- Non-resident heirs have 12 months from the date of death (or the date a will is probated) to file an inheritance tax return in Greece.

- Greek law enforces "forced heirship," which guarantees a portion of the estate to close family members regardless of the contents of a will.

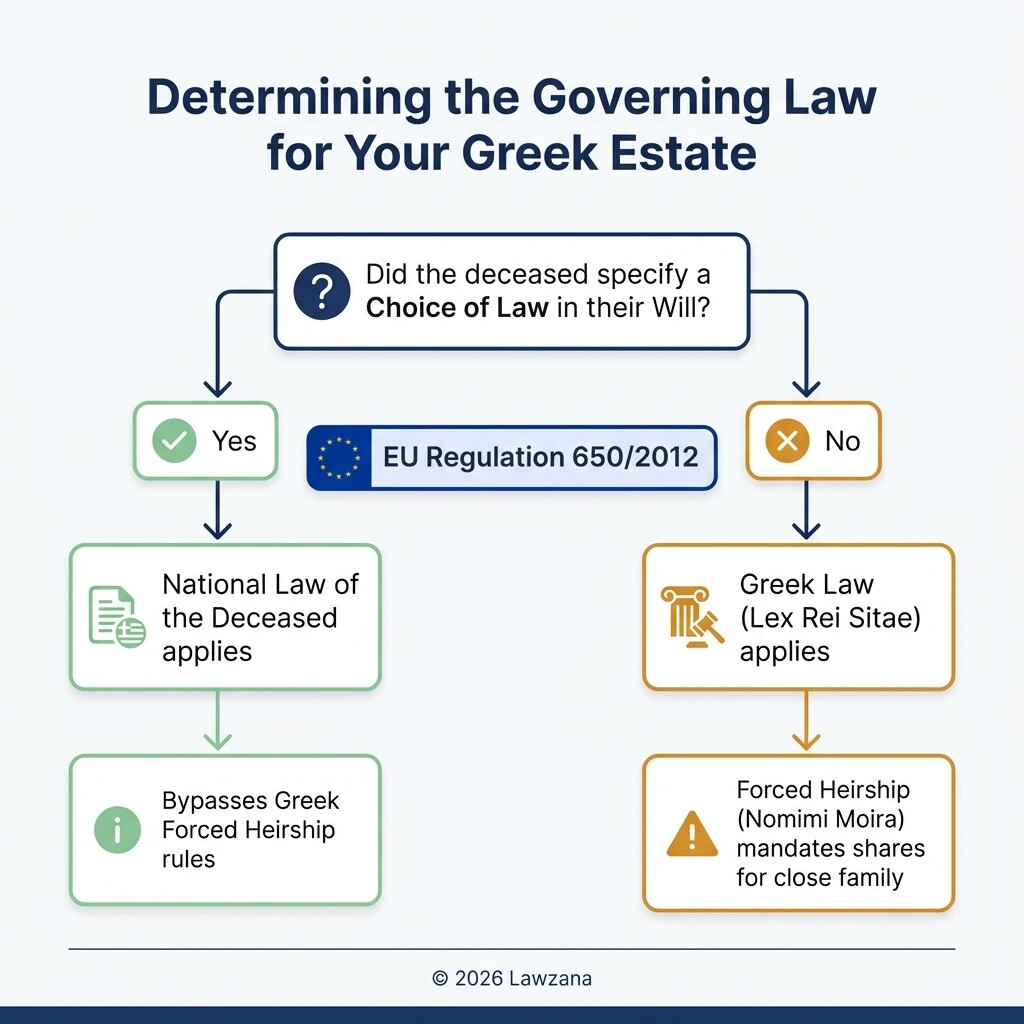

- Under EU Regulation 650/2012, non-residents can choose the law of their nationality to govern their Greek estate, potentially bypassing Greek forced heirship rules.

- Inheriting property in Greece requires a formal "Acceptance of Inheritance" act before a notary; ownership is not automatically transferred by a will alone.

- Renouncing an inheritance must be done within one year for those residing abroad to avoid inheriting the deceased's debts.

Checklist for Non-Resident Heirs of Greek Property

Inheriting property in Greece involves a specific sequence of legal and administrative steps. Use this checklist to ensure you meet all regulatory requirements and secure your title to the assets.

- Obtain the Death Certificate: If the death occurred outside Greece, the certificate must be translated and bear an Apostille stamp.

- Search for a Will: Check both the local courts in the deceased's country and the National Registry of Wills in Athens.

- Obtain a Greek Tax ID (AFM): Every heir must have a Greek tax identification number to process any inheritance documents.

- Appoint a Tax Representative: Non-residents are required to appoint a resident of Greece to act as their point of contact for the tax authorities.

- Gather Property Documents: Collect the previous title deeds, topography plans, and certificates from the Land Registry or Cadastre (Ktimatologio).

- File the Inheritance Tax Return: Submit this to the Tax Office for Foreign Residents within 12 months of the death.

- Execute the Act of Acceptance: Sign the formal "Acceptance of Inheritance" (Apodochi Klironomias) before a Greek Notary.

- Register the Deed: Submit the notarized act to the Land Registry (Ypothikofylakeio) or the Hellenic Cadastre to finalize legal ownership.

Understanding Forced Heirship in Greece

Greek law protects immediate family members through a concept known as "forced heirship" (nomimi moira). This legal framework ensures that children, spouses, and sometimes parents receive a minimum portion of the estate, even if they were intentionally excluded from a will.

Under the Greek Civil Code, forced heirs are entitled to half of the share they would have received if the deceased had died without a will (intestate). For example, if a child would have inherited 100% of a property under intestacy laws, their forced share would be 50%. If a will attempts to leave the entire property to a third party or a charity, the forced heirs can legally challenge the will to claim their mandatory portion.

To plan around this, property owners often use specific testamentary strategies. One common method is making lifetime gifts (donations), though these can sometimes be "called back" into the estate calculation if they were made to defeat forced heirship rights. The most effective tool for non-residents, however, is the "Choice of Law" provision under European regulations.

Choosing Which Country's Law Applies to Your Greek Estate

EU Regulation 650/2012 (Succession Regulation) allows individuals to choose the law of their nationality to govern the succession of their entire estate, including real estate located in Greece. This is a critical tool for non-resident owners from countries like the United States or the United Kingdom, where "testamentary freedom" allows individuals to leave their assets to whomever they choose.

To exercise this right, you must explicitly state in your will that you want the law of your nationality to apply to your estate. If you do not make this choice, Greek law will generally apply to any real estate you own in Greece because it is the "lex rei sitae" (law of the place where the property is situated). By choosing your national law, you can effectively bypass Greek forced heirship rules, ensuring your Greek property is distributed according to your specific wishes rather than the default mandates of the Greek Civil Code.

Deadlines for Filing Inheritance Tax Returns

In Greece, the inheritance tax return (Dilosi Forou Klironomias) is a mandatory filing that informs the state of the value of the assets being transferred. For heirs residing outside of Greece, the law provides a 12-month window to file this return, starting from the date of death or the date the will was probated.

Failure to meet this deadline results in monthly penalties and interest. The tax return must be filed with the Tax Office for Foreign Residents (DOY Katoikon Exoterikou). It is important to note that the "taxable value" of the property is often based on the "Objective Value" system-a government-calculated value used for tax purposes-rather than the current market price.

| Relationship Category | Tax-Exempt Threshold | Tax Rates (Above Threshold) |

|---|---|---|

| Category A (Spouse, Children, Parents) | €150,000 (Exemption up to €800,000 for close family) | 1% - 10% |

| Category B (Grandchildren, Siblings, Nieces/Nephews) | €30,000 | 5% - 20% |

| Category C (Other relatives, Non-relatives) | €6,000 | 20% - 40% |

The Process of Accepting or Renouncing an Inheritance

Accepting an inheritance in Greece is an active process; you do not become the legal owner of real estate simply by being named in a will. The heir must sign a formal "Acceptance of Inheritance" deed before a notary and subsequently register it.

However, if the deceased had significant debts, an heir may choose to renounce the inheritance. In Greece, you inherit both assets and liabilities. If the debts exceed the value of the property, renunciation is the only way to protect your personal assets. Non-residents must file a declaration of renunciation with the competent Greek court within one year of learning about their right to inherit. If you miss this deadline, you are legally deemed to have accepted the inheritance, including all associated debts.

Navigating the Certificate of Inheritance for Cross-Border Estates

The Certificate of Inheritance (Kleronomitirio) is a legal document issued by a Greek court that officially confirms the identity of the heirs and their respective shares of the estate. This document is often required by Greek banks to release funds or by the Land Registry when the inheritance involves complex family trees or foreign wills.

For estates involving multiple EU countries, the European Certificate of Succession (ECS) can be used. The ECS is designed to simplify the process of proving your status as an heir across borders without needing separate national documents in every country. If you are a non-resident heir, obtaining either a Greek Kleronomitirio or an ECS is a vital step in demonstrating your legal authority to manage and dispose of Greek assets, especially when dealing with conservative financial institutions.

Common Misconceptions

- "I automatically own the house because it's in the will." In Greece, a will is only a "title of acquisition." To become the legal owner, you must perform a formal "Acceptance of Inheritance" through a notary and register that act with the Land Registry.

- "I don't need to pay tax if the property is worth less than the market price." Greek inheritance tax is calculated on the "Objective Value," which is a state-determined figure. Even if no tax is due because of exemptions, you are still legally required to file a tax return.

- "My US/UK will isn't valid in Greece." Foreign wills are generally valid in Greece if they meet the legal requirements of the country where they were signed. However, they must be officially translated and usually require a "probate" equivalent process in Greece to be recognized by the Land Registry.

How much does it cost to inherit property in Greece?

The total cost typically ranges from 3% to 5% of the property's objective value. This includes notary fees (approx. 1% plus VAT), Land Registry fees (approx. 0.5% to 0.8%), and legal fees for the required due diligence and filing of tax returns.

Can I sell the inherited property immediately?

You can only sell the property after you have completed the "Acceptance of Inheritance" and registered the deed in your name. You must also obtain a "Tax Clearance Certificate" showing that all inheritance taxes have been paid in full before the sale can proceed.

What happens if there is no will?

If there is no will, Greek "Intestate Succession" laws apply. The estate is divided among the surviving spouse and relatives in specific "ranks." For example, the spouse receives 25% and the children share the remaining 75% in equal parts.

When to Hire a Lawyer

Navigating the Greek bureaucratic system is notoriously difficult for non-residents due to the language barrier and the complexity of the Land Registry (Ktimatologio). You should hire a lawyer if:

- You are an heir residing outside of Greece and cannot attend notary appointments in person.

- The estate involves significant debts or multiple heirs with conflicting interests.

- You wish to utilize EU Regulation 650/2012 to apply foreign law to the estate.

- The property has technical issues, such as unauthorized constructions that need to be "legalized" before the transfer.

Next Steps

- Secure the Property: Ensure that any Greek real estate is physically secure and that local municipal taxes (TAP) are being paid.

- Consult a Specialist: Contact a Greek lawyer specializing in cross-border succession to review your specific situation and the validity of any existing wills.

- Issue a Power of Attorney (PoA): To avoid frequent travel to Greece, you can sign a PoA at a Greek Consulate in your home country, allowing your lawyer to handle tax filings and the acceptance of inheritance on your behalf.

- Gather Vital Records: Start collecting birth, marriage, and death certificates, ensuring they are Apostilled for use in Greece.