Needs: Clearly define the issue or area where you require assistance. - Seek Professional Advice: Contact a tax lawyer or consultant experienced in Estonian tax law. - Prepare Documentation: Gather all relevant financial and tax-related documents to facilitate your consultation. - Explore Legal Options: Work with your advisor to explore available legal remedies or strategies to address your situation.

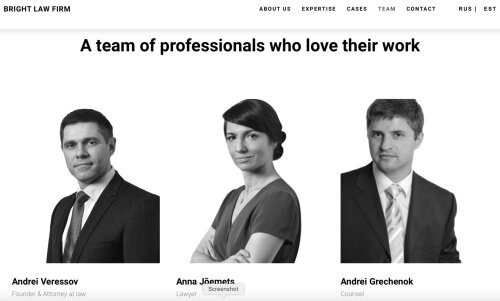

Lawzana helps you find the best lawyers and law firms in Estonia through a curated and pre-screened list of qualified legal professionals. Our platform offers rankings and detailed profiles of attorneys and law firms, allowing you to compare based on practice areas, including Tax, experience, and client feedback.

Each profile includes a description of the firm's areas of practice, client reviews, team members and partners, year of establishment, spoken languages, office locations, contact information, social media presence, and any published articles or resources. Most firms on our platform speak English and are experienced in both local and international legal matters.

Get a quote from top-rated law firms in Estonia — quickly, securely, and without unnecessary hassle.

Disclaimer:

The information provided on this page is for general informational purposes only and does not constitute legal advice. While we strive to ensure the accuracy and relevance of the content, legal information may change over time, and interpretations of the law can vary. You should always consult with a qualified legal professional for advice specific to your situation.

We disclaim all liability for actions taken or not taken based on the content of this page. If you believe any information is incorrect or outdated, please contact us, and we will review and update it where appropriate.

Browse tax law firms by city in Estonia

Refine your search by selecting a city.