- Delaware allows non-US residents to form an LLC without visiting the United States or having a US Social Security Number.

- You must appoint a Registered Agent with a physical address in Delaware to maintain legal standing.

- An Employer Identification Number (EIN) is required for US banking and can be obtained by foreign nationals via fax or mail.

- Delaware LLCs pay a flat annual Franchise Tax of $300, due by June 1st each year.

- Ownership of a US LLC does not grant the owner a visa or legal residency status in the United States.

Why is Delaware the preferred jurisdiction for foreign digital entrepreneurs?

Delaware is the premier choice for international entrepreneurs due to its sophisticated legal system and business-friendly tax environment. The state's Court of Chancery focuses specifically on business disputes, providing a level of legal predictability that is unmatched globally. For non-residents, Delaware offers a high degree of privacy, as the names of LLC members and managers are not required to be disclosed in the public Certificate of Formation.

Beyond legal protections, Delaware is the gold standard for venture capital and international investors. If you plan to raise US capital or use US-based payment processors like Stripe or PayPal, a Delaware entity is often a non-negotiable requirement. Furthermore, if the LLC does not conduct business within the state of Delaware and the members are non-residents, the entity generally does not pay Delaware state income tax.

Benefits for International Founders

- Privacy: Delaware does not list member or manager names on the public record, protecting your personal data from public searches.

- Speed of Formation: The Delaware Division of Corporations offers expedited filing services that can process your formation in as little as one hour.

- Access to US Markets: A Delaware LLC serves as a gateway to US banking, credit, and the world's largest consumer market.

- Flexible Management: LLCs can be member-managed or manager-managed, allowing for a structure that fits your specific business model.

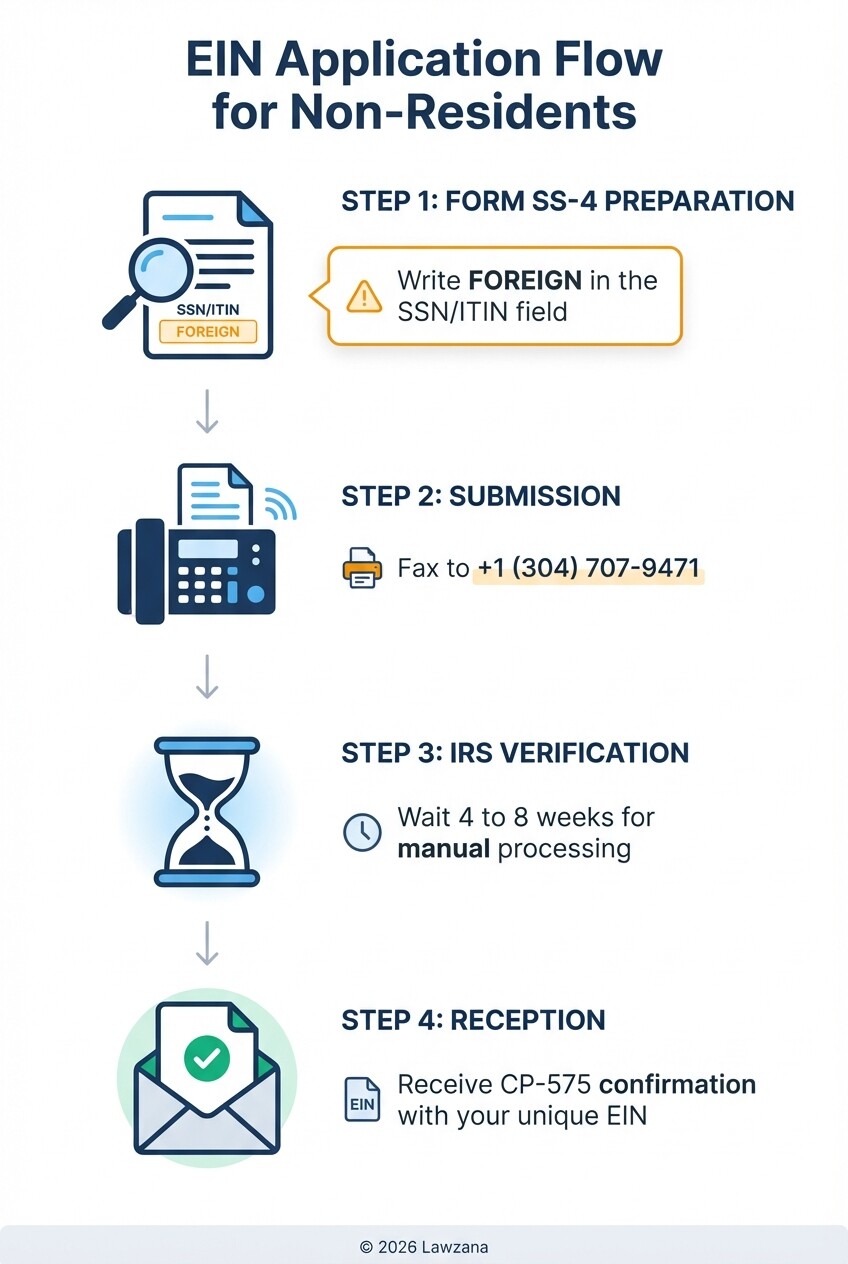

How do non-residents obtain an EIN without a Social Security Number?

Non-US residents can obtain an Employer Identification Number (EIN) by submitting Form SS-4 to the Internal Revenue Service (IRS) via fax or mail. You do not need a Social Security Number (SSN) or an Individual Taxpayer Identification Number (ITIN) to obtain an EIN for your business. The EIN is essential for opening a US business bank account, hiring employees, and complying with federal tax filings.

The process for foreign applicants is slightly different than for US citizens. While US residents can apply online, international founders must use the manual submission process. You must designate a "Responsible Party" for the entity, which is typically the individual owner or a manager.

Step-by-Step EIN Process for Non-Residents

- Complete Form SS-4: Fill out the form accurately. In the section for the SSN/ITIN of the responsible party, you will write "Foreign" if you do not have a US tax ID.

- Submit via Fax: Fax the completed form to the IRS at the designated international fax number: +1 (304) 707-9471.

- Wait for Confirmation: The IRS typically processes these requests within 4 to 8 weeks, though this timeline can vary. They will fax or mail the CP-575 confirmation notice back to you.

- Receive the EIN: Once you have the number, you can immediately begin using it for banking applications and tax documentation.

What are the Delaware Registered Agent requirements for non-residents?

Delaware law requires every business entity to maintain a Registered Agent who is physically located within the state. The Registered Agent acts as the official point of contact for the Secretary of State and is responsible for receiving service of process (legal notices) and official tax documents. Because non-residents typically do not have a physical presence in Delaware, hiring a professional Registered Agent service is mandatory.

A Registered Agent must be available during standard business hours to accept hand-delivered legal documents. Failure to maintain an active Registered Agent will result in the LLC losing its "Good Standing" status, which can lead to the administrative dissolution of the company.

Criteria for a Delaware Registered Agent

- Must have a physical street address in Delaware (P.O. Boxes are not permitted).

- Must be authorized to do business in the State of Delaware.

- Must promptly forward all legal and state correspondence to the LLC owners.

- Should provide a secure online portal for viewing documents and managing compliance deadlines.

Which Operating Agreement essentials are critical for cross-border ownership?

An Operating Agreement for a foreign-owned LLC must clearly define how the company is governed, how profits are distributed, and how it is treated for tax purposes. For international owners, it is vital to specify whether the LLC will be a "Disregarded Entity" or taxed as a "Corporation." This document is an internal contract between members and is not filed with the state, but it is often required by banks to open an account.

Because the members are located outside the US, the agreement should include provisions for digital signatures and virtual meetings. It should also outline the process for capital contributions in foreign currencies and how exchange rate fluctuations might be handled.

Key Clauses for International LLCs

- Tax Classification: Clearly state how the entity intends to be taxed (e.g., as a partnership or a corporation).

- Dispute Resolution: Specify that any internal disputes will be governed by Delaware law and settled in Delaware courts.

- Capital Contributions: Define how non-US members will contribute funds and what happens if a member fails to meet a capital call.

- Dissolution Procedures: Outline the steps for closing the business and distributing remaining assets to international members.

- Reporting Requirements: Include mandates for members to provide information necessary for the company to file IRS Form 5472, which is required for foreign-owned US corporations and disregarded entities.

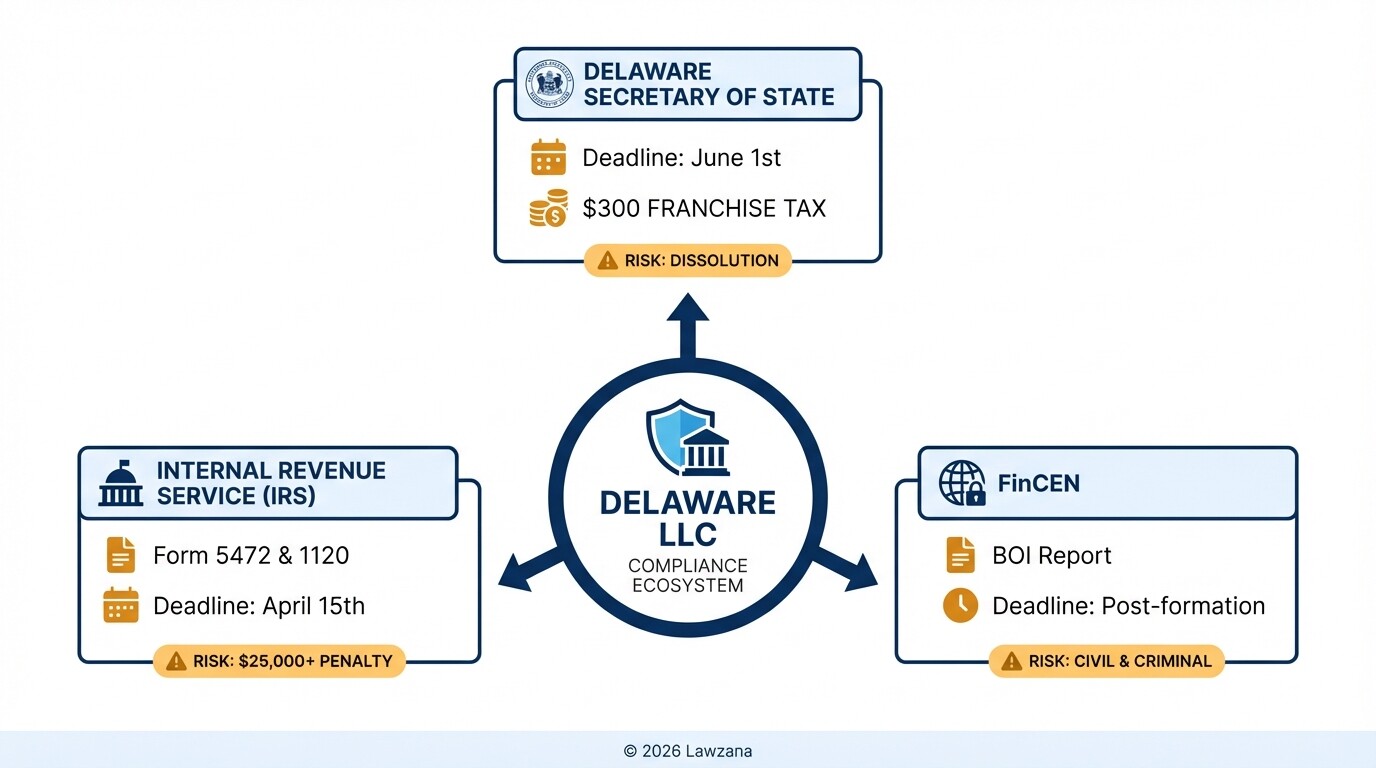

What are the annual compliance requirements for a Delaware LLC?

Delaware LLCs must pay an annual Franchise Tax of $300 and maintain an active Registered Agent to remain in good standing. The Franchise Tax is a flat fee for LLCs, regardless of the company's revenue or activity level. This tax is due every year by June 1st; failing to pay on time results in a $200 penalty plus 1.5% monthly interest.

In addition to state-level fees, foreign-owned LLCs have significant federal reporting obligations. Even if the LLC has no US-source income, it may still be required to file information returns with the IRS. For example, a single-member LLC owned by a non-resident is treated as a "Reporting Corporation" for the purposes of Form 5472, which tracks transactions between the LLC and its foreign owner.

Annual Compliance Checklist

| Requirement | Deadline | Cost | Authority |

|---|---|---|---|

| Delaware Franchise Tax | June 1st | $300 | DE Secretary of State |

| Registered Agent Fee | Varies | $50 - $300 | Private Provider |

| Form 5472 & 1120 | April 15th | $0 (Filing only) | IRS |

| FinCEN BOI Report | Varies | $0 | FinCEN |

Common Misconceptions About Delaware LLCs

"Forming an LLC grants me a US Visa"

Owning a Delaware LLC is a financial investment and does not provide any immigration benefits. While a US entity can be a vehicle for an E-2 or L-1 visa, the mere act of registration does not grant you the right to live or work in the United States. You must apply for the appropriate visa through US Citizenship and Immigration Services (USCIS).

"I don't have to pay any US taxes"

Many entrepreneurs believe a Delaware LLC is "tax-free." While Delaware does not tax non-resident income earned outside the state, the federal government (IRS) has strict rules. If your LLC is "Engaged in a Trade or Business in the United States" (ETBUS), you will likely owe federal income tax. Even if you owe $0, the penalties for failing to file information returns like Form 5472 can start at $25,000.

"I need a US address to start the company"

You do not need a personal US address to form a Delaware LLC. You only need a Delaware Registered Agent. For banking and receiving mail, many foreign entrepreneurs use virtual mailbox services that provide a US street address and scan mail for digital viewing.

FAQ

Can I open a US bank account without visiting the US?

Yes, many "neobanks" and fintech platforms allow foreign owners of Delaware LLCs to open accounts remotely. Traditional "brick-and-mortar" banks, however, usually require the owner to appear in person with their passport and formation documents.

How long does it take to form a Delaware LLC?

Standard processing by the Delaware Division of Corporations takes approximately 10 to 15 business days. However, you can pay for expedited services to have the entity formed in 24 hours or even on the same business day.

Do I need a lawyer to form my LLC?

While you can file the Certificate of Formation yourself, international entrepreneurs often benefit from legal counsel to ensure their Operating Agreement and tax structure comply with both US laws and the laws of their home country.

What is the FinCEN BOI reporting requirement?

Starting in 2024, most LLCs must file a Beneficial Ownership Information (BOI) report with the Financial Crimes Enforcement Network (FinCEN). This report discloses the individuals who own or control the company and is mandatory for both domestic and foreign-owned entities. Details can be found at FinCEN.gov.

When to Hire a Lawyer

While the administrative act of filing a Delaware LLC is straightforward, the legal and tax implications for non-residents are complex. You should consult a lawyer if:

- You have multiple partners located in different countries.

- You are unsure how to structure your Operating Agreement to protect your intellectual property.

- You need to navigate the intersection of US tax treaties and your home country's tax laws.

- You are planning to use the LLC as a vehicle for a US visa application.

- You receive a notice of non-compliance or a penalty from the IRS or the State of Delaware.

Next Steps

- Choose a Name: Verify that your desired business name is available through the Delaware Department of State.

- Appoint a Registered Agent: Select a reliable service provider located in Delaware to handle your legal correspondence.

- File the Certificate of Formation: Submit your filing and pay the state filing fee (typically $90).

- Draft your Operating Agreement: Create a comprehensive document that outlines management and tax elections.

- Apply for an EIN: Submit Form SS-4 to the IRS via fax to obtain your tax identification number.

- Open a Bank Account: Use your EIN and formation documents to apply for a US business bank account.

- File BOI Report: Ensure you file your Beneficial Ownership Information report with FinCEN within the required timeframe after formation.