- Italian exporters must comply with Regulation (EU) 2021/821, which governs "dual-use" items that can be used for both civilian and military purposes.

- The primary regulatory authority in Italy is UAMA (Unità per le Autorizzazioni degli Armamenti Materiali), located within the Ministry of Foreign Affairs and International Cooperation.

- Directors of Italian companies face personal criminal liability, including potential imprisonment and fines up to €250,000, for violating export controls.

- Effective compliance requires a robust "Internal Compliance Program" (ICP) to screen both the end-user and the final destination of goods.

- Sanctions-proof clauses in international contracts are essential to allow for legal termination or suspension of delivery if new trade restrictions emerge.

How do you identify prohibited dual-use goods under EU regulations?

Prohibited or restricted dual-use goods are items, software, and technology that can be used for both civil and military applications. In Italy, these are primarily identified through Annex I of Regulation (EU) 2021/821, which lists specific categories ranging from electronics and sensors to aerospace and nuclear materials. If your product meets the technical specifications listed in this annex, you must obtain an export authorization before shipping it outside the European Union.

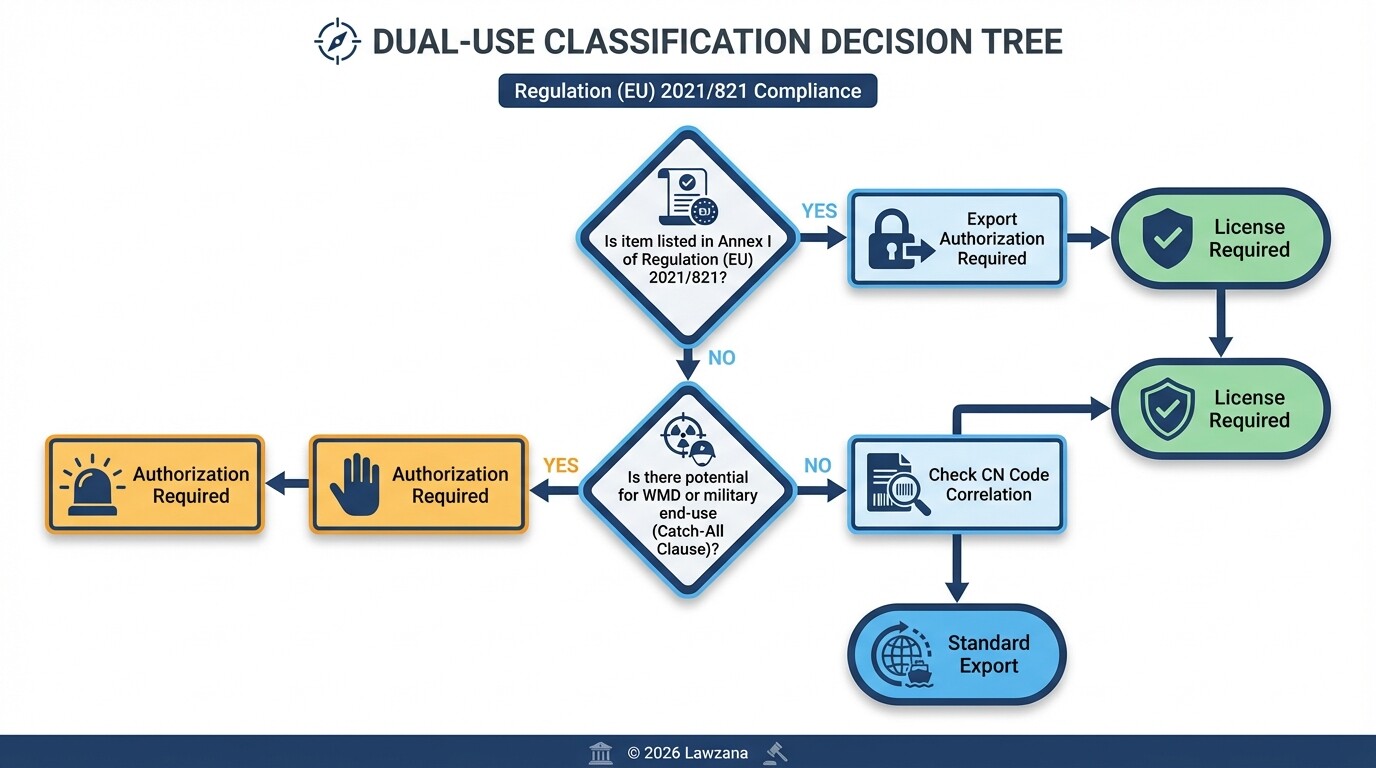

To determine if your goods are controlled, you should follow this classification process:

- Technical Assessment: Compare your product's specifications against the ten categories in the EU Dual-Use List (e.g., Category 3 for electronics, Category 5 for telecommunications).

- The "Catch-All" Clause: Even if a product is not explicitly listed in Annex I, Italian authorities may require a license if there is reason to believe the items are intended for chemical, biological, or nuclear weapons or for military end-use in an embargoed country.

- Consulting the CN Codes: Cross-reference your Combined Nomenclature (CN) codes with the EU correlation tables to see if your tariff code is flagged for potential export restrictions.

- Software and Technology: Remember that dual-use controls apply to the transfer of intangible technology via email, cloud access, or technical assistance, not just physical hardware.

How should Italian firms implement effective Know Your Customer (KYC) protocols?

Effective KYC protocols for Italian exporters involve a multi-layered screening process designed to ensure that the recipient of the goods is not a sanctioned entity and the intended use is legitimate. This process, often part of an Internal Compliance Program (ICP), requires verifying the identity of the customer, the beneficial owners, and the ultimate end-user. Because Italy's export-heavy economy is a prime target for "diversion" schemes, your KYC must look beyond the immediate buyer.

A standard KYC checklist for Italian exporters should include:

- Sanctioned Party Screening: Use automated tools to check all parties against the EU Consolidated Financial Sanctions List and the U.S. OFAC lists (if there is a U.S. nexus).

- End-User Statement (EUS): Require a formal, signed document from the final recipient detailing exactly what the product will be used for and promising not to re-export it to restricted regions.

- Red Flag Identification: Train sales teams to spot suspicious behavior, such as a customer who is reluctant to provide end-use information or a small trading company ordering advanced industrial machinery.

- Beneficial Ownership Check: Investigate who owns or controls your customer; sanctions apply if a prohibited person owns 50% or more of the entity, even if the entity itself is not listed.

What are the legal consequences of sanctions violations for Italian directors?

Directors of Italian companies face severe administrative and criminal penalties for violating export controls and international sanctions under Legislative Decree No. 221/2017. Unlike some jurisdictions where only the corporate entity is fined, Italian law emphasizes individual accountability. If a company exports restricted goods without a license or violates an EU restrictive measure, the "legal representative" or the director with delegated powers is often held personally liable.

The specific penalties in Italy include:

| Violation Type | Potential Criminal Penalty | Administrative Fine |

|---|---|---|

| Exporting without license | 2 to 6 years imprisonment | €25,000 to €250,000 |

| Violating license conditions | 1 to 4 years imprisonment | €15,000 to €150,000 |

| False declarations to UAMA | Up to 2 years imprisonment | Up to €25,000 |

| Administrative oversight | N/A | Confiscation of goods and profits |

Beyond these penalties, companies face reputational damage, the loss of existing export licenses, and being "debarred" from public tenders in Italy and the EU.

How can you draft sanctions-proof clauses in international sale contracts?

A sanctions-proof clause is a contractual provision that protects an Italian exporter from breach-of-contract claims if they are forced to stop delivery due to new or changing trade restrictions. These clauses must be drafted with technical precision to ensure that "force majeure" or "hardship" concepts actually cover regulatory changes. Without these specific protections, an Italian firm could find itself trapped between violating EU law by exporting and being sued for damages by the buyer for non-delivery.

Key elements to include in your international sales contracts:

- Compliance Warranty: A requirement for the buyer to certify they are not subject to sanctions and will comply with all EU export laws.

- Right to Suspend/Terminate: A clause explicitly allowing the Italian exporter to terminate the contract without penalty if performance would lead to a violation of EU, UN, or national sanctions.

- Non-Liability for Delays: Language stating that the exporter is not liable for delays caused by the time required to obtain UAMA licenses.

- Indemnification: A provision requiring the buyer to indemnify the Italian exporter for any fines or legal costs incurred due to the buyer's misrepresentation of the end-use.

What are the procedures for obtaining export authorizations from UAMA?

The procedure for obtaining an export license in Italy is centralized through the Unità per le Autorizzazioni degli Armamenti Materiali (UAMA). The process is entirely digital and requires exporters to interact with the Ministry of Foreign Affairs through a dedicated portal. For most Italian manufacturing firms, the goal is to obtain either an Individual Export Authorization or, if shipping frequently to trusted partners, a Global Export Authorization.

Follow these steps to navigate the UAMA process:

- E-Licensing Registration: Register your company on the UAMA "E-Licensing" portal using a digital signature (Firma Digitale).

- Determine License Type: Choose between an "Individual" license (single transaction), "Global" (multiple transactions for one exporter), or "General EU" authorizations for specific low-risk destinations.

- Submit Documentation: Upload the technical data sheet of the product, the commercial contract, and the End-User Statement (EUS) validated by the authorities in the destination country.

- Technical Review: UAMA consults with other ministries and may require an opinion from the "Consultative Committee." This process typically takes 60 to 90 days.

- Reporting: Once a license is granted, you must provide periodic reports to UAMA regarding the actual shipments made under that authorization.

Official resources for verification:

- Italian Ministry of Foreign Affairs - UAMA

- EU Sanctions Map

Common Misconceptions About Italian Export Controls

"My product is purely for civilian use, so I don't need a license."

This is the most common mistake. Many industrial components, chemicals, and software are classified as "dual-use" even if the exporter only intends for them to be used in a factory. If the technical parameters match the EU list, a license is mandatory regardless of your intent.

"I am only selling to a distributor in a friendly country, so I am safe."

You are responsible for the final destination of your goods. If you sell to a distributor in Turkey or the UAE who then re-exports your products to a sanctioned entity in Russia or Iran, Italian authorities may hold you liable for "circumvention" if you failed to conduct proper due diligence.

"If I didn't know the end-user was sanctioned, I am not liable."

Under Italian law, "willful blindness" is not a defense. Directors are expected to exercise professional diligence. If a simple search or a red-flag check would have revealed the risk, the lack of actual knowledge will not prevent criminal prosecution.

FAQ

How long does it take to get a dual-use license in Italy?

Generally, the UAMA process takes between 60 and 90 days. However, complex cases involving sensitive destinations or "catch-all" reviews can take significantly longer, sometimes exceeding six months.

What is a "Catch-All" control?

A "Catch-All" control allows UAMA to require a license for any item, even if it is not on a restricted list, if they believe it might be used for weapons of mass destruction or military purposes in a country subject to an arms embargo.

Do I need a license to ship within the EU?

Most dual-use items do not require a license for shipment between Italy and other EU member states. However, extremely sensitive items (listed in Annex IV of the EU Regulation) still require authorization for intra-EU transfers.

Can I be fined if the U.S. sanctions a company but the EU does not?

If your transaction involves U.S. citizens, U.S. parts (usually more than 25% by value), or U.S. dollars, you may be subject to "extraterritorial" U.S. sanctions (OFAC). While Italian law follows EU lists, violating U.S. sanctions can lead to your company being blacklisted from the global financial system.

When to Hire a Lawyer

Navigating export controls is necessary when your business involves:

- Exporting advanced technology, machinery, or chemicals to "high-risk" emerging markets.

- Negotiating high-value contracts with state-owned enterprises in non-EU countries.

- Undergoing an audit or investigation by the Italian Customs Agency (Agenzia delle Accise, Dogane e Monopoli) or the Guardia di Finanza.

- Setting up an Internal Compliance Program (ICP) to shield directors from personal liability.

Next Steps

- Audit Your Product Catalog: Match your technical specifications against Annex I of Regulation (EU) 2021/821 to identify "Dual-Use" items.

- Register with UAMA: Ensure your company is registered on the E-Licensing portal before you need a license to avoid delays.

- Review Existing Contracts: Update your international sale terms to include robust sanctions and compliance clauses.

- Implement Screening Software: If you export frequently, invest in automated tools to screen customers against global sanctions lists in real-time.