- The UK operates a strict liability regime for financial sanctions breaches, meaning a company can be fined even if it did not intend to break the law.

- Ownership and control tests extend beyond a simple 50 percent shareholding to include "de facto" influence over an entity.

- Export licenses for high-priority goods are managed through the SPIRE system and require rigorous technical specifications.

- Third-party intermediaries are the most common source of "sanctions circumvention" and require enhanced due diligence.

- Modern contracts must include specific "Sanctions and Export Control" force majeure language to prevent legal deadlock during geopolitical shifts.

UK Sanctions Compliance Checklist 2026

Effective sanctions compliance in the UK requires a proactive framework that adapts to the rapidly changing lists provided by the Office of Financial Sanctions Implementation (OFSI). This checklist provides the foundational steps for international traders to verify their supply chains and financial flows.

- Entity Screening: Screen all customers, suppliers, and beneficial owners against the UK Sanctions List and the OFSI Consolidated List.

- Ownership Analysis: Determine if any non-sanctioned counterparty is owned more than 50 percent by a designated person or controlled by one.

- Product Classification: Check the UK Strategic Export Control Lists to see if your goods require a Standard Individual Export License (SIEL).

- End-User Verification: Obtain a signed End-User Undertaking (EUU) to ensure goods are not diverted to prohibited military or internal repression uses.

- Red Flag Assessment: Evaluate transactions for "circumvention" risks, such as unusually complex shipping routes or payments from third-country bank accounts.

- Contractual Safeguards: Review all international trade agreements to ensure they include "right to terminate" clauses triggered by new sanctions designations.

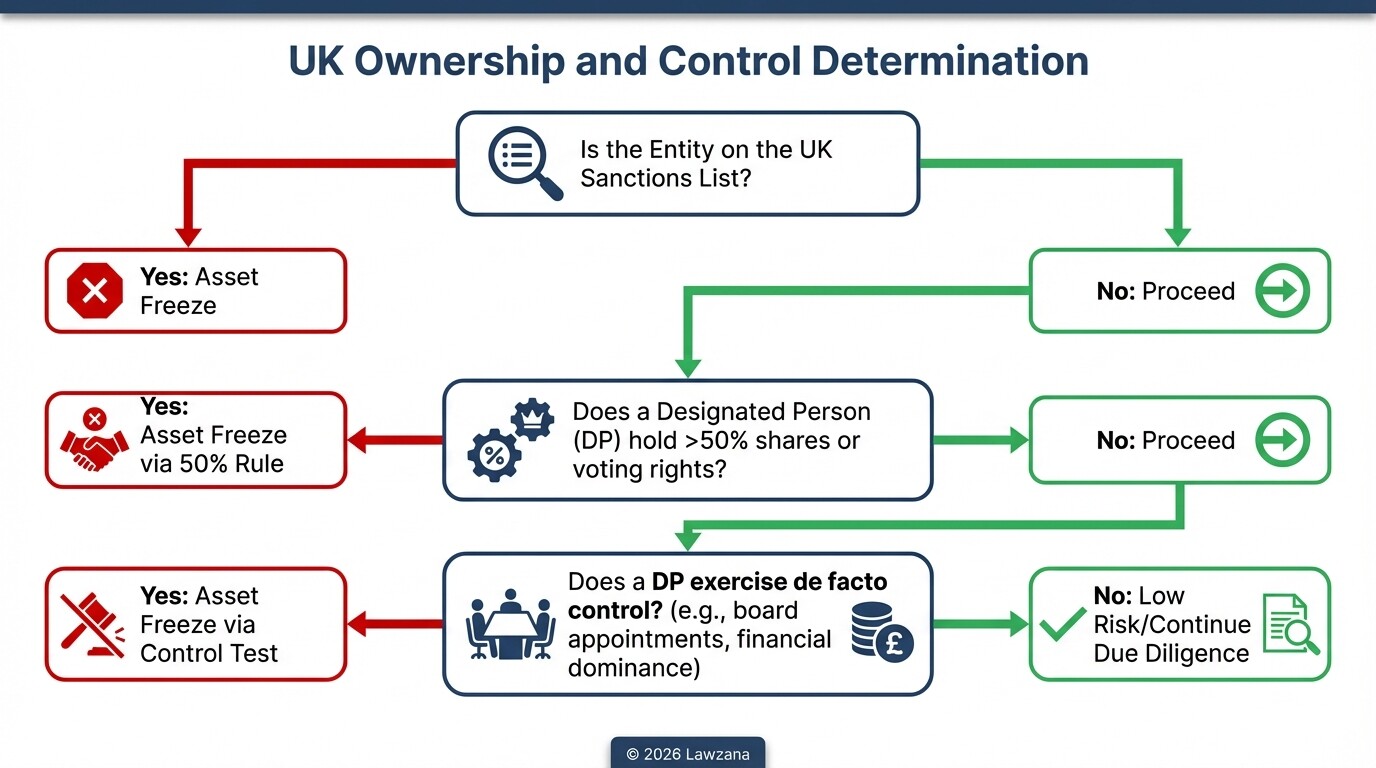

Understanding the Ownership and Control Test for Sanctioned Entities

An entity is considered sanctioned in the UK if it is owned or controlled by a "Designated Person" (DP) on the official sanctions list. This goes beyond a simple name match, as any company "connected" to a DP is also subject to the same asset freeze and restrictions.

The UK government applies two primary criteria to determine ownership and control. If either is met, the entity is treated as a sanctioned body:

- The 50 Percent Rule: The DP holds, directly or indirectly, more than 50 percent of the shares or voting rights in the entity. This includes aggregated holdings if multiple DPs work together to control the business.

- The Control Test: A DP has the right to appoint or remove a majority of the board of directors, or it is reasonable to expect the DP can ensure the entity's affairs are conducted in accordance with their wishes.

In 2026, the UK courts have increasingly focused on "de facto" control. Even if a DP holds no official shares, they may be deemed in control if they provide the primary financing or if the management regularly defers to their instructions.

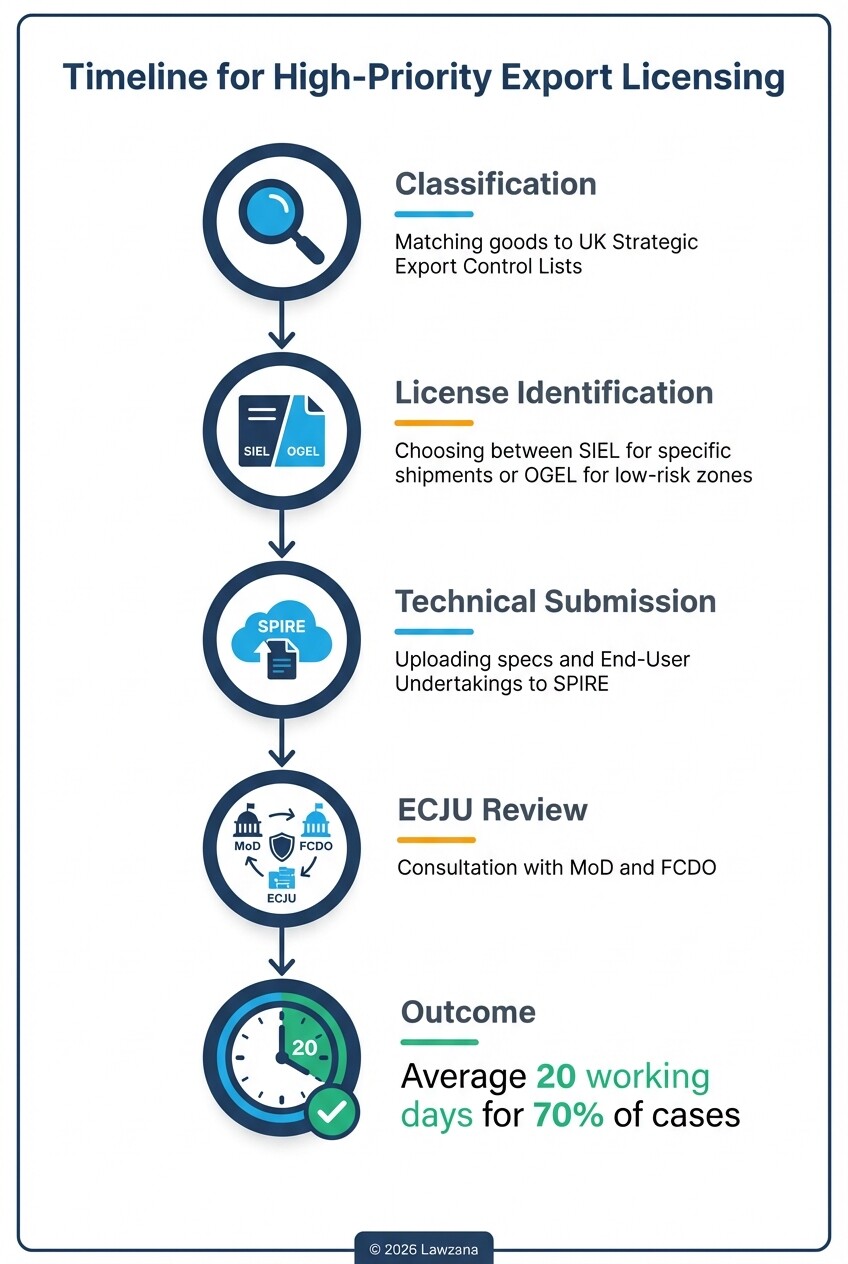

Applying for Licenses for High-Priority Goods Under 2026 Rules

Applying for a license for high-priority goods requires a formal submission to the Export Control Joint Unit (ECJU) via the digital licensing platform. Traders must demonstrate that their exports do not contribute to prohibited military programs or violate regional stability protocols.

High-priority goods generally include dual-use technology, high-end electronics, and specific industrial components that could be repurposed for military use. To navigate the 2026 rules:

- Classify Your Goods: Use the UK Consolidated List of Strategic Military and Dual-Use Items to find the correct "Rating" for your product.

- Identify the License Type: Most traders use a Standard Individual Export License (SIEL) for specific shipments, though frequent exporters may apply for an Open General Export License (OGEL) if the destination country is low-risk.

- Technical Documentation: Provide full technical specifications and a clear explanation of the end-use. The ECJU often consults with the Ministry of Defence and the Foreign, Commonwealth & Development Office (FCDO).

- Processing Timelines: While the UK aims to process 70 percent of SIEL applications within 20 working days, high-priority items involving complex jurisdictions can take several months.

Detailed guidance on current licensing criteria can be found at the official Export Control Joint Unit website.

Penalty Structures for Accidental Breaches of UK Financial Sanctions

The UK government enforces a "strict liability" standard for civil breaches of financial sanctions, administered by the Office of Financial Sanctions Implementation (OFSI). This means that the government does not need to prove you knew you were breaking the law; simply carrying out the prohibited transaction is enough for a penalty.

Penalties for non-compliance are severe and designed to act as a significant deterrent:

- Monetary Fines: OFSI can impose fines of up to £1,000,000 or 50 percent of the estimated value of the breach, whichever is higher.

- Public Disclosure: OFSI frequently publishes reports of breaches even when no fine is issued. This "naming and shaming" can cause irreparable reputational damage and lead to the withdrawal of banking facilities.

- Criminal Prosecution: For "knowing" or "intentional" breaches, individuals can face up to seven years in prison and unlimited fines under the Sanctions and Anti-Money Laundering Act 2018.

To mitigate these risks, companies should maintain a robust "compliance defense." If a breach occurs, making a voluntary disclosure to OFSI can lead to a significant reduction in the final penalty.

Due Diligence Requirements for Third-Party Intermediaries

Due diligence for third-party intermediaries involves a deep-dive investigation into agents, brokers, and freight forwarders to ensure they are not acting as "fronts" for sanctioned parties. In 2026, "circumvention" is a top priority for UK enforcement agencies.

Traders are expected to move beyond basic database checks. A defensible due diligence process includes:

- Ultimate Beneficial Ownership (UBO): Identifying the physical people who own the intermediary, often going through several layers of shell companies.

- Geographic Risk Assessment: Increasing scrutiny if the intermediary is based in a "hub" known for re-exporting goods to sanctioned regions.

- Transaction Monitoring: Looking for red flags like "round-tripping" payments, where funds move through multiple countries before reaching their destination.

- Contractual Reps and Warranties: Requiring the intermediary to sign certificates of compliance and granting the exporter the right to audit their books.

Sample Force Majeure Clause for Sanctions Disruptions

Standard force majeure clauses often fail to cover the specific legal impossibility created by new sanctions. Using a dedicated sanctions provision ensures that your business can suspend performance or terminate a contract without being sued for breach of contract.

Sample Sanctions & Export Control Clause

"The Company shall not be required to perform any obligation under this Agreement if such performance would violate, or expose the Company to punitive measures under, any sanctions or export control laws applicable to the United Kingdom, the United States, or the United Nations.

In the event that new sanctions are imposed that prohibit the delivery of goods or services, or if a counterparty becomes a Designated Person, the Company may suspend performance immediately upon written notice. If the disruption continues for more than 30 days, the Company reserves the right to terminate this Agreement without liability. The Customer warrants that it is not currently subject to sanctions and shall notify the Company immediately of any change in its status or ownership."

Common Misconceptions About UK Sanctions

"If a person isn't on the list, I can trade with them."

This is the most dangerous misconception. Because of the "Ownership and Control" rules, you may be prohibited from trading with a non-sanctioned person if they are 51 percent owned by someone who is on the list. Always look "up the chain" of ownership.

"I am safe because my bank cleared the payment."

Banks use automated filters that catch many hits, but they are not infallible. The legal responsibility for sanctions compliance rests with the company making the trade, not the financial institution facilitating the payment. You cannot use "the bank let it through" as a legal defense.

"EU sanctions and UK sanctions are the same."

Since Brexit, the UK maintains its own independent list. While they often align with the EU and US, the UK frequently adds individuals or entities that the EU does not, or vice versa. You must check the UK-specific list for all domestic operations.

FAQ

What is the difference between an asset freeze and a trade sanction?

An asset freeze prohibits any person in the UK from dealing with funds or economic resources owned or controlled by a designated person. Trade sanctions specifically restrict the import, export, or transfer of certain goods, technology, or services to specific countries or entities.

Do UK sanctions apply to my overseas branches?

Yes. UK sanctions apply to all persons within the territory or jurisdiction of the UK, and to all UK persons wherever they are in the world. This includes branches of UK companies located in foreign countries.

How often is the UK Sanctions List updated?

The list is updated frequently, sometimes daily, as the geopolitical landscape shifts. Most compliance teams use automated software that syncs with the OFSI API to ensure real-time updates.

When to Hire a Lawyer

You should consult a legal expert in UK sanctions if you discover a potential "hit" during screening that involves a complex corporate structure or if you need to make a voluntary disclosure to OFSI. Legal counsel is also essential when drafting high-value international trade contracts to ensure that "Ownership and Control" risks are properly allocated and that termination rights are enforceable. If you receive a "Request for Information" from the ECJU or OFSI, professional representation is vital to protect your company from civil or criminal liability.

Next Steps

- Audit your current database: Ensure your screening software is specifically pulling from the UK Consolidated List, not just EU or US lists.

- Review your contracts: Update your force majeure and "compliance with laws" clauses using the sample language provided above.

- Train your team: Ensure the procurement and sales departments understand the "Red Flags" of sanctions circumvention to prevent accidental breaches.

- Download the latest guidance: Visit the GOV.UK Sanctions page to review regime-specific notices.