- Non-resident landlords must strictly adhere to the Prevention of Illegal Eviction from and Unlawful Occupation of Land Act (PIE Act) and the Rental Housing Act to avoid legal penalties.

- Security deposits must be placed in a separate interest-bearing account, with interest accruing for the benefit of the tenant.

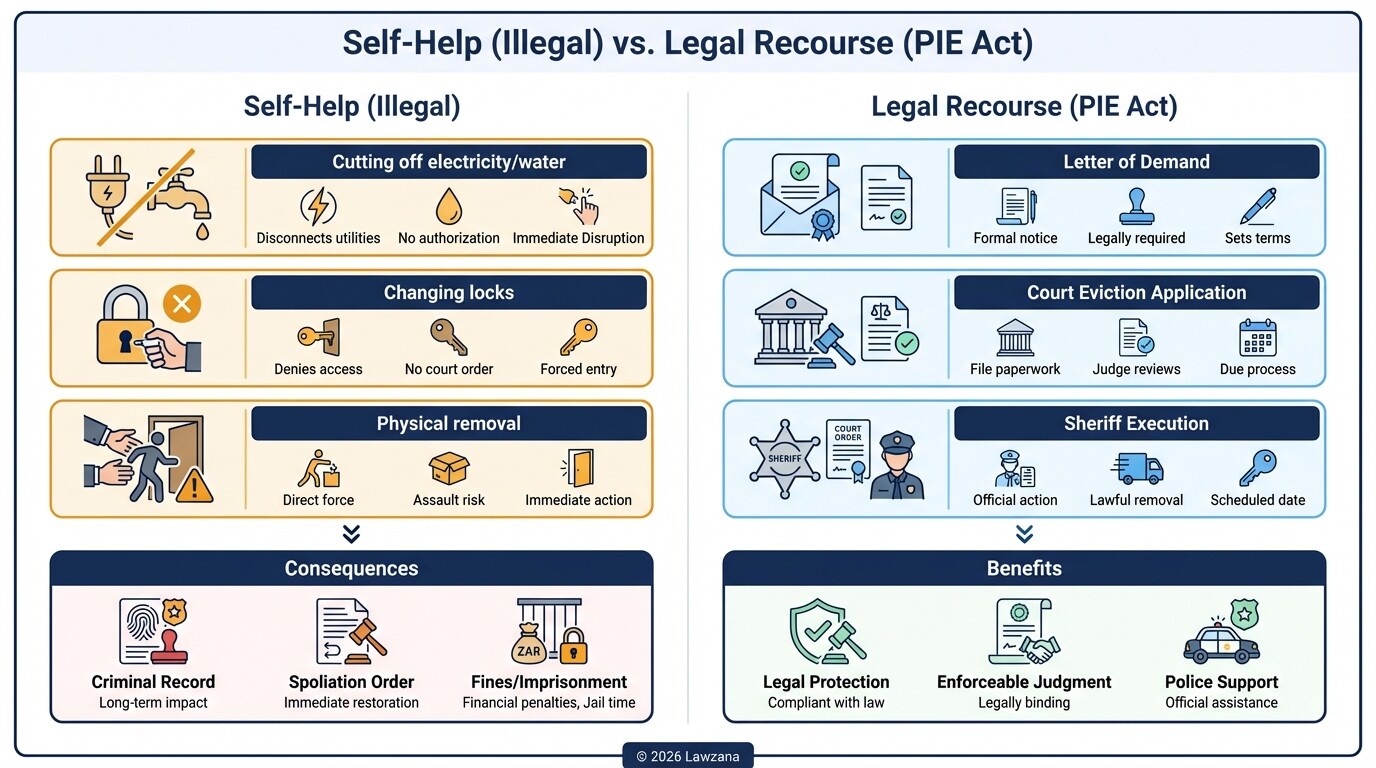

- Illegal "self-help" measures, such as cutting off electricity or water, are considered criminal offenses and can result in immediate court orders against the landlord.

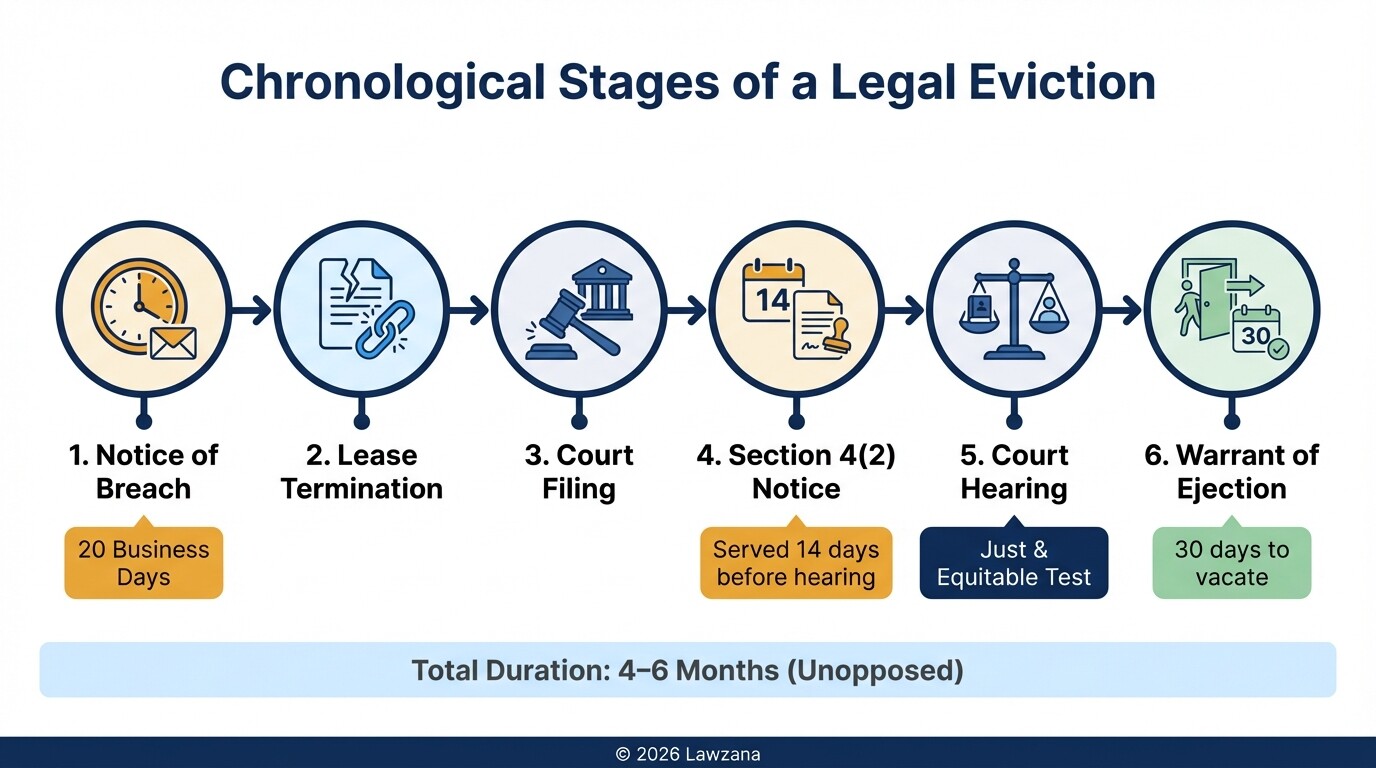

- A legal eviction process in South Africa generally takes between 4 and 6 months to complete through the court system.

- Rental income derived from South African property is subject to South African income tax, requiring non-residents to register with the South African Revenue Service (SARS).

Foreign Landlord Compliance Checklist

Foreign property owners must meet specific administrative and legal requirements to protect their investments and remain compliant with South African law. Failing to follow these steps can lead to unenforceable lease terms or difficulty in recovering unpaid rent.

Use this checklist to ensure your South African rental property is legally managed:

- Written Lease Agreement: Ensure the lease is in writing and signed by all parties to comply with the latest amendments to the Rental Housing Act.

- Inbound Inspection Report: Conduct a joint physical inspection with the tenant before they move in and document it with photos and a signed report.

- Interest-Bearing Deposit Account: Open a dedicated account for the security deposit where interest can be tracked for the tenant.

- SARS Registration: Obtain a South African tax number to report rental income and claim allowable expenses.

- Local Representative: Appoint a local property manager or attorney to receive legal notices, as the PIE Act requires certain documents to be served physically.

- Utility Management: Ensure municipal accounts are monitored monthly to prevent debt accumulation that could lead to property liens.

Compliance with the Rental Housing Act and PIE Act for Evictions

The Rental Housing Act and the Prevention of Illegal Eviction from and Unlawful Occupation of Land Act (PIE Act) provide the legal framework that protects both landlords and tenants in South Africa. Foreign owners must realize that South African law heavily favors the "right to housing," meaning a tenant cannot be removed without a specific court order issued under the PIE Act.

To remain compliant during an eviction, a landlord must follow a rigid procedural path. The PIE Act requires that "just and equitable" circumstances be considered by a magistrate or judge before an eviction is granted. This includes evaluating the rights of the elderly, children, or households headed by women. If a foreign owner attempts to bypass these statutes by using a generic international lease agreement that does not reference South African law, the court may dismiss the eviction application entirely.

Why Illegal Termination of Utilities Is a Costly Mistake

Cutting off electricity or water to force a non-paying tenant to vacate is an illegal practice known as "spoliation" in South African law. Landlords who take this route face immediate legal retaliation through a "Spoliation Order," which forces the landlord to restore services and pay the tenant's legal costs.

In South Africa, access to water and electricity is often viewed through the lens of constitutional rights. When a landlord terminates utilities without a court order, they are taking the law into their own hands, which the courts do not tolerate. Furthermore, under the Rental Housing Act, interfering with a tenant's utilities is a criminal offense that can lead to a fine or even imprisonment. If a tenant stops paying, the only legal recourse is to issue a formal letter of demand and proceed with a summons for debt recovery or an eviction application.

Requirements for Holding Security Deposits in Interest-Bearing Accounts

Under Section 5(3)(d) of the Rental Housing Act, a landlord must invest the tenant's security deposit in an interest-bearing account with a financial institution. The interest earned on that deposit belongs to the tenant and must be paid out to them, along with the principal amount, at the end of the lease term after any legitimate deductions for damages.

Foreign landlords often mistakenly believe they can keep the deposit in an offshore account or a standard non-interest savings account. This is a violation of the Act. Upon request, the landlord must provide the tenant with written proof of the interest accrued on the deposit. When the lease ends, the landlord and tenant must conduct a joint exit inspection to determine if any of the deposit should be withheld for repairs. If no repairs are needed, the deposit and the accrued interest must be refunded within 7 days of the lease expiration.

Estimated Timeline for a Legal Eviction Through the Courts

A standard, unopposed eviction in South Africa typically takes between 4 and 6 months from the initial breach of contract to the physical removal of the tenant. If the tenant chooses to oppose the application, the timeline can extend to 8 months or longer depending on the court's availability.

The process follows a specific chronological order:

- Notice of Breach (20 Business Days): If the tenant fails to pay, the landlord must provide a written notice giving them 20 business days to rectify the breach (per the Consumer Protection Act).

- Termination of Lease: If the tenant does not pay within those 20 days, the landlord formally cancels the lease.

- Filing the Eviction Application: An attorney files an application in the Magistrate's Court or High Court.

- Section 4(2) Notice: The court issues a notice that must be served by the Sheriff to the tenant and the local municipality at least 14 days before the hearing.

- The Hearing: A judge hears the case and determines if the eviction is "just and equitable."

- Warrant of Ejection: If the order is granted, the tenant is usually given 30 days to move out voluntarily. If they stay, the Sheriff is authorized to remove them.

Tax Obligations for Non-Resident Landlords in South Africa

Non-resident landlords are legally required to pay income tax to the South African Revenue Service (SARS) on any profit generated from South African rental property. Even if the owner resides in the United States or Europe, the "source" of the income is South Africa, giving SARS the primary taxing right.

The tax is calculated on the gross rental income minus "allowable expenses," which include property management fees, repairs, insurance, and municipal rates. It is important to note that if a landlord uses an agent to collect rent, and that agent does not have a valid exemption certificate, the agent may be required to withhold 15% of the gross rent as a preliminary tax payment for the landlord. Non-residents must file an annual tax return (ITR12) in South Africa to ensure they are not overpaying and to remain in good standing with the law, especially if they plan to sell the property later, as the "Capital Gains Tax" will be scrutinized upon exit.

| Expense Type | Tax Deductible? | Note |

|---|---|---|

| Property Management Fees | Yes | Fees paid to local agents are fully deductible. |

| Mortgage Interest | Yes | Only the interest portion, not the principal repayment. |

| Home Improvements | No | Improvements are added to the "base cost" for Capital Gains Tax. |

| General Repairs | Yes | Day-to-day maintenance is deductible. |

| Municipal Rates/Taxes | Yes | Ongoing taxes paid to the city are deductible. |

Common Misconceptions

Myth: I can change the locks if the lease has expired and the tenant stays. Fact: This is an illegal "lock-out." Even if the lease has expired, the person is considered an "unlawful occupier" and can only be removed via a court order under the PIE Act. Changing locks can result in a court order for the tenant to be let back in at your expense.

Myth: If I live overseas, South African laws don't apply to my private contract. Fact: South African property law follows the principle of lex situs, meaning the law of the place where the property is located always takes precedence. Any clause in your lease that contradicts the Rental Housing Act is legally void.

Myth: I can use the security deposit to cover the last month's rent. Fact: Legally, the deposit is for damages and unpaid bills at the end of the term. Unless the lease specifically allows it and the landlord agrees, the tenant is required to pay the final month's rent separately.

FAQs

Can a foreign landlord evict a tenant if they need the property for their own use?

Yes, but the landlord must still follow the PIE Act process. They must prove to the court that they genuinely intend to occupy the property and provide the tenant with the required notice period stipulated in the lease agreement, usually one to two months.

Do I need a South African bank account to receive rent?

While not strictly required by law, it is highly recommended. Using a local account makes it easier to manage the interest-bearing deposit requirement and pay local expenses like municipal rates and taxes without incurring international transfer fees.

What happens if the tenant refuses to move out after the court order?

The landlord cannot personally remove the tenant. Only the Sheriff of the Court has the legal authority to physically remove an occupant and their possessions. Any attempt by the landlord to do so is a criminal offense.

When to Hire a Lawyer

Navigating the PIE Act is technically demanding, and a single procedural error can restart the 4-6 month eviction clock. You should hire a South African attorney if:

- Your tenant has missed two or more consecutive rental payments.

- You have received a notice from the municipality regarding illegal activities on your property.

- You are drafting a lease agreement for the first time and want to ensure it complies with the Rental Housing Act and Consumer Protection Act.

- You need to defend yourself against a "Spoliation Order" or a Rental Housing Tribunal complaint.

Next Steps

- Audit Your Lease: Review your current lease agreement to ensure it contains the necessary South African legal disclosures and references.

- Verify the Deposit: Confirm that your tenant's deposit is in a separate, interest-bearing account and provide them with proof of this.

- Appoint a Representative: If you are abroad, ensure you have a local "address for service" (domicilium citandi et executandi) where legal documents can be delivered.

- Register with SARS: If you haven't already, consult a South African tax practitioner to register for income tax to avoid penalties and interest on rental profits.