Best Retirement Lawyers in India

Share your needs with us, get contacted by law firms.

Free. Takes 2 min.

Or refine your search by selecting a city:

List of the best lawyers in India

About Retirement Law in India

Retirement in India is governed by a range of laws and regulations designed to provide financial security to individuals after they cease working. The primary focus is on ensuring that employees receive appropriate financial support in their retirement years. This involves the management of various funds like the Employees' Provident Fund (EPF), the National Pension System (NPS), gratuity, and other pension schemes. Indian retirement laws aim to cover individuals in both organized and unorganized sectors, though the provisions might differ significantly. Understanding these laws is crucial to planning effectively for retirement in India.

Why You May Need a Lawyer

There are several situations where individuals may need legal assistance regarding retirement in India:

- Handling disputes related to the mismanagement or miscalculation of retirement funds.

- Understanding eligibility and claiming pension benefits under various government schemes and employer-provided plans.

- Navigating complexities in the distribution of retirement benefits upon the death of an employee.

- Legal advice for NRIs seeking to manage or retrieve retirement benefits held in India.

- Addressing grievances related to employer contributions to provident and pension funds.

- Clarification on tax implications related to withdrawal or pension receipt.

Local Laws Overview

India’s retirement-related laws primarily consist of the following:

- The Employees' Provident Funds and Miscellaneous Provisions Act, 1952: It mandates employers and employees to contribute to the EPF, along with the Employees' Pension Scheme (EPS) and Employees' Deposit Linked Insurance (EDLI).

- The Payment of Gratuity Act, 1972: Provides a lumpsum payment to employees who have completed five or more years of service, up to a specified limit.

- National Pension System (NPS): A government-backed voluntary retirement savings scheme aimed at providing old age security.

- Pension Fund Regulatory and Development Authority (PFRDA) Act, 2013: Governs the management and regulation of pension schemes.

- Income Tax Laws: These determine the tax liabilities on retirement benefits and income received thereof.

Frequently Asked Questions

What is the age of retirement in India?

The standard retirement age in India varies between 58 and 65 years depending on the employment sector and organization’s policies.

Is EPF mandatory for all employees?

EPF is mandatory for employees earning a basic salary of up to INR 15,000 per month in organizations with more than 20 employees, though many employers extend this benefit to all employees.

How can I check my EPF balance?

EPF balance can be checked online through the EPFO portal, via SMS, or using the UMANG app.

Can NRIs participate in NPS?

Yes, NRIs can invest in NPS, although the maturity proceeds must be received in Indian currency.

Is my pension taxable in India?

Yes, pension income is taxable under the Income Tax Act. However, certain exemptions may apply depending on the type of pension.

What happens to the gratuity amount upon an employee's death?

The gratuity amount is paid to the nominee or legal heir of the deceased employee.

Are there any special retirement schemes for government employees?

Yes, government employees are primarily covered under the Central Government Pension Scheme or state-specific schemes, which include assured pension benefits.

What is the implication of early withdrawal from EPF?

Early withdrawals from EPF before five years of continuous service may attract tax liabilities on the amount withdrawn.

How can one resolve disputes regarding retirement fund mismanagement?

Disputes can be addressed through the EPF tribunal, Labor Court, or seeking help from a legal expert specializing in employment and retirement laws.

Can an employee contribute more than 12% to the EPF?

Yes, employees can voluntarily contribute higher to EPF, known as Voluntary Provident Fund (VPF), though employers are not obliged to match such contributions.

Additional Resources

For further support and information related to retirement, consider these resources:

- Employees’ Provident Fund Organisation (EPFO), which manages EPF, EPS, and EDLI schemes.

- Pension Fund Regulatory and Development Authority (PFRDA) for guidance on pension systems.

- Central Board of Direct Taxes (CBDT) for understanding the tax implications on retirement benefits.

- Ministry of Labour & Employment for policies affecting retirement and labor laws.

Next Steps

If you require legal assistance concerning retirement matters in India, consider taking the following steps:

- Gather all necessary documents such as employment contracts, EPF statements, and pension records.

- Identify and contact a lawyer specializing in labor and retirement laws in India.

- Utilize online platforms or bar associations’ directories to locate legal experts if needed.

- Prepare a list of specific questions or issues you need guidance on before your consultation.

- Check for any free legal aid services if costs are prohibitive.

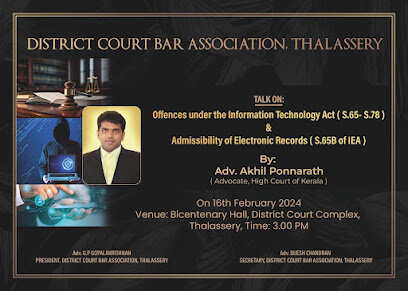

Lawzana helps you find the best lawyers and law firms in India through a curated and pre-screened list of qualified legal professionals. Our platform offers rankings and detailed profiles of attorneys and law firms, allowing you to compare based on practice areas, including Retirement, experience, and client feedback.

Each profile includes a description of the firm's areas of practice, client reviews, team members and partners, year of establishment, spoken languages, office locations, contact information, social media presence, and any published articles or resources. Most firms on our platform speak English and are experienced in both local and international legal matters.

Get a quote from top-rated law firms in India — quickly, securely, and without unnecessary hassle.

Disclaimer:

The information provided on this page is for general informational purposes only and does not constitute legal advice. While we strive to ensure the accuracy and relevance of the content, legal information may change over time, and interpretations of the law can vary. You should always consult with a qualified legal professional for advice specific to your situation.

We disclaim all liability for actions taken or not taken based on the content of this page. If you believe any information is incorrect or outdated, please contact us, and we will review and update it where appropriate.

Browse retirement law firms by city in India

Refine your search by selecting a city.