- The Out-of-Court Workout (OCW) is a digital platform designed to restructure debts exceeding €10,000 owed to the Greek State, social security funds, and financial institutions.

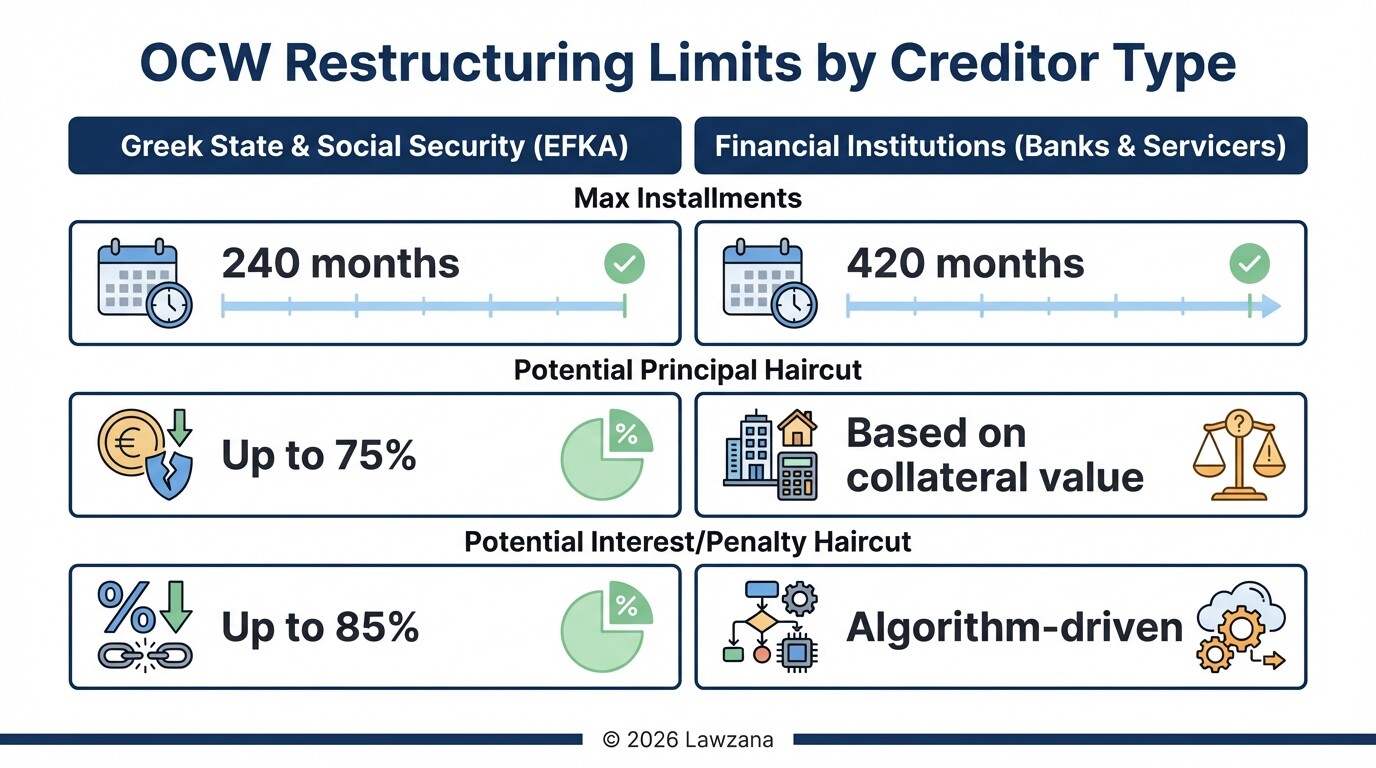

- Eligible businesses can secure up to 240 monthly installments for debts to the State and up to 420 installments for debts to banks and systemic creditors.

- Successful submission of an application provides an automatic stay of enforcement, protecting company assets from auctions and seizures during the negotiation period.

- Debt "haircuts" (reductions) are determined by a standardized algorithm based on the debtor's financial capacity and the liquidation value of their assets, rather than manual negotiation.

- Participation is voluntary for creditors, but recent reforms have made it mandatory for banks to explain their reasons if they reject a proposal generated by the platform.

What are the eligibility criteria for the OCW platform for legal entities?

To qualify for the Greek Out-of-Court Workout Mechanism, a business must have total debts exceeding €10,000 and not have a single creditor holding more than 90% of the total debt. The process is open to all legal entities operating in Greece, provided they are not currently in a state of bankruptcy or liquidation and have not been convicted of financial crimes like tax evasion or money laundering.

Businesses must meet the following specific requirements to initiate an application:

- Debt Threshold: The aggregate debt to the Greek State (Tax Office), Social Security (EFKA), and financial institutions must be at least €10,000.

- Creditor Distribution: A business cannot use the OCW if one creditor holds 90% or more of the total debt, as this would be considered a bilateral rather than a multilateral negotiation.

- Operational Status: The company must be active and not under a court-ordered liquidation process or have a pending bankruptcy petition filed by another party.

- Clean Record: Owners and managers must not have final convictions for fraud, money laundering, or other financial crimes as defined by the Greek Ministry of Finance.

- Transparency: The applicant must consent to the lifting of bank and tax secrecy to allow the platform to aggregate financial data automatically.

How does the automated algorithm calculate debt haircuts and repayment installments?

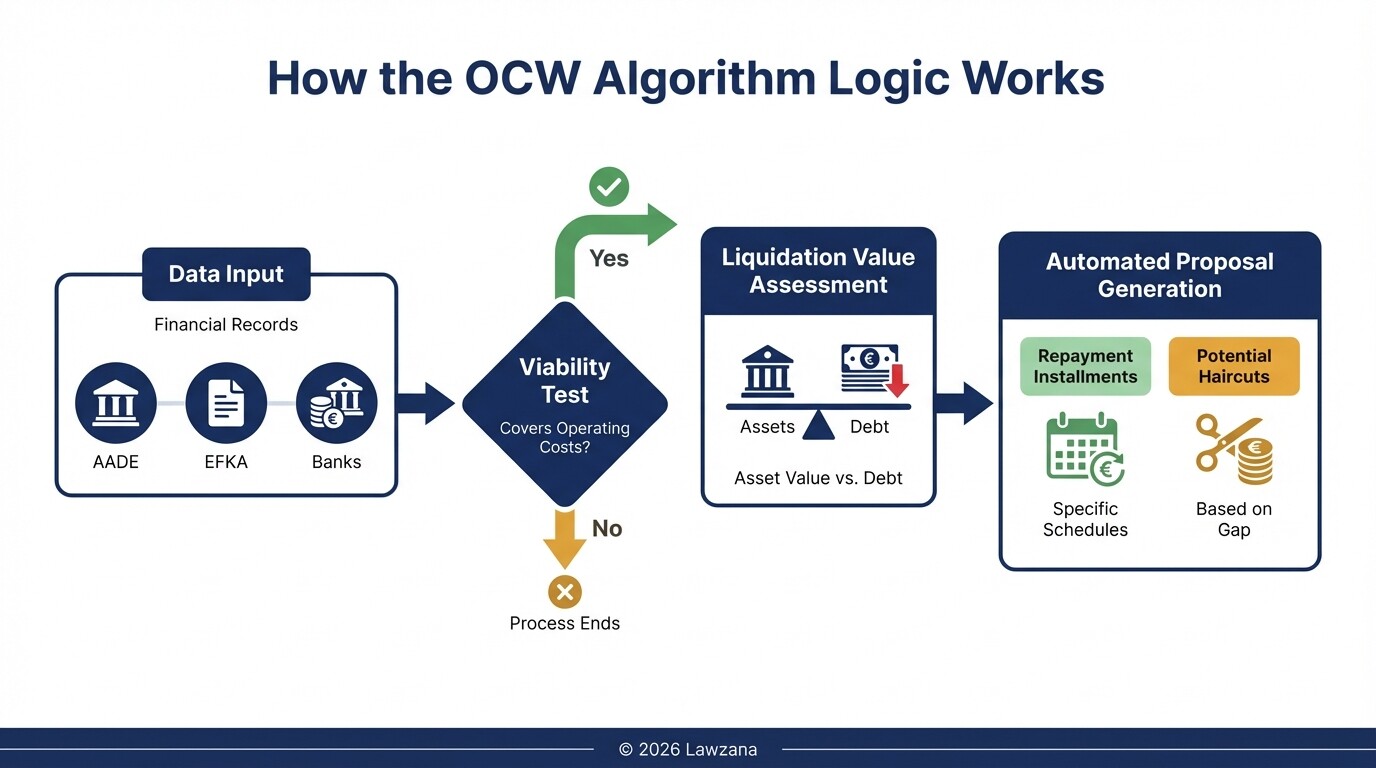

The OCW mechanism uses a sophisticated, automated algorithm to generate a "Restructuring Proposal" based on the debtor's income, expenses, and asset values. This algorithm ensures transparency and speed by removing human bias from the initial calculation of how much debt can be forgiven and how many months the business needs to pay it back.

The calculation follows these core logic pillars:

- The Viability Test: The system compares the business's projected cash flow against its debt obligations. If the business is deemed viable, the algorithm calculates a repayment plan that allows the company to continue operating.

- Liquidation Value: A "haircut" on the principal debt is only possible if the total value of the company's assets (real estate, equipment, accounts receivable) is less than the total debt owed. The algorithm ensures that creditors receive at least what they would get if the business were liquidated immediately.

- State Debt Caps: For debts to the Greek Tax Authority and EFKA, the algorithm can suggest up to 240 installments, with a potential haircut on interest and penalties of up to 85%, and up to 75% on the principal.

- Bank Debt Caps: For debts to banks and credit managers (servicers), the algorithm can extend the repayment period up to 420 installments (35 years), depending on the age of the debtor and the nature of the collateral.

- Mandatory Logic: If the algorithm produces a solution where the creditors recover more than they would in a bankruptcy, the proposal is automatically sent to the creditors for a vote.

How does the suspension of enforcement measures work during the negotiation?

Once a business successfully completes the submission of its application on the OCW platform, an automatic suspension of enforcement measures is triggered for a period of two months. This "stay" prevents creditors from initiating or continuing legal actions such as bank account seizures, property auctions, or asset confiscations while the restructuring proposal is being evaluated.

The suspension provides the following protections:

- Stop on Auctions: Any scheduled electronic auctions of company real estate or equipment are paused immediately upon the formal "Final Submission" of the application.

- Protection Against Seizures: Creditors are barred from seizing company bank accounts or "garnishing" payments from clients.

- Preservation of Operations: Because assets cannot be seized, the business can maintain its daily operations and payroll without the immediate threat of its liquid assets being frozen.

- Extension Possibilities: While the initial stay is for two months, it can be extended if the negotiation process requires more time, provided there is progress toward a multilateral agreement.

It is important to note that this protection is lost if the business fails to provide requested documents, if the application is rejected due to bad faith, or if the business misses the strict deadlines set by the platform.

What is the role of the multilateral agreement between creditors?

A multilateral agreement is the final contract between the debtor and a majority of their creditors that legally binds all parties to the new repayment terms. In Greece, for an OCW proposal to be successful, it must be approved by creditors representing at least 60% of the total debt, which must include 40% of the "secured" debt (those holding mortgages or liens).

The role of this agreement includes:

- Consensus Building: The platform attempts to find a middle ground that satisfies the Tax Office, Social Security, and multiple banks simultaneously.

- Binding the State: Once the 60% threshold is met by private creditors, the Greek State and Social Security funds are legally required to accept the restructuring terms if they were included in the application.

- Uniformity: The agreement ensures that the debtor isn't paying one creditor at the expense of another, creating a balanced financial ecosystem for the company's recovery.

- Court Ratification (Optional): In some complex cases, the agreement can be ratified by a court to provide extra legal certainty against future challenges, though the platform-based agreement is legally enforceable on its own.

What are the common pitfalls that lead to the rejection of restructuring applications?

Many Greek businesses fail to secure a restructuring agreement because of technical errors or a lack of transparency during the digital application process. The OCW platform is data-heavy, and any discrepancy between the information provided by the user and the data held by the State or banks can lead to an automatic rejection.

Frequent reasons for rejection include:

- Incomplete Financial Data: Failing to list all assets, including those held by family members if they are guarantors, is a major red flag for creditors.

- The "Strategic Defaulter" Label: If the algorithm detects that the company has the cash flow to pay its debts but is simply choosing not to, the application will be rejected for "lack of objective need."

- Missing the 90-Day Window: Once an application is started, there are strict timelines for uploading documents. If a deadline is missed, the application is discarded and the stay of enforcement is lifted.

- Pre-existing Petitions: If a creditor has already filed a bankruptcy petition against the business and the court date is imminent, the OCW platform may not be able to stop the court process unless the creditor agrees to a stay.

- Refusal to Lift Secrecy: Some business owners hesitate to allow the platform to access their bank and tax records. Without this consent, the application cannot proceed.

Step-by-Step: The OCW Application Process

| Step | Action | Description |

|---|---|---|

| 1 | Login | Access the Special Secretariat for Private Debt Management using TaxisNet credentials. |

| 2 | Data Retrieval | The platform automatically pulls data from the Tax Office, EFKA, and the "Teiresias" banking system. |

| 3 | Asset Disclosure | Manually enter any assets not automatically found (overseas property, vehicles, etc.). |

| 4 | Submission | Finalize the application to trigger the 2-month stay of enforcement. |

| 5 | Algorithm Proposal | The system generates a repayment plan based on the "Recovery Value." |

| 6 | Creditor Vote | Creditors have up to 2 months to vote "Yes" or "No" on the proposal. |

| 7 | Contract Signing | If approved, the agreement is digitally signed and the new payment plan begins. |

Common Misconceptions

"The OCW automatically wipes out 50% of my debt."

This is incorrect. Debt forgiveness (the haircut) is not a right; it is a mathematical result. If your assets and income are sufficient to pay the full debt over time, the algorithm will not grant a haircut. Reductions are only granted when the total debt exceeds the company's ability to pay and the value of its assets.

"I can pick and choose which debts to include."

The OCW is an "all-in" mechanism. You must include all debts to the State and all financial institutions. You cannot restructure your bank loan while ignoring your tax arrears, or vice versa. This ensures a comprehensive "fresh start" for the entity.

FAQ

Can I apply if my business is already closed?

Yes, former business owners (individuals) can apply for their professional debts even if the legal entity has been dissolved, provided the debts were incurred during the business's operation.

How much does it cost to use the OCW platform?

The Greek government does not charge a fee to use the electronic platform. However, businesses usually incur costs for legal counsel and accounting fees to ensure the data is entered correctly and to negotiate with creditors.

What happens if I miss an installment after the agreement?

If you fail to pay three installments (or if the total overdue amount exceeds three months' worth), the agreement is "lost." Creditors regain the right to pursue enforcement measures for the original, full amount of the debt, minus whatever you paid during the plan.

Does the OCW protect my guarantors?

Yes, the restructuring agreement typically extends its benefits to the guarantors of the debt, provided they are also included in the application and disclose their financial status.

When to Hire a Lawyer

Navigating the Greek OCW platform is a complex legal and financial undertaking. You should consult a restructuring lawyer if:

- Your business faces imminent auction or seizure of critical assets.

- Your financial structure involves complex corporate groups or cross-collateralized loans.

- You have been rejected by the platform once and need to understand the legal grounds for a re-application.

- You need to negotiate specific terms that the automated algorithm does not cover, such as the release of specific collateral.

Next Steps

- Audit Your Debts: Gather all current statements from the Tax Office (AADE), Social Security (EFKA), and your banks.

- Access the Platform: Log in to the EGDICH platform to see what data is already pre-populated.

- Consult a Professional: Speak with a specialized lawyer or accountant to run a "pre-check" on your eligibility and potential haircut.

- Prepare Documentation: Ensure your most recent E3 and balance sheets are accurate and ready for upload.