- Anti-dumping and countervailing duties are governed by the Special Import Measures Act (SIMA), which aims to protect Canadian manufacturers from unfair foreign pricing.

- Two distinct government bodies oversee these cases: the Canada Border Services Agency (CBSA) determines the existence of dumping, while the Canadian International Trade Tribunal (CITT) determines if that dumping caused "material injury" to Canadian industry.

- Investigations move quickly, typically concluding within seven months, requiring exporters to provide massive amounts of transactional data on very short notice.

- Exporters can significantly reduce their specific duty rates by participating fully in the CBSA investigation and proving their "normal value" through domestic sales data.

- Duty orders typically last for five years but are subject to annual re-investigations and five-year "expiry reviews" to determine if duties should continue.

Exporter Compliance Checklist for SIMA Investigations

Foreign exporters must act immediately upon notification of a Canadian trade investigation. This checklist outlines the essential steps to manage the data-heavy requirements of the Canada Border Services Agency (CBSA).

- Designate a Response Team: Appoint internal leads in finance, sales, and logistics to coordinate data collection.

- Retain Canadian Counsel: Appoint a legal representative authorized to handle confidential business information (CBI) under a protective order.

- Review the Request for Information (RFI): The CBSA will issue a detailed questionnaire. Identify data gaps in your accounting software immediately.

- Analyze Domestic Sales: Identify sales of "like goods" in your home market to establish a baseline for normal value.

- Validate Export Transactions: Ensure all shipping, insurance, and handling costs for Canadian exports are documented to calculate the net export price.

- Check for Subsidies: If the case involves countervailing duties, gather records of any government grants, low-interest loans, or tax credits received in your home country.

- Prepare for On-Site Verification: The CBSA may visit your foreign facilities to audit your financial records against the data submitted in your RFI.

- Monitor Deadlines: SIMA deadlines are statutory and rarely extended. Missing a filing by even one day can result in "Facts Available" treatment, leading to the highest possible duty rate.

The Legal Timeline of a Canadian Anti-Dumping Investigation

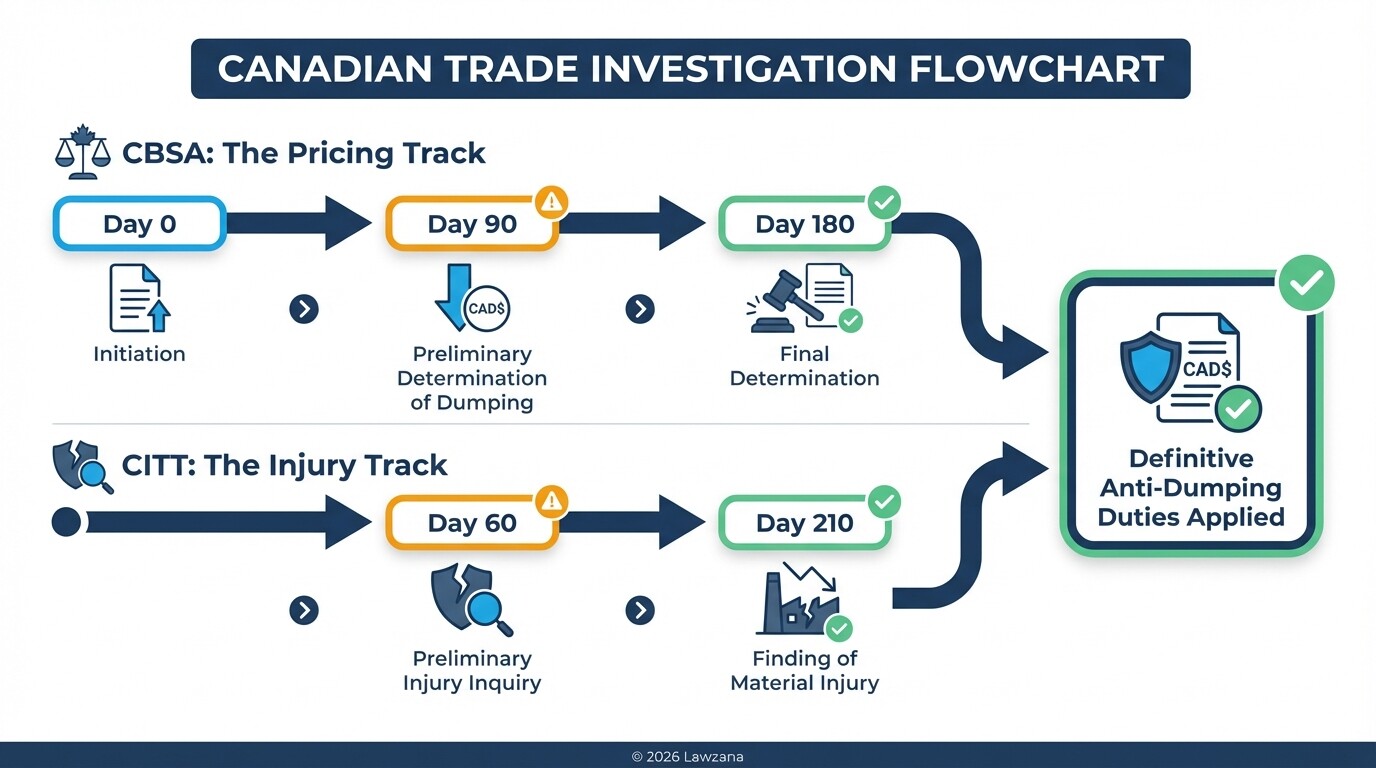

A Canadian anti-dumping investigation follows a rigid statutory schedule that usually lasts about 210 days from initiation to final orders. The process is bifurcated, meaning two different government agencies run concurrent investigations into different aspects of the case.

The CBSA begins the process by investigating whether goods are being sold at a lower price in Canada than in the exporter's home market. Simultaneously, the CITT investigates whether these imports are actually hurting Canadian producers. If both agencies find in the affirmative, definitive duties are applied.

| Phase | Timeline | Responsible Agency | Action Taken |

|---|---|---|---|

| Initiation | Day 0 | CBSA | Official start of the investigation. |

| Preliminary Determination | Day 90 | CBSA | Initial calculation of dumping margins; provisional duties may be applied. |

| Preliminary Injury Inquiry | Day 60 | CITT | Determination if there is a reasonable indication of injury to Canadian industry. |

| Final Determination | Day 180 | CBSA | Final calculation of specific duty rates for participating exporters. |

| Finding of Injury | Day 210 | CITT | Final decision on whether the dumped goods caused material injury. |

Proving Normal Value and Export Price to Minimize Duty Rates

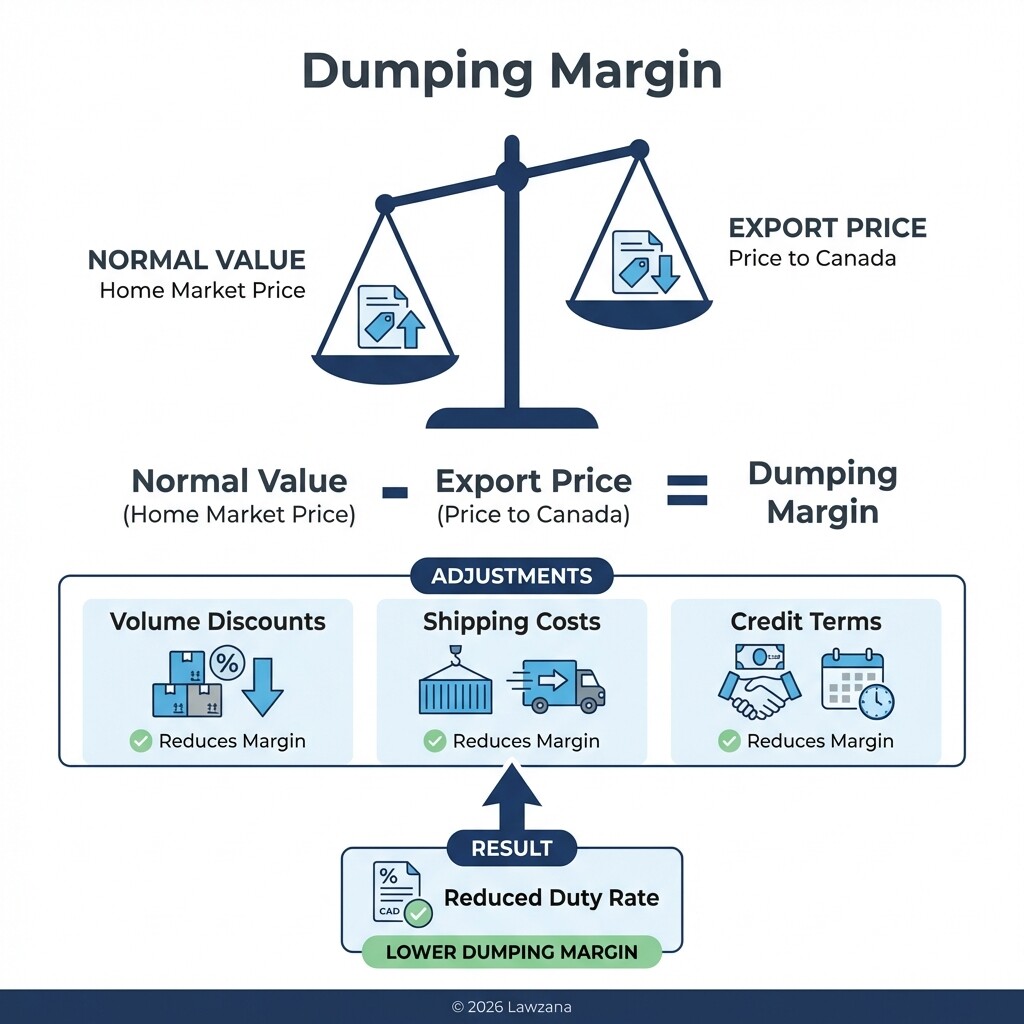

The "dumping margin" is the difference between the normal value of the goods and their export price to Canada. To minimize or eliminate duty rates, an exporter must prove to the CBSA that their Canadian sales prices are commensurate with their home market prices or their cost of production plus a reasonable profit.

Normal value is typically calculated based on the price at which the exporter sells the same or similar goods to customers in their own country. If there are insufficient domestic sales, the CBSA uses a "constructed value" method, which totals the cost of production, administrative selling expenses, and a margin for profit.

The export price is the price paid by the Canadian importer, minus any costs associated with shipping the goods from the country of export. To lower the dumping margin, exporters should:

- Ensure all adjustments, such as volume discounts or differences in credit terms, are clearly documented.

- Prove that domestic sales are made in the "ordinary course of trade" to profitable customers.

- Accurately categorize "like goods" so that lower-cost domestic models are compared to lower-cost export models.

Representing Your Business Before the Canadian International Trade Tribunal

While the CBSA focuses on the math of pricing, the CITT focuses on the economic impact. Even if the CBSA finds that you are dumping goods, you will not face permanent duties if the CITT decides those goods did not cause "material injury" to Canadian manufacturers.

Representing an exporter before the CITT requires a sophisticated economic defense. The tribunal looks for a causal link between the dumped imports and the Canadian industry's loss of market share, declining profits, or reduced employment. Exporters must argue that any struggles faced by Canadian companies are due to other factors, such as shifting consumer preferences, poor management, or global economic downturns.

Because much of the evidence involves sensitive pricing data from Canadian competitors, only lawyers who have signed a confidentiality undertaking can access the full record. This makes specialized legal counsel essential for interpreting the strengths and weaknesses of the domestic industry's claims.

Strategies for Annual Reviews and Duty Recalculations

Once a duty order is in place, the specific rate applied to your company is not necessarily permanent. The CBSA conducts periodic re-investigations, often referred to as "Normal Value Reviews" or "re-investigations," to update the duty rates based on more recent market data.

If your production costs have decreased or your home market prices have fallen since the original investigation, you can request a review to have your duty rate lowered. This is a proactive strategy that allows exporters to regain competitiveness in the Canadian market. Conversely, if you fail to participate in these reviews, the CBSA may revoke your specific rate and apply the "All Others" rate, which is typically the highest possible duty based on the most aggressive data provided by Canadian producers.

How Trade Agreements Impact Duty Enforcement in Canada

Canada is a member of several major trade agreements, including the United States-Mexico-Canada Agreement (USMCA/CUSMA) and the Comprehensive Economic and Trade Agreement (CETA) with the European Union. These agreements do not exempt exporters from anti-dumping laws, but they do provide unique procedural safeguards.

Under the USMCA, for example, exporters from the United States or Mexico can request a "Chapter 10" binational panel review. This allows a panel of experts from both countries to review whether the CBSA or CITT followed Canadian law correctly, providing an alternative to the Federal Court of Appeal. These international frameworks ensure a higher level of transparency and accountability in how Canada applies its trade remedy laws.

Common Misconceptions About Canadian Anti-Dumping Duties

"Anti-dumping duties are a penalty for illegal behavior." Dumping is not a crime or a violation of international law in the traditional sense. It is a commercial practice that triggers a trade remedy. The duties are meant to level the playing field for Canadian producers, not to punish the foreign exporter.

"If I match my competitor's price in Canada, I won't be dumped." This is a dangerous myth. Dumping is calculated by comparing your Canadian price to your home market price, not by comparing your price to other Canadian sellers. If your home market price is high, matching a low price in Canada will result in a dumping finding regardless of what your competitors are doing.

"I can wait until the final determination to provide my data." The CBSA operates on a "pay-to-play" model. If you do not provide complete, verified data during the initial 90-day window, the agency will use "Facts Available," which almost always results in a prohibitively high duty rate that can effectively bar you from the Canadian market for years.

FAQ

What is the difference between anti-dumping and countervailing duties?

Anti-dumping duties apply when a foreign company sells goods at prices lower than its home market. Countervailing duties apply when a foreign government provides specific subsidies or financial benefits to its manufacturers, allowing them to export at unfairly low prices.

How long do anti-dumping duties last in Canada?

Under the Special Import Measures Act, duty orders generally expire after five years. However, the CITT conducts an "Expiry Review" before the deadline. If they determine that dumping and injury are likely to continue if the duties are removed, the order is renewed for another five years.

Can an exporter appeal a CBSA or CITT decision?

Yes. CBSA determinations can be appealed to the CITT on specific valuation issues. Final injury findings by the CITT or final duty determinations by the CBSA can be challenged at the Federal Court of Appeal or through a binational panel under certain trade agreements like the USMCA.

What happens if I don't participate in the investigation?

If an exporter ignores the CBSA's Request for Information, they are assigned a "residual" or "All Others" duty rate. This rate is calculated using the highest dumping margins found during the investigation and is usually high enough to make exporting to Canada financially impossible.

When to Hire a Lawyer

Navigating a SIMA investigation is impossible without specialized trade counsel. You should hire a lawyer immediately if:

- Your company has received a "Notice of Initiation of Investigation" from the CBSA.

- You are a major exporter to Canada and hear rumors that a Canadian domestic industry group is preparing a "dumping complaint."

- You believe your current anti-dumping duty rate is based on outdated information and want to request a Normal Value Review.

- You need to access confidential evidence submitted by Canadian competitors during a CITT injury inquiry.

Next Steps

- Audit your records: Immediately gather the last 12 months of sales data for both your home market and your exports to Canada.

- Contact a trade expert: Engage a Canadian lawyer who specializes in the Special Import Measures Act to serve as your authorized representative.

- Notify your importers: Communicate with your Canadian partners, as they are the ones who will technically be responsible for paying the duties at the border.

- Prepare your narrative: Work with counsel to identify non-price factors (like quality or specialized technology) that explain your market share in Canada, which can be used in the CITT injury defense.