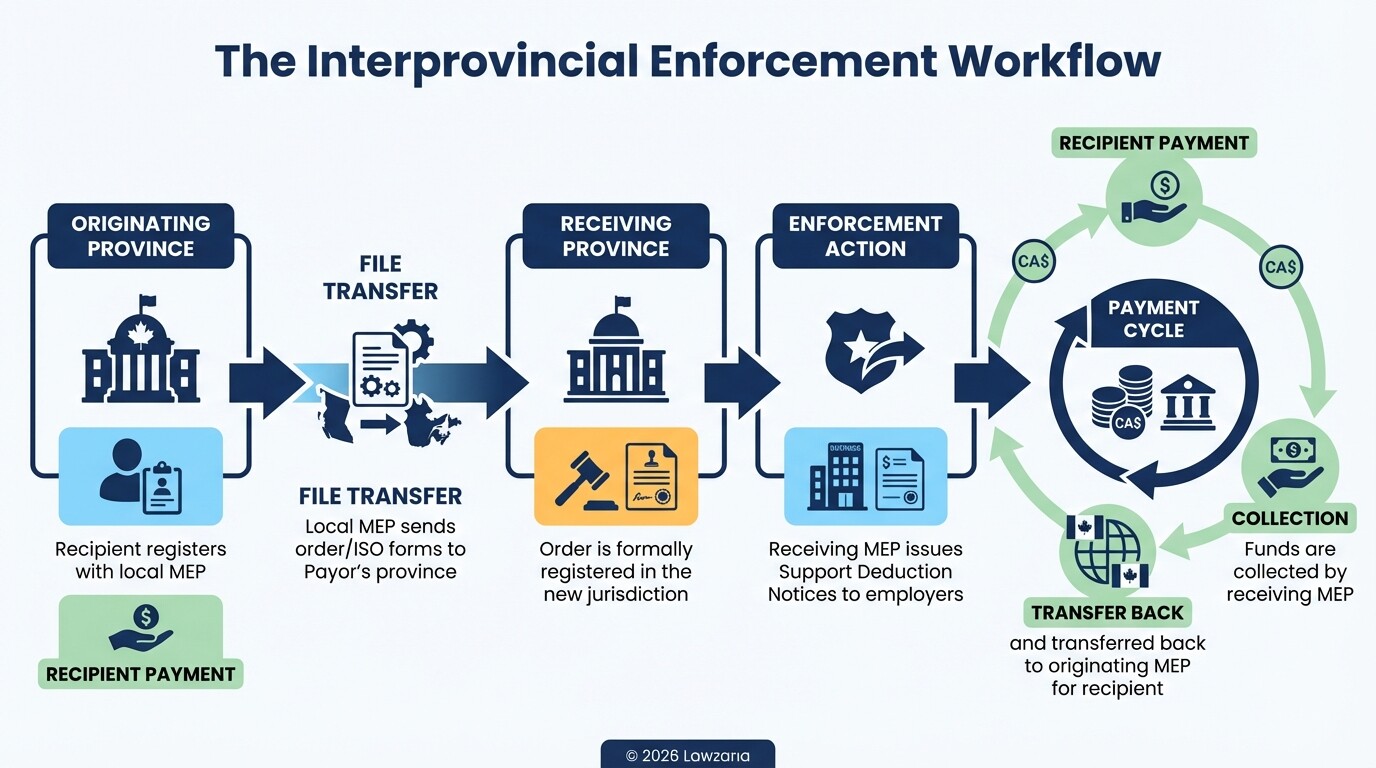

- Interprovincial support is governed by the Interjurisdictional Support Orders (ISO) Act, which allows orders from one Canadian province to be legally recognized and enforced in another.

- Every Canadian province and territory operates a Maintenance Enforcement Program (MEP) that manages the collection and distribution of support payments across borders.

- Reciprocal agreements between provinces mean you generally do not need to attend court in the province where the other parent lives to enforce an existing order.

- Federal laws allow for the garnishment of federal payments, such as income tax refunds and employment insurance, to satisfy unpaid child support.

- Maintenance Enforcement Programs have the authority to trace a payor parent's location and employment through government and private databases.

Step-by-Step Checklist for Enforcing an Interprovincial Support Order

Enforcing a child support order across provincial lines requires coordination between your local enforcement agency and the agency in the payor parent's province. Following this checklist ensures that your file is processed efficiently and that the necessary legal triggers are activated.

| Step | Action Required | Responsible Party |

|---|---|---|

| 1 | Locate Your Current Order | Obtain a certified copy of your current provincial court order or registered written agreement. |

| 2 | Enroll in Your Local MEP | Register with your province's Maintenance Enforcement Program (e.g., FRO in Ontario, MEP in Alberta). |

| 3 | Submit an ISO Application | Complete the required Interjurisdictional Support Orders (ISO) forms if the order is not yet registered in the new province. |

| 4 | Verify Payor Information | Provide the last known address, employer, and Social Insurance Number (SIN) of the payor parent. |

| 5 | Registration of Order | Your local MEP sends the order to the reciprocating jurisdiction for formal registration in their court system. |

| 6 | Initiate Enforcement | The receiving MEP issues a Support Deduction Notice to the payor's employer or intercepts federal funds. |

| 7 | Monitor Payments | Track payments through your local MEP portal to ensure the file remains active and arrears are being managed. |

Understanding the Interjurisdictional Support Orders (ISO) Act

The Interjurisdictional Support Orders (ISO) Act is a set of harmonized laws used by all Canadian provinces and territories to handle support cases involving different jurisdictions. It creates a legal framework that allows a person to obtain or change a support order in one province even if the other party lives elsewhere, without the need for the applicant to travel to the other province's court.

Under the ISO Act, the legal process is streamlined through the exchange of forms and documents. If you have an existing order in British Columbia and the payor moves to Nova Scotia, the Act ensures that Nova Scotia courts recognize the B.C. order as if it were made locally. This eliminates the "jurisdictional gap" that previously allowed parents to avoid support obligations simply by moving across a provincial border.

The Act also facilitates the "registration" of orders. Once an out-of-province order is registered under the local ISO Act, the enforcement agency in that province gains the full legal authority to use all available provincial enforcement tools against the payor parent.

The Role of Provincial Maintenance Enforcement Programs (MEP)

Maintenance Enforcement Programs (MEP) act as the primary intermediary for the collection and disbursement of child support payments in Canada. Each province has its own agency-such as the Family Responsibility Office (FRO) in Ontario or the Family Maintenance Enforcement Program (FMEP) in British Columbia-that coordinates with other provinces to ensure money flows to the recipient.

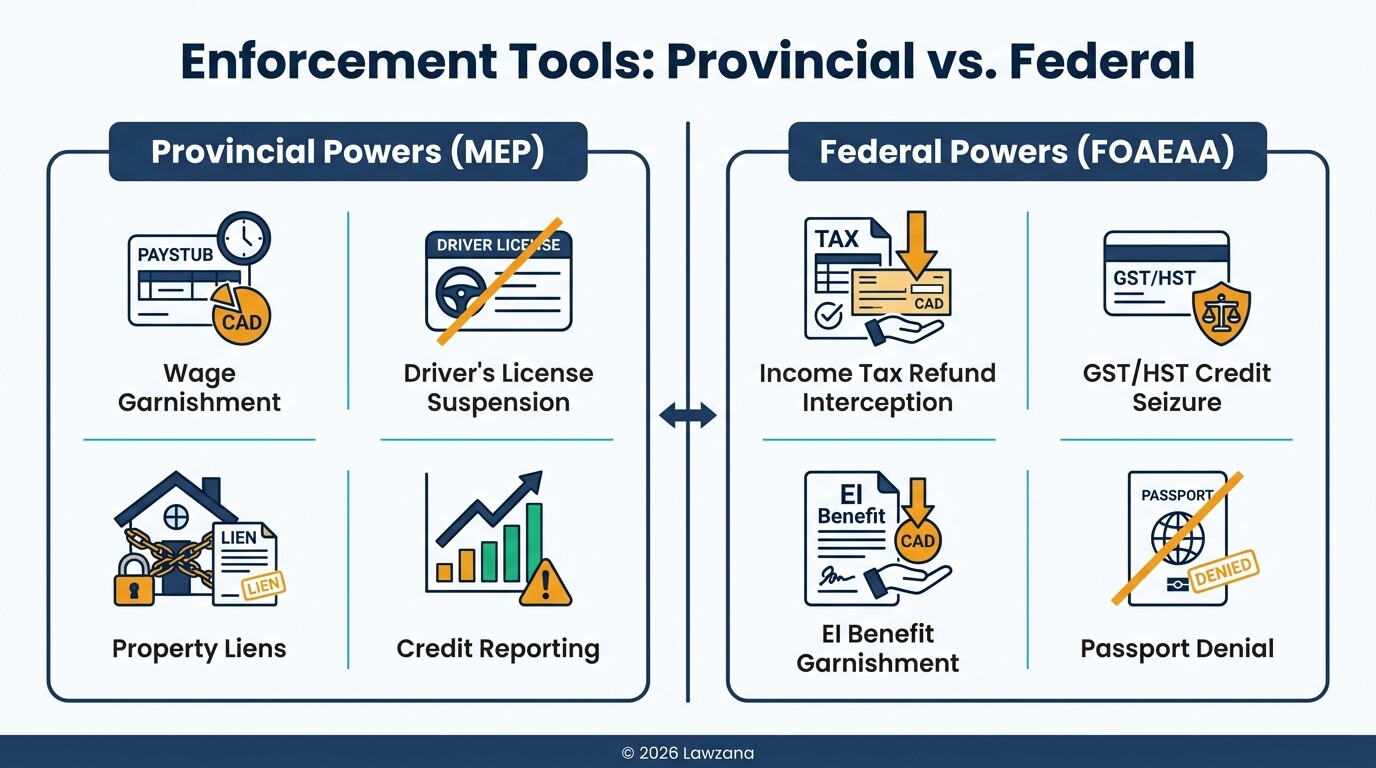

When a payor moves to a different province, your local MEP will send your file to the MEP in the province where the payor now resides. The "receiving" MEP then takes over the heavy lifting of collection. They have the power to:

- Issue binding notices to employers to deduct support directly from wages.

- Place liens on real estate or personal property owned by the payor.

- Suspend driver's licenses or professional licenses if payments are missed.

- Report the debt to credit bureaus, affecting the payor's ability to get loans.

Garnishment of Wages and Federal Tax Refunds

Garnishment is the most common and effective tool for collecting interprovincial child support, allowing funds to be redirected before they reach the payor's bank account. This process is supported by both provincial laws and the federal Family Orders and Agreements Enforcement Assistance Act (FOAEAA).

At the provincial level, an MEP sends a "Notice of Attachment" or "Support Deduction Notice" to the payor's employer. This legal notice requires the employer to withhold a specific portion of the payor's salary and send it directly to the MEP. This process remains effective even if the employer is located in a different province than the recipient parent.

At the federal level, the FOAEAA allows the government to intercept federal payments owed to a support payor. These include:

- Income tax refunds and GST/HST credits.

- Employment Insurance (EI) benefits.

- Canada Pension Plan (CPP) payments.

- Old Age Security (OAS) payments.

These federal intercepts are often the primary method for collecting arrears (unpaid past support) even when a payor parent is unemployed or self-employed.

Registration of Out-of-Province Court Orders

Registration is the formal process by which a court in one province adopts an order made by a court in another province. This is a critical step because a province generally only has the jurisdiction to enforce its own orders or orders that have been officially "attorned" to its jurisdiction.

When an order is registered, the "responding" court sends a notice to the payor parent, giving them a short window (usually 30 days) to challenge the registration. Challenges are rarely successful and are typically limited to proving the order is no longer in effect or was made without proper notice. Once the registration is finalized, the order has the same weight as a local judgment.

This registration process allows for "reciprocal enforcement," meaning that the enforcement tools available in the payor's current province-such as seizing a bank account or cancelling a passport application-can be fully utilized to satisfy the out-of-province order.

Tracing Payor Parents Through Government Databases

One of the greatest challenges in interprovincial enforcement is "skipping," where a parent moves without providing a forwarding address to avoid payment. Provincial Maintenance Enforcement Programs have specialized tracing units that use high-level access to databases to locate these individuals.

MEPs have the legal authority to request information from various sources that are not accessible to the general public or private lawyers. These sources include:

- Motor vehicle records and driver's license registries.

- Social Insurance Number (SIN) records through federal data-sharing agreements.

- Records from utility companies (electricity, heat, water).

- Employment records and union memberships.

Because the provinces share information under the ISO framework, a trace initiated in one province can trigger a search in another. Once a new address or employer is identified, the enforcement process resumes automatically, often leading to a sudden garnishment of the payor's new wages.

Common Misconceptions About Interprovincial Enforcement

Moving to a new province "resets" the child support debt

Many believe that crossing a provincial border makes a child support order unenforceable or that arrears disappear. This is false. Child support debt is cumulative and follows the payor regardless of where they move within Canada. The ISO Act ensures that the debt remains legally binding and enforceable nationwide.

You need to hire a lawyer in the payor's province

Recipients often worry they must hire a second lawyer in the province where the other parent lives. In most cases involving MEPs and the ISO Act, this is unnecessary. The administrative coordination between provincial MEPs handles the legal legwork of registration and enforcement at little to no cost to the recipient.

Only wages can be garnished for support

While wage garnishment is common, it is not the only source. Interprovincial enforcement can seize bank accounts, corporate assets (if the payor owns a business), insurance settlements, and even lottery winnings.

FAQs

How long does it take to start receiving support from another province?

The timeline varies depending on whether the payor's location is known. If the payor is already identified and employed, registration and garnishment typically take three to six months. If tracing is required, the process may take longer.

Can a support order from the United States be enforced in Canada?

Yes. Most Canadian provinces have reciprocal agreements with American states. The process is similar to interprovincial enforcement under the ISO Act, though it involves international coordination through the provincial MEP.

What happens if the payor parent moves to a different province again?

The enforcement file follows the payor. Your local MEP will simply transfer the registration and enforcement requests to the new province's MEP. You do not need to restart the entire application process.

When to Hire a Lawyer

While provincial Maintenance Enforcement Programs handle the daily mechanics of collection, certain situations require the expertise of a family law attorney:

- Disputing the Amount: If the payor parent applies to the court to significantly reduce their support payments due to a change in income.

- Complex Income Structures: When a payor is self-employed or uses corporate structures to hide income that an MEP might not easily trace.

- Initial Order Creation: To ensure your original court order is drafted with "enforcement-ready" language that complies with ISO Act standards.

- Retroactive Support: If you are seeking years of back-dated support that has never been documented in a court order.

Next Steps

- Gather Documentation: Locate your most recent court order or registered separation agreement. Ensure it is signed and has a court seal.

- Contact Your MEP: Visit the website of your province's Maintenance Enforcement Program (e.g., Family Responsibility Office in Ontario or Alberta Maintenance Enforcement).

- Complete the ISO Forms: If the payor is out-of-province, ask your MEP representative for the Interjurisdictional Support Orders (ISO) application package.

- Provide Tracing Leads: Compile any known information about the payor's new address, employer, or social media activity to assist the MEP tracing unit.

- Set Up Direct Deposit: Ensure your MEP file is set for direct deposit to avoid delays once funds are recovered from the other province.