- As of January 1, 2024, foreign companies without a Regional Headquarters (RHQ) in Riyadh are generally ineligible for contracts with Saudi government agencies and state-owned entities.

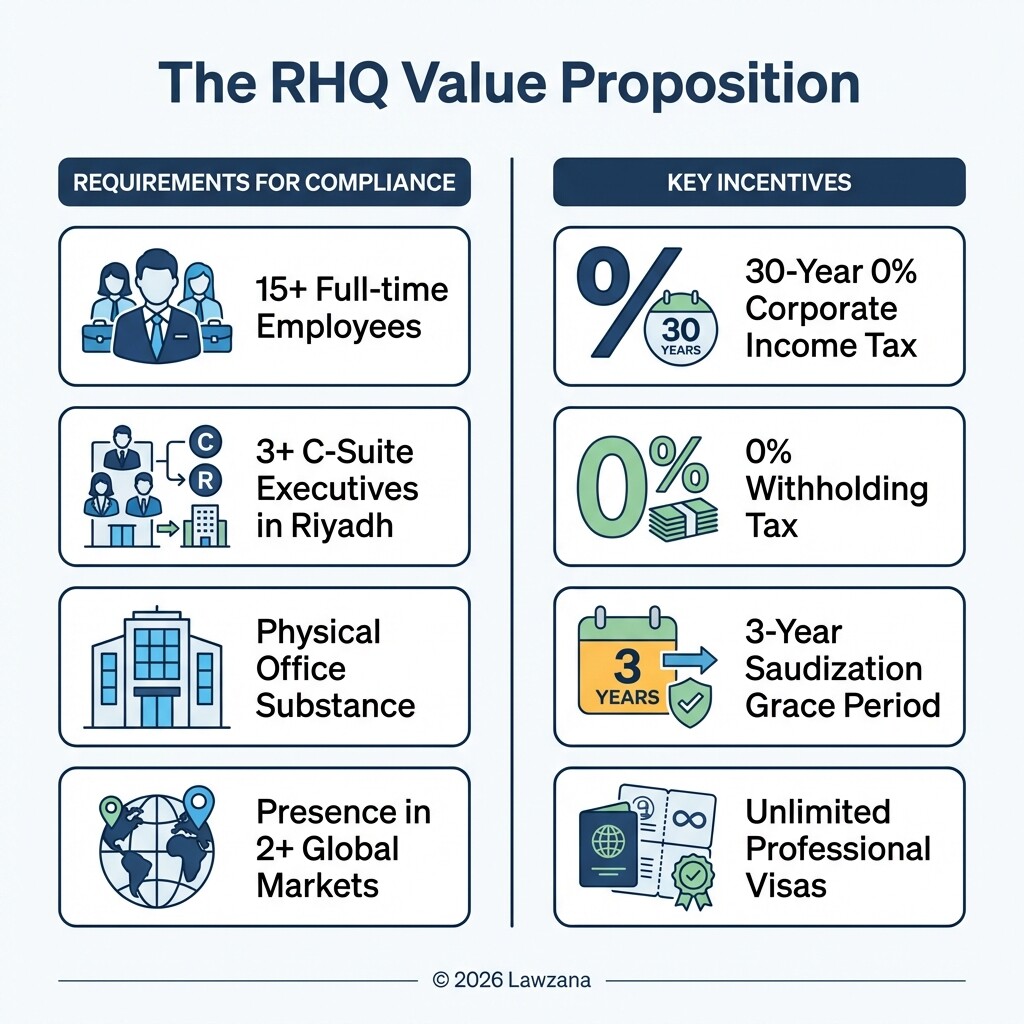

- The RHQ program offers a 30-year 0% corporate income tax rate and a 0% withholding tax on eligible activities.

- Companies receive a three-year exemption from Saudization quotas and access to an unlimited number of professional work visas for their RHQ staff.

- Establishing an RHQ requires a physical office in Saudi Arabia and the employment of at least 15 full-time staff members, including senior executives, within the first year.

What are the criteria for the Saudi Regional Headquarters (RHQ) license?

To obtain an RHQ license from the Ministry of Investment of Saudi Arabia (MISA), a multinational firm must demonstrate an existing presence in at least two different countries, excluding Saudi Arabia and its home country. The entity must serve as the center of administrative and strategic control for its regional subsidiaries and cannot engage in revenue-generating commercial activities directly; instead, it provides management and support services to its branches.

The following requirements must be met to maintain the license:

- Minimum Staffing: You must hire at least 15 full-time employees within one year of license issuance.

- Executive Presence: At least three of these employees must be "C-suite" or high-level executive management relocated to Riyadh.

- Physical Substance: You must maintain a physical office in the Kingdom that is suitable for the scale of regional operations.

- Regional Scope: The RHQ must provide mandatory activities such as strategic planning, business development, and financial supervision for the company's regional network.

What tax incentives and exemptions apply to RHQ entities?

The Saudi government provides a competitive tax package for RHQs, featuring a 30-year 0% rate on corporate income tax and a 0% withholding tax for payments made to non-residents for approved RHQ activities. These incentives are administered by the Zakat, Tax and Customs Authority (ZATCA) and are designed to provide long-term fiscal stability for multinational firms moving their regional hubs from other cities.

The tax incentives cover specific activities, including:

- Strategic management and business planning.

- Coordination of regional marketing and sales.

- Provision of technical and operational support to subsidiaries.

- Financial management and treasury services.

- Data processing and IT support for the regional group.

How does the RHQ program provide labor law flexibility and Saudization exemptions?

RHQs are granted significant relief from the Kingdom's standard labor regulations, most notably a three-year grace period from Saudization (Nitaqat) requirements. This allows international firms to bring in their own global talent without being immediately restricted by local hiring ratios. Additionally, the Ministry of Human Resources and Social Development (MHRSD) allows RHQs to bypass standard visa caps for their staff.

Benefits for RHQ employees and their families include:

- Professional Visas: Access to an unlimited number of work visas for qualifying management and technical roles.

- Family Benefits: Spouses of RHQ employees are granted the right to work in Saudi Arabia, and the age limit for dependent children has been increased to 25.

- Standardized Processing: Priority processing for residency permits (Iqamas) and work authorizations through the MISA portal.

How does the 2024 deadline affect government contracts and tenders?

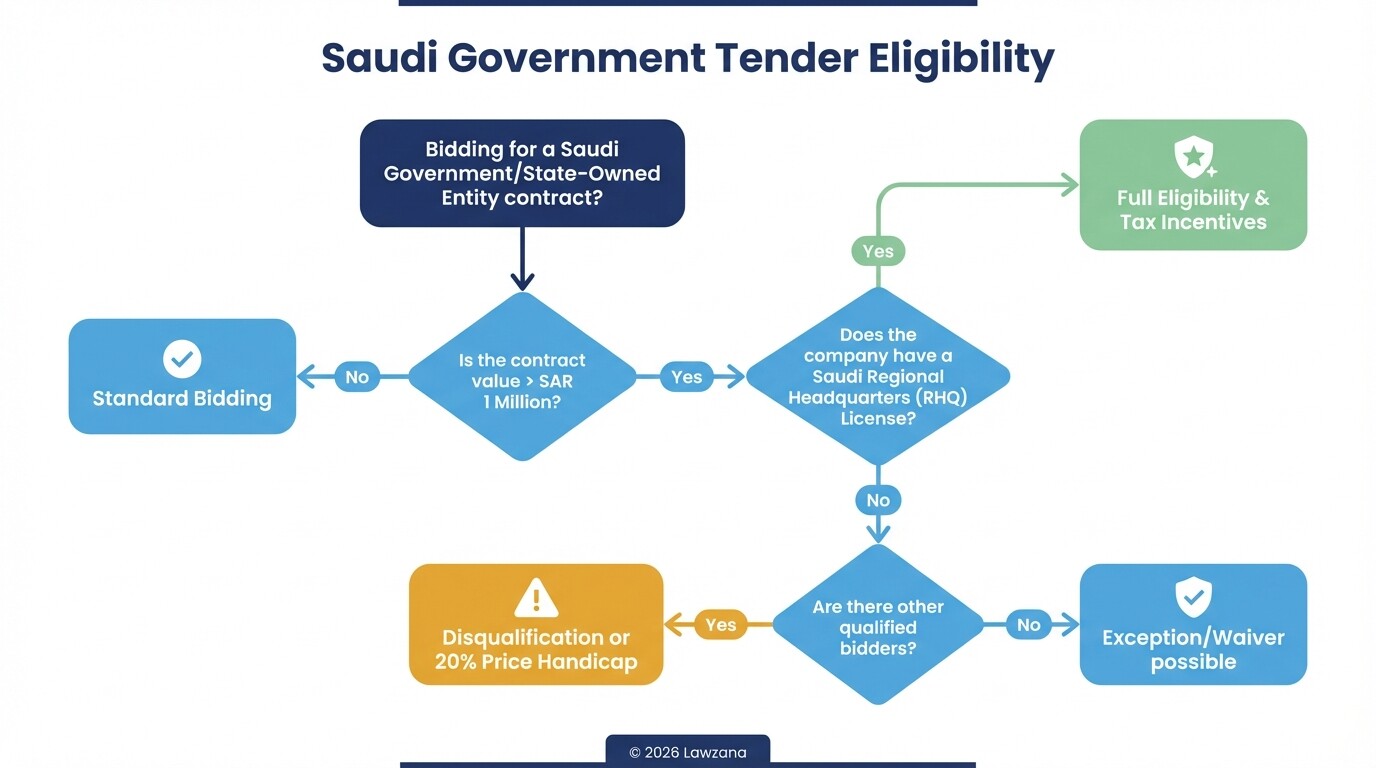

Starting January 1, 2024, all Saudi government bodies, ministries, and agencies-including the Public Investment Fund (PIF) and its subsidiaries-are restricted from awarding contracts to foreign firms that do not have their regional headquarters located in Saudi Arabia. This policy applies to any procurement process exceeding SAR 1 million, effectively making the RHQ license a prerequisite for high-value government business.

Key impacts of this policy include:

- Tender Exclusion: Companies without an RHQ may be disqualified from the bidding process at the pre-qualification stage.

- Exceptional Circumstances: Agencies may only contract with non-RHQ firms if there is no other qualified bidder or in cases of emergency where the non-RHQ firm offers the only viable solution.

- Cost Comparison: In cases where a non-RHQ firm is allowed to bid, their financial proposal may be subject to a price handicap (often 20%) when compared to RHQ-compliant competitors.

How should firms restructure global management to meet KSA substance requirements?

To comply with "Economic Substance" rules, a firm must prove that the Riyadh office is the actual seat of regional decision-making, rather than a shell entity. This involves relocating key management functions from other regional hubs (such as Dubai or London) to Riyadh, ensuring that the staff located in Saudi Arabia have the authority to sign contracts, approve budgets, and set regional strategy.

To meet these requirements, companies should follow these steps:

- Identify Regional Scope: Define which countries fall under the "Middle East and North Africa" (MENA) remit for the Riyadh headquarters.

- Relocate Key Executives: Move the Regional CEO, CFO, and other department heads to Riyadh as their primary place of residence.

- Update Delegations of Authority: Formally update corporate bylaws to grant the Riyadh RHQ the legal power to manage regional subsidiaries.

- Document Board Meetings: Conduct and record board meetings or executive committee sessions within Saudi Arabia to demonstrate active local management.

Common Misconceptions About the RHQ Program

Many business leaders hold outdated or incorrect views on how the RHQ program operates in the Saudi market.

- Myth 1: The RHQ is a revenue-generating branch. In reality, the RHQ is a support entity. It does not sell products or services to the public. Instead, it bills its own subsidiaries or the parent company for management services. Revenue-generating activities must still be handled by a separate commercial branch or a Limited Liability Company (LLC) in the Kingdom.

- Myth 2: Only major construction firms need an RHQ. The requirement applies to all sectors. Whether you are in IT, consulting, defense, or healthcare, if you intend to sign a contract with a government entity for more than SAR 1 million, you need an RHQ.

- Myth 3: The RHQ replaces the local LLC. The RHQ does not replace your operational entity. Most companies maintain their existing Saudi LLC to execute local projects and sales, while the RHQ sits alongside or above it to manage the broader MENA region.

Checklist for RHQ License Application

| Step | Action Required | Responsible Party |

|---|---|---|

| 1 | Gather proof of operations in 2+ countries (Audited financials/Licenses) | Legal/Finance Team |

| 2 | Submit RHQ License application via MISA Portal | Local Counsel/MISA |

| 3 | Issue Commercial Registration (CR) from Ministry of Commerce | Ministry of Commerce |

| 4 | Secure a physical office space in Riyadh (Minimum 1-year lease) | Real Estate/Admin |

| 5 | Register with ZATCA and MHRSD (Qiwa/GOSI) | HR/Tax Department |

| 6 | Relocate or hire 15 full-time staff within 12 months | HR/Mobility Team |

What is the cost of the RHQ license?

The initial MISA license fee is approximately SAR 2,000 for the first year, though administrative costs, legal fees for restructuring, and office rental will significantly increase the total investment. Annual renewal fees apply and are subject to the company's compliance with staffing requirements.

Does the RHQ requirement apply to private sector contracts?

Currently, the "No RHQ, No Contract" rule only applies to government agencies and state-owned enterprises. Private companies are free to contract with any firm, regardless of their headquarters location. However, many private firms are voluntarily adopting these standards to align with the Kingdom's Vision 2030 goals.

Can an RHQ support subsidiaries outside of the Middle East?

The RHQ is primarily intended to manage the Middle East and North Africa (MENA) region. While there is no strict prohibition against supporting other regions, MISA expects the Riyadh office to be the primary hub for the company's Middle Eastern operations to justify the tax and labor incentives.

Is it possible to get a waiver for the RHQ requirement?

Waivers are extremely rare and are only granted if the government agency can prove that the specific goods or services are not available from any company that has an RHQ. Even in these cases, the non-RHQ firm may face a price premium or other contractual disadvantages.

When to Hire a Lawyer

Navigating the RHQ program involves complex intersections of corporate law, tax strategy, and labor regulations. You should consult a legal professional if you are:

- Restructuring your global corporate hierarchy to move management functions to Saudi Arabia.

- Negotiating high-value government tenders where RHQ compliance is a prerequisite.

- Seeking a formal tax ruling from ZATCA to ensure your 30-year exemption is secure.

- Dealing with complex visa or residency issues for executive leadership.

Next Steps

- Audit Your Contracts: Review all current and upcoming bids with Saudi government entities to determine if they meet the SAR 1 million threshold.

- Gap Analysis: Compare your current Saudi presence against the MISA "substance" requirements (15 employees, executive relocation).

- Engage with MISA: Reach out to the Ministry of Investment to discuss your specific corporate structure and eligibility for the RHQ license.

- Develop a Relocation Plan: Begin identifying the "C-suite" roles that will be moved to Riyadh to satisfy the executive presence requirement.