Navigating the legal landscape of India's startup ecosystem requires a proactive approach to mitigate risks before they escalate. From formalizing founder relationships to maintaining rigorous regulatory compliance, a solid legal foundation ensures that your business is ready for venture capital investment and long-term growth.

What are the key founder and shareholder documents every Indian startup should have?

Indian startups must prioritize a Founder's Agreement and a Shareholders' Agreement (SHA) to define ownership, voting rights, and exit strategies. These documents serve as the internal constitution of the company, preventing disputes over equity split, roles, and decision-making power during critical growth phases.

Beyond the basic Memorandum of Association (MoA) and Articles of Association (AoA) required for incorporation, you should secure the following:

- Founder's Agreement: This should detail the initial capital contribution, roles and responsibilities, and a "vesting schedule" (typically four years with a one-year cliff) to ensure founders earn their equity over time.

- Shareholders' Agreement (SHA): Essential when onboarding investors, this covers:

- Right of First Refusal (ROFR): Prevents founders from selling shares to outsiders without offering them to existing shareholders first.

- Tag-Along and Drag-Along Rights: Protects minority shareholders during a sale and allows majority shareholders to force a sale if a lucrative exit arises.

- Pre-emptive Rights: Allows existing shareholders to maintain their ownership percentage during future funding rounds.

- Intellectual Property (IP) Assignment Agreement: This ensures that all code, designs, and branding created by the founders before and after incorporation belong to the company entity, not the individuals.

Which document takes precedence if there is a conflict?

In India, it is standard practice to amend the Articles of Association (AoA) to reflect the terms of the SHA. If the SHA and AoA conflict, the AoA generally prevails in the eyes of the law, so aligning them is a critical step for your legal counsel.

What are the essential clauses in Indian vendor, customer, and employment contracts?

Contracts in India should focus on clarity regarding liability, intellectual property, and termination triggers to avoid the ambiguities of the Indian Contract Act, 1872. Well-drafted clauses act as a shield, ensuring that business disruptions do not lead to catastrophic financial losses.

Employment Contracts

Under Indian law, "At-will" employment is not a standard legal concept; therefore, notice periods and termination for cause must be explicitly defined.

- IP Ownership: Explicitly state that all work produced is a "work for hire" owned by the company.

- Non-Compete and Non-Solicitation: Note that post-employment non-compete clauses are generally difficult to enforce in India under Section 27 of the Contract Act, but non-solicitation of clients and employees remains enforceable.

- Confidentiality (NDA): Protect proprietary data and trade secrets with robust non-disclosure obligations.

Vendor and Customer Agreements

To protect your cash flow and operations, ensure these three clauses are included:

- Limitation of Liability: Cap your total financial exposure to a specific amount (e.g., the total fees paid in the last 12 months) to prevent unlimited damage claims.

- Indemnification: Require vendors to compensate you if their products or services violate a third party's IP or cause a regulatory breach.

- Force Majeure: Specifically include "pandemics" or "government-mandated lockdowns" to protect against non-performance during unforeseen systemic disruptions.

What are the common compliance mistakes under Indian corporate and competition laws?

The most frequent compliance mistakes for Indian startups involve missing mandatory filings with the Registrar of Companies (ROC) and failing to adhere to Goods and Services Tax (GST) timelines. Overlooking these tasks can lead to the "Strike Off" of your company name or the freezing of your corporate bank accounts.

Common Pitfalls to Avoid:

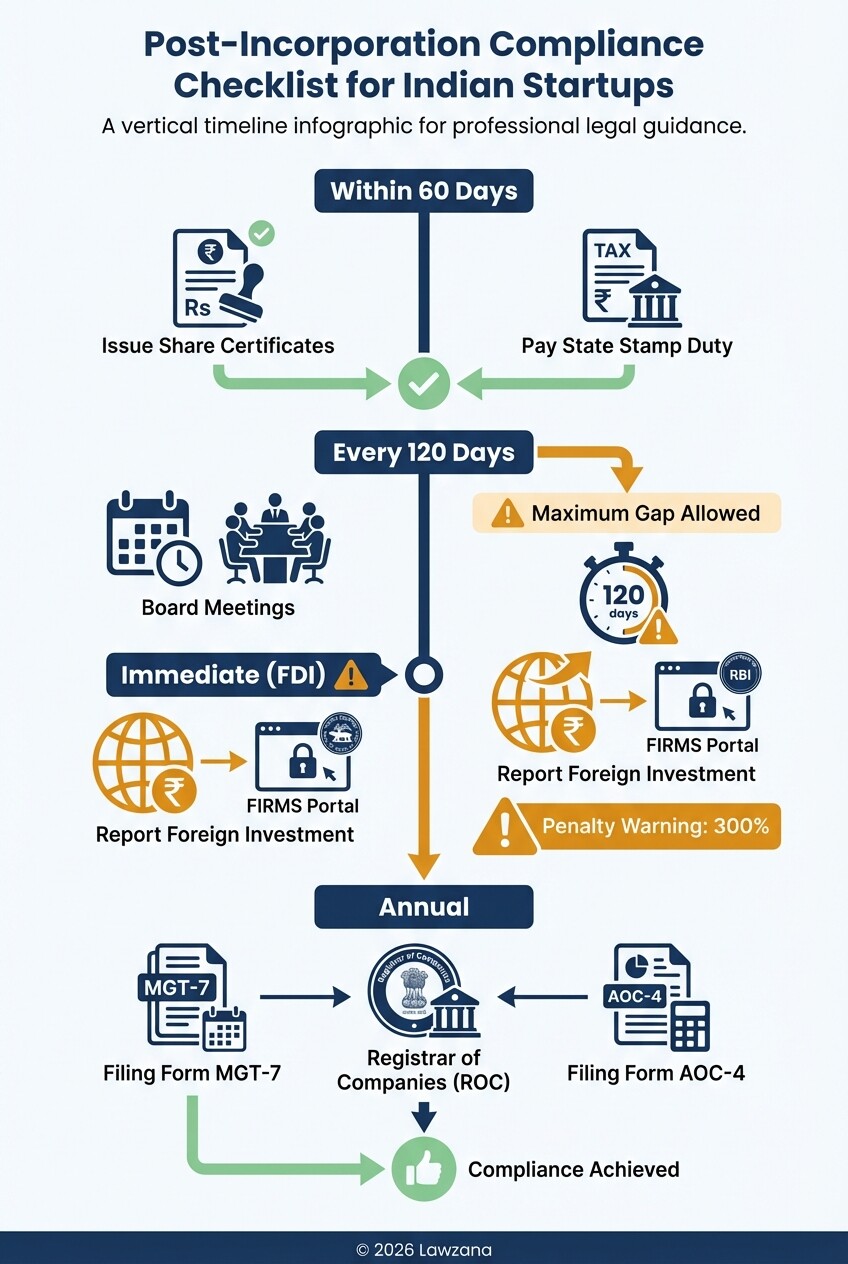

- Failure to Issue Share Certificates: Companies must issue share certificates within 60 days of allotment and pay the required stamp duty to the state government.

- Incomplete Board Meetings: Under the Companies Act, 2013, startups must hold at least four board meetings a year, with a gap of no more than 120 days between them (though "Small Companies" have relaxed requirements).

- Ignoring FEMA Regulations: If you receive foreign investment (FDI), you must report it to the Reserve Bank of India (RBI) via the FIRMS portal within strict timelines. Failure to do so can result in penalties of up to 300% of the amount involved.

- Competition Law Overlook: Startups with significant market share or those engaging in "predatory pricing" must ensure they do not violate the Competition Act, 2002, which prohibits anti-competitive agreements.

You can verify your company's filing status and search for compliance requirements on the official Ministry of Corporate Affairs portal.

How should you handle a legal notice or threatened lawsuit from a business partner?

When you receive a legal notice in India, the first step is to stay calm and verify the "Period of Limitation," which is usually three years for contractual disputes. A legal notice is a formal communication demanding a specific action; ignoring it often leads the court to assume the allegations are true.

Step-by-Step Response Strategy:

- Acknowledge and Review: Confirm receipt but do not admit to any claims immediately. Review the contract's "Dispute Resolution" clause to see where and how disputes must be handled.

- Preserve Evidence: Save all emails, WhatsApp chats, and invoices related to the claim. In India, digital evidence is admissible under the Information Technology Act.

- Draft a Detailed Reply: Hire a lawyer to draft a "Reply to Legal Notice" within the timeframe mentioned (usually 15 or 30 days). A strong, fact-based rebuttal can often prevent the matter from ever reaching a courtroom.

- Explore Settlement: Most commercial disputes in India are settled through negotiation. Proposing a "Without Prejudice" settlement can save years of litigation costs.

When should you consider arbitration or mediation instead of going to court?

Arbitration and mediation are highly recommended for Indian startups because the traditional court system can take 10 to 20 years to resolve a commercial dispute. The Arbitration and Conciliation Act, 1996, provides a framework that allows businesses to resolve conflicts in months rather than decades.

Choosing Arbitration

- Speed: Modern Indian arbitration laws mandate that awards should be passed within 12 to 18 months.

- Confidentiality: Unlike court proceedings, arbitration is private, protecting your startup's reputation.

- Expertise: You can choose an arbitrator with specific technical or industry expertise, which a general judge might lack.

Choosing Mediation

Mediation is a voluntary, non-binding process where a neutral third party helps both sides reach a compromise. It is ideal for preserving relationships with long-term vendors or co-founders where a win-win outcome is more valuable than a legal victory.

| Feature | Litigation (Court) | Arbitration | Mediation |

|---|---|---|---|

| Duration | 10+ Years | 1-2 Years | Days to Weeks |

| Cost | High (long term) | Moderate to High | Low |

| Control | None (Judge decides) | High (Party-driven) | Maximum (Parties decide) |

| Publicity | Public Record | Private | Private |

Common Misconceptions about Indian Startup Law

- "A Founder's Agreement isn't necessary if we are friends." Professional relationships change under the pressure of scaling or financial stress. Without a written agreement, a departing founder could legally freeze your company's operations or claim equity they didn't earn.

- "IP ownership is automatic if I pay the developer." In India, unless there is a written contract stating the IP is assigned to the company, the individual creator often retains "Moral Rights" or even legal ownership. Always get it in writing.

- "Registrar filings can wait until we raise money." Late filing fees under the MCA accrue daily. Furthermore, investors will conduct a "Legal Due Diligence" and any history of non-compliance can kill your funding round or significantly lower your valuation.

Frequently Asked Questions

What is the cost of incorporating a private limited company in India?

Incorporation costs typically range from ₹15,000 to ₹40,000 (roughly $180 to $480 USD), including professional fees, name reservation, and government stamp duty, which varies by state and authorized capital.

Can an Indian startup have a foreign director?

Yes, a private limited company can have a foreign director, but at least one director must be a resident of India (stayed in India for at least 182 days in the previous financial year).

How do I protect my brand name in India?

You should apply for a Trademark (TM) under the Trade Marks Act, 1999. Registration with the Controller General of Patents, Designs and Trade Marks provides nationwide protection and the right to use the ® symbol.

When to Hire a Lawyer

While DIY templates are tempting, you should hire an Indian corporate lawyer when:

- You are drafting your first Shareholders' Agreement with external investors.

- You are receiving a legal notice regarding intellectual property infringement or breach of contract.

- You are structuring "Employee Stock Option Plans" (ESOPs), as these have complex tax implications under the Income Tax Act.

- You are expanding operations internationally and need to comply with "Transfer Pricing" and FEMA rules.

Next Steps

- Audit your current contracts: Ensure every employee and contractor has signed an IP assignment clause.

- Check your MCA status: Visit the MCA portal to ensure all annual returns and "DIR-3 KYC" filings for directors are up to date.

- Draft a Standard Terms of Service: If you operate a platform, ensure your website has localized Terms of Service and a Privacy Policy compliant with India's Digital Personal Data Protection (DPDP) Act.

- Consult a Professional: Schedule a consultation with a corporate lawyer to review your Founder's Agreement before your first major hire or funding round.