- Regulatory Shift: While the UK Corporate Governance Code is mandatory for premium listed companies, large private companies must now follow the Wates Principles or explain their governance under Section 172 of the Companies Act 2006.

- 2026 Standards: New Financial Reporting Council (FRC) updates place a heavier burden on boards to monitor and report on the effectiveness of internal controls and risk management.

- Stakeholder Focus: Corporate governance in the UK has moved beyond shareholder primacy to include the interests of employees, suppliers, and the environment.

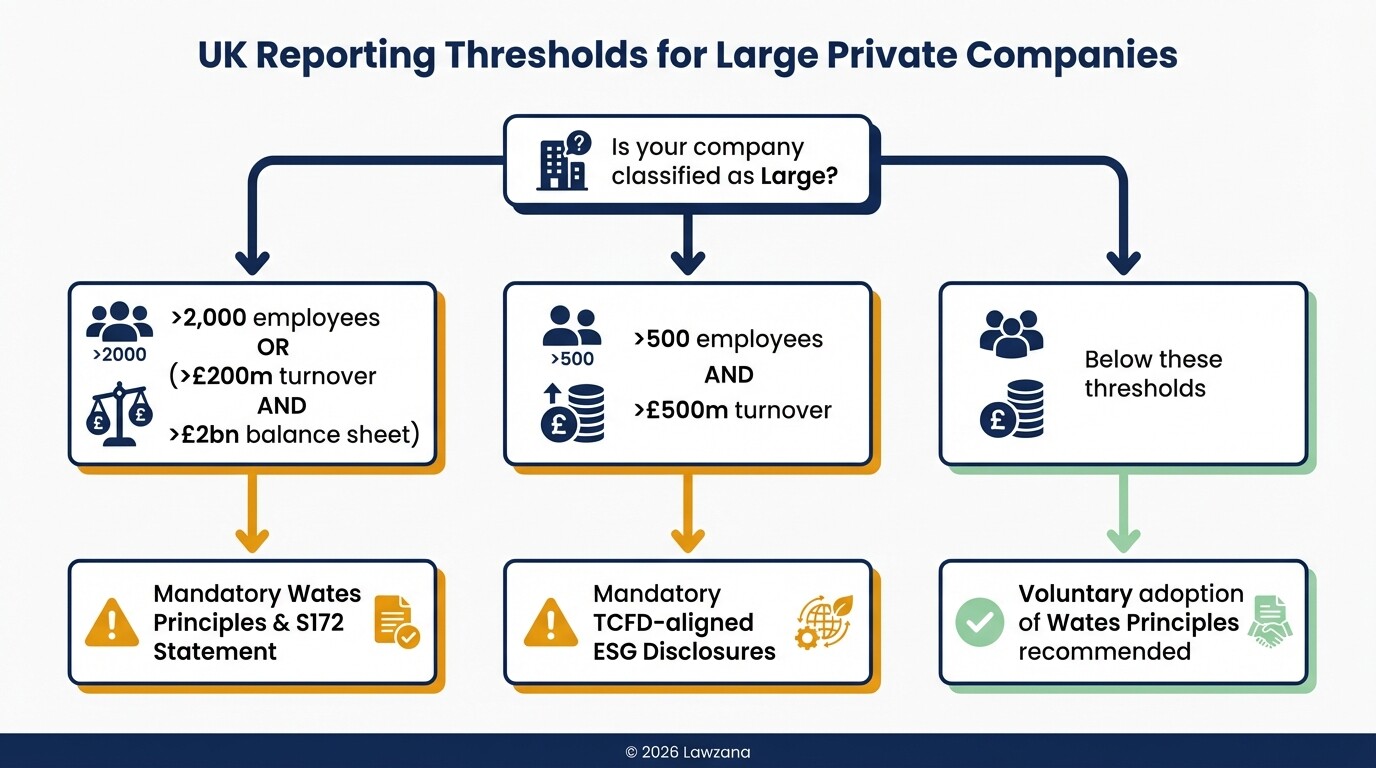

- Reporting Thresholds: Private companies with more than 2,000 employees or a turnover over £200 million and a balance sheet over £2 billion are subject to specific disclosure requirements.

Corporate Governance Compliance Checklist for Private Companies

A robust governance framework ensures that a private company remains attractive to investors, stays compliant with the Companies Act 2006, and mitigates operational risk. Use this checklist to evaluate your current standing against 2026 expectations.

| Focus Area | Requirement / Action Item | Status |

|---|---|---|

| Board Structure | Does the board include at least two independent non-executive directors (NEDs)? | [ ] |

| S172 Reporting | Is there a published statement explaining how directors promoted the success of the company for stakeholders? | [ ] |

| ESG Strategy | Has the company identified its climate-related financial risks (if over the £500m turnover threshold)? | [ ] |

| Internal Controls | Is there a written framework for monitoring financial, operational, and compliance controls? | [ ] |

| Diversity Policy | Is there a formal policy for board recruitment that considers gender and ethnic diversity? | [ ] |

| Minute-Taking | Are board minutes recorded, signed, and stored for at least 10 years as per Section 248? | [ ] |

| Succession Planning | Is there a documented plan for the replacement of the CEO and other key senior executives? | [ ] |

Board Composition, Diversity, and Director Independence

Board composition in the UK refers to the mix of skills, experience, and backgrounds of the individuals who lead a company. For private companies aiming for high-growth or exit, the board should ideally balance "Executive Directors" (those involved in daily operations) with "Non-Executive Directors" (independent advisors who provide oversight).

An effective board should not be a "rubber stamp" for the CEO. Instead, it must foster constructive challenge. Director independence is vital; an independent director is someone without a material interest in the company, such as a significant shareholding or a previous employment history within the firm. This independence ensures that decisions are made in the long-term interest of the entity rather than for personal or short-term gain.

Diversity is no longer just a "nice-to-have" metric but a governance priority. The FRC emphasizes that diverse boards-across gender, ethnicity, and cognitive approach-avoid "groupthink" and make better strategic decisions. Private companies should establish a formal nomination committee to oversee recruitment, ensuring that the selection process is transparent and merit-based.

Reporting Duties Under Section 172 of the Companies Act

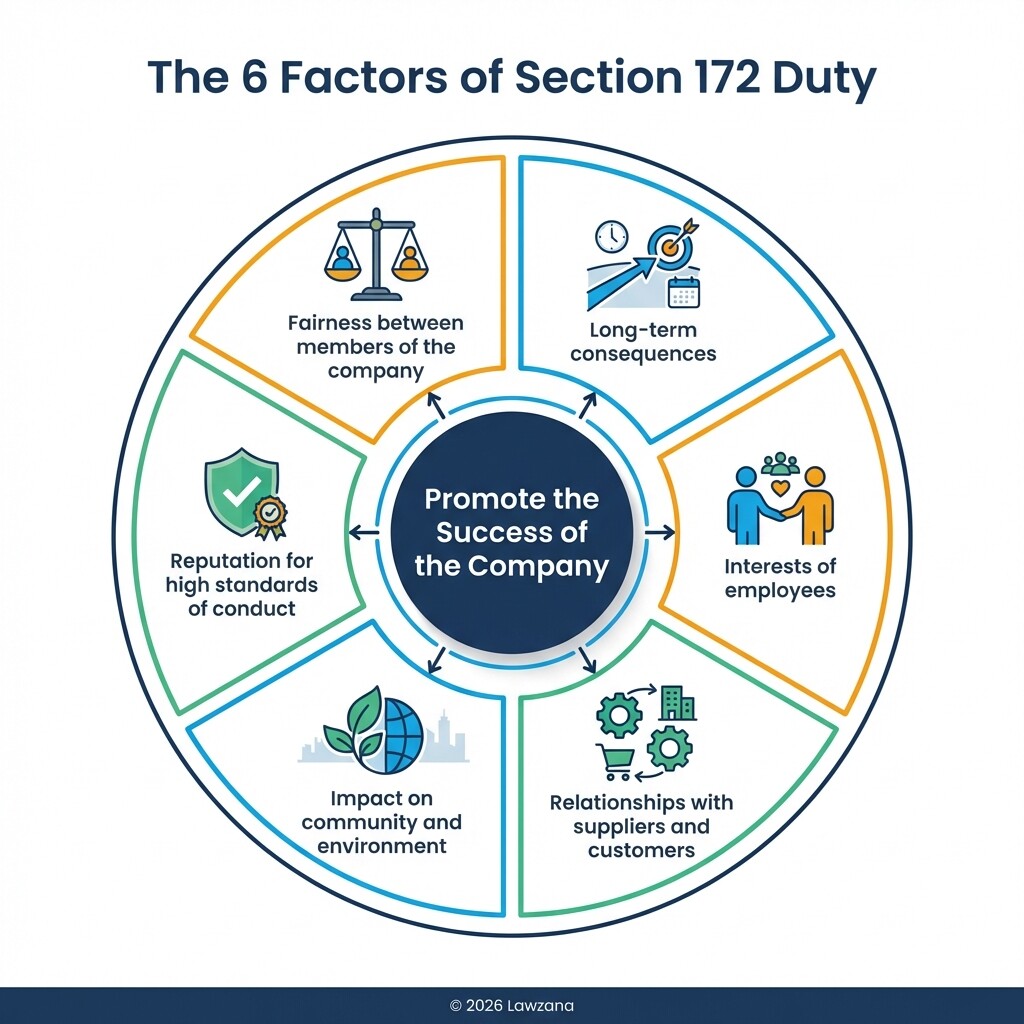

Section 172 of the Companies Act 2006 requires a director to act in a way they consider, in good faith, would be most likely to promote the success of the company for the benefit of its members as a whole. This duty is the cornerstone of UK corporate law, shifting the focus from short-term profits to long-term sustainability.

Large private companies must include a "Section 172(1) Statement" in their annual Strategic Report. This statement must explain how directors have had regard to:

- The likely consequences of any decision in the long term.

- The interests of the company's employees.

- The need to foster the company's business relationships with suppliers, customers, and others.

- The impact of the company's operations on the community and the environment.

- The desirability of the company maintaining a reputation for high standards of business conduct.

Failure to provide a meaningful S172 statement can lead to regulatory scrutiny and potential personal liability for directors if it is proven they neglected these statutory duties.

ESG Disclosure Expectations for Large Private Companies

Environmental, Social, and Governance (ESG) reporting is the process by which companies disclose their impact on the planet and society. In the UK, large private companies (typically those with over 500 employees and £500 million in turnover) are increasingly required to provide climate-related financial disclosures.

The UK government has aligned its reporting requirements with the Task Force on Climate-related Financial Disclosures (TCFD) framework. This means companies must report on:

- Governance: The board's oversight of climate-related risks.

- Strategy: The actual and potential impacts of climate change on the business model.

- Risk Management: How the company identifies, assesses, and manages climate risks.

- Metrics and Targets: The specific data used to assess these risks, such as carbon footprint.

Even for smaller private companies, following these standards is becoming a prerequisite for securing bank loans or attracting private equity, as institutional lenders are now required to report on the "greenness" of their portfolios.

Internal Control and Risk Management Frameworks for 2026

Internal controls are the systems and processes a company uses to ensure the accuracy of financial reporting, the safety of assets, and compliance with laws. Under the 2024 update to the UK Corporate Governance Code (which impacts 2026 reporting cycles), there is a heightened focus on the board's responsibility for these controls.

By 2026, boards will be expected to provide a declaration in their annual reports regarding the effectiveness of their "material" controls. This includes not just financial controls, but also operational and compliance systems. To prepare, private companies should:

- Map Risks: Identify where the business is most vulnerable (e.g., cybersecurity, supply chain disruption, or fraud).

- Audit Regularly: Conduct internal or third-party audits to test if controls are actually functioning as intended.

- Document Evidence: Maintain a "Risk Register" that tracks identified threats and the specific actions taken to mitigate them.

Best Practices for Minute-Taking and Corporate Records

Board minutes are the official legal record of the decisions made by a company's directors. Under Section 248 of the Companies Act 2006, every company must cause minutes of all proceedings at meetings of its directors to be recorded.

Effective minute-taking should capture the "why" behind a decision, not just the "what." In the event of litigation or a regulatory audit, well-drafted minutes serve as evidence that the directors fulfilled their Section 172 duties. A standard minute should include:

- The date, time, and location of the meeting.

- A list of attendees and any apologies for absence.

- Declarations of interest (conflicts of interest).

- A concise summary of the discussion, including any dissenting views or challenges raised by directors.

- Clear wording of the resolutions passed and the specific actions assigned to individuals.

Minutes should be circulated and approved at the following board meeting to ensure accuracy and then kept at the company's registered office for a minimum of ten years.

Common Misconceptions

- Myth: Only Public Companies (PLCs) Need a Board. While legally a private limited company (Ltd) can have a single director, having a formal board with oversight is a requirement for many commercial contracts and is expected by the Financial Reporting Council for any company of significant scale.

- Myth: Corporate Governance Is Just Paperwork. Governance is about decision-making power. Poor governance is often the primary cause of corporate failure, leading to insolvency even when a company's product or service is successful.

- Myth: Shareholders Can Overrule Any Board Decision. While shareholders own the company, directors have a statutory duty to the company as a legal entity. If a shareholder's request violates the director's duty under Section 172, the director must refuse.

Frequently Asked Questions

What are the Wates Principles for private companies?

The Wates Principles are a voluntary framework for large private companies to help them comply with reporting requirements. They focus on six key areas: purpose, board composition, director responsibilities, opportunity and risk, remuneration, and stakeholder engagement.

Does a private company need a Company Secretary?

Under the Companies Act 2006, a private limited company is not legally required to have a Company Secretary. However, many choose to appoint one to ensure that the board follows legal procedures, maintains records, and stays compliant with filing deadlines at Companies House.

Can a director be held personally liable for poor governance?

Yes. If a director breaches their fiduciary duties-such as failing to act in the company's best interest or ignoring financial risks-they can be held personally liable for losses. This can lead to disqualification from acting as a director for up to 15 years and, in extreme cases, criminal charges.

When to Hire a Lawyer

Navigating the UK's evolving governance landscape requires professional legal oversight, especially during transitional periods. You should consult a corporate lawyer if:

- You are scaling from a small business to a "large" entity and need to implement Wates Principles.

- You are preparing for an investment round or an IPO and need a governance audit.

- There is a conflict of interest among board members that requires independent mediation.

- You need to draft complex Articles of Association or Shareholders' Agreements to define board powers.

- You are facing an investigation by the Insolvency Service or the Financial Conduct Authority (FCA).

Next Steps

- Audit Your Current Board: Review the balance between executive and independent directors to ensure fresh perspectives are present.

- Review Your Articles of Association: Ensure your constitutional documents reflect modern governance standards and allow for digital record-keeping.

- Draft Your Section 172 Statement: Start tracking how your board decisions impact stakeholders throughout the year, rather than waiting until the end of the financial year.

- Implement a Risk Register: Formalize how you identify and mitigate business risks to prepare for the 2026 internal control standards.