- Most business sectors in Vietnam allow 100% foreign ownership, though certain conditional industries require local partnerships.

- Foreign investors must follow a dual-licensing process: first obtaining an Investment Registration Certificate (IRC), followed by an Enterprise Registration Certificate (ERC).

- Minimum capital is not legally defined for most industries, but the "charter capital" must be sufficient to cover projected operating costs until the business becomes self-sustaining.

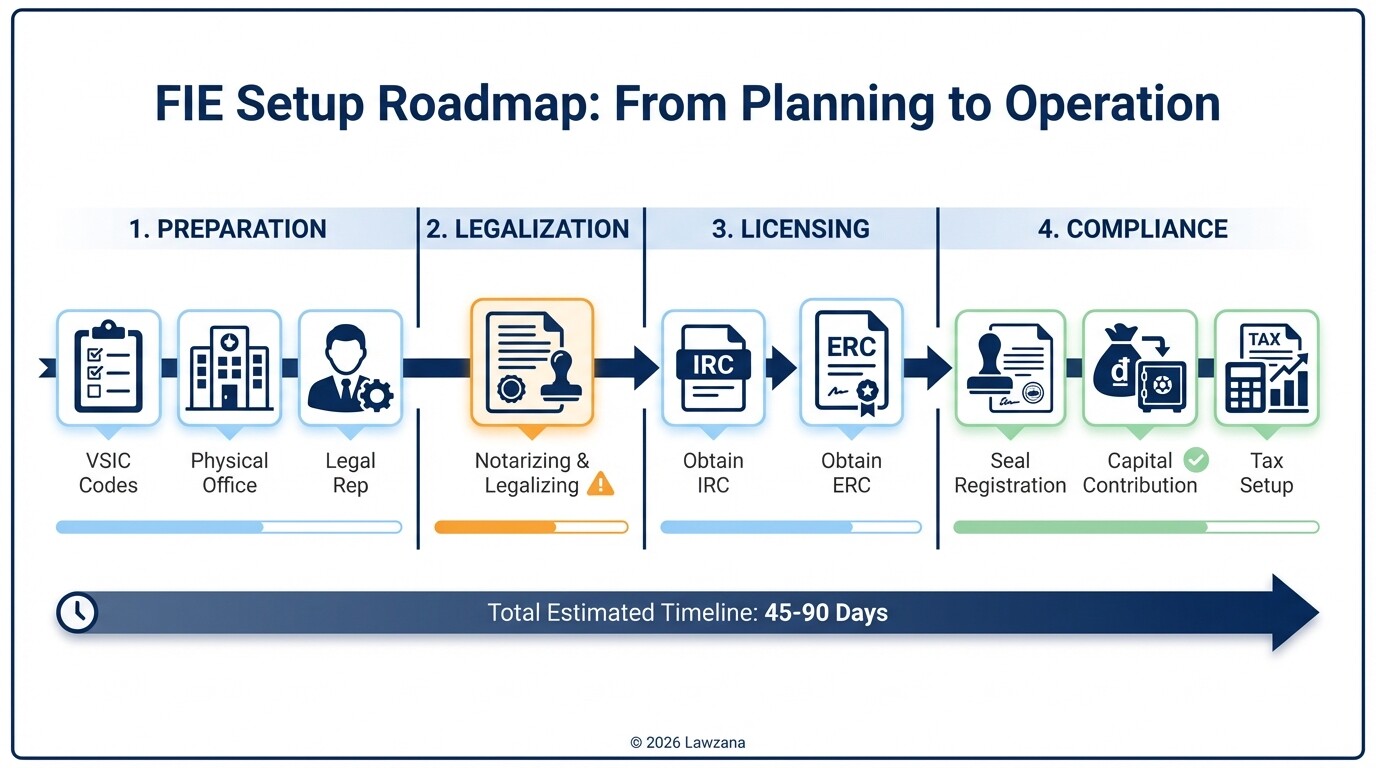

- Total registration timelines typically range from 45 to 90 days, depending on the complexity of the business lines and the completeness of documentation.

- All foreign documents must be notarized and legalized in the investor's home country and translated into Vietnamese before submission to authorities.

Setting Up a Foreign-Invested Enterprise (FIE) in Vietnam: The Essential Checklist

Setting up a business in Vietnam requires a systematic approach to satisfy both the Law on Investment and the Law on Enterprises. This checklist outlines the critical milestones from the initial planning phase to the moment you can legally issue invoices.

Phase 1: Pre-Incorporation Requirements

- Define Business Lines: Identify the specific VSIC (Vietnam Standard Industrial Classification) codes for your activities. Check the WTO Commitment Schedule to see if your industry has foreign ownership caps.

- Select a Legal Structure: Choose between a Limited Liability Company (LLC) - the most common for FIEs - or a Joint Stock Company (JSC).

- Secure a Physical Office: You must have a lease agreement or a memorandum of understanding (MOU) for a physical location. "Virtual offices" are increasingly scrutinized for FIEs.

- Appoint a Legal Representative: Identify at least one person who will reside in Vietnam to act as the legal representative.

Phase 2: Documentation and Legalization

- Proof of Finance: Prepare a bank reference letter or bank statements showing you have the funds required for the proposed charter capital.

- Investor Identity: For individuals, a notarized copy of your passport. For corporate entities, notarized copies of the Certificate of Incorporation, Articles of Association, and audited financial statements.

- Consular Legalization: Ensure all foreign-issued documents are legalized by the Vietnamese Embassy/Consulate in your home country.

Phase 3: Licensing Steps

- Apply for the Investment Registration Certificate (IRC): Submit the investment project proposal to the Department of Planning and Investment (DPI).

- Apply for the Enterprise Registration Certificate (ERC): Once the IRC is issued, apply for the business license that provides your tax ID and company name.

Phase 4: Post-Licensing Compliance

- Corporate Seal: Order and register the official company chop (seal).

- Capital Contribution: Transfer the committed charter capital into a specialized Capital Contribution Bank Account (CCBA) within 90 days of the ERC issuance.

- Initial Tax Declaration: Register for Electronic Tax Filing and pay the annual Business License Tax.

- Public Announcement: Post the registration details on the National Business Registration Portal.

Obtaining the Investment Registration Certificate (IRC)

The Investment Registration Certificate (IRC) is the formal approval from the Vietnamese government allowing a foreign entity to execute an investment project. It functions as a "permit to invest" and specifies the project's scale, location, and duration.

To obtain an IRC, investors must submit a detailed dossier to the Department of Planning and Investment (DPI) or the Management Board of Industrial Zones. The dossier must include an investment project proposal outlining the capital contribution schedule, the technology to be used (if applicable), and the projected economic impact. For projects not requiring a "decision on investment policy" (most standard manufacturing or service businesses), the statutory processing time is 15 business days. However, if the industry is "conditional" - such as education, healthcare, or logistics - the DPI may consult with other ministries, extending the timeline significantly.

Applying for the Enterprise Registration Certificate (ERC)

The Enterprise Registration Certificate (ERC) acts as the "birth certificate" of the company, officially creating the legal entity under Vietnamese law. It contains the enterprise code (which also serves as the tax identification number), the company name, the head office address, and the legal representative's details.

Once the IRC is granted, the application for the ERC is submitted to the Business Registration Office (BRO) under the DPI. This step is generally faster and more administrative than the IRC phase. The application includes the company charter (articles of association) and a list of members or shareholders. Under the Law on Enterprises, the BRO is required to issue the ERC within three to five business days if the dossier is valid. Once you receive the ERC, your company is legally recognized, though you must still complete post-registration tasks like making a seal and opening bank accounts before commencing full operations.

Minimum Capital Requirements for Regulated Industries

Vietnam does not have a general minimum capital requirement for most service and manufacturing businesses, provided the amount is "reasonable" for the business scale. However, "conditional" sectors have strict legal capital requirements that must be met to obtain operational licenses.

| Industry | Minimum Capital Requirement (Approximate) |

|---|---|

| Real Estate Development | 20 Billion VND (approx. $800,000 USD) |

| Banking (Commercial) | 3,000 Billion VND (approx. $120 Million USD) |

| Language Centers | 20 Million VND per student (excluding land) |

| Air Transportation | 100 Billion to 1,300 Billion VND (depends on fleet size) |

| Finance Companies | 500 Billion VND (approx. $20 Million USD) |

For non-regulated industries, the DPI evaluates the proposed capital against your business plan. For example, setting up a consulting firm with only $1,000 USD in capital may lead to a rejection, as it is deemed insufficient to cover office rent and initial salaries. A common "safe" starting point for many service-based FIEs is $10,000 to $30,000 USD.

Estimated Timelines for Business License Approvals

The total time required to set up a business in Vietnam generally spans two to three months from the moment you have legalized documents in hand. While the law mandates specific windows for government response, administrative delays are common.

- Dossier Preparation & Legalization: 2-4 weeks (depends on your home country).

- IRC Issuance: 15-20 business days (statutory), though 30 days is common.

- ERC Issuance: 3-7 business days.

- Post-Licensing (Seal, Bank, Tax): 10-15 business days.

- Sub-licensing (if applicable): 30-90 days. Some sectors (like retail or chemicals) require an additional "Business License" or "Operating Permit" after the ERC is issued.

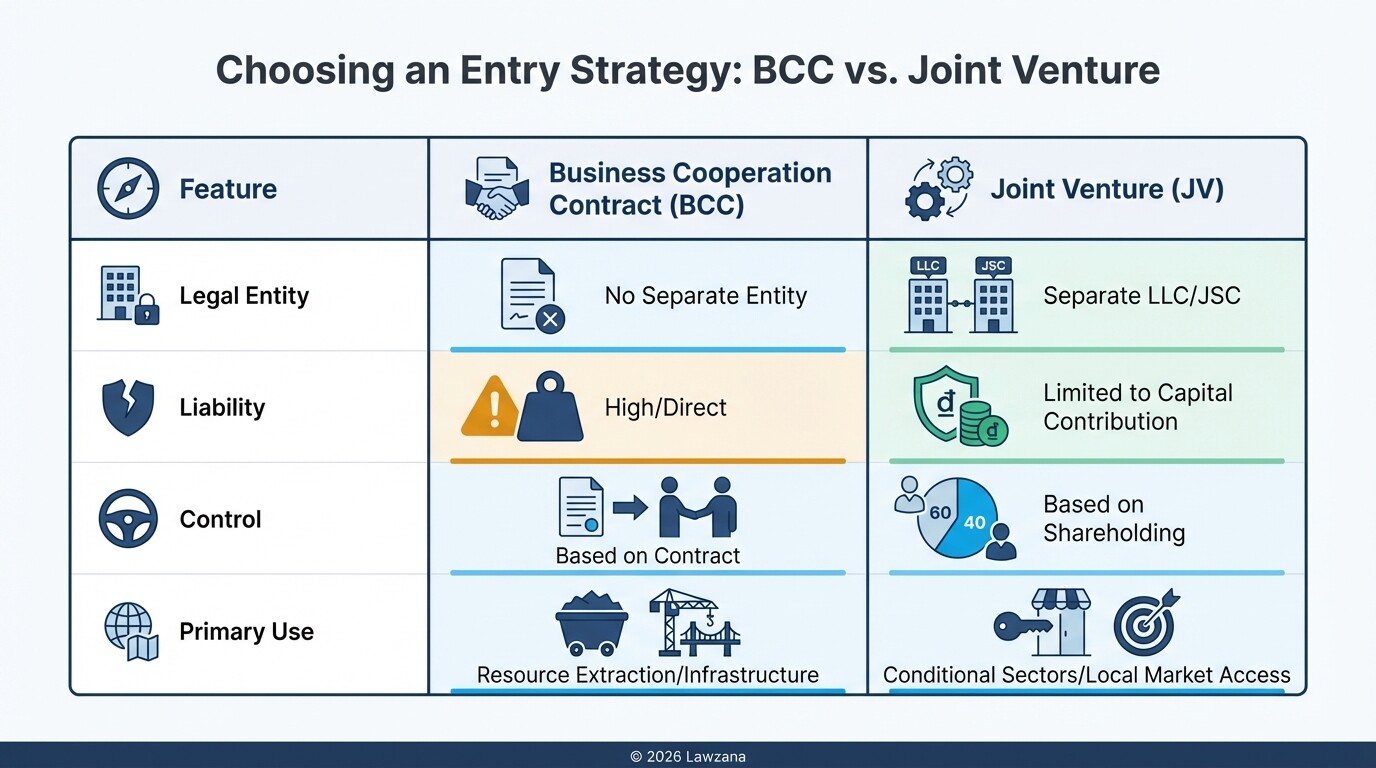

Alternatives: Business Cooperation Contracts (BCC) vs. Joint Ventures

Investors who are not ready to establish a full Limited Liability Company may choose alternative structures to enter the Vietnamese market. The choice depends on the desired level of control and the necessity of a local partner.

Business Cooperation Contract (BCC)

A BCC is an agreement between investors to cooperate on specific business activities and share profits or products without creating a new legal entity.

- Best for: Infrastructure projects, telecommunications, or oil and gas exploration.

- Pros: No need to establish a new company; flexible termination; simpler exit strategy.

- Cons: High liability as there is no separate legal entity; complex tax reporting for each party.

Joint Venture (JV)

A Joint Venture in Vietnam typically takes the form of a Limited Liability Company with at least one foreign and one local shareholder.

- Best for: Industries where foreign ownership is capped (e.g., advertising, tourism, specialized transport).

- Pros: Access to the local partner's market knowledge, existing relationships, and land-use rights.

- Cons: Potential for management disputes; shared profits; risk of the local partner not meeting capital contribution deadlines.

Common Misconceptions

"I can use a virtual office for my FIE registration."

While domestic Vietnamese startups often use virtual offices, the Department of Planning and Investment is much stricter with foreign-invested enterprises. You are usually required to provide a physical lease agreement and, in some cases, proof that the landlord has the legal right to lease the property for commercial use. Using a residential apartment for an office address is strictly prohibited.

"I can contribute the capital whenever the business makes a profit."

The Law on Enterprises is very clear: charter capital must be fully contributed within 90 days from the date of the ERC issuance. If you fail to do so, you must apply to reduce your capital or face significant fines. Furthermore, the capital must flow through a specific Capital Contribution Bank Account (CCBA) opened in Vietnam; bringing in cash or using personal transfers will not count toward your legal obligation.

FAQs

Can a foreigner be the sole owner of a company in Vietnam?

Yes, in the majority of sectors (such as IT, manufacturing, and management consulting), 100% foreign ownership is permitted. Some sectors like logistics or tourism may require a Vietnamese partner holding at least 49% or 51% of the shares.

Do I need to live in Vietnam to own a business there?

No, shareholders do not need to reside in Vietnam. However, every company must have at least one Legal Representative who maintains a permanent residence in the country. If the sole Legal Representative leaves the country for more than 30 days, they must authorize another person to act on their behalf.

What is the difference between Charter Capital and Investment Capital?

Charter Capital is the amount members/shareholders commit to the company for its operations, as recorded in the ERC. Investment Capital is the total amount (including loans) that will be spent on the specific project, as recorded in the IRC. The Investment Capital is always equal to or higher than the Charter Capital.

When to Hire a Lawyer

Navigating Vietnam's regulatory environment is challenging due to the interplay between central laws and local provincial interpretations. You should consult a legal professional if:

- Your business falls under "conditional" sectors requiring additional sub-licenses.

- You are entering a Joint Venture and need a robust Shareholders' Agreement to protect your interests.

- You need assistance with the consular legalization of documents in multiple jurisdictions.

- You are unsure if your chosen office location is zoned for your specific business activities.

Next Steps

- Verify your VSIC codes: Check the Vietnam National Business Registration Portal to ensure your business activities are listed correctly.

- Gather documents: Start the notarization and legalization process for your identity documents immediately, as this often takes the longest.

- Consult with a local expert: Confirm if your specific business model requires any additional "sub-licenses" beyond the IRC and ERC.