- Lower Intervention Thresholds: The Competition Bureau can now challenge mergers that significantly lessen competition even if they do not create a total monopoly.

- Global Revenue Penalties: Violations may result in administrative monetary penalties (AMPs) of up to 10% of a company's worldwide gross revenue or three times the benefit derived from the conduct.

- Greenwashing Scrutiny: New provisions require businesses to provide scientific evidence for any environmental or "green" claims made about their products or services.

- Expanded Private Rights: Private parties can now apply directly to the Competition Tribunal for leave to seek remedies for anti-competitive conduct, a right previously reserved for the Commissioner.

- Interlocking Directorships: It is now illegal for competitors to share the same directors or officers if it significantly prevents or lessens competition in a market.

What Are the New Thresholds for Mandatory Pre-Merger Notification?

Foreign investors must notify the Competition Bureau of a transaction if the target corporation's assets in Canada or its annual gross revenue from sales in or from Canada exceed $93 million CAD (for 2024). This "size-of-target" threshold is reviewed annually and works in tandem with the "size-of-parties" test, which triggers notification when the parties and their affiliates have combined assets or revenues exceeding $400 million CAD.

The 2024-2025 updates have eliminated the "efficiencies defense," which previously allowed mergers to proceed if the economic efficiencies outweighed the harm to competition. Now, even if a merger creates significant cost savings, the Bureau can block it if it substantially harms the competitive landscape.

| Threshold Type | 2024 Value (CAD) | Application |

|---|---|---|

| Size-of-Target | $93 Million | Value of Canadian assets or revenue from sales in/from Canada. |

| Size-of-Parties | $400 Million | Combined aggregate value of assets/revenue of all parties involved. |

| Limitation Period | 1 Year | Period during which the Bureau can challenge a non-notified merger. |

How Have the Competition Bureau's Investigation Powers Changed?

The Competition Bureau now possesses expanded authority to conduct market studies and compel the production of documents from companies, regardless of whether a formal investigation into a specific violation has begun. Under the new "market inquiry" powers, the Commissioner can seek a court order to force businesses to provide data, records, or written responses to help the Bureau understand broader industry trends and competitive barriers.

Furthermore, the Bureau can now investigate "past conduct" for up to three years after a transaction or activity has ceased. This prevents firms from avoiding scrutiny by quickly dissolving an anti-competitive arrangement before a formal inquiry can be completed.

Key investigation tools now available include:

- Section 11 Orders: Court-enforced subpoenas for records, data, and oral examinations of corporate officers.

- Search and Seizure: The ability to obtain warrants to enter premises and seize physical and digital evidence.

- Information Requests: Formal demands for information during a 30-day "initial period" of a merger review, which can be extended via Supplementary Information Requests (SIRs).

What Are the Penalties for Anti-Competitive Business Practices?

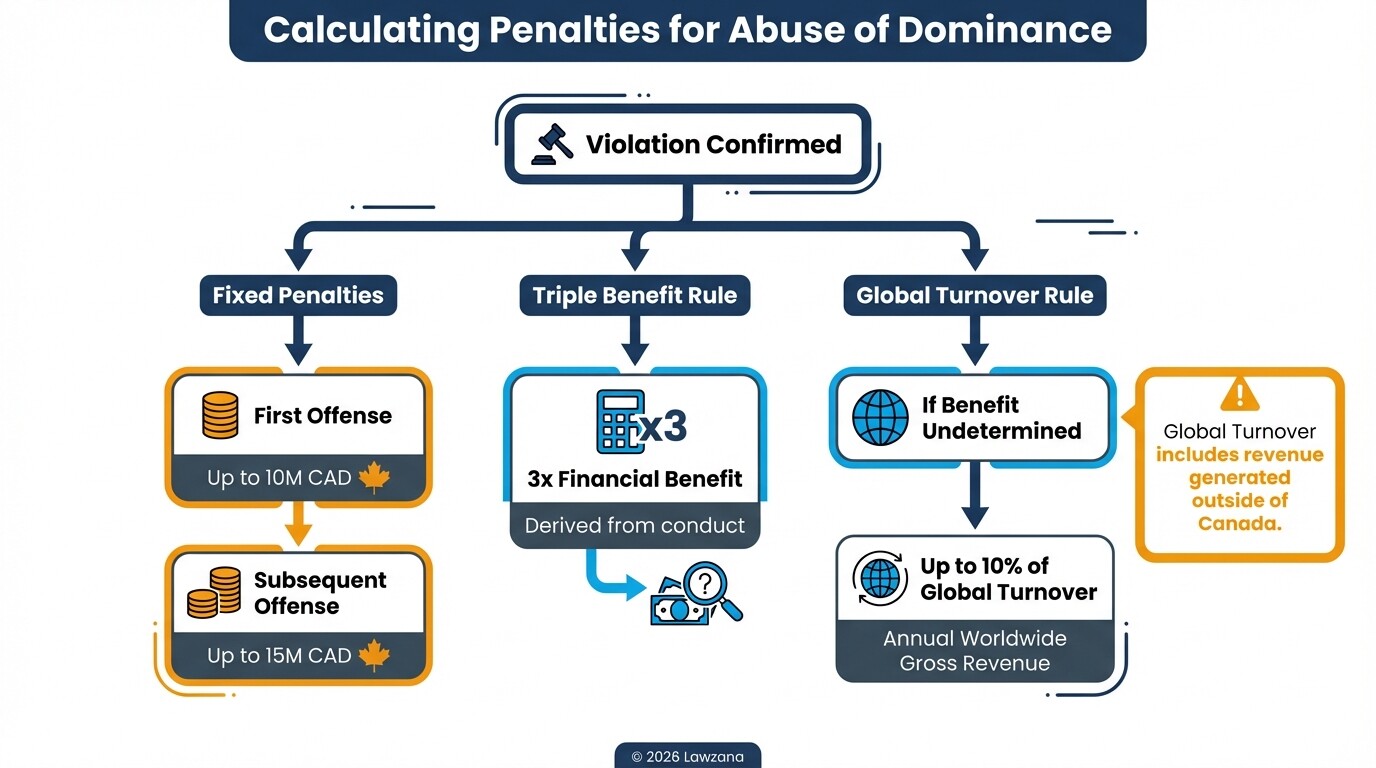

Canada has significantly increased the financial risks of non-compliance, moving away from fixed-cap fines to penalties based on global turnover. For civilly reviewable practices, such as abuse of dominance, the Competition Tribunal can impose administrative monetary penalties (AMPs) that reflect the scale of the business and the harm caused.

These penalties are designed to be punitive and deterrent rather than mere regulatory costs. For foreign investors with large global footprints, a violation in the Canadian market could trigger a penalty based on their total worldwide revenue, making compliance a board-level priority.

Penalty Structure for Abuse of Dominance:

- Initial Violation: Up to $10 million CAD (or $15 million CAD for subsequent violations).

- Alternative Calculation: Three times the value of the benefit derived from the conduct.

- Global Turnover Rule: If the benefit cannot be determined, the penalty can be up to 10% of the company's annual worldwide gross revenue.

How Do the Right to Repair and Greenwashing Provisions Work?

The 2024 amendments introduced "Right to Repair" provisions that allow the Competition Tribunal to order manufacturers to provide diagnostic tools, parts, and manuals to third-party repairers or consumers. These changes aim to prevent "refusal to deal" tactics where manufacturers monopolize the secondary repair market to force consumers into buying new products.

Simultaneously, "Greenwashing" provisions now require that any claim regarding the environmental benefits of a product be substantiated by an "adequate and proper test." Claims about a business's general environmental impact or climate goals must be based on "internationally recognized methodology."

Compliance Checklist for Foreign Firms:

- Verify all environmental claims (e.g., "carbon neutral," "eco-friendly") against scientific data before launching Canadian marketing campaigns.

- Review service and warranty agreements to ensure they do not unfairly restrict third-party repairs.

- Audit public-facing sustainability reports to ensure they align with the new Canadian substantiation standards.

How Does Foreign Investment Review (ICA) Differ from Competition Review?

Foreign investors entering Canada face two distinct regulatory hurdles: the Investment Canada Act (ICA) and the Competition Act. While the Competition Act focuses on market power and pricing, the ICA focuses on "Net Benefit to Canada" and national security concerns.

Recent updates to the ICA have introduced a mandatory pre-closing filing requirement for investments in specific "sensitive sectors," such as critical minerals, artificial intelligence, and biotechnology. Unlike the Competition Act review, which is often public and structured around market data, ICA reviews are conducted by the Minister of Innovation, Science, and Industry and are heavily influenced by geopolitical factors.

| Feature | Competition Act Review | Investment Canada Act (ICA) Review |

|---|---|---|

| Primary Focus | Market competition and consumer prices. | National security and economic "Net Benefit." |

| Agency | Competition Bureau Canada | Investment Review Division (ISED). |

| Trigger | Specific revenue/asset thresholds. | Acquisition of control or sensitive sector investment. |

| Outcome | Divestitures, injunctions, or fines. | Approval, mitigation conditions, or rejection. |

Common Misconceptions About Canadian Antitrust Law

1. "We don't need to worry if our Canadian revenue is low."

Even if a transaction does not meet the mandatory $93 million notification threshold, the Competition Bureau still has the jurisdiction to review and challenge any merger for up to one year after closing. If the Bureau believes a "sub-threshold" deal substantially lessens competition in a niche Canadian market, they can seek to undo the transaction.

2. "The efficiencies defense will save our merger."

This is no longer true. Historically, many cross-border mergers were approved in Canada because the parties could prove the deal created corporate efficiencies (like shared logistics or manufacturing) that outweighed the loss of competition. With the repeal of the efficiencies defense, the Bureau now prioritizes competitive rivalry over corporate cost savings.

FAQ

Can private companies sue for antitrust violations in Canada?

Yes. Recent changes allow private parties to apply to the Competition Tribunal for leave to seek damages or remedial orders for restrictive trade practices. Previously, private litigation was largely limited to price-fixing and conspiracy cases.

What is the "Right to Repair" in a business context?

It is a provision that prevents manufacturers from refusing to provide parts, tools, or software needed for repairs. If a manufacturer's refusal is found to have an adverse effect on competition, the Tribunal can force them to grant access to independent repair shops.

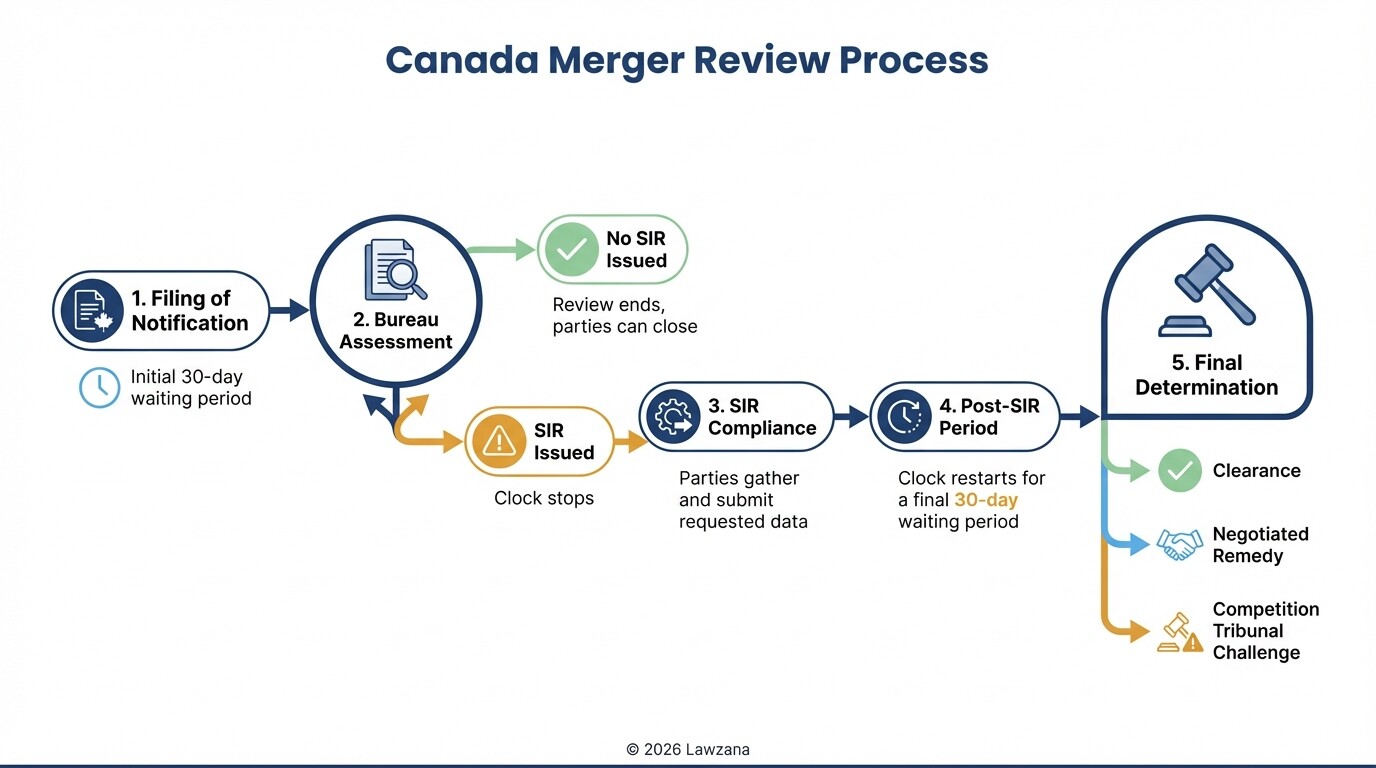

How long does a merger review take in Canada?

For notified transactions, there is a mandatory 30-day waiting period. If the Bureau issues a Supplementary Information Request (SIR), the waiting period is extended until 30 days after the parties have complied with the request, which often takes several months.

When to Hire a Lawyer

Foreign investors should engage Canadian legal counsel as soon as a letter of intent (LOI) is contemplated for a transaction involving Canadian assets or customers. Legal intervention is critical if:

- Your transaction meets the $93 million size-of-target threshold.

- You operate in a highly concentrated industry (e.g., telecommunications, groceries, banking).

- Your marketing team plans to use environmental or "sustainability" claims in Canadian advertising.

- You are a manufacturer implementing restrictive repair or warranty policies.

Next Steps

- Audit Canadian Assets: Determine the exact book value of assets and gross revenues generated from sales into Canada for the previous fiscal year.

- Assess Sensitive Sectors: Check if your industry falls under the ICA's "sensitive sectors" list, which may require a national security filing regardless of deal size.

- Update Marketing Guidelines: Ensure your "green" claims are backed by rigorous, documented testing to avoid the new greenwashing penalties.

- Consult the Bureau: In complex cases, consider applying for an Advance Ruling Certificate (ARC) from the Competition Bureau to gain certainty that a merger will not be challenged.