Best Bad Faith Insurance Lawyers in United States

Share your needs with us, get contacted by law firms.

Free. Takes 2 min.

Or refine your search by selecting a city:

List of the best lawyers in United States

About Bad Faith Insurance Law in United States

In the United States, insurance companies have a duty to act in good faith and deal fairly with those they insure. Bad faith insurance refers to situations where an insurer unreasonably denies benefits or fails to investigate and process a claim promptly. These actions can lead to policyholders facing undue financial hardship or emotional distress. Bad faith insurance laws enable policyholders to seek compensation beyond the policy limits due to the insurer's unfair practices. Although the specifics can vary by state, the fundamental principle remains to protect consumer rights and ensure ethical behavior from insurance companies.

Why You May Need a Lawyer

Legal representation may be necessary in several scenarios involving bad faith insurance. Common situations include an outright denial of a legitimate claim, unreasonable delays in claim resolution, lowball settlements that do not cover adequate losses, failure to properly investigate a claim, and misrepresentation of policy provisions by the insurer. These situations can be complex, and the stakes are often high, making it crucial to consult a legal professional who understands the nuances of bad faith insurance laws to protect your rights and navigate the legal process effectively.

Local Laws Overview

Bad faith insurance laws can vary significantly from state to state. However, most jurisdictions recognize both first-party and third-party bad faith claims. First-party claims arise when a policyholder's own insurer acts in bad faith, while third-party claims involve an insurer's conduct regarding a claim brought against the insured by another party. Important aspects of local laws include statutes of limitations for filing claims, the availability of punitive damages, and the need to demonstrate that the insurer acted with knowledge or reckless disregard for the rights of the insured. It is essential to consult the specific laws in your state as they relate to bad faith actions and available remedies.

Frequently Asked Questions

What is a bad faith insurance claim?

A bad faith insurance claim arises when an insurer unfairly denies benefits, delays payment, or otherwise fails to fulfill its contractual obligations to the policyholder.

How can I recognize bad faith insurance practices?

Signs include unjust claim denial, inadequate claim investigation, delayed payment, misleading representations, and unreasonable claim settlement offers.

Are there federal bad faith laws in the United States?

There is no specific federal bad faith insurance law; such claims are governed by state laws and regulations, which can vary.

Can I sue my insurance company for bad faith?

Yes, if you believe your insurer has acted in bad faith, you may file a lawsuit seeking damages for losses and possibly punitive damages.

What damages can I recover in a bad faith claim?

Damages can include the amount owed under the policy, additional financial losses, emotional distress, legal fees, and possibly punitive damages.

How long do I have to file a bad faith insurance claim?

Time limits, known as statutes of limitations, vary by state, typically ranging from two to six years after discovering the bad faith actions.

Does a denied claim always mean bad faith?

No, a claim denial isn't automatically bad faith. The denial must be unreasonable or unjustified given the policy terms and circumstances.

Can I handle a bad faith insurance claim without a lawyer?

While it's possible, due to legal complexities and potential for significant financial implications, consulting a lawyer is advisable.

What should I do if I suspect bad faith from my insurer?

Document every interaction with the insurance company, gather evidence, and consult with an attorney experienced in bad faith insurance claims.

What is the difference between first-party and third-party bad faith claims?

First-party claims involve a policyholder's direct issues with their insurer. Third-party claims involve disputes concerning the insurer's handling of claims from others against the insured.

Additional Resources

Consider consulting resources like the National Association of Insurance Commissioners (NAIC), your state's insurance department, or consumer protection agencies. Legal aid organizations and bar associations can also offer valuable assistance or referrals to experienced attorneys.

Next Steps

If you need legal assistance with bad faith insurance, start by gathering all relevant documentation related to your insurance policy and communications with the insurer. Conduct research to understand your state's specific laws on bad faith insurance. Contact a lawyer specializing in bad faith insurance claims to evaluate your case and guide you through the legal process. An experienced attorney can help ensure your rights are protected and work towards achieving a fair resolution.

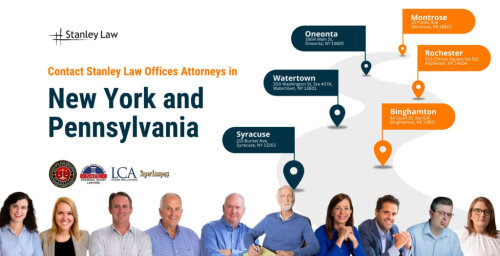

Lawzana helps you find the best lawyers and law firms in United States through a curated and pre-screened list of qualified legal professionals. Our platform offers rankings and detailed profiles of attorneys and law firms, allowing you to compare based on practice areas, including Bad Faith Insurance, experience, and client feedback.

Each profile includes a description of the firm's areas of practice, client reviews, team members and partners, year of establishment, spoken languages, office locations, contact information, social media presence, and any published articles or resources. Most firms on our platform speak English and are experienced in both local and international legal matters.

Get a quote from top-rated law firms in United States — quickly, securely, and without unnecessary hassle.

Disclaimer:

The information provided on this page is for general informational purposes only and does not constitute legal advice. While we strive to ensure the accuracy and relevance of the content, legal information may change over time, and interpretations of the law can vary. You should always consult with a qualified legal professional for advice specific to your situation.

We disclaim all liability for actions taken or not taken based on the content of this page. If you believe any information is incorrect or outdated, please contact us, and we will review and update it where appropriate.

Browse bad faith insurance law firms by state in United States

Refine your search by selecting a state.