- Shareholders' agreements (patti parasociali) in Italy are generally limited to a five-year duration for unlisted companies, requiring active renewal to remain enforceable.

- The Italian "Golden Power" legislation grants the government authority to review and potentially block foreign investments in strategic sectors, including tech, food, and health.

- Succession planning is the most common point of failure in Italian SME investments; formalizing family governance through the investment contract is mandatory for long-term stability.

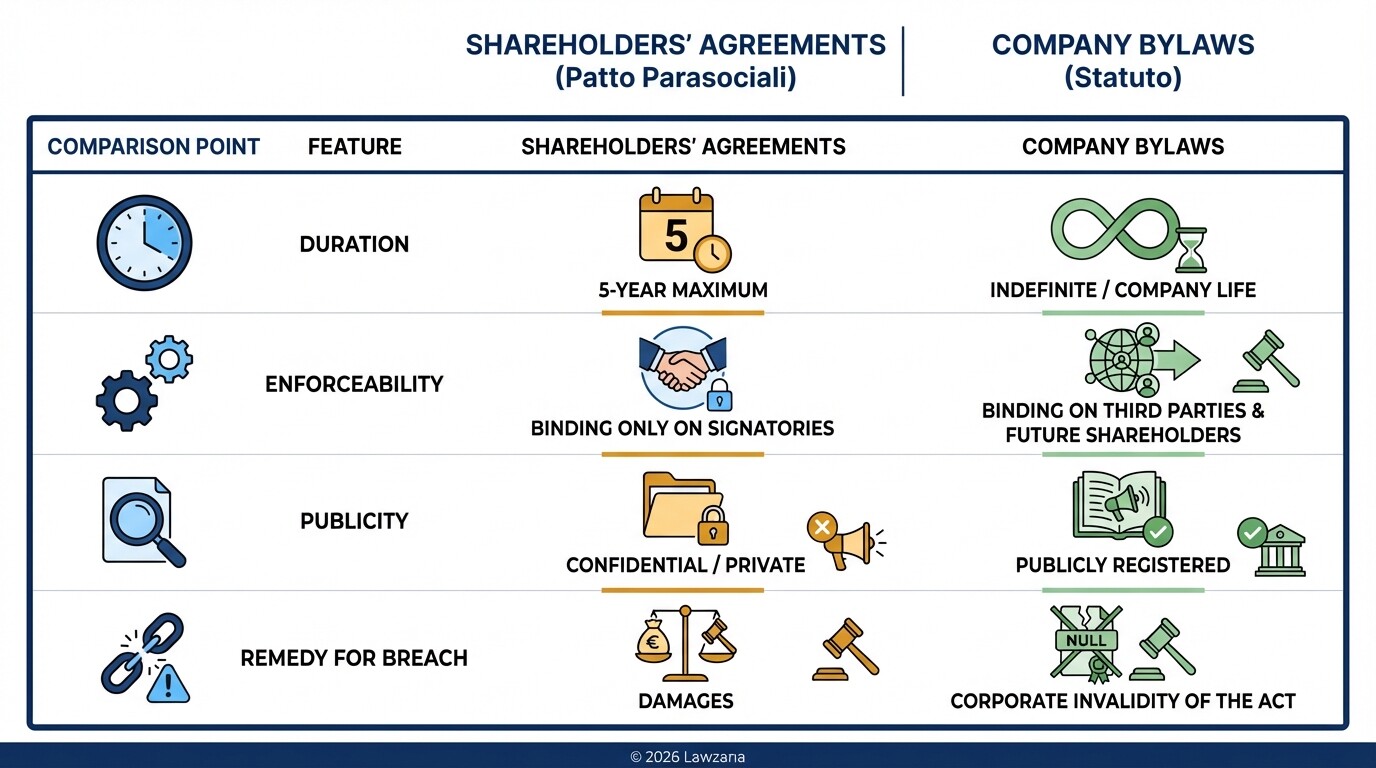

- Exit mechanisms like drag-along and tag-along rights must be meticulously drafted into the company's Bylaws (Statuto) to ensure they are enforceable against third parties.

- Labor law due diligence is critical due to Italy's mandatory severance pay (TFR) and rigid protections for employees in "small" vs. "large" enterprise categories.

How Do You Draft Enforceable Shareholders' Agreements Under Italian Law?

To draft an enforceable Shareholders' Agreement (Patto Parasociali) in Italy, you must adhere to Article 2341-bis of the Italian Civil Code, which limits the duration of such agreements to five years for unlisted companies. While the agreement can be renewed upon expiration, any clause suggesting a permanent or indefinite duration is legally void. To ensure maximum protection, investors should mirror the key commercial terms of the agreement within the company's formal Bylaws (Statuto), as the Bylaws have "real" effect against third parties, whereas the agreement only has "obligatory" effect between the signatories.

Effective agreements typically include:

- Governance Rights: Specific provisions for the appointment of Board members and the right to appoint the CFO or Chairman.

- Veto Rights: Reserved matters that require the investor's consent, such as extraordinary capital increases, mergers, or the sale of core assets.

- Transfer Restrictions: Lock-up periods (usually 3-5 years) and Right of First Refusal (ROFR) to prevent the founding family from selling to a competitor.

- Reporting Obligations: Mandatory monthly or quarterly financial reporting packages that comply with international accounting standards (IFRS/GAAP) rather than just Italian statutory accounts.

How Is Family Governance Managed in Italian Investment Contracts?

Managing family governance in an Italian investment contract requires balancing the professionalization of the firm with the founding family's emotional and historical ties. Investors must use the investment agreement to transition the company from "family-led" to "manager-led" by defining clear roles, compensation structures, and non-compete obligations for family members. This process often involves the creation of a "Family Council" or a "Steering Committee" to separate family interests from the operational Board of Directors.

Key strategies for managing succession and family dynamics include:

- Professionalization Clauses: Requirements that family members must meet specific educational or professional benchmarks to hold executive positions.

- Key-Man Clauses: Provisions that trigger a default or a "Put Option" if the founder or a critical family CEO leaves the business without an approved successor.

- Non-Compete Agreements: Strict, geographically defined non-compete and non-solicitation clauses for family members who exit the business or sell their shares.

- Succession Roadmaps: A contractually mandated timeline for transitioning leadership from the first or second generation to external professional management.

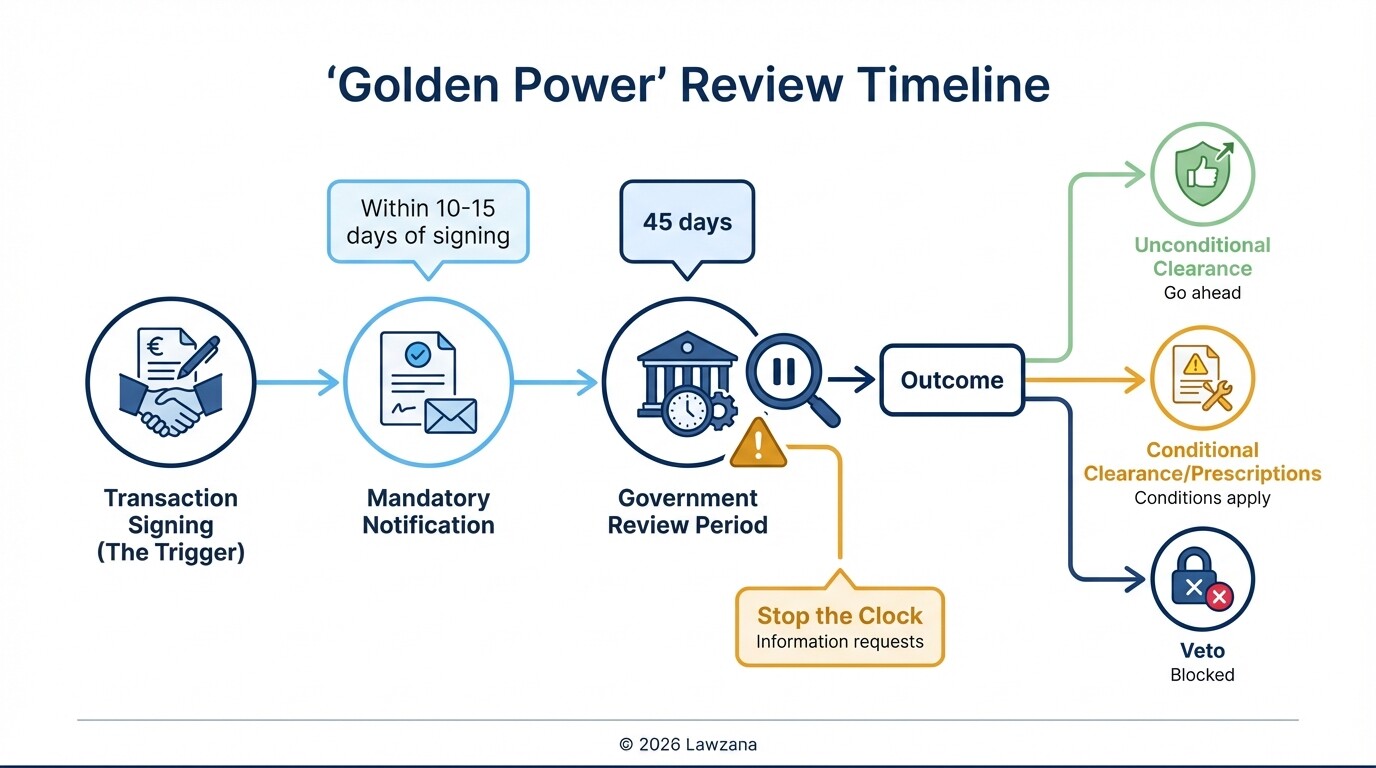

What Are the Golden Power Regulations for Foreign Investors in Italy?

The Italian "Golden Power" regime allows the Italian Government to exercise special powers over corporate transactions involving "strategic" assets to protect national interests. Under Decree Law 21/2012 and subsequent expansions, the government can veto a deal, impose specific conditions, or require the disposal of certain assets. While originally focused on defense and energy, the scope now includes "high-tech" sectors, including 5G, artificial intelligence, healthcare, and even the agri-food industry.

The process for navigating Golden Power involves:

- Mandatory Notification: The investor or the target company must notify the Presidency of the Council of Ministers within 10 to 15 days of signing the transaction documents.

- Review Period: The government generally has 45 days to review the filing, during which it can request additional information, which "stops the clock."

- Outcome: The transaction can be cleared, cleared with specific behavioral or structural prescriptions, or-in rare cases-blocked entirely.

- Sanctions: Failure to notify can result in fines of up to double the value of the transaction (minimum 1% of turnover) and the potential nullity of the acquisition.

How Do Exit Strategies Like Drag-Along and Tag-Along Rights Work in Italy?

Exit strategies in Italy are primarily executed through Put/Call options and Drag-along/Tag-along rights, which must be clearly defined in both the Shareholders' Agreement and the corporate Bylaws. For a "Drag-along" right (where a majority shareholder forces a minority to sell) to be enforceable in Italy, the price offered to the minority must be "fair," often tied to a valuation determined by an independent expert to avoid litigation based on the principle of shareholder equality.

Common exit mechanisms include:

- Drag-Along Rights: Allows the PE fund to sell 100% of the company to a third party, forcing the family founders to sell their remaining stake on the same terms.

- Tag-Along Rights: Protects the founding family (or the investor if they are a minority) by allowing them to join a sale initiated by the other party.

- Put and Call Options: Structured triggers-often based on EBITDA multiples or the passage of time-that allow the investor to exit or the family to buy back the stake.

- Liquidation Preference: Clauses ensuring the investor receives their initial investment plus a preferred return before the founders receive any proceeds in a "down-side" exit scenario.

What Are the Critical Due Diligence Areas for Italian Family Firms?

Due diligence in Italian family businesses must look beyond standard financial statements to identify hidden liabilities in labor law and tax compliance. Italian labor law is particularly protective, and "off-the-books" arrangements or misclassification of contractors can lead to massive retroactive social security claims. Furthermore, many SMEs have complex tax histories involving intra-family asset transfers or aggressive tax planning that require a thorough "look-back" period of at least five to seven years.

Investors should focus their due diligence on:

- Labor Liabilities: Calculation of the Trattamento di Fine Rapporto (TFR), a mandatory end-of-service payment that accumulates annually and must be properly funded on the balance sheet.

- Tax Compliance: Reviewing "related-party transactions" between the company and other entities owned by the family to ensure fair market pricing (Transfer Pricing).

- Environmental & Real Estate: Many Italian SMEs operate in historical buildings or industrial zones where environmental remediation costs or zoning non-compliance can be significant.

- Intellectual Property: Ensuring that trademarks, patents, and "know-how" are legally owned by the company and not by individual family members personally.

| Due Diligence Category | Key Risk in Italy | Mitigation Strategy |

|---|---|---|

| Labor | Unpaid social security or TFR | Escrow account for 24 months post-closing |

| Tax | Historical "black" income or tax audits | Tax insurance or comprehensive indemnity |

| Governance | Informal family decision-making | Mandatory board minutes and formal bylaws |

| Contracts | Change of control clauses in debt | Pre-closing waivers from Italian banks |

Common Misconceptions About Italian Private Equity

"Shareholders' agreements are valid forever."

In many jurisdictions, these agreements last as long as the parties are shareholders. In Italy, the law imposes a strict five-year limit for unlisted companies. If you do not formally renew the agreement or embed the protections in the Bylaws, your veto rights and governance protections may simply disappear after the fifth anniversary.

"The Golden Power only applies to Chinese or Russian investors."

While the legislation was strengthened to address non-EU threats, the notification requirement applies to many transactions regardless of the investor's origin. Even EU-based or US-based funds must notify the government if the target company operates in a sector deemed "strategic" by the Italian state.

"Family owners will easily step down once the check is signed."

Italian entrepreneurs are deeply tied to their companies' identities. Professionalizing an SME often meets cultural resistance. Legal contracts must include clear "exit ramps" for founders and specific behavioral covenants to prevent "shadow management" where the founder continues to give orders to staff outside of formal board channels.

FAQ

What is the minimum capital for an Italian S.r.l. (Limited Liability Company)?

The standard minimum share capital for an Società a responsabilità limitata (S.r.l.) is €10,000. However, for most PE transactions, the capital is significantly higher to support the company's leverage and operational needs.

How long does the "Golden Power" review process take?

The standard review period is 45 days from the date of notification. If the government requests more information, the clock stops until that information is provided. It is wise to factor at least 60 days into your closing timeline for this clearance.

Are "Non-Compete" clauses always enforceable in Italy?

Non-compete clauses are enforceable only if they are in writing, limited by geography and duration (usually max 3-5 years for shareholders/directors), and-most importantly-provide for specific financial compensation. A non-compete without a "price" is void under Italian law.

Can we use English law for an Italian acquisition?

While the Share Purchase Agreement (SPA) can sometimes be governed by English law, the internal governance of the company, the transfer of shares, and the enforceability of the Bylaws will always be governed by the Italian Civil Code. Most investors find it more efficient to use Italian law for the entire suite of documents.

When to Hire a Lawyer

You should engage an Italian legal expert as soon as the Letter of Intent (LOI) or Memorandum of Understanding (MOU) is being drafted. Because Italian SMEs often have "informal" structures, early legal intervention is necessary to identify "deal-breakers" in tax or labor compliance before expensive due diligence begins. Furthermore, navigating the Golden Power notification requires specialized counsel who understands the current administrative climate in Rome.

Next Steps

- Conduct a Preliminary "Red Flag" Due Diligence: Focus on tax, labor, and Golden Power applicability before submitting a binding offer.

- Draft the Bylaws (Statuto) Simultaneously with the Shareholders' Agreement: Ensure your governance rights are registered in the public Companies Register for maximum protection.

- Verify Golden Power Status: Consult with the Presidency of the Council of Ministers or legal counsel to determine if your target falls within strategic sectors.

- Define the Governance Transition: Create a 12-to-24-month roadmap for moving from family management to professional management, codified in the investment contract.