Repatriating Profits: Foreign Investment Laws in South Africa

South Africa offers a sophisticated legal framework for international investors, but the movement of capital across its borders is strictly governed by the South African Reserve Bank (SARB). Navigating these regulations is essential for any foreign-owned entity looking to return profits to its home country efficiently and legally.

How do SARB Exchange Control regulations affect foreign-owned entities?

South African Exchange Control regulations exist to manage the country's foreign currency reserves and ensure the stability of the South African Rand (ZAR). Foreign-owned entities are generally permitted to repatriate profits, provided they can prove the initial capital was brought into the country and that the local entity has satisfied its tax and legal obligations.

The South African Reserve Bank delegates the administration of these controls to Authorized Dealers, which are major commercial banks. These banks act as intermediaries, ensuring that every transaction complies with the Currency and Exchanges Act of 1933 and the Exchange Control Regulations of 1961.

Key compliance factors for foreign entities:

- Proof of Inward Investment: You must provide documentation showing that funds were transferred from abroad into a South African bank account.

- Reporting Requirements: Every cross-border payment must be assigned a specific category code so the SARB can track the nature of the outflow (e.g., profit distribution, loan repayment, or service fee).

- Local Borrowing Limits: Historically, foreign-controlled companies faced limits on how much they could borrow locally, but these "financial assistance" rules have been significantly relaxed to encourage investment.

How long does SARB approval take?

For routine dividend payments, your Authorized Dealer can often process the transfer within 24 to 48 hours, provided all documentation is in order.

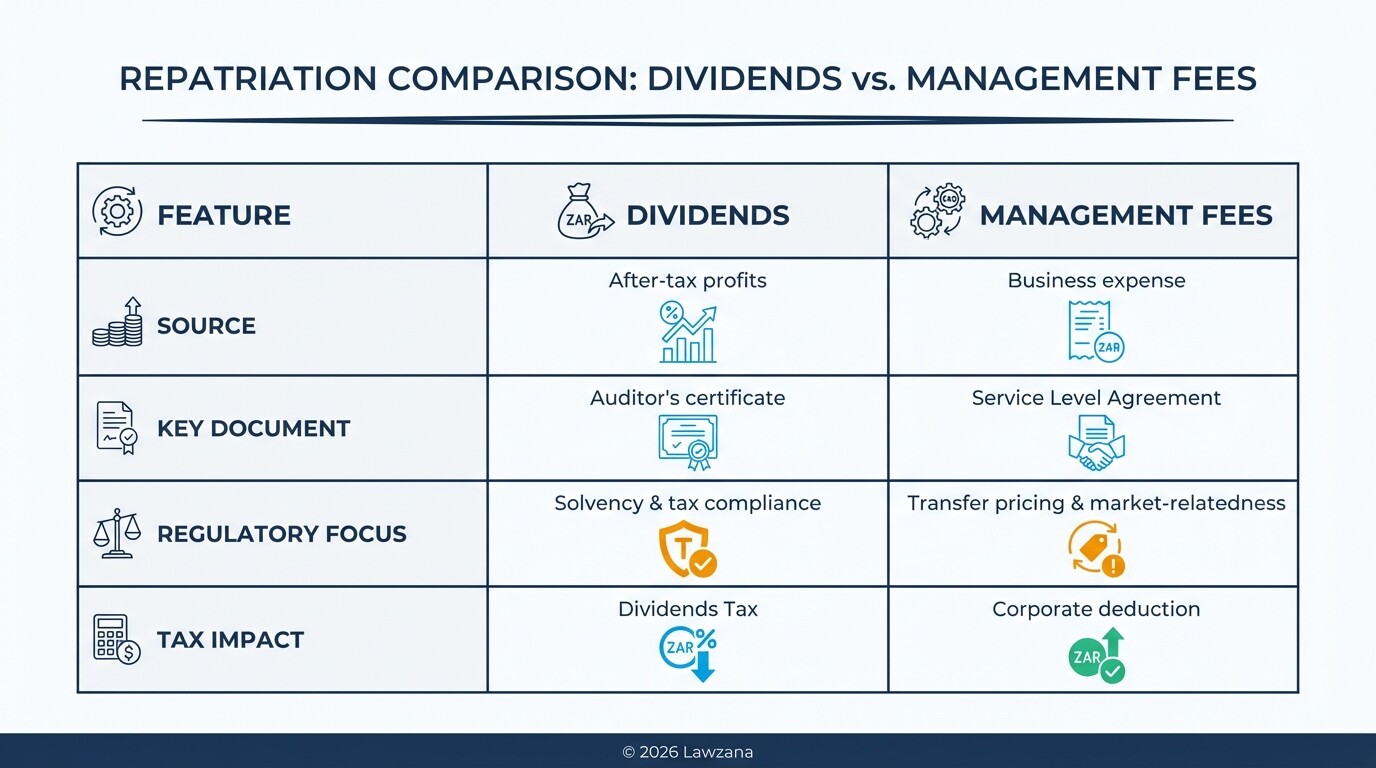

What are the requirements for the repatriation of dividends and management fees?

Repatriating dividends is a relatively straightforward process compared to management fees, as dividends are distributions of after-tax profits. To remit dividends, a company must provide its Authorized Dealer with an auditor's certificate confirming that the amount is paid out of realized profits and that the company remains solvent after the distribution.

Management fees and technical service fees are scrutinized more heavily by the SARB to prevent "transfer pricing"-the practice of shifting profits to lower-tax jurisdictions via inflated service charges. These payments require a written agreement between the South African subsidiary and the foreign parent company, detailing the specific services rendered and the basis for the fee calculation.

Checklist for remitting funds:

- For Dividends:

- A board resolution authorizing the dividend payment.

- An auditor's certificate confirming the company's financial standing.

- A copy of the share register and endorsed share certificates.

- For Management Fees:

- A formal Service Level Agreement (SLA).

- Invoices detailing the work performed.

- Proof that the fee is at an "arm's length" (market-related) price.

Can you pay management fees without a contract?

No; without a formal agreement filed with your bank, the SARB may block the transaction or treat it as a dividend, leading to unintended tax consequences.

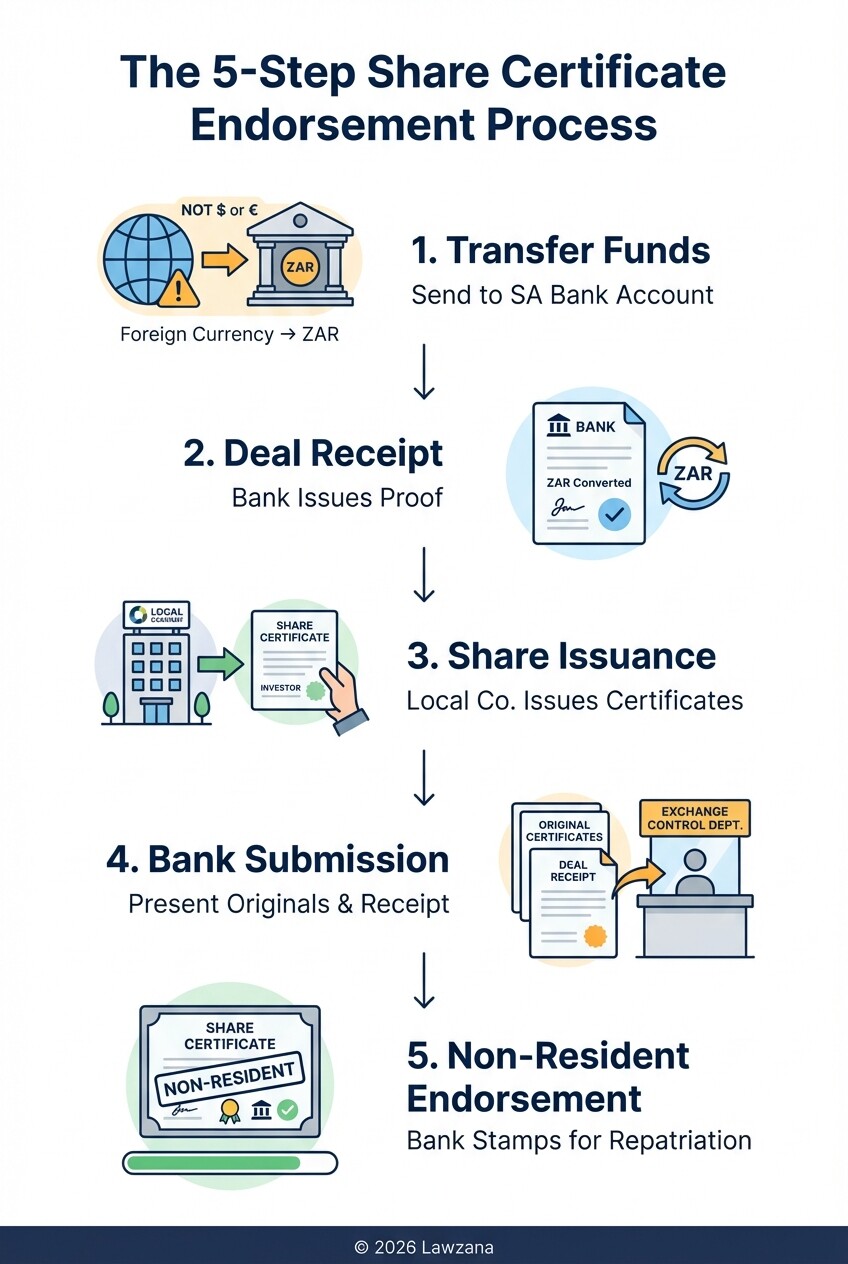

How does the inward investment registration and share certificate process work?

The "Share Certificate" process is the cornerstone of foreign investment in South Africa. When a foreign investor injects capital into a South African company, the share certificate issued must be endorsed as "Non-Resident" by an Authorized Dealer.

This endorsement serves as permanent proof that the investment was funded with foreign currency. Without this stamp, the investor will face significant hurdles when trying to sell their shares or repatriate the proceeds and dividends later. It is essentially your "receipt" for the money brought into the country.

Steps to secure an endorsed share certificate:

- Transfer Funds: Send the investment amount in foreign currency to a South African bank.

- Obtain a Deal Receipt: Your bank will issue a receipt confirming the conversion of foreign currency to Rand.

- Issue Shares: The South African company issues share certificates to the foreign investor.

- Submit to Bank: Present the original share certificates and the deal receipt to the bank's exchange control department.

- Endorsement: The bank stamps the certificate "Non-Resident," allowing for future capital and profit repatriation.

What happens if I lose my endorsed certificate?

You will need to apply for a replacement and provide a sworn affidavit along with the original bank records of the inward transfer, which can be a lengthy and difficult process.

How do you navigate the FinSur system for cross-border payments?

The Financial Surveillance Department (FinSur) is the branch of the SARB responsible for overseeing the integrity of the South African financial system. While businesses interact mostly with their commercial banks, the banks report every transaction to FinSur through an electronic balance of payments (BoP) reporting system.

Navigating this system requires precise categorization of your transaction. If a payment is miscoded-for example, marking a loan repayment as a "service fee"-it can trigger an audit or lead to the freezing of future transfers until the error is rectified.

Common BoP Category Codes for Repatriation:

| Transaction Type | BoP Category Code |

|---|---|

| Dividends to non-residents | 301 |

| Interest on foreign loans | 302 |

| Management/Technical fees | 307 |

| Royalty payments | 308 |

Why was my transfer flagged?

Transactions are typically flagged if the amount is inconsistent with prior filings or if the required supporting documents (like tax clearance certificates) are missing from the bank's files.

What are the tax withholding obligations on outward remittances?

South Africa operates on a source-based tax system, meaning it taxes income that originates within its borders. When profits leave the country, the South African Revenue Service (SARS) requires the withholding of a portion of that money to settle the non-resident's tax liability.

The most common obligation is the Dividends Tax, currently set at a flat rate of 20%. However, South Africa has signed Double Taxation Agreements with over 80 countries, including the US, UK, and most EU nations. These agreements often reduce the withholding rate to 5%, 10%, or 15%, depending on the level of ownership the foreign entity holds in the South African company.

Standard Withholding Tax (WHT) Rates:

- Dividends: 20% (unless reduced by DTA).

- Interest: 15% (applies to interest paid to non-residents from a South African source).

- Royalties: 15% (applies to the use of intellectual property, patents, or trademarks in South Africa).

How do I claim a reduced tax rate?

You must submit a specific declaration form (the "DTA declaration") to your Authorized Dealer before the payment is made. You cannot apply the reduced rate retroactively without a complex refund claim through SARS.

Common Misconceptions About South African Investment

Myth 1: "Exchange controls have been abolished." While the government has significantly liberalized the rules to attract investment, exchange controls are still very much in place. Every cent that leaves the country must be documented and categorized through the SARB's reporting system.

Myth 2: "I can repatriate all revenue, not just profit." You can only repatriate "transferable" funds. For a subsidiary, this means net profits after tax or legitimate business expenses like management fees. You cannot simply empty a local bank account of all gross revenue without providing a legal and accounting basis for the transfer.

Myth 3: "Digital assets like Bitcoin bypass SARB rules." The SARB has explicitly stated that exchange control regulations apply to crypto-assets. Using digital assets to move value out of South Africa without reporting is a violation of the law and can lead to criminal prosecution.

FAQs

Can I repatriate my initial capital investment if I sell my business?

Yes. As long as you have the original "Non-Resident" endorsed share certificates and can provide the sale agreement, you are permitted to repatriate the full proceeds of the sale, including any capital gains, provided all local taxes are paid.

Do I need a tax clearance certificate for every dividend payment?

For companies, a tax clearance is generally not required for each individual transfer, but the company must be in good standing with SARS. The Authorized Dealer will require an auditor's certificate confirming the company's tax compliance and solvency.

Is there a limit on the amount of profit I can send home?

There is no fixed Rand limit on the amount of profit that can be repatriated, provided the profits were legitimately earned, the company remains solvent, and all tax obligations have been met.

When to Hire a Lawyer

Repatriating profits in South Africa is as much about administrative precision as it is about legal compliance. You should consult a South African international trade or tax lawyer if:

- You are structuring a complex multi-national holding company.

- You are drafting Management or Technical Service Agreements that need to withstand SARB and SARS scrutiny.

- You are facing a dispute with an Authorized Dealer regarding the endorsement of share certificates.

- You need to navigate the complexities of a Double Taxation Agreement to reduce your withholding tax burden.

Next Steps

- Verify your documents: Ensure all current foreign-held share certificates in your South African entity are stamped "Non-Resident."

- Review your contracts: If you are paying management fees, ensure a formal Service Level Agreement is in place and has been submitted to your bank.

- Consult an Auditor: Obtain the necessary solvency and profit certifications before attempting a large dividend distribution.

- Speak with your bank: Establish a relationship with the Exchange Control desk at your South African bank to understand their specific internal requirements for cross-border transfers.