- Legal Foundation: All commercial contracts in Malaysia are primarily governed by the Contracts Act 1950, which requires offer, acceptance, consideration, and the intention to create legal relations.

- Stamp Duty is Mandatory: For a contract to be admissible as evidence in a Malaysian court, it must be stamped by the Inland Revenue Board (LHDN) within 30 days of execution.

- Penalty Clauses: Unlike some jurisdictions, Malaysia does not allow for "punitive" damages; liquidated damages must be a reasonable estimate of actual loss under Section 75 of the Contracts Act.

- Digital Contracts: Electronic signatures are legally recognized under the Electronic Commerce Act 2006, provided they meet specific security and identity verification standards.

- Dispute Resolution: While litigation is the default, most international commercial contracts in Malaysia opt for arbitration through the Asian International Arbitration Centre (AIAC).

How Does the Contracts Act 1950 and 2026 Updates Affect Commercial Agreements?

The Contracts Act 1950 serves as the primary legislation governing the formation and enforceability of agreements in Malaysia. It outlines the essential elements of a contract, including the capacity of parties to contract and the legality of the object. As Malaysia moves toward a more digital-centric economy, upcoming 2026 updates and ongoing reforms focus on harmonizing traditional contract law with electronic transactions, smart contracts, and consumer protection in B2B environments.

To ensure compliance with the current framework and upcoming shifts, businesses should focus on these core pillars:

- Free Consent: Agreements must be made without coercion, undue influence, fraud, or misrepresentation.

- Lawful Consideration: What is exchanged (money, goods, services) must be legal; contracts for illegal purposes are void.

- Digital Readiness: Ensure that electronic agreements comply with the Electronic Commerce Act 2006, which will likely see expanded enforcement and stricter standards for data integrity by 2026.

- Capacity: Confirm that the signatories have the legal authority to bind the corporation, typically verified through a Board Resolution or Power of Attorney.

What Are the Best Practices for Limitation of Liability and Indemnity?

Limitation of liability and indemnity clauses are used to manage financial risk by capping the amount one party owes another in the event of a breach. In Malaysia, these clauses are generally enforceable provided they are not deemed unconscionable or against public policy. However, you cannot limit liability for death or personal injury resulting from negligence, as this is restricted by common law principles.

When drafting these sections, follow these professional standards:

| Clause Type | Purpose | Best Practice for Malaysia |

|---|---|---|

| Limitation of Liability | Caps total financial exposure. | Link the cap to a percentage of the contract value or insurance coverage. |

| Indemnity | Obligates one party to compensate the other for specific losses. | Clearly define the "indemnified acts" (e.g., IP infringement or third-party claims). |

| Exclusion Clause | Removes liability for specific types of loss (e.g., loss of profit). | Use clear, unambiguous language; any ambiguity is interpreted against the party seeking to rely on it. |

Pro Tip: Under Section 75 of the Contracts Act 1950, if a contract stipulates a sum to be paid in case of a breach, the court will only award "reasonable compensation" not exceeding that amount. You must be prepared to justify the figure as a genuine pre-estimate of loss.

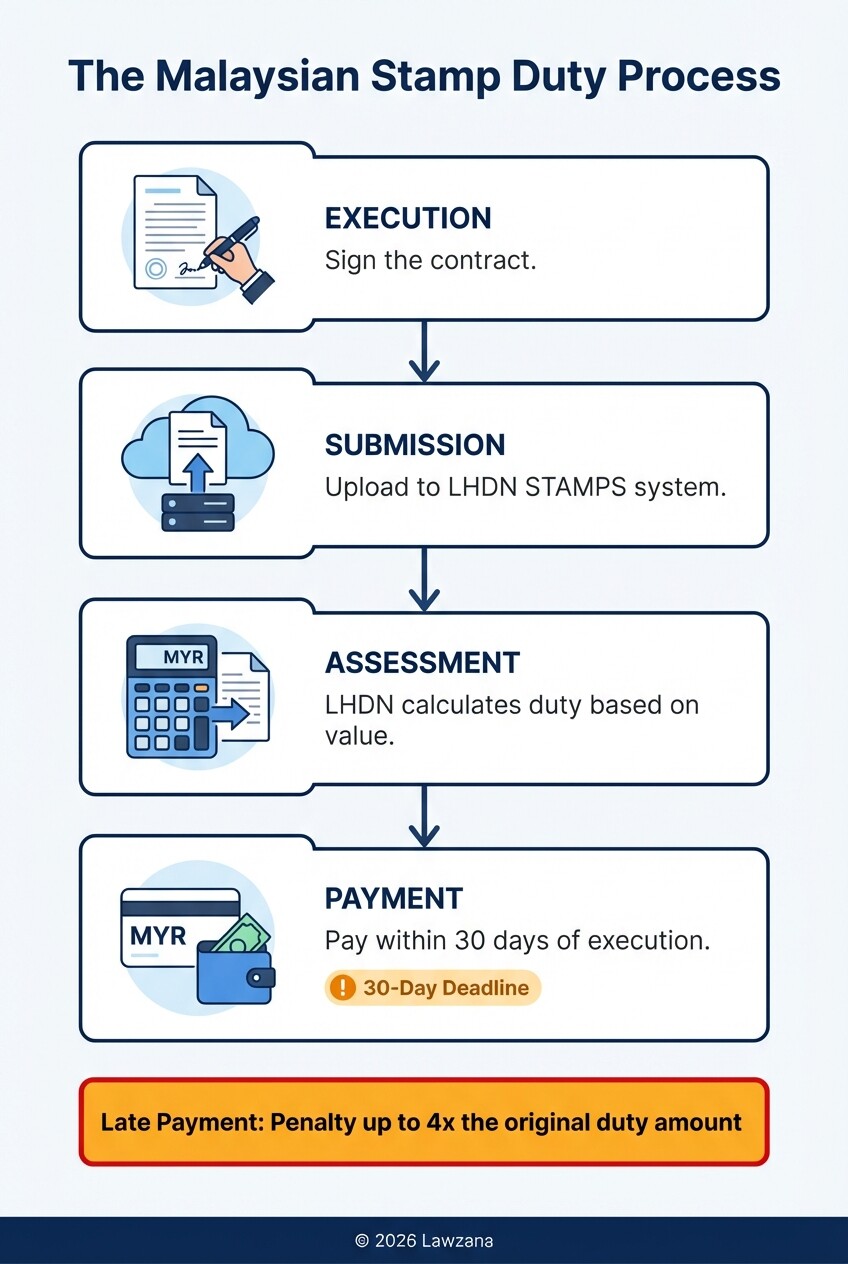

Why Is Stamp Duty Required for Document Admissibility?

Stamp duty is a tax imposed on legal and financial documents in Malaysia under the Stamp Act 1949. While an unstamped contract is still technically valid between the parties, it cannot be produced as evidence in a court of law if a dispute arises. To rectify this later, you must pay the original duty plus a significant penalty.

The process for stamping involves:

- Execution: Sign the contract.

- Submission: Upload the document to the Inland Revenue Board (LHDN) STAMPS system.

- Assessment: LHDN calculates the duty based on the contract value.

- Payment: Pay the duty within 30 days of the signing date (if signed in Malaysia) or 30 days after the document is received (if signed abroad).

Standard Costs:

- Fixed Duty: RM 10 for general agreements and service contracts.

- Ad Valorem Duty: 0.5% of the total value for specific instruments like loan agreements or transfers of property.

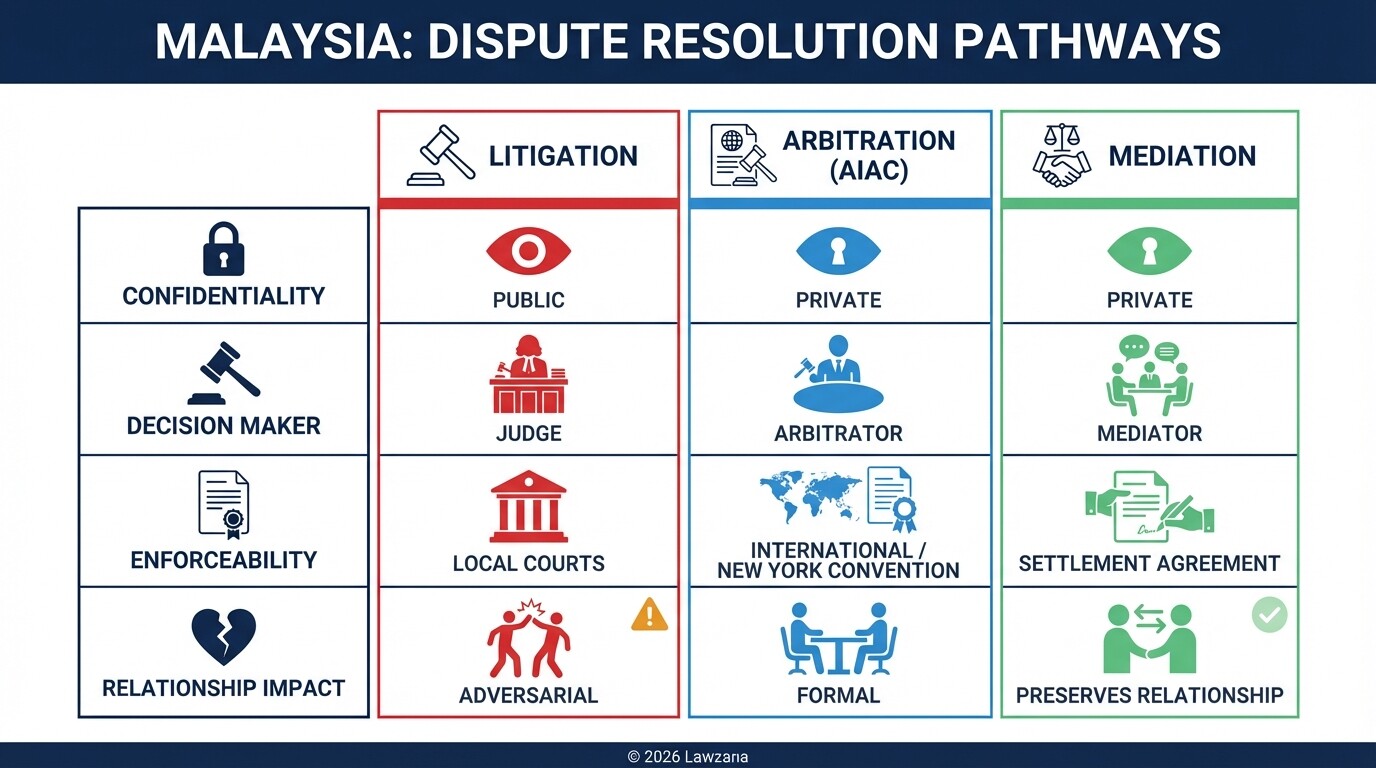

Should You Choose Litigation or ADR in Malaysian Contracts?

Choosing between litigation (the court system) and Alternative Dispute Resolution (ADR) like arbitration or mediation depends on the complexity of the deal and the need for confidentiality. In Malaysia, the Arbitration Act 2005 governs domestic and international arbitration, making the country a regional hub for ADR.

Consider these factors when choosing your forum:

- Litigation: Generally less expensive for simple debt recovery but public in nature. Malaysian courts have specialized "Construction" and "Commercial" divisions to handle complex cases.

- Arbitration: Preferred for international contracts. It is confidential, and the resulting "Award" is enforceable in over 160 countries under the New York Convention.

- Mediation: A non-binding process aimed at settlement. It is highly recommended for maintaining long-term business relationships.

The Asian International Arbitration Centre (AIAC) in Kuala Lumpur is the standard institution cited in Malaysian commercial arbitration clauses.

How Do Force Majeure and Frustration of Contract Work?

Force Majeure is a contractual provision that excuses a party from performing their obligations due to extraordinary events beyond their control, such as natural disasters or pandemics. If a contract does not have a Force Majeure clause, Malaysian law applies the "Doctrine of Frustration" under Section 57 of the Contracts Act 1950.

Key Differences:

- Force Majeure Clause: The parties define what counts as an "excuse" (e.g., labor strikes, government lockdowns). It allows for the suspension of the contract rather than immediate termination.

- Doctrine of Frustration: This is a statutory "nuclear option." If an event makes the contract impossible to perform or changes the purpose of the contract fundamentally, the contract becomes void and ends automatically.

Checklist for Force Majeure Clauses:

- Define specific "Trigger Events" (do not just say "Acts of God").

- Include a requirement for formal notice to the other party.

- Specify the consequences (e.g., "Performance is suspended for 60 days, after which either party may terminate").

- Detail the mitigation steps the affected party must take to minimize loss.

Common Misconceptions About Malaysian Contracts

1. "A contract isn't valid unless it's signed in front of a lawyer."

This is false. While having a lawyer witness a signature is good practice for high-value deals to prevent claims of forgery, most commercial contracts are valid as soon as both parties sign. The main requirement for court use is the LHDN stamp, not a lawyer's seal.

2. "Emails and WhatsApp messages don't count as contracts."

In Malaysia, digital communication can form a binding contract if it contains an offer, acceptance, and a clear intention to be bound. Businesses should use "Subject to Contract" headers in negotiations to avoid accidentally forming a binding agreement via chat.

3. "We can set any amount for late payment interest."

While parties have freedom of contract, Malaysian courts can strike down interest rates that are deemed "usurious" or unconscionable. Standard commercial interest rates usually hover between 1.5% and 8% per annum.

FAQ

Is a contract written in English valid in Malaysia?

Yes, English is the standard language for commercial contracts in Malaysia. However, if the matter goes to court, certain documents may need to be translated into Bahasa Malaysia for formal proceedings, although the High Court often allows submissions in English.

What is the limitation period for suing on a contract breach?

Under the Limitation Act 1953, you generally have six years from the date the breach occurred to file a lawsuit in West Malaysia.

Can a contract be signed electronically in Malaysia?

Yes, the Electronic Commerce Act 2006 recognizes electronic signatures. For commercial agreements, a digital signature that identifies the person and indicates their approval is legally equivalent to a handwritten signature.

What happens if a contract is not stamped?

The contract remains valid but is "inadmissible" in court. You will have to pay the unpaid stamp duty plus a penalty of up to four times the original amount to use it as evidence in a legal dispute.

When to Hire a Lawyer

Navigating Malaysian contract law requires more than just a template. You should consult a qualified Malaysian legal professional if:

- You are drafting a multi-year service agreement or a high-value M&A deal.

- Your contract involves cross-border parties or intellectual property licensing.

- You need to customize "Limitation of Liability" clauses to protect against specific industry risks.

- You are facing a breach of contract and need to issue a formal Letter of Demand.

Next Steps

- Audit Existing Agreements: Review your current contracts for Section 75 compliance regarding liquidated damages.

- Verify Stamping Status: Ensure all active commercial agreements have been stamped by LHDN.

- Update Digital Protocols: If you use e-signatures, ensure your process creates a clear audit trail as required by the Electronic Commerce Act.

- Consult a Specialist: Reach out to a commercial lawyer to draft a standard "Terms of Business" template tailored to the Malaysian jurisdiction.