- Digital Compliance: The Digital Work Card (Ergani II) is now mandatory for most Greek sectors, requiring real-time reporting of working hours to avoid heavy fines.

- Probationary Limits: New legislation has reduced the maximum probationary period from 12 months to 6 months, impacting how firms evaluate new hires.

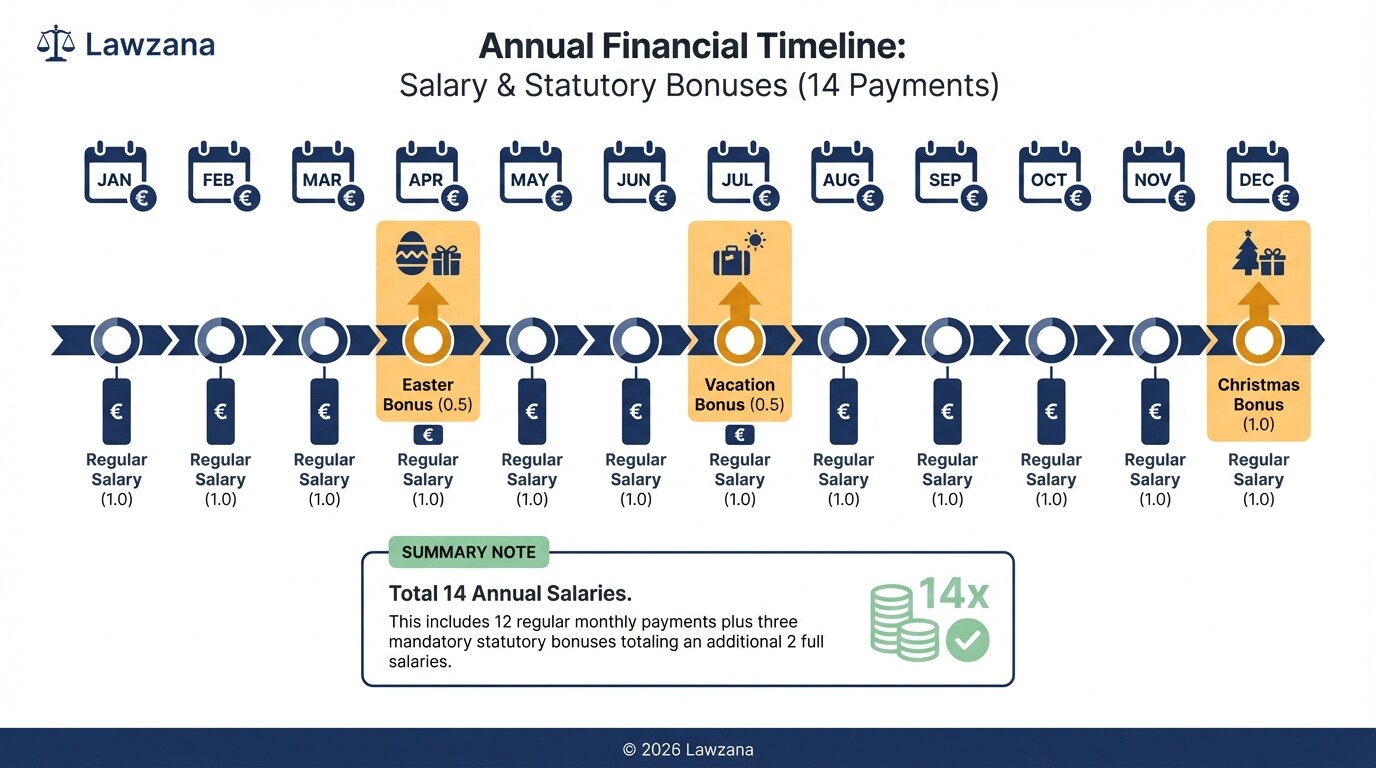

- Mandatory Bonuses: Greek private sector employees are legally entitled to 14 salaries per year (Christmas, Easter, and Vacation bonuses), which must be factored into total compensation costs.

- Remote Work Obligations: Employers are legally required to cover the costs of equipment and maintenance for remote employees and must respect the "right to disconnect."

- Termination Nuances: Notice periods significantly reduce severance costs, but failure to follow strict procedural steps in the Ergani system can void a termination.

How Does the Digital Work Card System Affect Greek Employment Contracts?

The Digital Work Card system, integrated with the Ergani II platform, requires employers to record the exact start and end times of work in real-time. This system is designed to prevent unpaid overtime and ensure compliance with statutory rest periods. For international firms, this means your contracts must explicitly reference the employee's obligation to use the digital card and adhere to the recorded schedule.

Failing to implement or monitor the Digital Work Card can lead to administrative fines of up to €10,500 per employee. To ensure compliance, international firms should:

- Update Internal Policies: Clearly state in the employment handbook that failing to "clock in" or "clock out" is a breach of contract.

- Sync Global HR Systems: Ensure that internal time-tracking software is compatible with or feeds accurately into the Greek Ministry of Labour and Social Affairs Ergani II portal.

- Monitor Overtime: Any discrepancy between the contractually agreed hours and the digital logs will automatically trigger a red flag for labor inspectors.

Why is the Classification of Fixed-Term vs. Open-Ended Contracts Critical?

In Greece, the open-ended (permanent) contract is the legal default, while fixed-term contracts are strictly regulated and require an "objective reason" for their duration. If a firm uses successive fixed-term contracts without a valid legal justification, the Greek courts will automatically reclassify the relationship as an open-ended contract, granting the employee full seniority and severance rights.

To avoid the risk of "deemed permanent" status, firms must understand these restrictions:

- Objective Justification: You must state why the contract is temporary (e.g., a specific project, replacement of an employee on maternity leave, or seasonal demand).

- The 36-Month Rule: Successive fixed-term contracts cannot exceed a total duration of 36 months.

- The "Three-Contract" Limit: If you renew a fixed-term contract more than twice within a three-year period, it is presumed to be covering "constant and permanent needs," triggering a reclassification to an open-ended status.

| Feature | Fixed-Term Contract | Open-Ended Contract |

|---|---|---|

| End Date | Specified in the document | Indefinite |

| Severance | Generally not required at expiry | Required based on years of service |

| Justification | Must have an "objective reason" | None required for the contract type |

| Notice Period | Not applicable | Required to reduce severance costs |

What are the Legal Limits for Probationary Periods in Greece?

Under recent labor law reforms (Law 5053/2023), the maximum duration for a probationary period in Greece has been shortened to six months. During this window, an employer can terminate the contract if the employee is found unsuitable for the role, though the specific notice requirements and severance rules still apply depending on the total length of the relationship.

International firms frequently make the mistake of using the old 12-month standard found in older templates. Key points to remember include:

- Contractual Clarity: The probationary period must be explicitly written in the contract; it is not "implied" by law.

- Termination during Probation: While the first 12 months of employment generally do not require severance pay in Greece, the probationary period specifically refers to the time during which the employer evaluates the employee's skills.

- Successive Probation: You cannot subject an employee to a new probationary period if they are promoted or change roles within the same company, provided the new role requires similar skills.

What Must be Included in Remote Work and 'Right to Disconnect' Clauses?

Greek Law 4808/2021 mandates that remote work (telework) must be mutually agreed upon and documented in writing, covering specific cost-reimbursement obligations. Furthermore, employees have a legally protected "right to disconnect," meaning they are prohibited from performing work or communicating via digital tools outside of their established working hours.

When drafting contracts for remote staff in Greece, firms must include:

- Cost Coverage: The employer is legally obligated to cover the costs of telecommunications, equipment maintenance, and a portion of the employee's home utility expenses. These amounts are often set by Ministerial Decisions and are currently non-taxable for the employee.

- Right to Disconnect: The contract must state that the employee will not be penalized for failing to respond to emails or calls outside of work hours.

- Data Privacy: Specific clauses must outline how the company's data will be protected in a home office environment, compliant with both Greek law and GDPR.

How are Severance and Notice Periods Calculated Under Greek Law?

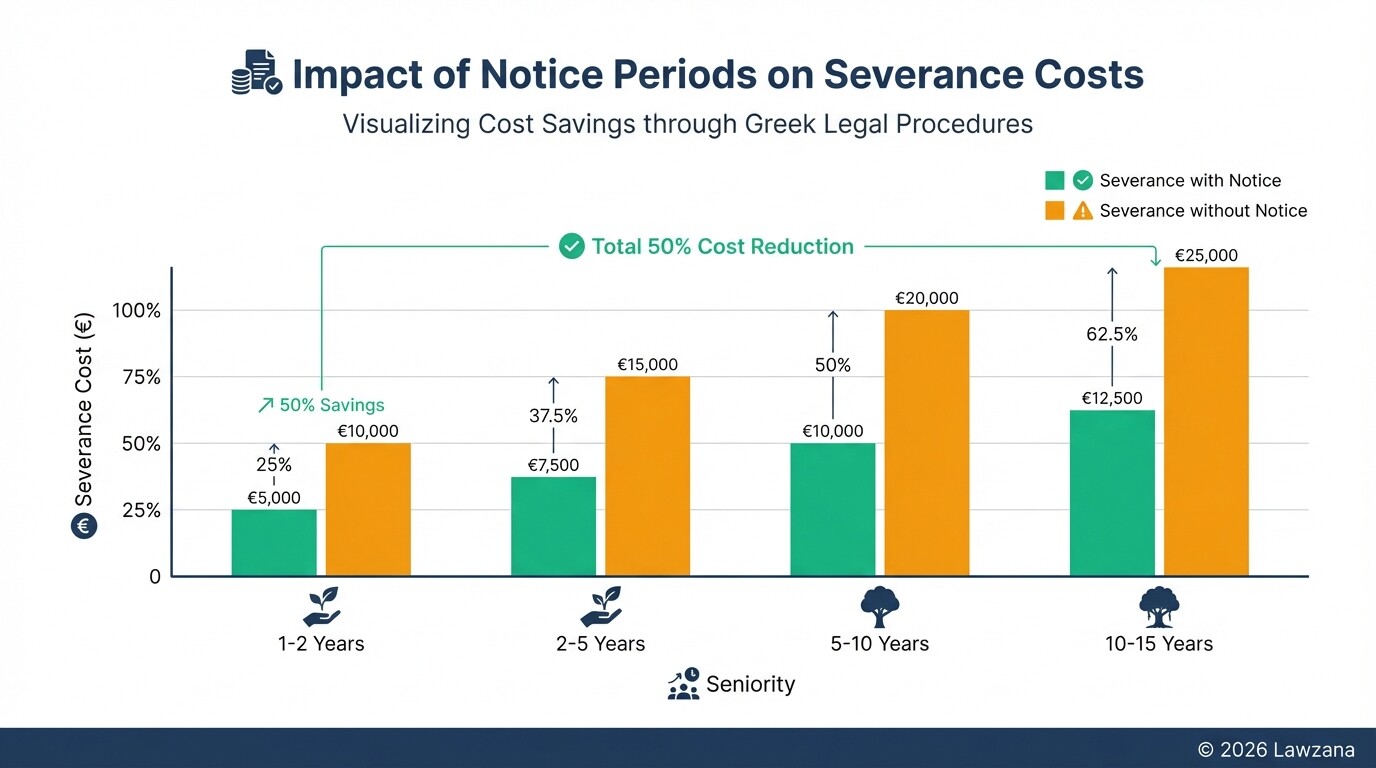

Severance pay in Greece is calculated based on the employee's length of service and their monthly salary, including the prorated value of the 13th and 14th salaries. A critical "pro-tip" for international firms is that providing formal written notice of termination reduces the required severance payment by 50%.

The following table outlines the statutory notice periods and severance requirements for white-collar employees:

| Years of Service | Notice Period | Severance (With Notice) | Severance (No Notice) |

|---|---|---|---|

| 1 - 2 years | 1 month | 1 month's pay | 2 months' pay |

| 2 - 5 years | 2 months | 1.5 months' pay | 3 months' pay |

| 5 - 10 years | 3 months | 3 months' pay | 6 months' pay |

| 10 - 15 years | 4 months | 4 months' pay | 8 months' pay |

Common Calculation Mistake: Many foreign firms calculate severance based on 12 months of pay. In Greece, you must use the "annualized monthly salary," which is (Monthly Salary x 14) / 12.

Common Misconceptions About Greek Employment Law

"At-Will" Employment Exists in Greece

Unlike many US jurisdictions, Greece does not have "at-will" employment. Terminating an employee requires a formal process, the payment of statutory severance (after the first year), and, in some cases, a justifiable reason to avoid "abuse of right" claims under Article 281 of the Civil Code.

Bonuses are Discretionary

While "performance bonuses" can be discretionary, the 13th and 14th-month salaries (Christmas, Easter, and Vacation allowances) are mandatory by law in the private sector. You cannot "contract out" of these payments.

English-Only Contracts are Sufficient

While you can sign a contract in English for internal purposes, the Greek Labor Inspectorate and the Ergani system require filings in Greek. It is standard practice to use a dual-column (Greek/English) format to ensure the document is legally enforceable in local courts.

FAQ

Is the 13th and 14th-month salary mandatory for all employees?

Yes, in the Greek private sector, these "bonuses" are legal requirements. The Christmas bonus is a full month's salary, the Easter bonus is half a month, and the Vacation bonus is half a month.

What is the standard workweek in Greece?

The standard workweek is 40 hours. While employees can work up to 48 hours (including overtime), anything beyond 40 hours triggers mandatory overtime pay premiums ranging from 20% to 120% depending on the circumstances.

Can I terminate an employee for poor performance without severance?

Only if they have been employed for less than 12 months. After one year of service, severance is mandatory regardless of performance, unless the termination is for "serious cause" (e.g., criminal activity), which is very difficult to prove in court.

Do I need a local entity to hire someone in Greece?

While there are "Employer of Record" (EOR) options, if you are hiring directly, you generally need a Greek tax ID (AFM) and must be registered with the Unified Social Security Fund (EFKA).

When to Hire a Lawyer

You should consult a Greek employment law specialist if:

- You are transitioning a large team to the Digital Work Card system for the first time.

- You need to terminate an employee who has more than 12 months of seniority.

- You are drafting a contract for a Managing Director or high-level executive (special rules apply).

- You are involved in a collective redundancy (terminating more than a certain percentage of your workforce).

Next Steps

- Audit Your Templates: Review your current employment contracts to ensure the probationary period is no longer than six months.

- Review Payroll: Ensure your budget accounts for 14 monthly salaries, not 12.

- Register for Ergani II: If you haven't already, ensure your local HR representative has set up the Digital Work Card tracking for all Greek-based staff.

- Draft a Remote Work Addendum: Update your contracts with specific language regarding equipment costs and the right to disconnect to comply with Law 4808/2021.