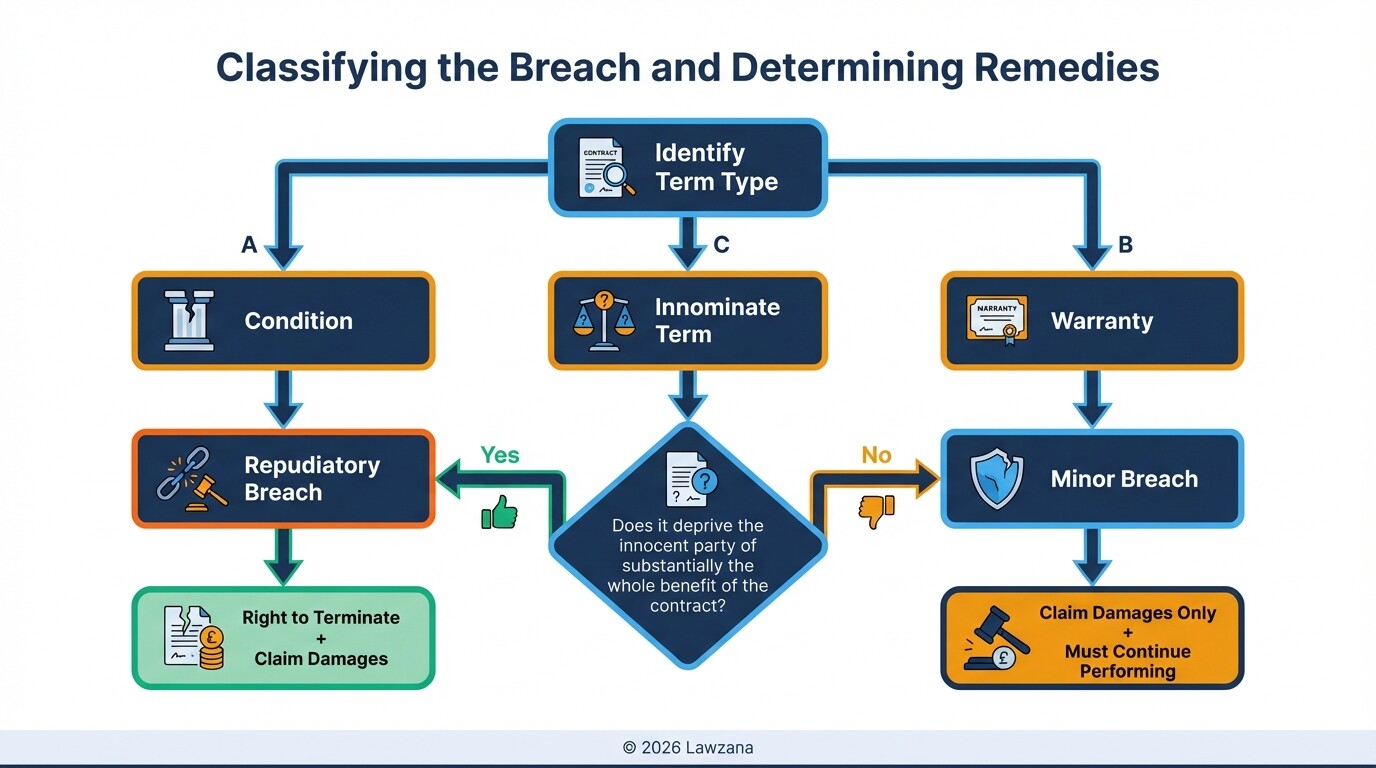

- English law distinguishes between minor breaches and "repudiatory" breaches, which determine whether you can terminate the contract or merely claim damages.

- Claimants have a legal "duty to mitigate," meaning they must take reasonable steps to minimize their financial losses after a breach occurs.

- The UK court system follows a "loser pays" principle, where the unsuccessful party typically covers a significant portion of the winner's legal costs.

- Alternative Dispute Resolution (ADR), such as mediation, is often mandatory to consider before a case proceeds to a full High Court trial.

- Specific performance-forcing a party to fulfill their contractual duty-is an equitable remedy granted only when monetary damages are an inadequate solution.

What is the difference between a material and a repudiatory breach of contract?

A repudiatory breach is a severe violation of a "condition" or a fundamental term that goes to the heart of the agreement, allowing the innocent party to terminate the contract and sue for damages. A material breach is a high-threshold failure to perform that is significant to the contract's objective but may not always grant the right to terminate unless explicitly defined in the agreement.

In the UK, the classification of the term breached dictates your legal path:

- Conditions: These are fundamental terms. Any breach of a condition is considered repudiatory, giving you the right to end the relationship immediately.

- Warranties: These are minor or secondary terms. A breach of a warranty only allows you to claim damages; you must continue performing your side of the contract.

- Innominate Terms: These are "intermediate" terms. The court looks at the effect of the breach. If the breach deprives you of "substantially the whole benefit" of the contract, it is treated as repudiatory.

When faced with a breach, you must choose whether to affirm the contract (keep it going and sue for losses) or terminate it. If you continue to accept services after a major breach, you may inadvertently "affirm" the contract, losing your right to terminate.

How are compensatory damages calculated and what is the duty to mitigate?

The primary goal of damages in UK commercial litigation is to put the claimant in the position they would have been in had the contract been performed correctly. This is known as "expectation loss," and it requires the claimant to prove that the loss was a foreseeable result of the breach.

To successfully claim damages, the court evaluates two main factors:

- Remoteness: Under the rule in Hadley v Baxendale, you can only recover losses that arise naturally from the breach or those that were in the "reasonable contemplation" of both parties when the contract was made.

- The Duty to Mitigate: You cannot sit back and let losses pile up. You must take "reasonable steps" to reduce your financial exposure. For example, if a supplier fails to deliver goods, you must attempt to buy them from another source at a market price. If you fail to mitigate, the court will deduct the amount you could have saved from your final award.

| Type of Loss | Description | Recoverable? |

|---|---|---|

| Direct Loss | Immediate financial impact (e.g., cost of replacement). | Yes |

| Consequential Loss | Indirect impact (e.g., lost profits on other deals). | Only if foreseeable |

| Punitive Damages | Costs meant to punish the defendant. | Rarely in contract law |

When can a business seek specific performance or injunctive relief?

Specific performance and injunctions are "equitable remedies" granted at the court's discretion when a simple check for damages cannot solve the problem. These are most common in cases involving unique assets, such as real estate, specialized intellectual property, or shares in a private company that cannot be bought on the open market.

- Specific Performance: A court order compelling the breaching party to fulfill their specific contractual obligations. It is never granted for personal service contracts (like employment) or if it would require constant court supervision.

- Prohibitory Injunctions: A court order preventing a party from doing something that would breach the contract (e.g., a former employee using trade secrets in violation of a non-compete clause).

- Mandatory Injunctions: An order requiring a party to take a specific action to undo a breach.

To secure these remedies, you must demonstrate that "damages are an inadequate remedy." If the court believes money can fix the issue, they will almost always prefer damages over an injunction.

What are the Pre-Action Protocols and the role of ADR in the UK?

Before filing a claim in the High Court or County Court, parties must follow the Practice Direction - Pre-Action Conduct, which mandates a formal exchange of information. This process is designed to encourage settlement and avoid the time and expense of a full trial.

The process typically involves:

- Letter of Claim: The claimant sends a detailed letter outlining the basis of the claim, the loss suffered, and the remedy sought.

- Letter of Response: The defendant has a set period (usually 14 to 30 days) to respond, either admitting liability or explaining their defense.

- Alternative Dispute Resolution (ADR): The courts expect parties to engage in mediation or neutral evaluation. If a party unreasonably refuses to participate in ADR, the court may penalize them by making them pay the other side's legal costs, even if they eventually win the case.

Mediation is the most popular form of ADR in UK commercial law. It involves a neutral third party helping both businesses reach a confidential, out-of-court settlement that is often more creative and flexible than a court judgment.

What are the timeline and cost expectations for High Court claims?

Commercial litigation in the High Court of Justice (specifically the Business and Property Courts) is a rigorous process that typically takes between 12 and 18 months from the issuance of a claim to a final trial. Costs vary significantly based on the complexity of the evidence and the length of the trial, often starting at £50,000 and exceeding £500,000 for high-value disputes.

The standard timeline includes:

- Issue and Service of Claim (Month 1): Filing the claim form and "Particulars of Claim."

- Defense and Counterclaim (Months 2-3): The defendant files their response.

- Case Management Conference (Months 4-6): A judge sets the schedule for the rest of the case.

- Disclosure (Months 6-9): Both sides exchange relevant documents (often called "E-disclosure" for digital records).

- Witness Statements and Expert Evidence (Months 9-12): Exchange of formal written testimony.

- Trial (Months 12-18): Oral arguments and cross-examination before a judge.

In the UK, the "Costs Follow the Event" rule applies. This means the winner usually recovers about 60% to 80% of their legal costs from the loser. This creates a high-stakes environment where the risk of losing often drives parties toward settlement.

Common Misconceptions in UK Commercial Litigation

Myth 1: "I can sue for the full value of the contract regardless of my other income." In reality, the duty to mitigate means if you found a replacement contract that covered some of your losses, those earnings must be deducted from your claim. You can only recover your actual net loss.

Myth 2: "We don't have a written contract, so I can't sue." Under English law, oral contracts and "contracts by conduct" are legally binding in most commercial contexts. While harder to prove than a signed document, a series of emails, invoices, and handshakes can constitute a valid agreement.

Myth 3: "If they breached the contract, I can stop paying them for everything immediately." This is a dangerous assumption. If the breach is "minor" (a warranty), and you stop paying, you might be the one committing a repudiatory breach. Always seek legal advice before withholding payment.

Frequently Asked Questions

What is the statute of limitations for a breach of contract in the UK?

Under the Limitation Act 1980, you generally have six years from the date of the breach to bring a claim. For contracts executed as a "deed," this period is extended to 12 years.

Can I recover "loss of profit" in a breach of contract claim?

Yes, provided the loss of profit was a foreseeable consequence of the breach at the time the contract was signed. If the profit loss resulted from a "special" circumstance the defendant didn't know about, it may be deemed too remote to recover.

Is a "Material Breach" the same as a "Fundamental Breach"?

While terms are often used interchangeably in conversation, a fundamental breach specifically refers to a violation so severe it justifies termination. "Material" is often a defined term within a specific contract's "Termination" clause and its meaning depends on the specific wording used.

Does the High Court handle all commercial disputes?

No. Claims for less than £100,000 are typically handled by the County Court. The High Court (Business and Property Courts) is reserved for higher-value, complex, or multi-jurisdictional commercial cases.

When to Hire a Lawyer

You should consult a commercial litigation solicitor as soon as you suspect a breach has occurred or if you have received a "Letter of Claim." Early intervention is critical to ensure you do not inadvertently affirm a contract you wish to terminate, or vice versa. Expert counsel is especially vital if:

- The contract involves complex cross-border jurisdictions.

- You need an urgent injunction to protect trade secrets or assets.

- The financial stakes are high enough to threaten your business's cash flow.

- You are entering the "Disclosure" phase, where mishandling digital evidence can lead to severe court sanctions.

Next Steps

- Gather Evidence: Collect all signed agreements, email trails, invoices, and proof of your attempts to mitigate losses.

- Review the Dispute Resolution Clause: Check your contract to see if it mandates arbitration or a specific jurisdiction before taking court action.

- Issue a Formal Notice: Have a solicitor draft a "Letter of Claim" that complies with the Pre-Action Protocol to signal your seriousness and encourage settlement.

- Consult the Judiciary of England and Wales website: Review current court guidance for business disputes to understand the procedural expectations for your specific sector.